See more : Sigmastar Technology Ltd. (301536.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Velo3D, Inc. (VLD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Velo3D, Inc., a leading company in the Computer Hardware industry within the Technology sector.

- African Gold Acquisition Corpor (AGAC-WT) Income Statement Analysis – Financial Results

- PlantFuel Life Inc. (PLFLF) Income Statement Analysis – Financial Results

- Savannah Resources Plc (SAV.L) Income Statement Analysis – Financial Results

- Dolphin Capital Investors Limited (DCI.L) Income Statement Analysis – Financial Results

- Topre Corporation (5975.T) Income Statement Analysis – Financial Results

Velo3D, Inc. (VLD)

About Velo3D, Inc.

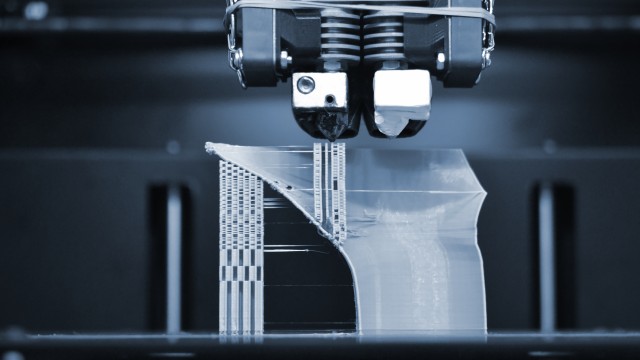

Velo3D, Inc. produces metal additive three dimensional printers in the United States and internationally. The company's printers enable the production of components for space rockets, jet engines, fuel delivery systems, and other high value metal parts, which it sells or leases to customers for use in their businesses. It offers Flow, a proprietary software platform, which scans part designs for geometrical features; Sapphire and Sapphire XC printers; Assure, a quality control system software platform that includes process metrologies; and Intelligent Fusion, an underlying manufacturing process that unifies and manages the information flow, sensor data from approximately 950 sensors, and the advanced printing technology for precision control of the entire print. The company also provides support services. Its customers range from small- and medium-sized enterprises to Fortune 500 companies in the space, aviation, defense, energy, and industrial markets. The company was founded in 2014 and is headquartered in Campbell, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 77.44M | 80.76M | 27.44M | 18.98M | 15.22M |

| Cost of Revenue | 103.71M | 77.86M | 22.48M | 12.61M | 10.39M |

| Gross Profit | -26.27M | 2.89M | 4.96M | 6.37M | 4.83M |

| Gross Profit Ratio | -33.92% | 3.58% | 18.07% | 33.55% | 31.73% |

| Research & Development | 42.03M | 46.27M | 27.00M | 14.19M | 14.59M |

| General & Administrative | 41.73M | 36.98M | 23.35M | 6.38M | 6.53M |

| Selling & Marketing | 23.23M | 23.91M | 12.36M | 7.00M | 8.60M |

| SG&A | 64.96M | 60.89M | 35.72M | 13.39M | 15.53M |

| Other Expenses | 506.00K | 1.45M | -88.00K | 35.00K | 0.00 |

| Operating Expenses | 106.99M | 107.16M | 62.72M | 27.57M | 29.90M |

| Cost & Expenses | 210.70M | 185.02M | 85.20M | 40.18M | 40.30M |

| Interest Income | 0.00 | 372.00K | 2.74M | 639.00K | 605.00K |

| Interest Expense | 9.72M | 372.00K | 2.74M | 639.00K | 0.00 |

| Depreciation & Amortization | 9.31M | 5.29M | 2.17M | 1.24M | 1.14M |

| EBITDA | -123.94M | 13.63M | -55.68M | -19.97M | -24.15M |

| EBITDA Ratio | -160.05% | -120.76% | -202.91% | -105.04% | -158.67% |

| Operating Income | -133.25M | -104.26M | -57.76M | -21.21M | -25.29M |

| Operating Income Ratio | -172.07% | -129.10% | -210.50% | -111.76% | -166.14% |

| Total Other Income/Expenses | -1.89M | 114.28M | -49.33M | -600.00K | -386.00K |

| Income Before Tax | -135.14M | 10.02M | -107.09M | -21.81M | -25.68M |

| Income Before Tax Ratio | -174.50% | 12.41% | -390.29% | -114.92% | -168.68% |

| Income Tax Expense | 9.14M | -114.28M | 2.65M | 674.00K | 0.00 |

| Net Income | -135.14M | 7.97M | -107.09M | -21.81M | -25.68M |

| Net Income Ratio | -174.50% | 9.87% | -390.29% | -114.92% | -168.68% |

| EPS | -23.97 | 1.51 | -63.87 | -48.83 | -57.50 |

| EPS Diluted | -23.97 | 1.40 | -63.87 | -48.83 | -57.50 |

| Weighted Avg Shares Out | 5.64M | 5.69M | 1.68M | 446.55K | 446.56K |

| Weighted Avg Shares Out (Dil) | 5.64M | 5.78M | 1.68M | 446.55K | 446.56K |

Velo3D, Inc. (VLD) Q4 2022 Earnings Call Transcript

Velo3D, Inc. (VLD) Reports Q4 Loss, Tops Revenue Estimates

Cathie Wood has been building stakes in two little-known stocks

Why Has Cathie Wood Bought This Stock for Seven Days in a Row?

Velo3D CFO William McCombe to Present at the 25th Annual Needham Growth Conference

Why Shares of Velo3D Plummeted 49% in November

Cathie Wood Goes Bargain Hunting: 3 Stocks She Just Bought

Velo3D: Proprietary PBF Technology Sets It Apart From Competitors

Velo3D, Inc. (VLD) Q3 2022 Earnings Call Transcript

Velo3D, Inc. (VLD) Reports Q3 Loss, Lags Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports