See more : Stillfront Group AB (publ) (SF.ST) Income Statement Analysis – Financial Results

Complete financial analysis of Velo3D, Inc. (VLD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Velo3D, Inc., a leading company in the Computer Hardware industry within the Technology sector.

- Unisys Corporation (UIS) Income Statement Analysis – Financial Results

- Iseki & Co., Ltd. (6310.T) Income Statement Analysis – Financial Results

- Promotora y Operadora de Infraestructura, S. A. B. de C. V. (PYOIF) Income Statement Analysis – Financial Results

- MKDWELL Tech Inc. (MKDW) Income Statement Analysis – Financial Results

- Meiwu Technology Company Limited (WNW) Income Statement Analysis – Financial Results

Velo3D, Inc. (VLD)

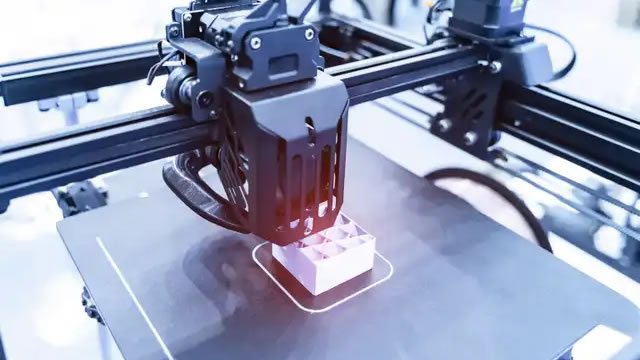

About Velo3D, Inc.

Velo3D, Inc. produces metal additive three dimensional printers in the United States and internationally. The company's printers enable the production of components for space rockets, jet engines, fuel delivery systems, and other high value metal parts, which it sells or leases to customers for use in their businesses. It offers Flow, a proprietary software platform, which scans part designs for geometrical features; Sapphire and Sapphire XC printers; Assure, a quality control system software platform that includes process metrologies; and Intelligent Fusion, an underlying manufacturing process that unifies and manages the information flow, sensor data from approximately 950 sensors, and the advanced printing technology for precision control of the entire print. The company also provides support services. Its customers range from small- and medium-sized enterprises to Fortune 500 companies in the space, aviation, defense, energy, and industrial markets. The company was founded in 2014 and is headquartered in Campbell, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 77.44M | 80.76M | 27.44M | 18.98M | 15.22M |

| Cost of Revenue | 103.71M | 77.86M | 22.48M | 12.61M | 10.39M |

| Gross Profit | -26.27M | 2.89M | 4.96M | 6.37M | 4.83M |

| Gross Profit Ratio | -33.92% | 3.58% | 18.07% | 33.55% | 31.73% |

| Research & Development | 42.03M | 46.27M | 27.00M | 14.19M | 14.59M |

| General & Administrative | 41.73M | 36.98M | 23.35M | 6.38M | 6.53M |

| Selling & Marketing | 23.23M | 23.91M | 12.36M | 7.00M | 8.60M |

| SG&A | 64.96M | 60.89M | 35.72M | 13.39M | 15.53M |

| Other Expenses | 506.00K | 1.45M | -88.00K | 35.00K | 0.00 |

| Operating Expenses | 106.99M | 107.16M | 62.72M | 27.57M | 29.90M |

| Cost & Expenses | 210.70M | 185.02M | 85.20M | 40.18M | 40.30M |

| Interest Income | 0.00 | 372.00K | 2.74M | 639.00K | 605.00K |

| Interest Expense | 9.72M | 372.00K | 2.74M | 639.00K | 0.00 |

| Depreciation & Amortization | 9.31M | 5.29M | 2.17M | 1.24M | 1.14M |

| EBITDA | -123.94M | 13.63M | -55.68M | -19.97M | -24.15M |

| EBITDA Ratio | -160.05% | -120.76% | -202.91% | -105.04% | -158.67% |

| Operating Income | -133.25M | -104.26M | -57.76M | -21.21M | -25.29M |

| Operating Income Ratio | -172.07% | -129.10% | -210.50% | -111.76% | -166.14% |

| Total Other Income/Expenses | -1.89M | 114.28M | -49.33M | -600.00K | -386.00K |

| Income Before Tax | -135.14M | 10.02M | -107.09M | -21.81M | -25.68M |

| Income Before Tax Ratio | -174.50% | 12.41% | -390.29% | -114.92% | -168.68% |

| Income Tax Expense | 9.14M | -114.28M | 2.65M | 674.00K | 0.00 |

| Net Income | -135.14M | 7.97M | -107.09M | -21.81M | -25.68M |

| Net Income Ratio | -174.50% | 9.87% | -390.29% | -114.92% | -168.68% |

| EPS | -23.97 | 1.51 | -63.87 | -48.83 | -57.50 |

| EPS Diluted | -23.97 | 1.40 | -63.87 | -48.83 | -57.50 |

| Weighted Avg Shares Out | 5.64M | 5.69M | 1.68M | 446.55K | 446.56K |

| Weighted Avg Shares Out (Dil) | 5.64M | 5.78M | 1.68M | 446.55K | 446.56K |

Velo3D to Announce Second-Quarter 2023 Results on August 10, 2023

Schoeller-Bleckmann Oilfield Technology Expands Additive Manufacturing Capabilities with a Velo3D Sapphire XC

Velo3D Announces the Appointment of Dr. Adrian Keppler to Its Board of Directors

Velo3D: Growth Deceleration In A Soft Demand Environment

Velo3D: Speculative Dip-Buying Opportunity

Velo3D, Inc. (VLD) Q1 2023 Earnings Call Transcript

Velo3D, Inc. (VLD) Reports Q1 Loss, Tops Revenue Estimates

3 Must-Watch 3D Printing Stocks if You Are Looking for Exponential Growth

Velo3D: Holding Its Own

3 Industrial Services Stocks to Buy in the Flourishing Industry

Source: https://incomestatements.info

Category: Stock Reports