See more : PT PP (Persero) Tbk (PTPP.JK) Income Statement Analysis – Financial Results

Complete financial analysis of The Weir Group PLC (WEGRY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Weir Group PLC, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Kibush Capital Corporation (DLCR) Income Statement Analysis – Financial Results

- Truking Technology Limited (300358.SZ) Income Statement Analysis – Financial Results

- Construtora Adolpho Lindenberg S.A. (CALI3.SA) Income Statement Analysis – Financial Results

- Oki Electric Industry Co., Ltd. (6703.T) Income Statement Analysis – Financial Results

- World Class Extractions Inc. (PUMP.CN) Income Statement Analysis – Financial Results

The Weir Group PLC (WEGRY)

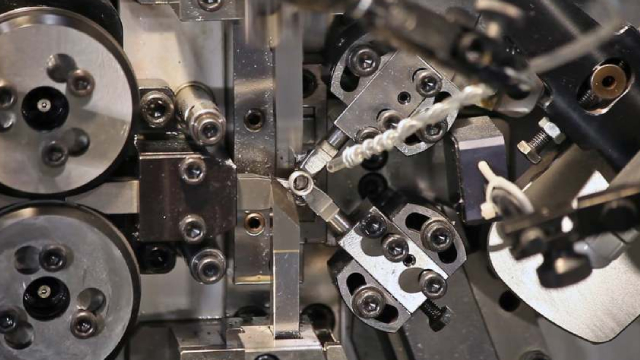

About The Weir Group PLC

The Weir Group PLC produces and sells highly engineered original equipment worldwide. It operates in two segments, Minerals and ESCO. The Minerals segment offers slurry handling equipment and associated aftermarket support services for abrasive high-wear applications used in the mining and oil sands markets. The ESCO segment provides ground engaging tools for mining machines. This segment also produces smart and rugged cameras that monitor and provide valuable and timely data on equipment performance, faults, payloads, and rock fragmentation. The company offers its products under the Accumin, Aspir, Cavex, Delta Industrial, Enduron, Envirotech, Floway, GEHO, Gemex, Hazleton, Hydrau-Flo, R. Wales, Isodry, Isogate, Lewis, Linatex, Multiflo, Synertrex, Stampede, Trio, Vulco, FusionCast, ESCO, Motion Metrics, and Warman brands. The company was founded in 1871 and is headquartered in Glasgow, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.64B | 2.47B | 1.93B | 1.96B | 2.66B | 2.45B | 2.36B | 1.84B | 1.92B | 2.44B | 2.43B | 2.54B | 2.29B | 1.64B | 1.39B | 1.35B | 1.01B | 870.40M | 789.40M | 690.06M | 793.42M | 701.21M | 740.44M | 745.94M | 637.52M | 624.42M | 636.83M | 619.90M | 622.01M | 475.52M | 449.04M | 424.77M | 424.11M | 318.92M | 232.05M | 171.37M | 137.26M | 148.58M | 139.77M |

| Cost of Revenue | 1.64B | 1.60B | 1.24B | 1.27B | 1.79B | 1.63B | 1.62B | 1.24B | 1.37B | 1.63B | 1.56B | 1.65B | 1.50B | 1.02B | 935.00M | 930.10M | 709.00M | 623.60M | 570.70M | 499.22M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 994.90M | 873.90M | 692.00M | 692.90M | 874.20M | 816.90M | 736.70M | 603.20M | 545.70M | 806.00M | 872.60M | 886.10M | 796.60M | 617.30M | 455.20M | 423.50M | 299.80M | 246.80M | 218.70M | 190.84M | 793.42M | 701.21M | 740.44M | 745.94M | 637.52M | 624.42M | 636.83M | 619.90M | 622.01M | 475.52M | 449.04M | 424.77M | 424.11M | 318.92M | 232.05M | 171.37M | 137.26M | 148.58M | 139.77M |

| Gross Profit Ratio | 37.74% | 35.35% | 35.79% | 35.27% | 32.84% | 33.34% | 31.27% | 32.70% | 28.46% | 33.06% | 35.91% | 34.91% | 34.76% | 37.76% | 32.74% | 31.29% | 29.72% | 28.35% | 27.70% | 27.66% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 48.20M | 46.90M | 30.60M | 24.80M | 24.30M | 34.40M | 25.20M | 25.90M | 27.00M | 23.20M | 18.00M | 22.30M | 18.40M | 14.80M | 9.70M | 9.80M | 8.90M | 6.10M | 0.00 | 0.00 | 5.45M | 4.61M | 4.91M | 5.45M | 3.33M | 3.09M | 2.78M | 3.17M | 2.92M | 2.75M | 3.09M | 2.70M | 2.16M | 1.37M | 682.00K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 253.10M | 295.30M | 237.60M | 258.40M | 272.40M | 231.60M | 201.00M | 180.90M | 256.90M | 254.10M | 238.90M | 237.80M | 206.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -50.10M | -44.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 293.80M | 284.00M | 218.90M | 209.30M | 270.50M | 245.80M | 260.00M | 221.10M | 218.90M | 213.50M | 222.60M | 220.80M | 211.30M | 169.80M | 145.80M | 136.10M | 113.60M | 110.70M | 106.60M | 92.62M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 632.20M | 579.30M | 456.50M | 467.70M | 542.90M | 477.40M | 461.00M | 402.00M | 475.80M | 467.60M | 461.50M | 458.60M | 211.30M | 169.80M | 145.80M | 136.10M | 113.60M | 110.70M | 56.50M | 48.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | -53.90M | -10.40M | -19.40M | -7.50M | 63.70M | 66.40M | 50.20M | 44.60M | -14.90M | -4.10M | -70.80M | -35.20M | 4.80M | 4.60M | 4.60M | 4.40M | 3.40M | 2.40M | 9.20M | 7.02M | -13.07M | -16.54M | 668.28M | 683.04M | 583.28M | 578.68M | 588.20M | 571.64M | 577.99M | 432.78M | 410.67M | 391.96M | 394.94M | 317.56M | 229.37M | 169.99M | 137.26M | 144.85M | 139.77M |

| Operating Expenses | 626.50M | 568.90M | 437.10M | 460.20M | 606.60M | 543.80M | 511.20M | 446.60M | 460.90M | 463.50M | 390.70M | 2.08B | 1.89B | 1.35B | 1.21B | 1.18B | 901.90M | 781.50M | 186.00M | 139.00M | 747.06M | 656.74M | 673.19M | 688.49M | 586.61M | 581.77M | 590.98M | 574.81M | 580.90M | 435.53M | 413.76M | 394.65M | 397.10M | 318.92M | 230.05M | 169.99M | 137.26M | 144.85M | 139.77M |

| Cost & Expenses | 2.27B | 2.17B | 1.68B | 1.73B | 2.39B | 2.18B | 2.13B | 1.69B | 1.83B | 2.10B | 1.95B | 2.08B | 1.89B | 1.35B | 1.21B | 1.18B | 901.90M | 781.50M | 756.70M | 638.22M | 747.06M | 656.74M | 673.19M | 688.49M | 586.61M | 581.77M | 590.98M | 574.81M | 580.90M | 435.53M | 413.76M | 394.65M | 397.10M | 318.92M | 230.05M | 169.99M | 137.26M | 144.85M | 139.77M |

| Interest Income | 12.00M | 3.70M | 5.60M | 3.80M | 4.30M | 2.70M | 1.60M | 4.40M | 4.70M | 6.00M | 3.00M | 5.20M | 4.30M | 1.50M | 2.50M | 8.40M | 10.80M | 10.20M | 2.50M | 3.27M | 5.00M | 1.78M | 4.44M | 1.84M | 1.38M | 4.49M | 1.93M | 803.00K | 599.00K | 1.18M | 2.26M | 4.92M | 4.59M | 2.94M | 1.22M | 986.00K | 2.90M | 1.13M | 524.00K |

| Interest Expense | 59.60M | 51.00M | 52.70M | 53.80M | 53.90M | 40.70M | 44.10M | 48.90M | 42.90M | 46.60M | 58.60M | 49.10M | 21.40M | 16.50M | 20.20M | 17.20M | 12.70M | 10.80M | 6.60M | 6.39M | 6.50M | 3.77M | 12.20M | 13.79M | 5.66M | 2.74M | 2.13M | 3.01M | 2.61M | 1.59M | 1.86M | 2.11M | 2.41M | 2.14M | 2.19M | 1.15M | 1.80M | 1.77M | 2.89M |

| Depreciation & Amortization | 109.20M | 114.30M | 105.50M | 111.00M | 115.60M | 128.10M | 101.70M | 106.10M | 115.90M | 106.00M | 105.80M | 86.10M | 61.10M | 52.30M | 44.80M | 37.20M | 22.90M | 17.50M | 17.10M | 15.21M | 22.17M | 23.51M | 19.44M | 21.90M | 17.62M | 15.28M | 14.89M | 14.50M | 14.88M | 11.41M | 9.62M | 8.68M | 7.34M | 5.91M | 5.25M | 3.65M | 3.15M | 1.99M | 2.01M |

| EBITDA | 489.50M | 422.80M | 361.90M | 372.60M | 416.40M | 403.20M | 331.70M | 259.70M | -18.60M | 295.50M | 592.70M | 550.90M | 467.50M | 345.60M | 236.30M | 212.50M | 144.00M | 118.80M | 61.20M | 77.00M | 71.57M | 72.53M | 67.17M | 92.95M | 65.30M | 81.50M | 76.42M | 66.53M | 62.19M | 43.89M | 49.26M | 48.26M | 44.39M | 35.58M | 29.82M | 23.92M | 18.00M | 18.82M | 13.93M |

| EBITDA Ratio | 18.57% | 17.44% | 19.29% | 19.66% | -5.06% | 10.56% | 14.36% | 10.74% | -2.14% | 12.37% | 24.51% | 22.03% | 20.63% | 21.14% | 17.00% | 16.17% | 14.27% | 13.67% | 7.79% | 11.21% | 9.02% | 10.34% | 12.33% | 12.83% | 11.99% | 13.05% | 12.00% | 10.73% | 10.00% | 10.81% | 11.46% | 11.36% | 10.27% | 11.16% | 13.71% | 14.76% | 13.11% | 15.17% | 9.97% |

| Operating Income | 368.40M | 307.50M | 256.60M | 234.30M | 267.60M | 124.10M | 223.10M | 90.30M | -158.30M | 192.50M | 490.30M | 469.10M | 407.90M | 291.50M | 188.10M | 168.30M | 110.90M | 91.10M | 41.60M | 59.04M | 46.31M | 41.80M | 43.12M | 54.71M | 39.80M | 50.84M | 46.73M | 45.33M | 42.09M | 32.47M | 33.07M | 32.13M | 27.85M | 29.67M | 2.00M | 1.39M | 14.85M | 3.73M | 11.92M |

| Operating Income Ratio | 13.98% | 12.44% | 13.27% | 11.93% | 10.05% | 5.07% | 9.47% | 4.89% | -8.25% | 7.90% | 20.18% | 18.48% | 17.80% | 17.83% | 13.53% | 12.43% | 10.99% | 10.47% | 5.27% | 8.56% | 5.84% | 5.96% | 5.82% | 7.33% | 6.24% | 8.14% | 7.34% | 7.31% | 6.77% | 6.83% | 7.37% | 7.56% | 6.57% | 9.30% | 0.86% | 0.81% | 10.82% | 2.51% | 8.53% |

| Total Other Income/Expenses | -47.70M | -47.30M | -47.10M | -50.00M | -46.30M | -38.00M | -42.20M | -47.50M | -41.20M | -43.40M | -59.10M | -47.90M | -17.10M | -15.00M | -17.70M | -8.80M | -1.90M | -600.00K | -4.10M | -3.64M | 4.95M | 20.33M | -7.71M | 2.11M | 1.80M | 20.72M | 13.40M | 3.71M | 3.41M | -1.92M | 4.47M | 7.07M | 6.40M | -2.50M | 20.37M | 17.73M | -1.80M | 11.33M | -2.89M |

| Income Before Tax | 320.70M | 260.20M | 209.50M | 184.30M | -371.80M | 86.10M | 180.60M | 42.80M | -199.80M | 149.10M | 431.20M | 424.00M | 390.80M | 276.50M | 170.40M | 159.50M | 109.00M | 90.50M | 37.50M | 55.92M | 51.25M | 59.61M | 35.40M | 56.83M | 41.60M | 71.56M | 60.14M | 49.04M | 45.50M | 30.55M | 37.54M | 39.20M | 34.24M | 27.17M | 22.38M | 19.12M | 13.05M | 15.05M | 9.03M |

| Income Before Tax Ratio | 12.17% | 10.53% | 10.83% | 9.38% | -13.97% | 3.51% | 7.67% | 2.32% | -10.42% | 6.12% | 17.75% | 16.70% | 17.05% | 16.91% | 12.26% | 11.78% | 10.80% | 10.40% | 4.75% | 8.10% | 6.46% | 8.50% | 4.78% | 7.62% | 6.52% | 11.46% | 9.44% | 7.91% | 7.32% | 6.42% | 8.36% | 9.23% | 8.07% | 8.52% | 9.64% | 11.16% | 9.51% | 10.13% | 6.46% |

| Income Tax Expense | 90.80M | 47.60M | 54.40M | 45.70M | -18.40M | 32.70M | 19.10M | -400.00K | -20.80M | 75.40M | 95.50M | 111.60M | 112.40M | 77.40M | 46.80M | 46.50M | 30.10M | 21.60M | 13.80M | 11.34M | 8.36M | 9.03M | 8.17M | 15.28M | 12.41M | 18.64M | 16.62M | 14.26M | 12.50M | 8.51M | 10.65M | 11.80M | 10.53M | 7.61M | 4.72M | 3.20M | 3.09M | 4.03M | 2.72M |

| Net Income | 227.90M | 213.40M | 155.10M | 138.60M | -353.40M | 18.00M | 159.90M | 38.30M | -178.70M | 73.10M | 334.90M | 313.00M | 298.30M | 185.10M | 128.80M | 170.80M | 174.90M | 81.60M | 25.90M | 44.02M | 42.88M | 50.16M | 27.22M | 41.48M | 29.14M | 52.83M | 43.43M | 34.82M | 32.93M | 22.04M | 26.89M | 27.40M | 23.71M | 19.42M | 17.62M | 15.92M | 9.96M | 12.83M | 6.31M |

| Net Income Ratio | 8.65% | 8.63% | 8.02% | 7.05% | -13.28% | 0.73% | 6.79% | 2.08% | -9.32% | 3.00% | 13.78% | 12.33% | 13.01% | 11.32% | 9.26% | 12.62% | 17.34% | 9.38% | 3.28% | 6.38% | 5.40% | 7.15% | 3.68% | 5.56% | 4.57% | 8.46% | 6.82% | 5.62% | 5.29% | 4.63% | 5.99% | 6.45% | 5.59% | 6.09% | 7.59% | 9.29% | 7.26% | 8.64% | 4.52% |

| EPS | 0.88 | 0.82 | 0.60 | 0.53 | -1.36 | 0.04 | 0.37 | 0.09 | -0.42 | 0.17 | 0.79 | 0.74 | 0.71 | 0.44 | 0.31 | 0.41 | 0.42 | 0.20 | 0.06 | 0.11 | 0.11 | 0.12 | 0.07 | 0.10 | 0.07 | 0.13 | 0.11 | 0.09 | 0.08 | 0.07 | 0.08 | 0.09 | 0.08 | 0.07 | 0.07 | 0.06 | 0.04 | 0.07 | 0.03 |

| EPS Diluted | 0.88 | 0.82 | 0.59 | 0.53 | -1.36 | 0.04 | 0.37 | 0.09 | -0.42 | 0.17 | 0.78 | 0.74 | 0.70 | 0.43 | 0.30 | 0.40 | 0.41 | 0.19 | 0.06 | 0.11 | 0.11 | 0.12 | 0.07 | 0.10 | 0.07 | 0.13 | 0.11 | 0.09 | 0.08 | 0.07 | 0.08 | 0.09 | 0.08 | 0.07 | 0.07 | 0.06 | 0.04 | 0.07 | 0.03 |

| Weighted Avg Shares Out | 258.39M | 258.70M | 259.30M | 259.50M | 259.50M | 488.20M | 439.80M | 431.20M | 427.40M | 426.60M | 426.00M | 424.40M | 422.40M | 421.20M | 420.60M | 419.80M | 417.20M | 414.20M | 409.17M | 414.11M | 409.12M | 406.12M | 403.22M | 400.21M | 402.29M | 404.22M | 404.41M | 400.28M | 395.53M | 339.44M | 317.45M | 315.01M | 300.79M | 272.55M | 251.09M | 246.43M | 225.67M | 194.81M | 181.59M |

| Weighted Avg Shares Out (Dil) | 259.80M | 260.30M | 261.00M | 259.50M | 259.50M | 491.60M | 442.60M | 433.80M | 427.40M | 427.80M | 427.60M | 427.00M | 426.80M | 426.20M | 424.00M | 422.00M | 421.80M | 420.20M | 414.40M | 414.11M | 409.12M | 409.25M | 405.39M | 400.21M | 405.66M | 405.65M | 407.22M | 400.28M | 395.53M | 339.44M | 317.45M | 315.01M | 300.79M | 272.55M | 251.09M | 246.43M | 225.67M | 194.81M | 181.59M |

Stewart Cink and Mike Weir Commit to Compete in Inaugural Simmons Bank Championship presented by Stephens

The Weir Group PLC (WEIGF) Q2 2024 Earnings Call Transcript

Weir Group (WEGRY) is on the Move, Here's Why the Trend Could be Sustainable

Recent Price Trend in Weir Group (WEGRY) is Your Friend, Here's Why

Weir Group (WEGRY) Is a Great Choice for 'Trend' Investors, Here's Why

Here's Why Momentum in Weir Group (WEGRY) Should Keep going

The Weir Group PLC (WEIGF) Q2 2023 Earnings Call Transcript

Weir Group (WEGRY) is on the Move, Here's Why the Trend Could be Sustainable

The Weir Group PLC (WEIGF) Q4 2022 Earnings Call Transcript

Recent Price Trend in Weir Group (WEGRY) is Your Friend, Here's Why

Source: https://incomestatements.info

Category: Stock Reports