Complete financial analysis of A. H. Belo Corporation (AHC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of A. H. Belo Corporation, a leading company in the Publishing industry within the Communication Services sector.

- Ceconomy AG (MTAGF) Income Statement Analysis – Financial Results

- SsangYong C&E Co., Ltd. (003410.KS) Income Statement Analysis – Financial Results

- Audix Corporation (2459.TW) Income Statement Analysis – Financial Results

- Taiwan Tea Corporation (2913.TW) Income Statement Analysis – Financial Results

- Daifuku Co., Ltd. (DAIUF) Income Statement Analysis – Financial Results

A. H. Belo Corporation (AHC)

About A. H. Belo Corporation

A.H. Belo Corporation, together with its subsidiaries, operates as a local news and information publishing company primarily in Texas. The company publishes The Dallas Morning News, a newspaper; Briefing newspaper; and Al Dia, a Spanish-language newspaper, as well as operates related websites and mobile applications. It also offers commercial printing, distribution, direct mail, and shared mail packaging services; and auto dealerships advertising services on the cars.com platform. In addition, the company provides digital marketing services, such as multi-channel marketing solutions through subscription sales of its cloud-based software; digital and marketing analytics, search engine marketing, and other marketing related services; social media account management and content marketing services; and multi- channel digital advertising and marketing services campaigns, as well as marketing and promotional products for businesses. A.H. Belo Corporation was founded in 1842 and is headquartered in Dallas, Texas.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 154.30M | 183.56M | 202.29M | 248.63M | 259.98M | 272.11M | 272.79M | 366.25M | 440.05M | 461.50M | 487.31M | 518.35M | 637.31M | 738.67M | 817.73M | 822.34M | 779.14M | 763.65M |

| Cost of Revenue | 90.18M | 107.24M | 112.19M | 138.16M | 145.42M | 156.72M | 154.75M | 191.04M | 228.45M | 235.02M | 238.49M | 270.31M | 343.03M | 361.73M | 390.85M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 64.12M | 76.32M | 90.09M | 110.47M | 114.56M | 115.39M | 118.04M | 175.21M | 211.60M | 226.48M | 248.82M | 248.03M | 294.28M | 376.94M | 426.88M | 822.34M | 779.14M | 763.65M |

| Gross Profit Ratio | 41.56% | 41.58% | 44.54% | 44.43% | 44.07% | 42.40% | 43.27% | 47.84% | 48.09% | 49.07% | 51.06% | 47.85% | 46.18% | 51.03% | 52.20% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Operating Expenses | 79.04M | 89.61M | 100.01M | 117.18M | 115.63M | 133.68M | 125.73M | 168.88M | 209.79M | 223.40M | 251.14M | 259.96M | 351.56M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Cost & Expenses | 169.22M | 196.86M | 212.20M | 255.34M | 261.05M | 290.40M | 280.47M | 359.92M | 438.23M | 458.43M | 489.63M | 530.27M | 694.59M | 711.68M | 760.38M | 721.25M | 689.46M | 645.38M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 311.00K | 630.00K | 669.00K | 808.00K | 1.38M | 4.03M | 34.83M | 31.81M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 52.31M | 46.58M | 46.22M | -15.65M | -18.07M |

| EBITDA | -1.29M | 23.19M | 4.70M | 15.12M | -9.96M | -6.55M | 112.93M | 40.59M | 35.61M | 30.41M | -92.86M | -73.63M | -22.07M | -261.35M | 105.44M | 124.40M | 74.03M | 100.21M |

| EBITDA Ratio | -0.83% | 12.63% | 2.32% | 6.08% | -3.83% | -2.41% | 41.40% | 11.08% | 8.09% | 6.59% | -19.06% | -14.21% | -3.46% | -35.38% | 12.89% | 15.13% | 9.50% | 13.12% |

| Operating Income | -14.92M | -13.29M | -9.91M | -6.71M | -1.06M | -18.30M | -7.69M | 6.33M | 1.81M | 3.08M | -2.32M | -11.92M | -57.28M | 26.99M | 57.36M | 101.09M | 89.68M | 118.27M |

| Operating Income Ratio | -9.67% | -7.24% | -4.90% | -2.70% | -0.41% | -6.72% | -2.82% | 1.73% | 0.41% | 0.67% | -0.48% | -2.30% | -8.99% | 3.65% | 7.01% | 12.29% | 11.51% | 15.49% |

| Total Other Income/Expenses | 6.36M | 27.00M | 3.91M | 10.61M | -20.39M | -1.47M | 99.67M | 2.41M | 339.00K | -9.00M | -129.49M | -108.45M | -22.10M | -375.49M | -30.31M | -22.91M | -15.65M | -18.07M |

| Income Before Tax | -8.56M | 13.71M | -6.00M | 3.90M | -21.45M | -19.76M | 91.99M | 8.74M | 2.15M | -5.92M | -131.81M | -120.37M | -79.38M | -348.50M | 27.05M | 78.18M | 74.03M | 100.21M |

| Income Before Tax Ratio | -5.55% | 7.47% | -2.97% | 1.57% | -8.25% | -7.26% | 33.72% | 2.39% | 0.49% | -1.28% | -27.05% | -23.22% | -12.45% | -47.18% | 3.31% | 9.51% | 9.50% | 13.12% |

| Income Tax Expense | -1.69M | 4.42M | -565.00K | -6.26M | -2.27M | -1.57M | 5.98M | 1.58M | 1.73M | 5.01M | -7.58M | -12.48M | -17.07M | -1.49M | 11.87M | 30.36M | 28.75M | 38.46M |

| Net Income | -6.87M | 9.29M | -5.43M | 10.16M | -19.31M | -17.84M | 92.93M | 16.12M | 526.00K | -10.93M | -124.24M | -107.90M | -62.30M | -347.01M | 15.18M | 47.82M | 45.29M | 61.75M |

| Net Income Ratio | -4.45% | 5.06% | -2.69% | 4.09% | -7.43% | -6.56% | 34.07% | 4.40% | 0.12% | -2.37% | -25.49% | -20.82% | -9.78% | -46.98% | 1.86% | 5.81% | 5.81% | 8.09% |

| EPS | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.97 | 2.94 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| EPS Diluted | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.89 | 2.92 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| Weighted Avg Shares Out | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.47M | 5.49M | 5.49M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

| Weighted Avg Shares Out (Dil) | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.50M | 5.52M | 5.52M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

Nearly 17,000 Southwest employees sign up for buyouts, voluntary leave as furlough threat looms

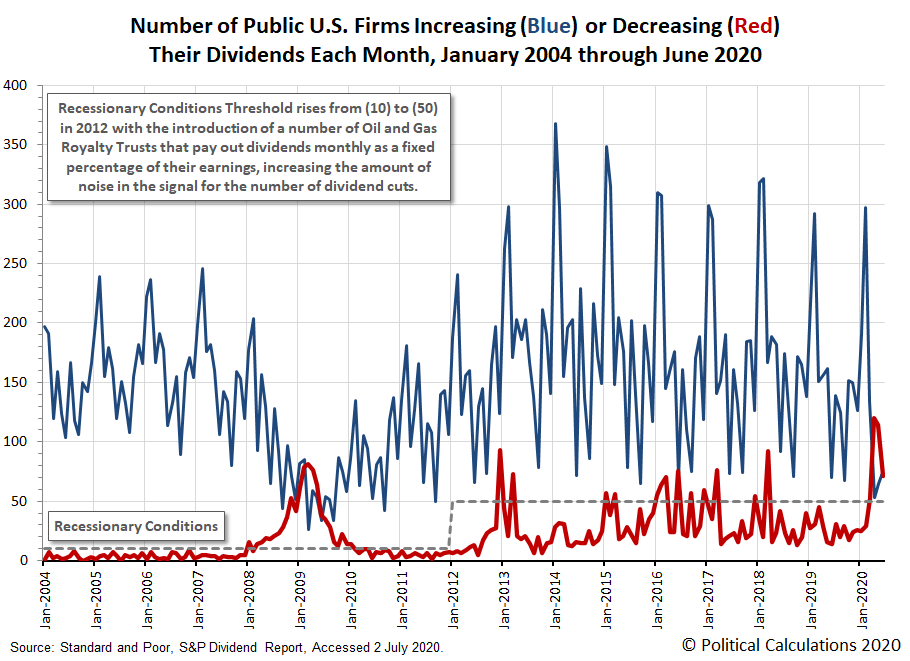

Dividends By The Numbers In June 2020 And 2020-Q2

Arch Re completes majority stake acquisition in PMAP - Reinsurance News

Ex-FDA Chief: U.S. May Actually Have Over 400,000 New Coronavirus Cases Per Day, But Not Testing Enough To Show It

Disappearing public newspaper companies were a thriving group not so long ago - Poynter

State Orders Bars Closed Amid Rampant Covid Spread Among Young People; Nearly 9,000 New Cases Seen

Pence attends Dallas rally, talks coronavirus’ ‘dangerous turn’ with Gov. Abbott

Texas, Florida Governors Walk Back Reopenings—But Refuse To Mandate Masks As Virus Rages

News in brief - The Boston Globe

Dallas Mavericks signing Trey Burke after losing Willie Cauley-Stein

Source: https://incomestatements.info

Category: Stock Reports