Complete financial analysis of A. H. Belo Corporation (AHC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of A. H. Belo Corporation, a leading company in the Publishing industry within the Communication Services sector.

- The Saudi Investment Bank (1030.SR) Income Statement Analysis – Financial Results

- Shanghai Xintonglian Packaging Co., Ltd. (603022.SS) Income Statement Analysis – Financial Results

- Megaworld Corporation (MGAWF) Income Statement Analysis – Financial Results

- Amincor, Inc. (AMNC) Income Statement Analysis – Financial Results

- Patron Exim Limited (PATRON.BO) Income Statement Analysis – Financial Results

A. H. Belo Corporation (AHC)

About A. H. Belo Corporation

A.H. Belo Corporation, together with its subsidiaries, operates as a local news and information publishing company primarily in Texas. The company publishes The Dallas Morning News, a newspaper; Briefing newspaper; and Al Dia, a Spanish-language newspaper, as well as operates related websites and mobile applications. It also offers commercial printing, distribution, direct mail, and shared mail packaging services; and auto dealerships advertising services on the cars.com platform. In addition, the company provides digital marketing services, such as multi-channel marketing solutions through subscription sales of its cloud-based software; digital and marketing analytics, search engine marketing, and other marketing related services; social media account management and content marketing services; and multi- channel digital advertising and marketing services campaigns, as well as marketing and promotional products for businesses. A.H. Belo Corporation was founded in 1842 and is headquartered in Dallas, Texas.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 154.30M | 183.56M | 202.29M | 248.63M | 259.98M | 272.11M | 272.79M | 366.25M | 440.05M | 461.50M | 487.31M | 518.35M | 637.31M | 738.67M | 817.73M | 822.34M | 779.14M | 763.65M |

| Cost of Revenue | 90.18M | 107.24M | 112.19M | 138.16M | 145.42M | 156.72M | 154.75M | 191.04M | 228.45M | 235.02M | 238.49M | 270.31M | 343.03M | 361.73M | 390.85M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 64.12M | 76.32M | 90.09M | 110.47M | 114.56M | 115.39M | 118.04M | 175.21M | 211.60M | 226.48M | 248.82M | 248.03M | 294.28M | 376.94M | 426.88M | 822.34M | 779.14M | 763.65M |

| Gross Profit Ratio | 41.56% | 41.58% | 44.54% | 44.43% | 44.07% | 42.40% | 43.27% | 47.84% | 48.09% | 49.07% | 51.06% | 47.85% | 46.18% | 51.03% | 52.20% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Operating Expenses | 79.04M | 89.61M | 100.01M | 117.18M | 115.63M | 133.68M | 125.73M | 168.88M | 209.79M | 223.40M | 251.14M | 259.96M | 351.56M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Cost & Expenses | 169.22M | 196.86M | 212.20M | 255.34M | 261.05M | 290.40M | 280.47M | 359.92M | 438.23M | 458.43M | 489.63M | 530.27M | 694.59M | 711.68M | 760.38M | 721.25M | 689.46M | 645.38M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 311.00K | 630.00K | 669.00K | 808.00K | 1.38M | 4.03M | 34.83M | 31.81M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 52.31M | 46.58M | 46.22M | -15.65M | -18.07M |

| EBITDA | -1.29M | 23.19M | 4.70M | 15.12M | -9.96M | -6.55M | 112.93M | 40.59M | 35.61M | 30.41M | -92.86M | -73.63M | -22.07M | -261.35M | 105.44M | 124.40M | 74.03M | 100.21M |

| EBITDA Ratio | -0.83% | 12.63% | 2.32% | 6.08% | -3.83% | -2.41% | 41.40% | 11.08% | 8.09% | 6.59% | -19.06% | -14.21% | -3.46% | -35.38% | 12.89% | 15.13% | 9.50% | 13.12% |

| Operating Income | -14.92M | -13.29M | -9.91M | -6.71M | -1.06M | -18.30M | -7.69M | 6.33M | 1.81M | 3.08M | -2.32M | -11.92M | -57.28M | 26.99M | 57.36M | 101.09M | 89.68M | 118.27M |

| Operating Income Ratio | -9.67% | -7.24% | -4.90% | -2.70% | -0.41% | -6.72% | -2.82% | 1.73% | 0.41% | 0.67% | -0.48% | -2.30% | -8.99% | 3.65% | 7.01% | 12.29% | 11.51% | 15.49% |

| Total Other Income/Expenses | 6.36M | 27.00M | 3.91M | 10.61M | -20.39M | -1.47M | 99.67M | 2.41M | 339.00K | -9.00M | -129.49M | -108.45M | -22.10M | -375.49M | -30.31M | -22.91M | -15.65M | -18.07M |

| Income Before Tax | -8.56M | 13.71M | -6.00M | 3.90M | -21.45M | -19.76M | 91.99M | 8.74M | 2.15M | -5.92M | -131.81M | -120.37M | -79.38M | -348.50M | 27.05M | 78.18M | 74.03M | 100.21M |

| Income Before Tax Ratio | -5.55% | 7.47% | -2.97% | 1.57% | -8.25% | -7.26% | 33.72% | 2.39% | 0.49% | -1.28% | -27.05% | -23.22% | -12.45% | -47.18% | 3.31% | 9.51% | 9.50% | 13.12% |

| Income Tax Expense | -1.69M | 4.42M | -565.00K | -6.26M | -2.27M | -1.57M | 5.98M | 1.58M | 1.73M | 5.01M | -7.58M | -12.48M | -17.07M | -1.49M | 11.87M | 30.36M | 28.75M | 38.46M |

| Net Income | -6.87M | 9.29M | -5.43M | 10.16M | -19.31M | -17.84M | 92.93M | 16.12M | 526.00K | -10.93M | -124.24M | -107.90M | -62.30M | -347.01M | 15.18M | 47.82M | 45.29M | 61.75M |

| Net Income Ratio | -4.45% | 5.06% | -2.69% | 4.09% | -7.43% | -6.56% | 34.07% | 4.40% | 0.12% | -2.37% | -25.49% | -20.82% | -9.78% | -46.98% | 1.86% | 5.81% | 5.81% | 8.09% |

| EPS | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.97 | 2.94 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| EPS Diluted | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.89 | 2.92 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| Weighted Avg Shares Out | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.47M | 5.49M | 5.49M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

| Weighted Avg Shares Out (Dil) | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.50M | 5.52M | 5.52M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

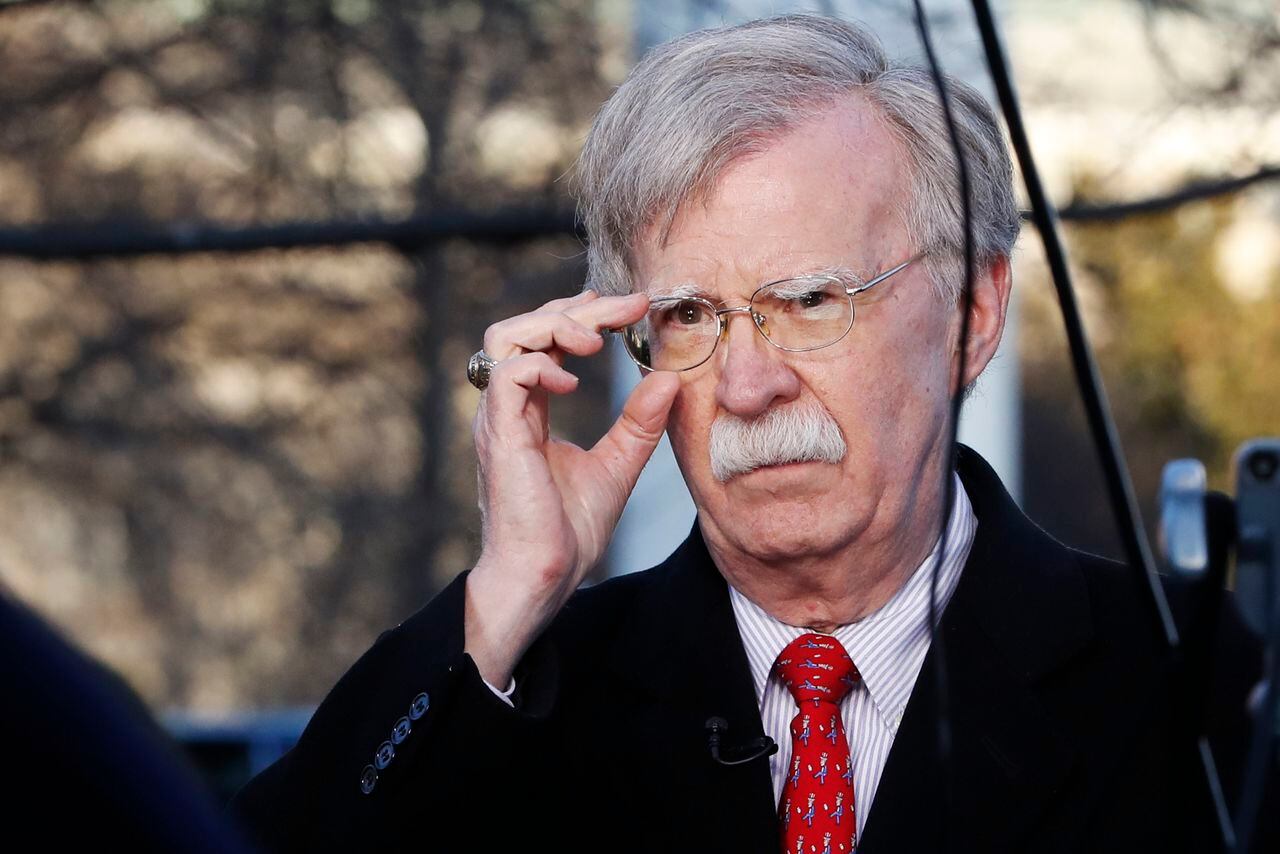

President Trump thinks some journalists should be executed, according to John Bolton’s upcoming book - Poynter

Racism Baked Into Formulas, Algorithms Used To Help Doctors Make Medical Decisions

Dallas County declares racism a public health emergency

Nebraska Governor Says Local Governments Won't Receive Coronavirus Funding If They Require Masks

Trump administration files lawsuit in attempt to stop Bolton’s book: A.M. News Links

1 wounded, 1 sought in Dallas shopping mall shooting

One person wounded as gunman opens fire at mall in Dallas

Amputee claims flight attendants told her to 'scoot' to the lavatory

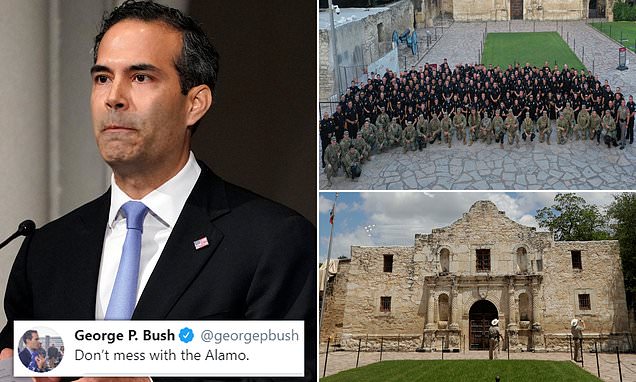

George P. Bush warns protesters not to 'mess with the Alamo'

Source: https://incomestatements.info

Category: Stock Reports