See more : NS Shopping Co., Ltd (138250.KS) Income Statement Analysis – Financial Results

Complete financial analysis of A. H. Belo Corporation (AHC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of A. H. Belo Corporation, a leading company in the Publishing industry within the Communication Services sector.

- Proto Script Pharmaceutical Corp. (PSCR) Income Statement Analysis – Financial Results

- Takbo Group Holdings Limited (8436.HK) Income Statement Analysis – Financial Results

- Evershine Group Holdings Limited (8022.HK) Income Statement Analysis – Financial Results

- Priority Aviation, Inc. (PJET) Income Statement Analysis – Financial Results

- Yunnan Energy International Co. Limited (1298.HK) Income Statement Analysis – Financial Results

A. H. Belo Corporation (AHC)

About A. H. Belo Corporation

A.H. Belo Corporation, together with its subsidiaries, operates as a local news and information publishing company primarily in Texas. The company publishes The Dallas Morning News, a newspaper; Briefing newspaper; and Al Dia, a Spanish-language newspaper, as well as operates related websites and mobile applications. It also offers commercial printing, distribution, direct mail, and shared mail packaging services; and auto dealerships advertising services on the cars.com platform. In addition, the company provides digital marketing services, such as multi-channel marketing solutions through subscription sales of its cloud-based software; digital and marketing analytics, search engine marketing, and other marketing related services; social media account management and content marketing services; and multi- channel digital advertising and marketing services campaigns, as well as marketing and promotional products for businesses. A.H. Belo Corporation was founded in 1842 and is headquartered in Dallas, Texas.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 154.30M | 183.56M | 202.29M | 248.63M | 259.98M | 272.11M | 272.79M | 366.25M | 440.05M | 461.50M | 487.31M | 518.35M | 637.31M | 738.67M | 817.73M | 822.34M | 779.14M | 763.65M |

| Cost of Revenue | 90.18M | 107.24M | 112.19M | 138.16M | 145.42M | 156.72M | 154.75M | 191.04M | 228.45M | 235.02M | 238.49M | 270.31M | 343.03M | 361.73M | 390.85M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 64.12M | 76.32M | 90.09M | 110.47M | 114.56M | 115.39M | 118.04M | 175.21M | 211.60M | 226.48M | 248.82M | 248.03M | 294.28M | 376.94M | 426.88M | 822.34M | 779.14M | 763.65M |

| Gross Profit Ratio | 41.56% | 41.58% | 44.54% | 44.43% | 44.07% | 42.40% | 43.27% | 47.84% | 48.09% | 49.07% | 51.06% | 47.85% | 46.18% | 51.03% | 52.20% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 71.77M | 80.13M | 89.30M | 105.97M | 104.01M | 120.82M | 111.71M | 146.31M | 177.07M | 187.74M | 213.00M | 214.60M | 298.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Operating Expenses | 79.04M | 89.61M | 100.01M | 117.18M | 115.63M | 133.68M | 125.73M | 168.88M | 209.79M | 223.40M | 251.14M | 259.96M | 351.56M | 349.94M | 369.53M | 721.25M | 689.46M | 645.38M |

| Cost & Expenses | 169.22M | 196.86M | 212.20M | 255.34M | 261.05M | 290.40M | 280.47M | 359.92M | 438.23M | 458.43M | 489.63M | 530.27M | 694.59M | 711.68M | 760.38M | 721.25M | 689.46M | 645.38M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 311.00K | 630.00K | 669.00K | 808.00K | 1.38M | 4.03M | 34.83M | 31.81M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.27M | 9.48M | 10.70M | 11.21M | 11.62M | 12.86M | 14.02M | 22.57M | 32.72M | 35.67M | 38.14M | 45.36M | 53.28M | 52.31M | 46.58M | 46.22M | -15.65M | -18.07M |

| EBITDA | -1.29M | 23.19M | 4.70M | 15.12M | -9.96M | -6.55M | 112.93M | 40.59M | 35.61M | 30.41M | -92.86M | -73.63M | -22.07M | -261.35M | 105.44M | 124.40M | 74.03M | 100.21M |

| EBITDA Ratio | -0.83% | 12.63% | 2.32% | 6.08% | -3.83% | -2.41% | 41.40% | 11.08% | 8.09% | 6.59% | -19.06% | -14.21% | -3.46% | -35.38% | 12.89% | 15.13% | 9.50% | 13.12% |

| Operating Income | -14.92M | -13.29M | -9.91M | -6.71M | -1.06M | -18.30M | -7.69M | 6.33M | 1.81M | 3.08M | -2.32M | -11.92M | -57.28M | 26.99M | 57.36M | 101.09M | 89.68M | 118.27M |

| Operating Income Ratio | -9.67% | -7.24% | -4.90% | -2.70% | -0.41% | -6.72% | -2.82% | 1.73% | 0.41% | 0.67% | -0.48% | -2.30% | -8.99% | 3.65% | 7.01% | 12.29% | 11.51% | 15.49% |

| Total Other Income/Expenses | 6.36M | 27.00M | 3.91M | 10.61M | -20.39M | -1.47M | 99.67M | 2.41M | 339.00K | -9.00M | -129.49M | -108.45M | -22.10M | -375.49M | -30.31M | -22.91M | -15.65M | -18.07M |

| Income Before Tax | -8.56M | 13.71M | -6.00M | 3.90M | -21.45M | -19.76M | 91.99M | 8.74M | 2.15M | -5.92M | -131.81M | -120.37M | -79.38M | -348.50M | 27.05M | 78.18M | 74.03M | 100.21M |

| Income Before Tax Ratio | -5.55% | 7.47% | -2.97% | 1.57% | -8.25% | -7.26% | 33.72% | 2.39% | 0.49% | -1.28% | -27.05% | -23.22% | -12.45% | -47.18% | 3.31% | 9.51% | 9.50% | 13.12% |

| Income Tax Expense | -1.69M | 4.42M | -565.00K | -6.26M | -2.27M | -1.57M | 5.98M | 1.58M | 1.73M | 5.01M | -7.58M | -12.48M | -17.07M | -1.49M | 11.87M | 30.36M | 28.75M | 38.46M |

| Net Income | -6.87M | 9.29M | -5.43M | 10.16M | -19.31M | -17.84M | 92.93M | 16.12M | 526.00K | -10.93M | -124.24M | -107.90M | -62.30M | -347.01M | 15.18M | 47.82M | 45.29M | 61.75M |

| Net Income Ratio | -4.45% | 5.06% | -2.69% | 4.09% | -7.43% | -6.56% | 34.07% | 4.40% | 0.12% | -2.37% | -25.49% | -20.82% | -9.78% | -46.98% | 1.86% | 5.81% | 5.81% | 8.09% |

| EPS | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.97 | 2.94 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| EPS Diluted | -1.28 | 1.73 | -1.00 | 1.87 | -3.57 | -3.33 | 16.89 | 2.92 | 0.10 | -2.03 | -23.67 | -21.00 | -12.17 | -67.78 | 2.97 | 9.35 | 8.86 | 12.08 |

| Weighted Avg Shares Out | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.47M | 5.49M | 5.49M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

| Weighted Avg Shares Out (Dil) | 5.35M | 5.39M | 5.44M | 5.43M | 5.41M | 5.35M | 5.50M | 5.52M | 5.52M | 5.37M | 5.25M | 5.14M | 5.12M | 5.12M | 5.11M | 5.11M | 5.11M | 5.11M |

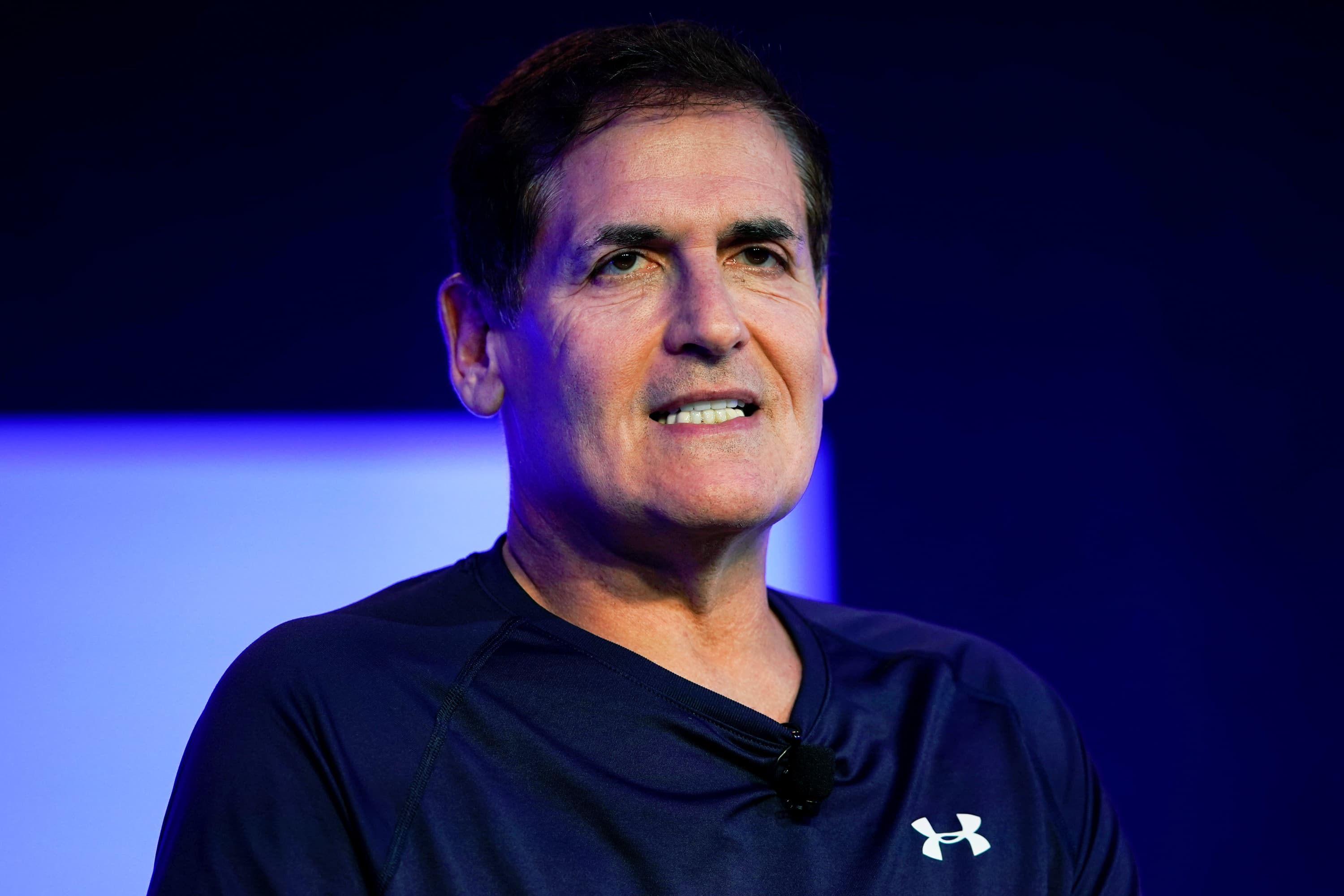

Mark Cuban: 'There is no quick fix' to systemic racism but white people 'need to change'

Zurich bolsters global A&H with three key hires - Reinsurance News

A.H. Belo: Huge Upside On Paper, Huge Risk From Strategy (NYSE:AHC)

Sneaker Boutiques and Resale Shops Impacted by Weekend Disorder

Curtis Cooke, Hall of Fame welterweight champion, dies at 82

Berkshire Hathaway Specialty Insurance Names Phil Gardham to Head Medical Stop Loss Division

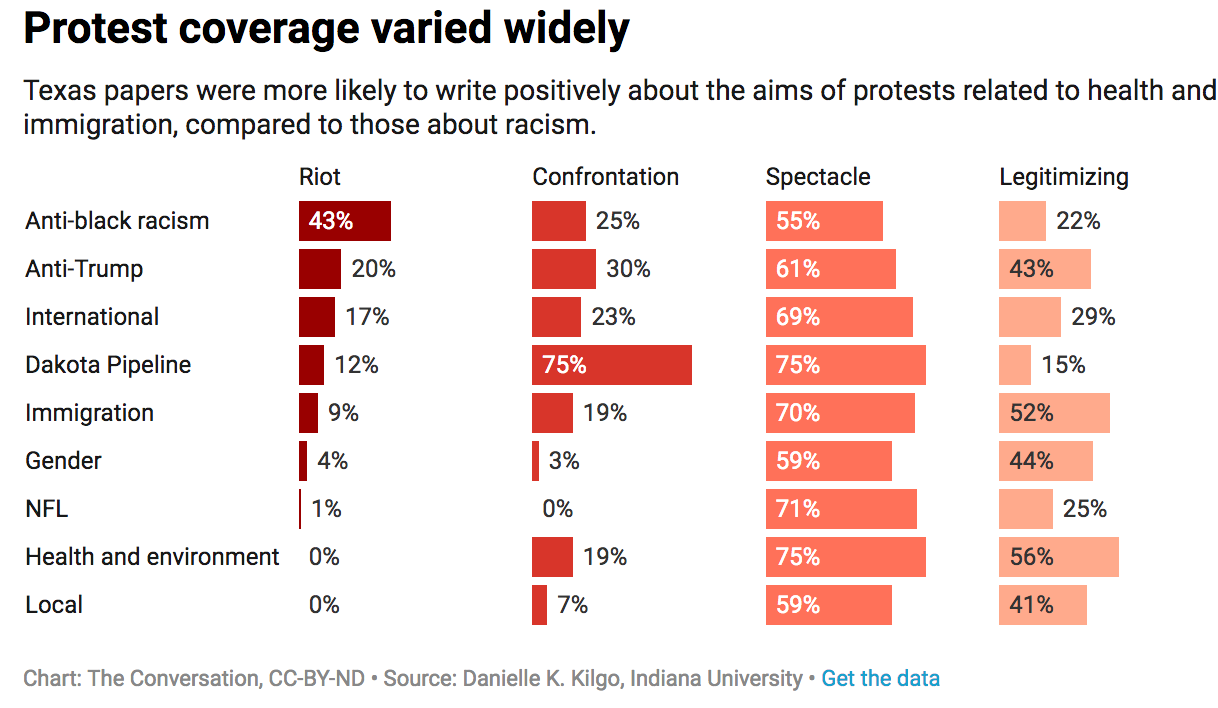

Riot or Resistance? How Media Frames Unrest in Minneapolis Will Shape Public’s View of Protest | naked capitalism

Flying during the pandemic? Here's what you need to know

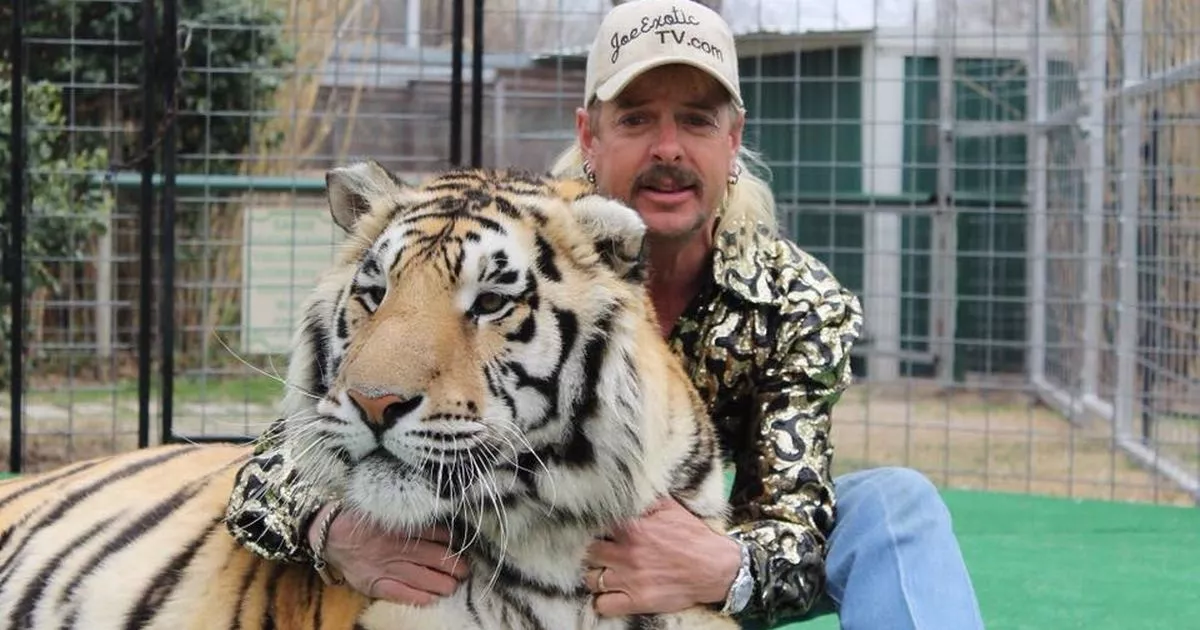

Netflix's Tiger King Joe Exotic ran bonkers pet shop 'with guns' before fame

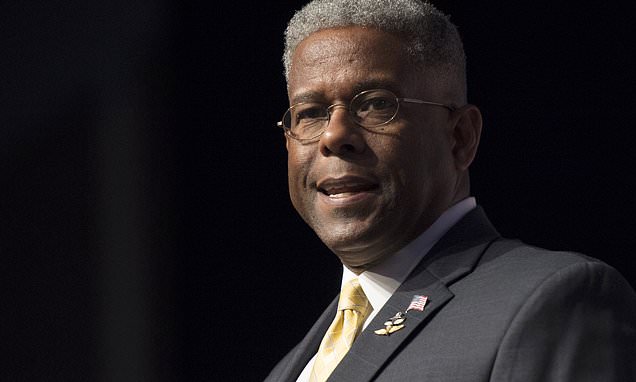

Ex-congressman Allen West of Florida injured in Texas crash

Source: https://incomestatements.info

Category: Stock Reports