See more : Nova Empire Public Company Limited (NOVA.BK) Income Statement Analysis – Financial Results

Complete financial analysis of Brookfield Property Partners L.P. (BPY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Brookfield Property Partners L.P., a leading company in the Real Estate – Services industry within the Real Estate sector.

- Tedea Technological Development and Automation Ltd. (TEDE.TA) Income Statement Analysis – Financial Results

- Shandong Kexing Bioproducts Co,.Ltd (688136.SS) Income Statement Analysis – Financial Results

- Molecular Partners AG (0QXX.L) Income Statement Analysis – Financial Results

- ManyDev Studio SE (MAN.WA) Income Statement Analysis – Financial Results

- Global International Credit Group Limited (1669.HK) Income Statement Analysis – Financial Results

Brookfield Property Partners L.P. (BPY)

About Brookfield Property Partners L.P.

Brookfield Property Partners, through Brookfield Property Partners L.P. and its subsidiary Brookfield Property REIT Inc., is one of the world's premier real estate companies, with approximately $88 billion in total assets. We own and operate iconic properties in the world's major markets, and our global portfolio includes office, retail, multifamily, logistics, hospitality, self-storage, triple net lease, manufactured housing and student housing. Brookfield Property Partners is the flagship listed real estate company of Brookfield Asset Management Inc., a leading global alternative asset manager with over $540 billion in assets under management. More information is available at www.brookfield.com.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8.07B | 7.72B | 7.25B | 9.12B | 7.24B | 6.14B | 5.35B | 4.85B | 4.37B | 4.29B | 3.77B | 2.78B |

| Cost of Revenue | 0.00 | 0.00 | 2.63B | 3.27B | 3.11B | 2.83B | 2.43B | 2.32B | 2.09B | 2.29B | 1.83B | 1.07B |

| Gross Profit | 8.07B | 7.72B | 4.61B | 5.85B | 4.13B | 3.30B | 2.92B | 2.54B | 2.28B | 2.00B | 1.94B | 1.71B |

| Gross Profit Ratio | 100.00% | 100.00% | 63.67% | 64.15% | 57.00% | 53.81% | 54.58% | 52.24% | 52.23% | 46.70% | 51.51% | 61.56% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 904.00M | 876.00M | 792.00M | 882.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Selling & Marketing | 26.00M | 23.00M | 28.00M | 71.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 930.00M | 899.00M | 820.00M | 953.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Other Expenses | 0.00 | 0.00 | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 38.00M | 104.00M | 20.00M |

| Operating Expenses | 4.11B | 1.13B | 6.49B | 2.84B | 1.34B | 889.00M | 809.00M | 739.00M | 552.00M | 366.00M | 254.00M | 156.00M |

| Cost & Expenses | -4.11B | -1.13B | -6.49B | -2.84B | 4.45B | 3.72B | 3.24B | 3.06B | 2.64B | 2.65B | 2.08B | 1.23B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.68B | 2.59B | 2.59B | 2.92B | 2.46B | 1.97B | 1.68B | 1.53B | 1.26B | 1.09B | 1.02B | 962.00M |

| Depreciation & Amortization | 287.00M | 308.00M | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 164.00M | 104.00M | 20.00M |

| EBITDA | 14.50B | 13.82B | 9.53B | 12.22B | 10.06B | 9.11B | 8.10B | 7.82B | 7.27B | 6.56B | -531.00M | 3.77B |

| EBITDA Ratio | -30.34% | -20.39% | -47.88% | -20.23% | 49.97% | 41.89% | 37.48% | 59.20% | 85.46% | 49.06% | 81.98% | 135.38% |

| Operating Income | -2.45B | -1.57B | 2.83B | 3.71B | 2.79B | 2.41B | 2.11B | 1.80B | 1.73B | 1.64B | 1.69B | 1.56B |

| Operating Income Ratio | -30.34% | -20.39% | 38.98% | 40.72% | 38.49% | 39.32% | 39.46% | 37.01% | 39.61% | 38.16% | 44.77% | 55.95% |

| Total Other Income/Expenses | -5.83B | -2.77B | -4.66B | -359.00M | 949.00M | 248.00M | 30.00M | -1.98B | 3.86B | 628.00M | 1.44B | 2.65B |

| Income Before Tax | 1.28B | 3.99B | -1.84B | 3.35B | 3.74B | 2.66B | 2.14B | 3.87B | 5.60B | 2.26B | 3.13B | 4.21B |

| Income Before Tax Ratio | 15.82% | 51.70% | -25.36% | 36.78% | 51.60% | 43.36% | 40.02% | 79.66% | 127.97% | 52.81% | 83.04% | 151.20% |

| Income Tax Expense | 281.00M | 490.00M | 220.00M | 196.00M | 81.00M | 192.00M | -575.00M | 100.00M | 1.18B | 501.00M | 489.00M | 439.00M |

| Net Income | -47.00M | 530.00M | -1.10B | 884.00M | 764.00M | 136.00M | 660.00M | 1.07B | 1.16B | 350.00M | 1.48B | 2.34B |

| Net Income Ratio | -0.58% | 6.87% | -15.15% | 9.70% | 10.55% | 2.22% | 12.33% | 21.95% | 26.41% | 8.16% | 39.17% | 84.29% |

| EPS | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| EPS Diluted | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| Weighted Avg Shares Out | 299.13M | 299.13M | 505.20M | 508.10M | 380.74M | 327.20M | 339.12M | 341.62M | 217.44M | 83.80M | 83.80M | 83.80M |

| Weighted Avg Shares Out (Dil) | 299.13M | 299.13M | 505.20M | 508.10M | 396.20M | 329.17M | 366.30M | 370.50M | 247.40M | 83.80M | 83.80M | 83.80M |

Wall Street Breakfast: Vaccine Optimism Lifts Markets

Retail - Especially Malls - More Impaired Than Most Suggest

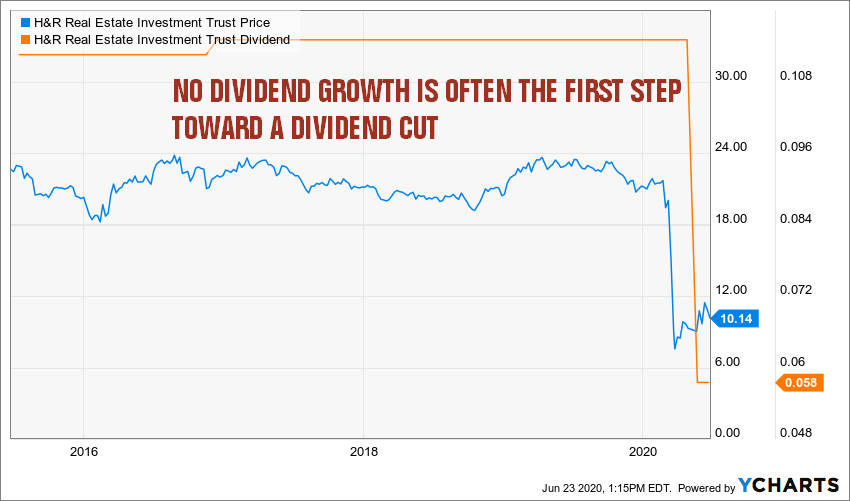

Techniques To Avoid Dividend Cuts

The Best Of The Brookfield Family: Brookfield Infrastructure

Strong Traffic Registered At Malls And Outlet Centers

Dividend Challenger Highlights: Week Of June 28

3 Fundamental Elements Of Portfolio Management

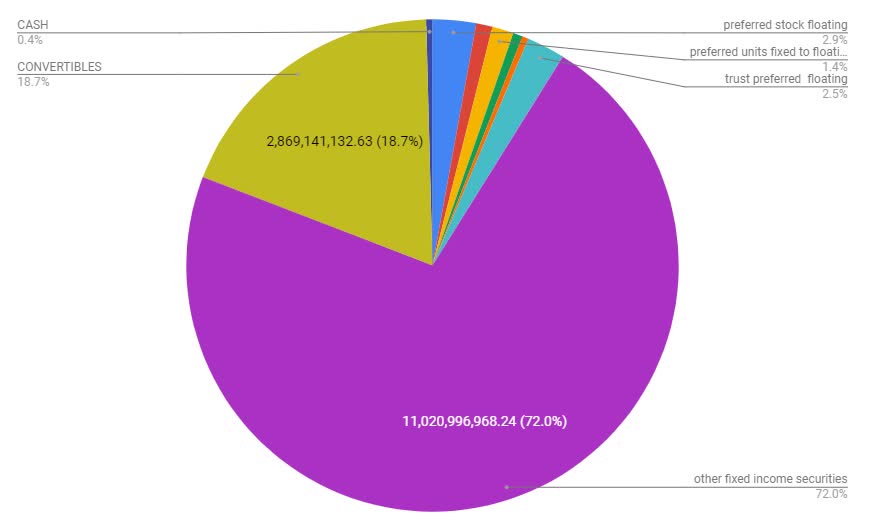

Not So Common Fixed-Income Preview

Dogcatcher Reader Favorites And Rogues May 12-June 9

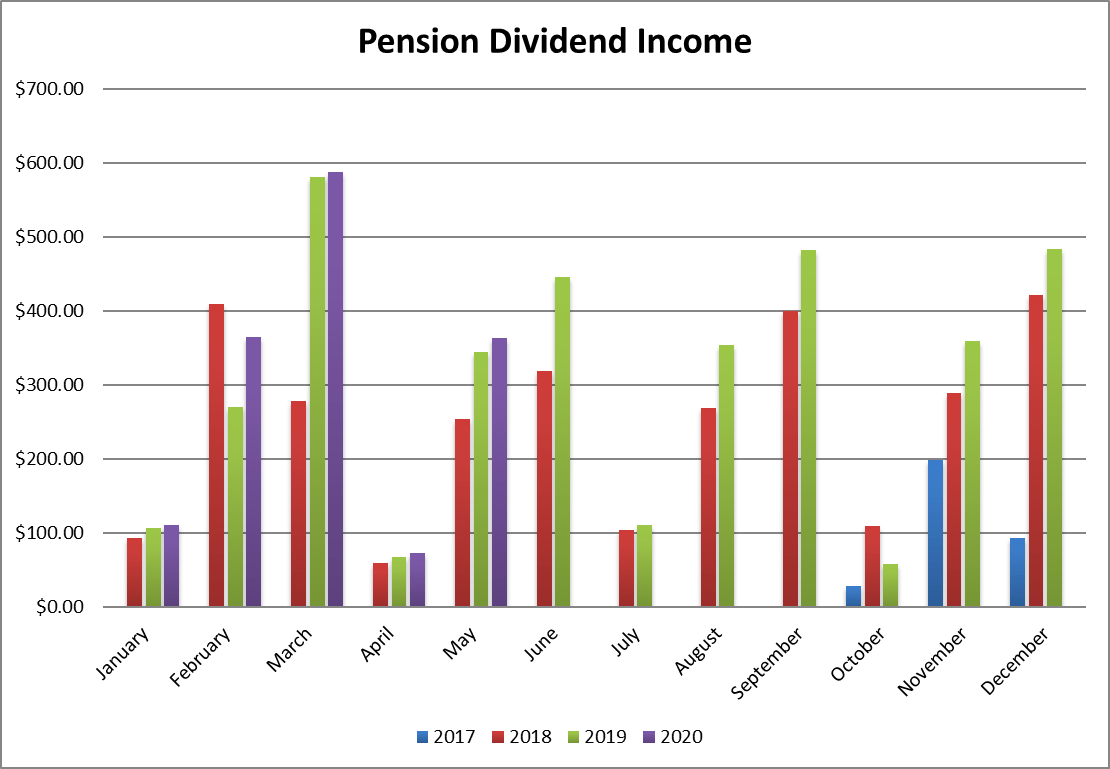

May Dividend Income Report - A Different Way To Build Cash

Source: https://incomestatements.info

Category: Stock Reports