See more : Landmark Infrastructure Partners LP (LMRK) Income Statement Analysis – Financial Results

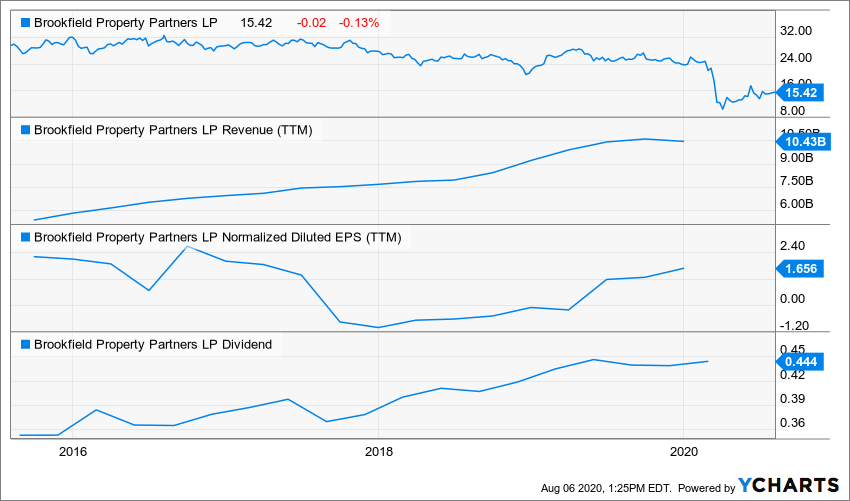

Complete financial analysis of Brookfield Property Partners L.P. (BPY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Brookfield Property Partners L.P., a leading company in the Real Estate – Services industry within the Real Estate sector.

- Tohbu Network Co., Ltd. (9036.T) Income Statement Analysis – Financial Results

- Digital Realty Trust, Inc. (DLR-PL) Income Statement Analysis – Financial Results

- ARC Group Worldwide, Inc. (ARCW) Income Statement Analysis – Financial Results

- Cannagistics, Inc. (CNGT) Income Statement Analysis – Financial Results

- Paradise Co., Ltd. (034230.KQ) Income Statement Analysis – Financial Results

Brookfield Property Partners L.P. (BPY)

About Brookfield Property Partners L.P.

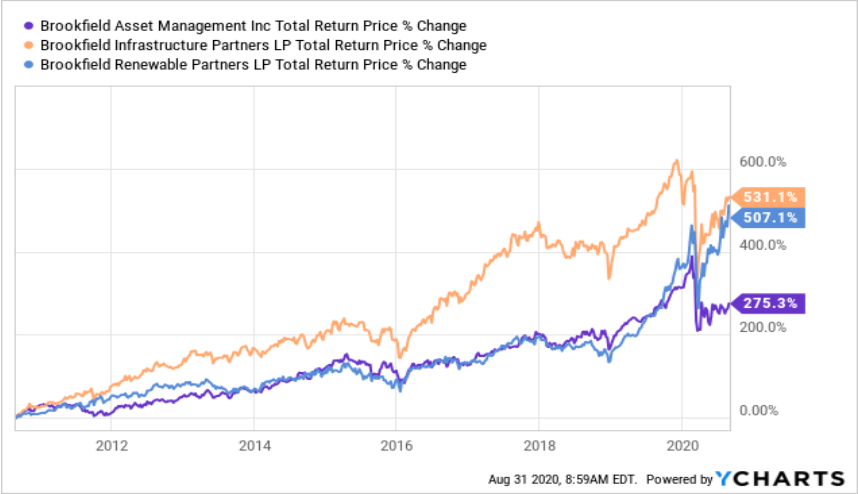

Brookfield Property Partners, through Brookfield Property Partners L.P. and its subsidiary Brookfield Property REIT Inc., is one of the world's premier real estate companies, with approximately $88 billion in total assets. We own and operate iconic properties in the world's major markets, and our global portfolio includes office, retail, multifamily, logistics, hospitality, self-storage, triple net lease, manufactured housing and student housing. Brookfield Property Partners is the flagship listed real estate company of Brookfield Asset Management Inc., a leading global alternative asset manager with over $540 billion in assets under management. More information is available at www.brookfield.com.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8.07B | 7.72B | 7.25B | 9.12B | 7.24B | 6.14B | 5.35B | 4.85B | 4.37B | 4.29B | 3.77B | 2.78B |

| Cost of Revenue | 0.00 | 0.00 | 2.63B | 3.27B | 3.11B | 2.83B | 2.43B | 2.32B | 2.09B | 2.29B | 1.83B | 1.07B |

| Gross Profit | 8.07B | 7.72B | 4.61B | 5.85B | 4.13B | 3.30B | 2.92B | 2.54B | 2.28B | 2.00B | 1.94B | 1.71B |

| Gross Profit Ratio | 100.00% | 100.00% | 63.67% | 64.15% | 57.00% | 53.81% | 54.58% | 52.24% | 52.23% | 46.70% | 51.51% | 61.56% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 904.00M | 876.00M | 792.00M | 882.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Selling & Marketing | 26.00M | 23.00M | 28.00M | 71.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 930.00M | 899.00M | 820.00M | 953.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Other Expenses | 0.00 | 0.00 | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 38.00M | 104.00M | 20.00M |

| Operating Expenses | 4.11B | 1.13B | 6.49B | 2.84B | 1.34B | 889.00M | 809.00M | 739.00M | 552.00M | 366.00M | 254.00M | 156.00M |

| Cost & Expenses | -4.11B | -1.13B | -6.49B | -2.84B | 4.45B | 3.72B | 3.24B | 3.06B | 2.64B | 2.65B | 2.08B | 1.23B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.68B | 2.59B | 2.59B | 2.92B | 2.46B | 1.97B | 1.68B | 1.53B | 1.26B | 1.09B | 1.02B | 962.00M |

| Depreciation & Amortization | 287.00M | 308.00M | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 164.00M | 104.00M | 20.00M |

| EBITDA | 14.50B | 13.82B | 9.53B | 12.22B | 10.06B | 9.11B | 8.10B | 7.82B | 7.27B | 6.56B | -531.00M | 3.77B |

| EBITDA Ratio | -30.34% | -20.39% | -47.88% | -20.23% | 49.97% | 41.89% | 37.48% | 59.20% | 85.46% | 49.06% | 81.98% | 135.38% |

| Operating Income | -2.45B | -1.57B | 2.83B | 3.71B | 2.79B | 2.41B | 2.11B | 1.80B | 1.73B | 1.64B | 1.69B | 1.56B |

| Operating Income Ratio | -30.34% | -20.39% | 38.98% | 40.72% | 38.49% | 39.32% | 39.46% | 37.01% | 39.61% | 38.16% | 44.77% | 55.95% |

| Total Other Income/Expenses | -5.83B | -2.77B | -4.66B | -359.00M | 949.00M | 248.00M | 30.00M | -1.98B | 3.86B | 628.00M | 1.44B | 2.65B |

| Income Before Tax | 1.28B | 3.99B | -1.84B | 3.35B | 3.74B | 2.66B | 2.14B | 3.87B | 5.60B | 2.26B | 3.13B | 4.21B |

| Income Before Tax Ratio | 15.82% | 51.70% | -25.36% | 36.78% | 51.60% | 43.36% | 40.02% | 79.66% | 127.97% | 52.81% | 83.04% | 151.20% |

| Income Tax Expense | 281.00M | 490.00M | 220.00M | 196.00M | 81.00M | 192.00M | -575.00M | 100.00M | 1.18B | 501.00M | 489.00M | 439.00M |

| Net Income | -47.00M | 530.00M | -1.10B | 884.00M | 764.00M | 136.00M | 660.00M | 1.07B | 1.16B | 350.00M | 1.48B | 2.34B |

| Net Income Ratio | -0.58% | 6.87% | -15.15% | 9.70% | 10.55% | 2.22% | 12.33% | 21.95% | 26.41% | 8.16% | 39.17% | 84.29% |

| EPS | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| EPS Diluted | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| Weighted Avg Shares Out | 299.13M | 299.13M | 505.20M | 508.10M | 380.74M | 327.20M | 339.12M | 341.62M | 217.44M | 83.80M | 83.80M | 83.80M |

| Weighted Avg Shares Out (Dil) | 299.13M | 299.13M | 505.20M | 508.10M | 396.20M | 329.17M | 366.30M | 370.50M | 247.40M | 83.80M | 83.80M | 83.80M |

The Mall Meltdown Is Underway

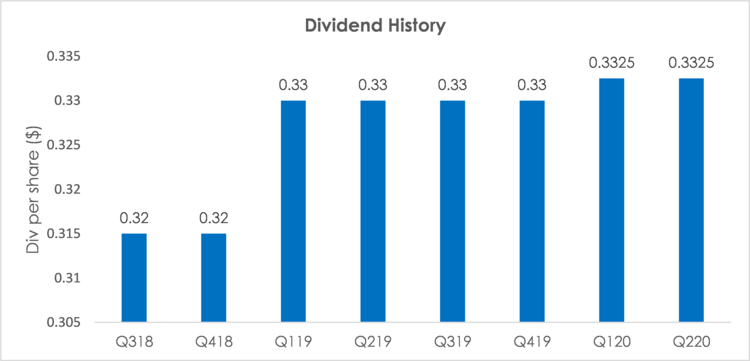

The Retirees' Dividend Portfolio: John And Jane's August Taxable Account Update

Wall Street Breakfast: Race To The Bottom For Central Banks

Brookfield Property REIT: 11.9% Yield, Higher Risk

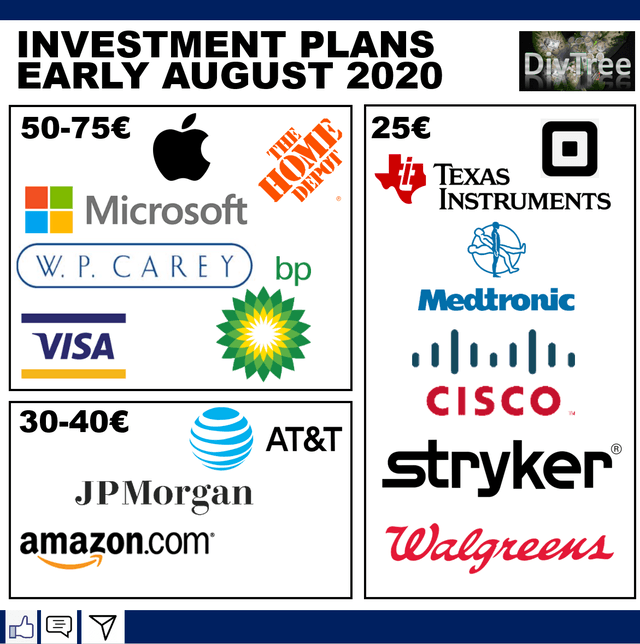

August 2020 Dividend Portfolio Update

Brookfield Property's Huge 11% Yield Makes It A Great Income Pick

Brookfield Property Partners: Should Your Shares Be Running This Bumpy Ride?

Not So Common Fixed Income Preview

Thinking About Malls

Dividend Challenger Highlights: Week Of August 23

Source: https://incomestatements.info

Category: Stock Reports