See more : Qell Acquisition Corp. (QELLU) Income Statement Analysis – Financial Results

Complete financial analysis of Brookfield Property Partners L.P. (BPY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Brookfield Property Partners L.P., a leading company in the Real Estate – Services industry within the Real Estate sector.

- Maj Invest Grønne Obligationer (MAJGRO.CO) Income Statement Analysis – Financial Results

- G City Ltd (GZT.TA) Income Statement Analysis – Financial Results

- ImmuneOnco Biopharmaceuticals (Shanghai) Inc. (1541.HK) Income Statement Analysis – Financial Results

- Guangxi Yuegui Guangye Holdings Co., Ltd. (000833.SZ) Income Statement Analysis – Financial Results

- Fast Fitness Japan Incorporated (7092.T) Income Statement Analysis – Financial Results

Brookfield Property Partners L.P. (BPY)

About Brookfield Property Partners L.P.

Brookfield Property Partners, through Brookfield Property Partners L.P. and its subsidiary Brookfield Property REIT Inc., is one of the world's premier real estate companies, with approximately $88 billion in total assets. We own and operate iconic properties in the world's major markets, and our global portfolio includes office, retail, multifamily, logistics, hospitality, self-storage, triple net lease, manufactured housing and student housing. Brookfield Property Partners is the flagship listed real estate company of Brookfield Asset Management Inc., a leading global alternative asset manager with over $540 billion in assets under management. More information is available at www.brookfield.com.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 8.07B | 7.72B | 7.25B | 9.12B | 7.24B | 6.14B | 5.35B | 4.85B | 4.37B | 4.29B | 3.77B | 2.78B |

| Cost of Revenue | 0.00 | 0.00 | 2.63B | 3.27B | 3.11B | 2.83B | 2.43B | 2.32B | 2.09B | 2.29B | 1.83B | 1.07B |

| Gross Profit | 8.07B | 7.72B | 4.61B | 5.85B | 4.13B | 3.30B | 2.92B | 2.54B | 2.28B | 2.00B | 1.94B | 1.71B |

| Gross Profit Ratio | 100.00% | 100.00% | 63.67% | 64.15% | 57.00% | 53.81% | 54.58% | 52.24% | 52.23% | 46.70% | 51.51% | 61.56% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 904.00M | 876.00M | 792.00M | 882.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Selling & Marketing | 26.00M | 23.00M | 28.00M | 71.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 930.00M | 899.00M | 820.00M | 953.00M | 1.03B | 614.00M | 569.00M | 559.00M | 404.00M | 328.00M | 150.00M | 136.00M |

| Other Expenses | 0.00 | 0.00 | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 38.00M | 104.00M | 20.00M |

| Operating Expenses | 4.11B | 1.13B | 6.49B | 2.84B | 1.34B | 889.00M | 809.00M | 739.00M | 552.00M | 366.00M | 254.00M | 156.00M |

| Cost & Expenses | -4.11B | -1.13B | -6.49B | -2.84B | 4.45B | 3.72B | 3.24B | 3.06B | 2.64B | 2.65B | 2.08B | 1.23B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.68B | 2.59B | 2.59B | 2.92B | 2.46B | 1.97B | 1.68B | 1.53B | 1.26B | 1.09B | 1.02B | 962.00M |

| Depreciation & Amortization | 287.00M | 308.00M | 319.00M | 341.00M | 308.00M | 275.00M | 240.00M | 180.00M | 148.00M | 164.00M | 104.00M | 20.00M |

| EBITDA | 14.50B | 13.82B | 9.53B | 12.22B | 10.06B | 9.11B | 8.10B | 7.82B | 7.27B | 6.56B | -531.00M | 3.77B |

| EBITDA Ratio | -30.34% | -20.39% | -47.88% | -20.23% | 49.97% | 41.89% | 37.48% | 59.20% | 85.46% | 49.06% | 81.98% | 135.38% |

| Operating Income | -2.45B | -1.57B | 2.83B | 3.71B | 2.79B | 2.41B | 2.11B | 1.80B | 1.73B | 1.64B | 1.69B | 1.56B |

| Operating Income Ratio | -30.34% | -20.39% | 38.98% | 40.72% | 38.49% | 39.32% | 39.46% | 37.01% | 39.61% | 38.16% | 44.77% | 55.95% |

| Total Other Income/Expenses | -5.83B | -2.77B | -4.66B | -359.00M | 949.00M | 248.00M | 30.00M | -1.98B | 3.86B | 628.00M | 1.44B | 2.65B |

| Income Before Tax | 1.28B | 3.99B | -1.84B | 3.35B | 3.74B | 2.66B | 2.14B | 3.87B | 5.60B | 2.26B | 3.13B | 4.21B |

| Income Before Tax Ratio | 15.82% | 51.70% | -25.36% | 36.78% | 51.60% | 43.36% | 40.02% | 79.66% | 127.97% | 52.81% | 83.04% | 151.20% |

| Income Tax Expense | 281.00M | 490.00M | 220.00M | 196.00M | 81.00M | 192.00M | -575.00M | 100.00M | 1.18B | 501.00M | 489.00M | 439.00M |

| Net Income | -47.00M | 530.00M | -1.10B | 884.00M | 764.00M | 136.00M | 660.00M | 1.07B | 1.16B | 350.00M | 1.48B | 2.34B |

| Net Income Ratio | -0.58% | 6.87% | -15.15% | 9.70% | 10.55% | 2.22% | 12.33% | 21.95% | 26.41% | 8.16% | 39.17% | 84.29% |

| EPS | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| EPS Diluted | -0.16 | 1.77 | -2.17 | 1.74 | 1.93 | 0.42 | 1.80 | 2.87 | 4.67 | 4.18 | 17.61 | 27.97 |

| Weighted Avg Shares Out | 299.13M | 299.13M | 505.20M | 508.10M | 380.74M | 327.20M | 339.12M | 341.62M | 217.44M | 83.80M | 83.80M | 83.80M |

| Weighted Avg Shares Out (Dil) | 299.13M | 299.13M | 505.20M | 508.10M | 396.20M | 329.17M | 366.30M | 370.50M | 247.40M | 83.80M | 83.80M | 83.80M |

Simon Property: E-Commerce Exposure On The Rise Through Authentic Brands Group And SPARC

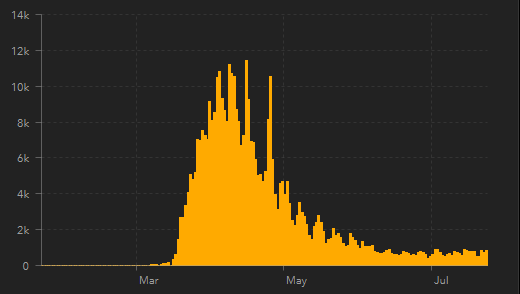

Brookfield Asset Management Q2 20: Navigating The Pandemic

Good News Is Bad News

Wall Street Breakfast: IEA Forecasts Deeper Contraction To Global Oil Demand

Horos Asset Management Quarterly Letter To Our Co-Investors July 2020

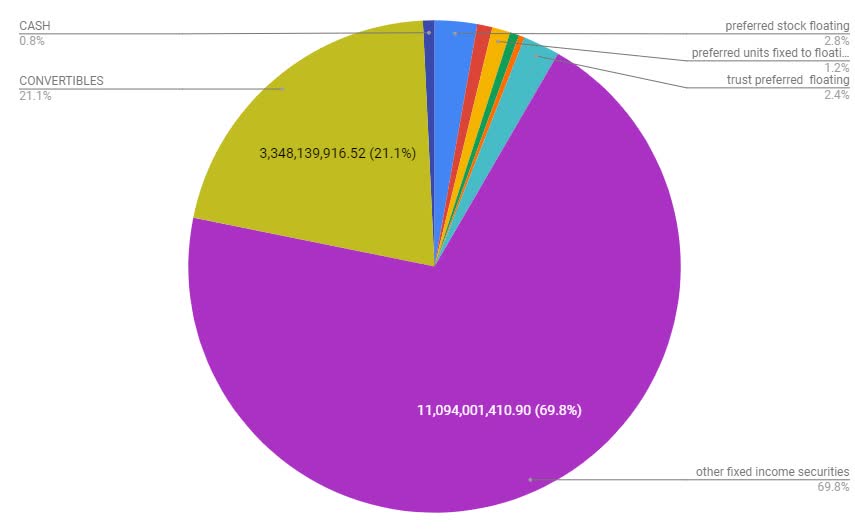

Not So Common Fixed Income Preview

Horos Asset Management 2Q 2020 Letter To Our Co-Investors

The Siren Song Of Brookfield Business Partners

The Deformed Bubble

The First REIT Bankruptcy Since 2009, A New Institutional Data Source, And Our Updated Sector Outlook

Source: https://incomestatements.info

Category: Stock Reports