See more : Elysee Development Corp. (ASXSF) Income Statement Analysis – Financial Results

Complete financial analysis of CECO Environmental Corp. (CECE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of CECO Environmental Corp., a leading company in the Industrial – Pollution & Treatment Controls industry within the Industrials sector.

- China Resources Gas Group Limited (CRGGF) Income Statement Analysis – Financial Results

- BioQuest Corp. (BQST) Income Statement Analysis – Financial Results

- Change Inc. (3962.T) Income Statement Analysis – Financial Results

- E.S. Australia Israel Holdings Ltd (AUIS.TA) Income Statement Analysis – Financial Results

- Daewoo Electronic Components Co., Ltd. (009320.KS) Income Statement Analysis – Financial Results

CECO Environmental Corp. (CECE)

Industry: Industrial - Pollution & Treatment Controls

Sector: Industrials

Website: https://www.cecoenviro.com

About CECO Environmental Corp.

CECO Environmental Corp. provides industrial air quality and fluid handling systems worldwide. It operates in two segments: Engineered Systems Segment and Industrial Process Solutions Segment. The company engineers, designs, builds, and installs systems that capture, clean, and destroy air- and water-borne emissions from industrial facilities as well as fluid handling, gas separation, and filtration systems. It offers dampers and diverters, selective catalytic reduction and selective non-catalytic reduction systems, cyclonic technology, thermal oxidizers, filtration systems, scrubbers, and water and fluid handling equipment, as well as plant engineering services and engineered design build fabrication. The company markets its products and services to natural gas processors, transmission and distribution companies, refineries, power generators, industrial manufacturing, engineering and construction companies, semiconductor manufacturers, compressor manufacturers, beverage can manufacturers, metals and minerals, and electric vehicle producer companies. CECO Environmental Corp. was incorporated in 1966 and is headquartered in Dallas, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 544.85M | 422.63M | 324.14M | 316.01M | 341.87M | 337.34M | 345.05M | 417.01M | 370.08M | 263.22M | 197.32M | 135.05M | 139.19M | 140.60M | 138.99M | 217.89M | 235.95M | 135.36M | 81.52M | 69.37M | 68.97M | 78.88M | 90.99M | 89.82M | 23.86M | 26.38M | 14.53M | 9.85M | 8.44M | 7.30M | 5.20M | 4.00M | 100.00K | 700.00K |

| Cost of Revenue | 373.83M | 294.40M | 223.22M | 210.88M | 227.77M | 225.80M | 231.86M | 282.15M | 258.51M | 178.39M | 135.76M | 92.61M | 101.02M | 107.95M | 108.04M | 174.50M | 195.55M | 111.26M | 64.52M | 56.27M | 55.15M | 62.99M | 72.46M | 71.72M | 15.47M | 17.95M | 8.12M | 5.19M | 4.74M | 4.10M | 3.20M | 2.00M | 0.00 | 1.10M |

| Gross Profit | 171.02M | 128.23M | 100.92M | 105.13M | 114.10M | 111.54M | 113.19M | 134.86M | 111.56M | 84.82M | 61.56M | 42.44M | 38.17M | 32.65M | 30.94M | 43.39M | 40.41M | 24.10M | 17.00M | 13.10M | 13.82M | 15.89M | 18.53M | 18.10M | 8.39M | 8.43M | 6.41M | 4.66M | 3.70M | 3.20M | 2.00M | 2.00M | 100.00K | -400.00K |

| Gross Profit Ratio | 31.39% | 30.34% | 31.14% | 33.27% | 33.38% | 33.06% | 32.81% | 32.34% | 30.15% | 32.23% | 31.20% | 31.43% | 27.42% | 23.22% | 22.26% | 19.91% | 17.12% | 17.80% | 20.85% | 18.88% | 20.03% | 20.15% | 20.37% | 20.15% | 35.15% | 31.95% | 44.15% | 47.32% | 43.86% | 43.84% | 38.46% | 50.00% | 100.00% | -57.14% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 122.34M | 92.97M | 81.10M | 0.00 | 0.00 | 0.00 | 0.00 | 81.74M | 68.29M | 51.74M | 40.60M | 25.23M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 600.00K | 500.00K | 700.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00M | -300.00K | -3.50M | 200.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 122.94M | 93.47M | 81.80M | 76.93M | 85.98M | 87.46M | 88.98M | 81.74M | 69.29M | 50.69M | 37.10M | 25.43M | 25.36M | 27.51M | 28.90M | 33.65M | 26.15M | 16.82M | 12.31M | 10.66M | 10.40M | 11.90M | 13.21M | 13.93M | 7.22M | 6.67M | 6.05M | 3.52M | 3.21M | 2.40M | 2.10M | 1.80M | 100.00K | 0.00 |

| Other Expenses | 13.50M | 6.81M | 7.79M | 8.80M | 8.50M | -365.00K | 106.00K | 310.00K | -2.08M | -2.31M | 982.00K | -152.00K | 441.00K | 105.00K | 759.00K | 1.55M | 1.62M | 1.23M | 1.17M | 1.25M | 1.58M | 1.79M | 2.32M | 2.15M | 729.33K | 617.96K | 384.66K | 416.99K | 429.66K | 300.00K | 200.00K | 200.00K | 0.00 | 100.00K |

| Operating Expenses | 136.45M | 100.28M | 89.59M | 85.73M | 94.48M | 97.15M | 96.11M | 101.97M | 94.90M | 61.14M | 47.36M | 25.76M | 25.80M | 27.62M | 29.66M | 35.20M | 27.77M | 18.05M | 13.48M | 11.91M | 11.98M | 13.69M | 15.53M | 16.09M | 7.95M | 7.29M | 6.44M | 3.94M | 3.64M | 2.70M | 2.30M | 2.00M | 100.00K | 100.00K |

| Cost & Expenses | 510.28M | 394.68M | 312.80M | 296.61M | 322.25M | 322.95M | 327.96M | 384.13M | 353.41M | 239.54M | 183.12M | 118.37M | 126.82M | 135.57M | 137.71M | 209.70M | 223.32M | 129.31M | 78.00M | 68.18M | 67.13M | 76.68M | 87.99M | 87.81M | 23.42M | 25.24M | 14.56M | 9.13M | 8.38M | 6.80M | 5.50M | 4.00M | 100.00K | 1.20M |

| Interest Income | 0.00 | 5.42M | 2.95M | 3.54M | 5.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 67.82K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 13.42M | 5.42M | 2.95M | 3.54M | 5.40M | 7.14M | 6.72M | 7.71M | 5.96M | 3.14M | 1.50M | 1.17M | 1.14M | 1.23M | 1.32M | 1.48M | 1.98M | 2.00M | 2.41M | 2.56M | 2.28M | 2.74M | 3.54M | 3.81M | 158.43K | 260.57K | 22.32K | 154.84K | 183.83K | 100.00K | 100.00K | 100.00K | 100.00K | 100.00K |

| Depreciation & Amortization | 12.51M | 10.61M | 9.85M | 9.92M | 10.61M | 13.10M | 16.09M | 18.90M | 25.61M | 10.15M | 6.76M | 331.00K | 1.40M | 1.76M | 759.00K | 3.18M | 1.62M | 1.23M | 1.17M | 1.25M | 1.58M | 1.79M | 2.32M | 2.15M | 729.33K | 617.96K | 384.66K | 416.99K | 429.66K | 300.00K | 200.00K | 200.00K | 0.00 | 100.00K |

| EBITDA | 47.45M | 38.33M | 21.89M | 30.52M | 30.23M | 22.74M | 26.57M | -6.35M | 45.07M | 35.10M | 14.60M | 17.78M | 14.26M | 6.66M | -14.07M | 13.28M | 14.25M | 6.46M | 4.69M | 2.24M | 2.61M | 3.69M | 5.33M | 4.20M | 809.33K | 1.75M | 360.41K | 1.14M | 486.20K | 800.00K | -100.00K | 200.00K | 100.00K | 100.00K |

| EBITDA Ratio | 8.71% | 10.77% | 5.21% | 9.57% | 8.45% | 7.03% | 7.05% | 12.81% | 10.86% | 11.98% | 11.12% | 12.49% | 9.89% | 4.83% | 1.47% | 5.22% | 6.04% | 4.78% | 6.86% | 3.23% | 4.64% | 4.80% | 5.42% | 3.78% | 2.82% | 6.65% | 2.48% | 10.69% | 5.76% | 10.96% | -1.92% | 5.00% | 100.00% | -71.43% |

| Operating Income | 34.57M | 34.89M | 9.86M | 21.44M | 17.99M | 10.00M | 8.02M | -25.56M | 5.38M | 22.41M | 6.97M | 16.68M | 12.37M | 5.04M | -15.83M | 8.20M | 12.63M | 6.05M | 3.53M | 1.19M | 1.83M | 2.20M | 3.01M | 2.01M | 441.57K | 1.14M | -24.25K | 718.24K | 56.54K | 500.00K | -300.00K | 0.00 | 100.00K | -500.00K |

| Operating Income Ratio | 6.34% | 8.26% | 3.04% | 6.78% | 5.26% | 2.96% | 2.33% | -6.13% | 1.45% | 8.52% | 3.53% | 12.35% | 8.89% | 3.58% | -11.39% | 3.76% | 5.35% | 4.47% | 4.32% | 1.71% | 2.66% | 2.79% | 3.30% | 2.24% | 1.85% | 4.31% | -0.17% | 7.29% | 0.67% | 6.85% | -5.77% | 0.00% | 100.00% | -71.43% |

| Total Other Income/Expenses | -13.04M | -11.20M | -5.18M | -1.50M | -4.65M | -7.51M | -6.61M | -7.40M | -8.05M | -5.45M | -517.00K | -1.32M | -685.00K | -1.36M | -19.19M | -519.00K | -1.97M | -1.19M | -3.31M | -2.36M | -2.40M | -2.85M | -3.15M | -3.04M | -101.59K | -187.87K | -46.38K | -72.07K | -327.29K | -100.00K | 0.00 | 0.00 | 0.00 | 100.00K |

| Income Before Tax | 21.53M | 23.69M | 4.67M | 11.84M | 13.34M | 2.50M | 1.41M | -32.96M | -2.66M | 16.96M | 6.46M | 15.36M | 11.72M | 3.68M | -17.91M | 7.64M | 10.67M | 4.86M | 212.00K | -1.18M | -228.00K | -339.00K | -141.00K | -1.03M | 295.71K | 944.06K | -70.63K | 646.17K | -127.29K | 400.00K | -300.00K | 0.00 | 0.00 | -400.00K |

| Income Before Tax Ratio | 3.95% | 5.61% | 1.44% | 3.75% | 3.90% | 0.74% | 0.41% | -7.90% | -0.72% | 6.44% | 3.27% | 11.38% | 8.42% | 2.61% | -12.89% | 3.50% | 4.52% | 3.59% | 0.26% | -1.70% | -0.33% | -0.43% | -0.15% | -1.15% | 1.24% | 3.58% | -0.49% | 6.56% | -1.51% | 5.48% | -5.77% | 0.00% | 0.00% | -57.14% |

| Income Tax Expense | 7.02M | 5.43M | 2.69M | 3.67M | -4.36M | 9.62M | 4.44M | 5.29M | 3.07M | 3.89M | -102.00K | 4.51M | 3.41M | 1.37M | -3.14M | 2.63M | 4.36M | 1.77M | 647.00K | -248.00K | -62.00K | -216.00K | 131.00K | -303.75K | 151.36K | 373.32K | 7.20K | 205.79K | -51.19K | 200.00K | -100.00K | 100.00K | 200.00K | -300.00K |

| Net Income | 12.91M | 17.42M | 1.98M | 8.21M | 17.71M | -7.12M | -3.03M | -38.22M | -5.60M | 13.08M | 6.56M | 10.85M | 8.27M | 2.11M | -15.03M | 5.01M | 6.31M | 3.09M | -435.00K | -928.00K | -166.00K | -123.00K | -264.00K | -689.92K | -366.16K | 532.93K | -53.77K | 301.08K | -48.74K | 200.00K | -200.00K | -100.00K | -100.00K | -400.00K |

| Net Income Ratio | 2.37% | 4.12% | 0.61% | 2.60% | 5.18% | -2.11% | -0.88% | -9.16% | -1.51% | 4.97% | 3.32% | 8.03% | 5.94% | 1.50% | -10.82% | 2.30% | 2.67% | 2.29% | -0.53% | -1.34% | -0.24% | -0.16% | -0.29% | -0.77% | -1.53% | 2.02% | -0.37% | 3.06% | -0.58% | 2.74% | -3.85% | -2.50% | -100.00% | -57.14% |

| EPS | 0.37 | 0.50 | 0.06 | 0.23 | 0.51 | -0.21 | -0.09 | -1.12 | -0.19 | 0.51 | 0.33 | 0.73 | 0.58 | 0.15 | -1.06 | 0.34 | 0.47 | 0.27 | -0.04 | -0.09 | -0.02 | -0.01 | -0.03 | -0.08 | -0.04 | 0.06 | -0.01 | 0.04 | -0.01 | 0.04 | -0.04 | -0.02 | -0.05 | -0.04 |

| EPS Diluted | 0.37 | 0.50 | 0.06 | 0.23 | 0.50 | -0.21 | -0.09 | -1.12 | -0.19 | 0.50 | 0.32 | 0.65 | 0.51 | 0.15 | -1.06 | 0.30 | 0.45 | 0.24 | -0.04 | -0.09 | -0.02 | -0.01 | -0.03 | -0.08 | -0.04 | 0.06 | -0.01 | 0.04 | -0.01 | 0.04 | -0.04 | -0.02 | -0.05 | -0.04 |

| Weighted Avg Shares Out | 34.67M | 34.67M | 35.35M | 35.29M | 34.99M | 33.91M | 33.66M | 33.98M | 28.79M | 25.75M | 20.12M | 14.81M | 14.39M | 14.31M | 14.22M | 14.77M | 13.46M | 11.26M | 9.99M | 9.99M | 9.85M | 9.58M | 7.90M | 8.20M | 8.25M | 8.22M | 7.55M | 7.00M | 6.25M | 5.00M | 5.71M | 4.51M | 1.99M | 9.19M |

| Weighted Avg Shares Out (Dil) | 35.33M | 35.01M | 35.59M | 35.52M | 35.48M | 34.71M | 34.45M | 33.98M | 28.79M | 26.20M | 20.72M | 17.25M | 17.12M | 17.10M | 14.22M | 15.41M | 14.04M | 12.89M | 9.99M | 9.99M | 9.85M | 9.58M | 7.90M | 8.30M | 9.32M | 8.65M | 7.95M | 7.00M | 6.25M | 5.00M | 5.71M | 4.51M | 1.99M | 9.19M |

CECO Environmental Corp. (CECE) CEO Dennis Sadlowski on Q1 2020 Results - Earnings Call Transcript

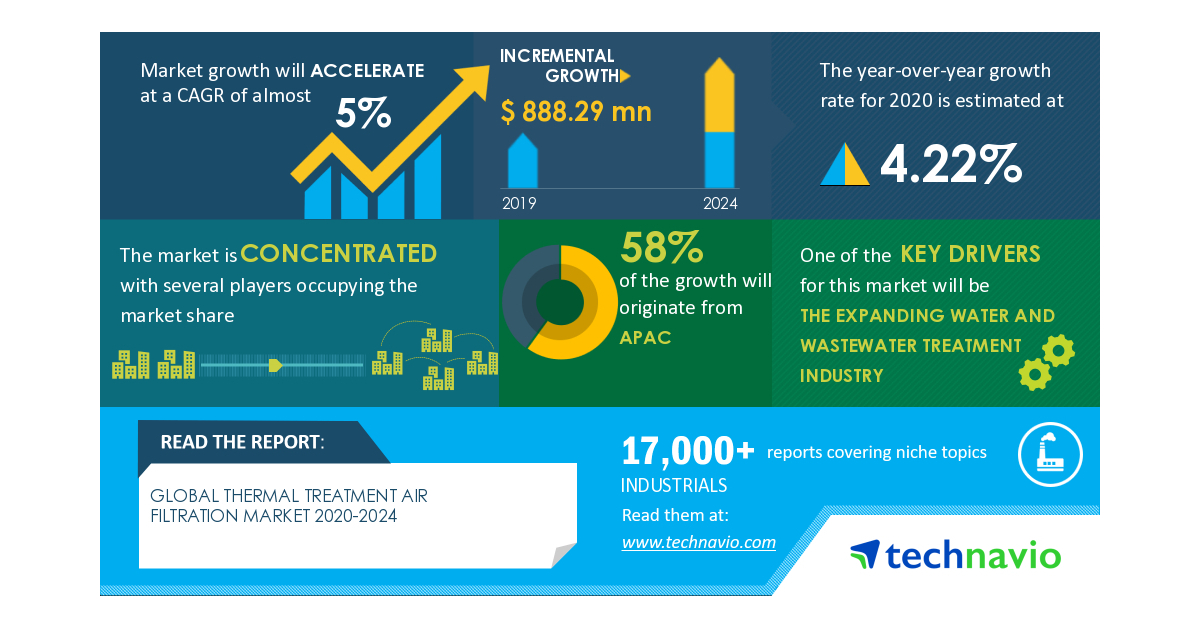

COVID-19 Impact and Recovery Analysis | Global Thermal Treatment Air Filtration Market 2020-2024 | Evolving Opportunities with CECO Environmental Corp. and CTP Air Pollution Control GmbH | Technavio

Honeywell (HON) Q1 Earnings Beat Estimates, Revenues Miss

Applied Industrial (AIT) Q3 Earnings Top Estimates, View Weak

Fortune Brands (FBHS) Q1 Earnings & Revenues Beat Estimates

Parker-Hannifin (PH) Q3 Earnings and Sales Surpass Estimates

Stanley Black (SWK) Q1 Earnings Surpass Estimates, Fall Y/Y

iRobot (IRBT) Q1 Earnings and Revenues Surpass Estimates

3M (MMM) Beats on Q1 Earnings & Sales, Suspends 2020 View

Source: https://incomestatements.info

Category: Stock Reports