See more : IQ-AI Limited (IQAI.L) Income Statement Analysis – Financial Results

Complete financial analysis of BlackRock Debt Strategies Fund, Inc. (DSU) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BlackRock Debt Strategies Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- SofWave Medical Ltd. (SOFW.TA) Income Statement Analysis – Financial Results

- Yum China Holdings, Inc. (0M30.L) Income Statement Analysis – Financial Results

- ATI Nationwide Holding Corp. (ATIN) Income Statement Analysis – Financial Results

- ECN Capital Corp. (ECN-PC.TO) Income Statement Analysis – Financial Results

- Cipla Limited (CIPLA.NS) Income Statement Analysis – Financial Results

BlackRock Debt Strategies Fund, Inc. (DSU)

Industry: Asset Management

Sector: Financial Services

Website: https://www.blackrock.com/investing/products/240192/blackrock-debt-strategies-fund-inc-usd-fund

About BlackRock Debt Strategies Fund, Inc.

BlackRock Debt Strategies Fund, Inc. is a closed ended fixed income mutual fund launched by BlackRock, Inc. The fund is managed by BlackRock Advisors, LLC. It invests in fixed income markets of the United States. The fund primarily invests in a diversified portfolio of companies' debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services (BBB or lower by S&P's or Baa or lower by Moody's) or unrated debt instruments, which are in the judgment of the investment adviser of equivalent quality. It was formerly known as Debt Strategies Fund Inc. BlackRock Debt Strategies Fund, Inc. was formed on March 27, 1998 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2011 |

|---|---|---|---|---|---|---|---|

| Revenue | 49.67M | -19.44M | 35.07M | 1.39M | 19.21M | 43.37M | 0.00 |

| Cost of Revenue | 3.72M | 4.10M | 4.64M | 4.44M | 4.45M | 0.00 | 0.00 |

| Gross Profit | 45.95M | -23.54M | 30.42M | -3.05M | 14.76M | 43.37M | 0.00 |

| Gross Profit Ratio | 92.51% | 121.08% | 86.76% | -218.93% | 76.82% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 356.15K | 296.94K | 518.05K | 528.71K | 894.96K | 971.29K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 356.15K | 296.94K | 518.05K | 528.71K | 894.96K | 971.29K | 0.00 |

| Other Expenses | 32.12M | 1.72K | 169.08K | 154.83K | 201.26K | 88.98K | 0.00 |

| Operating Expenses | -32.12M | 298.66K | 687.13K | 683.54K | 1.10M | 1.06M | 0.00 |

| Cost & Expenses | -28.40M | 298.66K | 687.13K | 683.54K | 1.10M | 1.06M | 0.00 |

| Interest Income | 57.54M | 42.51M | 34.81M | 36.66M | 56.52M | 60.55M | 0.00 |

| Interest Expense | 8.35M | 5.30M | 2.28M | 2.99M | 8.41M | 6.96M | 0.00 |

| Depreciation & Amortization | 167.90K | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 0.00 |

| EBITDA | 78.07M | -14.44M | 34.38M | 710.13K | 26.52M | 49.27M | 0.00 |

| EBITDA Ratio | 157.17% | 74.26% | 98.04% | 50.95% | 138.06% | 113.61% | 0.00% |

| Operating Income | 78.07M | -14.44M | 34.38M | 710.13K | 26.52M | 49.27M | 0.00 |

| Operating Income Ratio | 157.17% | 74.26% | 98.04% | 50.95% | 138.06% | 113.61% | 0.00% |

| Total Other Income/Expenses | -8.46M | -5.30M | -2.35M | -2.94M | -8.41M | -6.96M | 0.00 |

| Income Before Tax | 69.61M | -19.74M | 34.38M | 710.13K | 18.11M | 42.31M | 0.00 |

| Income Before Tax Ratio | 140.15% | 101.54% | 98.04% | 50.95% | 94.29% | 97.56% | 0.00% |

| Income Tax Expense | 54.47M | 38.83M | 28.24M | 30.09M | 46.50M | 0.00 | 0.00 |

| Net Income | 69.61M | -19.74M | 34.38M | 710.13K | 18.11M | 42.31M | 0.00 |

| Net Income Ratio | 140.15% | 101.54% | 98.04% | 50.95% | 94.29% | 97.56% | 0.00% |

| EPS | 1.49 | -0.42 | 0.74 | 0.02 | 0.37 | 0.74 | 0.00 |

| EPS Diluted | 1.49 | -0.42 | 0.74 | 0.02 | 0.37 | 0.74 | 0.00 |

| Weighted Avg Shares Out | 46.61M | 46.61M | 46.61M | 46.59M | 49.42M | 57.18M | 35.92M |

| Weighted Avg Shares Out (Dil) | 46.61M | 46.61M | 46.61M | 46.59M | 49.42M | 57.18M | 35.92M |

DSU: This Fund Is Raising Its 9.22% Distribution And Trades At A Huge Discount

Choosing Closed-End Credit Funds Over Equity Funds: Collecting Real Cash Vs. 'Eating Your Seed Corn'

DSU: Reaching For Yield The Contrarian Way

Pick Up Yield In These CEF Relative Value Switches

DSU - Leveraged Loan CEF From BlackRock, ~7% Yield

Weekly Closed-End Fund Roundup: December 26, 2021

The 'High-High-Low' Closed-End Fund Report, July 2021

Certain BlackRock Closed-End Funds Announce Estimated Sources of Distributions

Income Lab Ideas: Senior Loan Funds

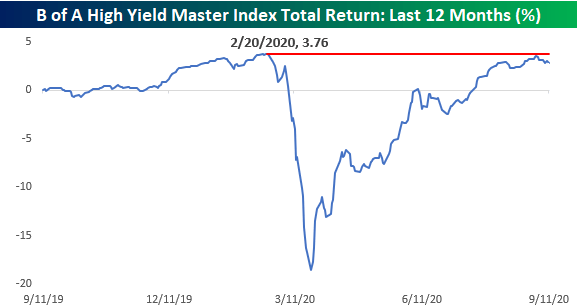

No New Highs For High Yield

Source: https://incomestatements.info

Category: Stock Reports