See more : Blackstone Minerals Limited (BSX.AX) Income Statement Analysis – Financial Results

Complete financial analysis of BlackRock Debt Strategies Fund, Inc. (DSU) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BlackRock Debt Strategies Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Cellcom Israel Ltd. (CEL.TA) Income Statement Analysis – Financial Results

- Vox Royalty Corp. (VOX.V) Income Statement Analysis – Financial Results

- Orzel Bialy S.A. (OBL.WA) Income Statement Analysis – Financial Results

- WEG S.A. (WEGZY) Income Statement Analysis – Financial Results

- Environmental Control Corp. (EVCC) Income Statement Analysis – Financial Results

BlackRock Debt Strategies Fund, Inc. (DSU)

Industry: Asset Management

Sector: Financial Services

Website: https://www.blackrock.com/investing/products/240192/blackrock-debt-strategies-fund-inc-usd-fund

About BlackRock Debt Strategies Fund, Inc.

BlackRock Debt Strategies Fund, Inc. is a closed ended fixed income mutual fund launched by BlackRock, Inc. The fund is managed by BlackRock Advisors, LLC. It invests in fixed income markets of the United States. The fund primarily invests in a diversified portfolio of companies' debt instruments, including corporate loans, which are rated in the lower rating categories of the established rating services (BBB or lower by S&P's or Baa or lower by Moody's) or unrated debt instruments, which are in the judgment of the investment adviser of equivalent quality. It was formerly known as Debt Strategies Fund Inc. BlackRock Debt Strategies Fund, Inc. was formed on March 27, 1998 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2011 |

|---|---|---|---|---|---|---|---|

| Revenue | 49.67M | -19.44M | 35.07M | 1.39M | 19.21M | 43.37M | 0.00 |

| Cost of Revenue | 3.72M | 4.10M | 4.64M | 4.44M | 4.45M | 0.00 | 0.00 |

| Gross Profit | 45.95M | -23.54M | 30.42M | -3.05M | 14.76M | 43.37M | 0.00 |

| Gross Profit Ratio | 92.51% | 121.08% | 86.76% | -218.93% | 76.82% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 356.15K | 296.94K | 518.05K | 528.71K | 894.96K | 971.29K | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 356.15K | 296.94K | 518.05K | 528.71K | 894.96K | 971.29K | 0.00 |

| Other Expenses | 32.12M | 1.72K | 169.08K | 154.83K | 201.26K | 88.98K | 0.00 |

| Operating Expenses | -32.12M | 298.66K | 687.13K | 683.54K | 1.10M | 1.06M | 0.00 |

| Cost & Expenses | -28.40M | 298.66K | 687.13K | 683.54K | 1.10M | 1.06M | 0.00 |

| Interest Income | 57.54M | 42.51M | 34.81M | 36.66M | 56.52M | 60.55M | 0.00 |

| Interest Expense | 8.35M | 5.30M | 2.28M | 2.99M | 8.41M | 6.96M | 0.00 |

| Depreciation & Amortization | 167.90K | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 0.00 |

| EBITDA | 78.07M | -14.44M | 34.38M | 710.13K | 26.52M | 49.27M | 0.00 |

| EBITDA Ratio | 157.17% | 74.26% | 98.04% | 50.95% | 138.06% | 113.61% | 0.00% |

| Operating Income | 78.07M | -14.44M | 34.38M | 710.13K | 26.52M | 49.27M | 0.00 |

| Operating Income Ratio | 157.17% | 74.26% | 98.04% | 50.95% | 138.06% | 113.61% | 0.00% |

| Total Other Income/Expenses | -8.46M | -5.30M | -2.35M | -2.94M | -8.41M | -6.96M | 0.00 |

| Income Before Tax | 69.61M | -19.74M | 34.38M | 710.13K | 18.11M | 42.31M | 0.00 |

| Income Before Tax Ratio | 140.15% | 101.54% | 98.04% | 50.95% | 94.29% | 97.56% | 0.00% |

| Income Tax Expense | 54.47M | 38.83M | 28.24M | 30.09M | 46.50M | 0.00 | 0.00 |

| Net Income | 69.61M | -19.74M | 34.38M | 710.13K | 18.11M | 42.31M | 0.00 |

| Net Income Ratio | 140.15% | 101.54% | 98.04% | 50.95% | 94.29% | 97.56% | 0.00% |

| EPS | 1.49 | -0.42 | 0.74 | 0.02 | 0.37 | 0.74 | 0.00 |

| EPS Diluted | 1.49 | -0.42 | 0.74 | 0.02 | 0.37 | 0.74 | 0.00 |

| Weighted Avg Shares Out | 46.61M | 46.61M | 46.61M | 46.59M | 49.42M | 57.18M | 35.92M |

| Weighted Avg Shares Out (Dil) | 46.61M | 46.61M | 46.61M | 46.59M | 49.42M | 57.18M | 35.92M |

Citigroup Inc. Sells 76,587 Shares of BlackRock Debt Strategies Fund, Inc. (NYSE:DSU)

BlackRock Debt Strategies Fund, Inc. Announces Commencement of Tender Offer

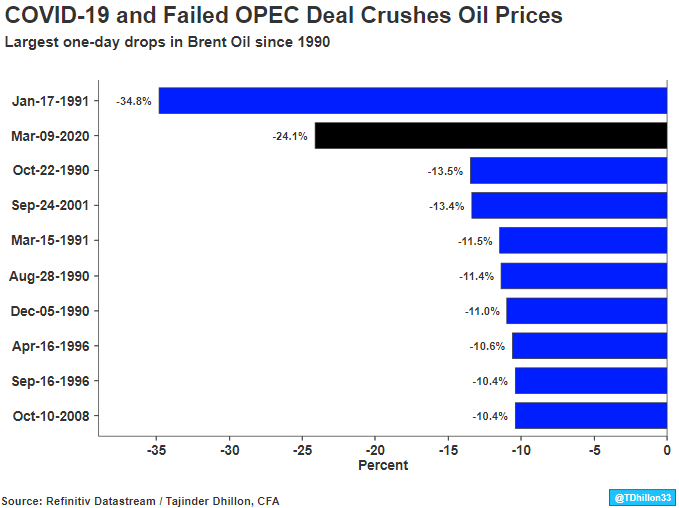

Impact Of Oil Collapse On High Yield Bond Market

BlackRock Debt Strategies Fund, Inc. Announces Results of Third Measurement Period

Certain BlackRock Closed-End Funds Announce Estimated Sources of Distributions

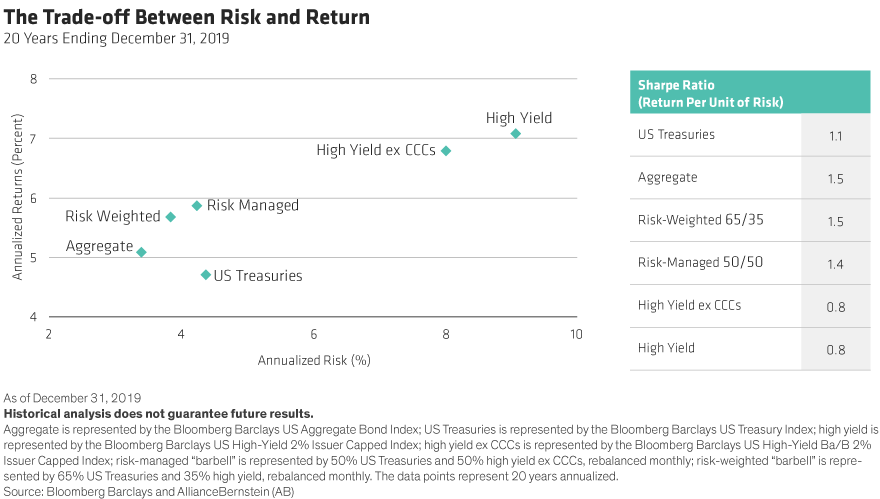

How To Balance Your Bond Portfolio In 2020

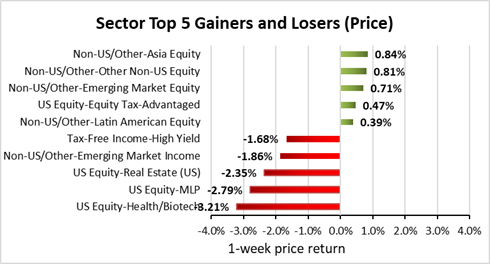

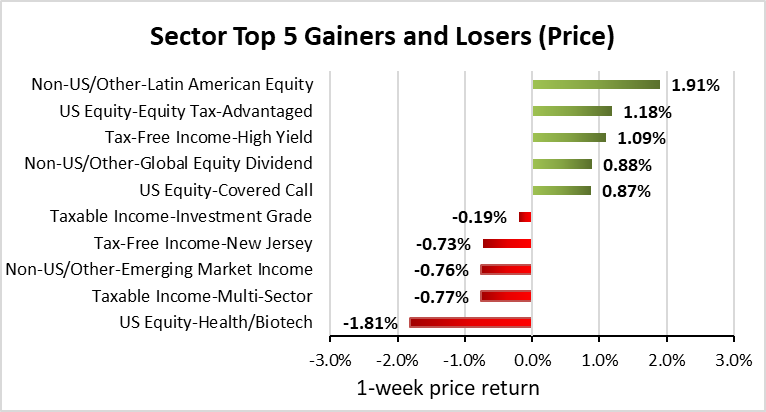

Weekly Closed-End Fund Roundup: DSU Tender Results, Some CEF High Fliers Lose Air

Weekly Closed-End Fund Roundup: FAX Cuts Big, NHF Rights Offering Announced

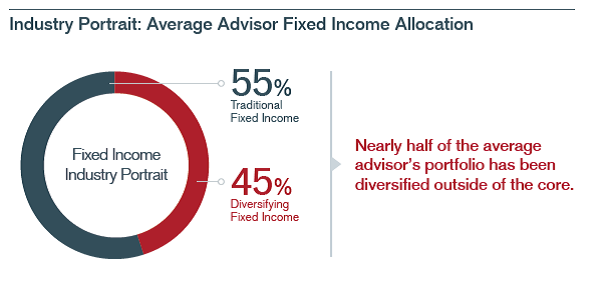

The Conundrum Within Core Fixed-Income Portfolios

Source: https://incomestatements.info

Category: Stock Reports