Complete financial analysis of Evelo Biosciences, Inc. (EVLO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Evelo Biosciences, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Fury Gold Mines Limited (FURY) Income Statement Analysis – Financial Results

- Guotai Junan Securities Co., Ltd. (GUOSF) Income Statement Analysis – Financial Results

- Sekisui House, Ltd. (1928.T) Income Statement Analysis – Financial Results

- Sterling Metals Corp. (SAGGF) Income Statement Analysis – Financial Results

- Kingdom Holding Company (4280.SR) Income Statement Analysis – Financial Results

Evelo Biosciences, Inc. (EVLO)

About Evelo Biosciences, Inc.

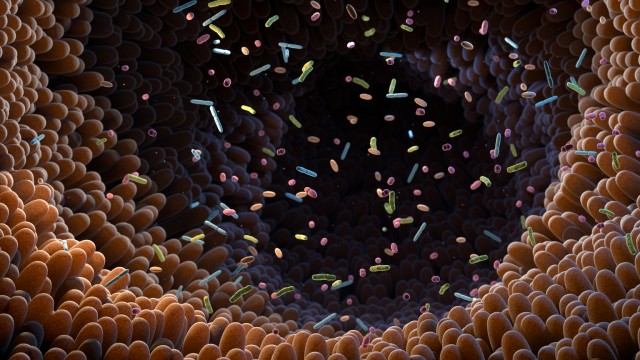

Evelo Biosciences, Inc., a biotechnology company, discovers and develops oral biologics for the treatment of inflammatory diseases and cancer. It is developing EDP1815, a whole-microbe candidate for the treatment of inflammatory diseases; and is in Phase 2 clinical trial for the treatment of psoriasis and atopic dermatitis, as well as for the hyperinflammatory response associated with COVID-19. The company also develops EDP1867, an inactivated investigational oral biologic, which is in Phase 1b for the treatment of inflammatory diseases; EDP2939, an extracellular vesicle investigational oral biologic for the treatment of inflammatory diseases; and EDP1908, a product candidate for oncology. Evelo Biosciences, Inc. was incorporated in 2014 and is headquartered in Cambridge, Massachusetts.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 78.55M | 83.64M | 69.62M | 63.13M | 39.89M | 19.96M | 9.13M |

| General & Administrative | 29.91M | 31.75M | 22.27M | 23.23M | 18.22M | 7.57M | 3.89M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 29.91M | 31.75M | 22.27M | 23.23M | 18.22M | 7.57M | 3.89M |

| Other Expenses | 0.00 | 486.00K | -1.37M | 1.08M | 1.16M | -301.00K | -20.00K |

| Operating Expenses | 108.47M | 115.40M | 91.89M | 86.36M | 58.10M | 27.53M | 13.03M |

| Cost & Expenses | 108.47M | 115.40M | 91.89M | 86.36M | 58.10M | 27.53M | 13.03M |

| Interest Income | 4.67K | 3.61K | 0.00 | 1.05K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.67M | 3.61M | 2.11M | 1.05M | 1.56M | 0.00 | 0.00 |

| Depreciation & Amortization | 2.06M | 2.22M | 2.03M | 1.76K | 1.94K | 834.00 | 495.00 |

| EBITDA | -106.35M | -115.40M | -91.89M | -86.36M | -58.10M | -26.70M | -12.53M |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -108.47M | -115.40M | -91.89M | -86.36M | -58.10M | -27.53M | -13.03M |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -5.13M | -6.35M | -1.37M | 885.00K | 1.16M | -516.00K | -307.00K |

| Income Before Tax | -113.60M | -121.75M | -93.26M | -85.47M | -56.95M | -28.05M | -13.33M |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 930.00K | 428.00K | 409.00K | 190.00K | -3.09M | 215.00K | 287.00K |

| Net Income | -114.53M | -122.18M | -93.67M | -85.66M | -53.85M | -28.05M | -13.33M |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -26.28 | -46.18 | -47.45 | -53.49 | -49.25 | -149.98 | -94.55 |

| EPS Diluted | -26.28 | -46.18 | -47.45 | -53.49 | -49.25 | -149.55 | -94.06 |

| Weighted Avg Shares Out | 4.36M | 2.65M | 1.97M | 1.60M | 1.09M | 187.00K | 141.00K |

| Weighted Avg Shares Out (Dil) | 4.36M | 2.65M | 1.97M | 1.60M | 1.09M | 187.54K | 141.74K |

EVLO to Provide Dominion Energy With Safety Enhanced Energy Storage Systems

Top 4 Health Care Stocks That May Rocket Higher This Month - Generation Bio (NASDAQ:GBIO), Evelo Biosciences (NASDAQ:EVLO)

Evelo (EVLO) Drops 59% on Flunking Psoriasis Drug Study

Evelo Biosciences shares tank 46% after trial failure

Evelo Biosciences to review options after Phase 2 trial of psoriasis treatment fails to meet main goal

Evelo Biosciences Announces Top-Line Results From its Phase 2 Clinical Study with EDP2939 in Moderate Psoriasis

Evelo Biosciences: May Be Worth A Small, Highly Speculative Long Position Considering Upcoming Psoriasis Phase 2 Results

Evelo Biosciences Announces Second Quarter Financial Results and Recent Business Highlights

Evelo Biosciences Closes $25.5 Million Private Placement

Evelo Biosciences Announces $25.5 Million Private Placement

Source: https://incomestatements.info

Category: Stock Reports