See more : Propel Funeral Partners Limited (PFP.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Flowserve Corporation (FLS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Flowserve Corporation, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Richmond Minerals Inc. (RMDFF) Income Statement Analysis – Financial Results

- CIMB Thai Bank PLC (BK6B.BE) Income Statement Analysis – Financial Results

- Shangya Technology Co., Ltd. (6130.TWO) Income Statement Analysis – Financial Results

- PT Surya Semesta Internusa Tbk (SSIA.JK) Income Statement Analysis – Financial Results

- Swancor Holding Co., LTD. (3708.TW) Income Statement Analysis – Financial Results

Flowserve Corporation (FLS)

About Flowserve Corporation

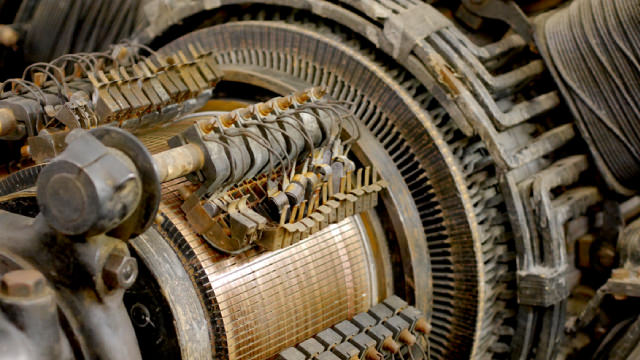

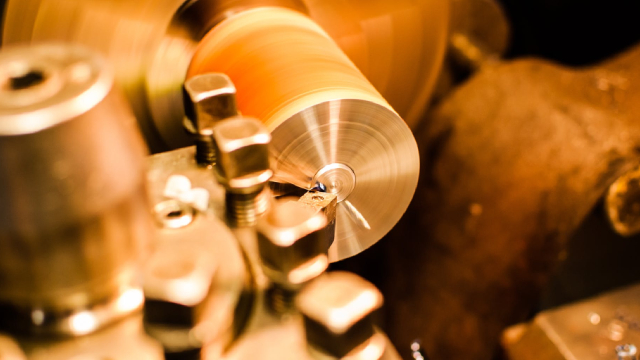

Flowserve Corporation designs, develops, manufactures, distributes, and services industrial flow management equipment in the United States, Europe, the Middle East, Africa, Asia, and internationally. It operates in two segments, Flowserve Pump Division (FPD) and Flow Control Division (FCD). The FPD segment offers custom and pre-configured pumps and pump systems, mechanical seals, auxiliary systems, replacement parts, upgrades, and related aftermarket services, including installation and commissioning services, seal systems spare parts, repairs, advanced diagnostics, re-rate and upgrade solutions, retrofit programs, and machining and asset management solutions, as well as manufactures a gas-lubricated mechanical seal for use in high-speed compressors for gas pipelines. The FCD segment provides engineered and industrial valve and automation solutions, including isolation and control valves, actuation, controls, and related equipment, as well as equipment maintenance services for flow control systems, including advanced diagnostics, repair, installation, commissioning, retrofit programs, and field machining capabilities. This segment's products are used to control, direct, and manage the flow of liquids, gases, and fluids. The company primarily serves oil and gas, chemical and pharmaceuticals, power generation, and water management markets, as well as general industries, including mining and ore processing, pulp and paper, food and beverage, and other smaller applications. The company distributes its products through direct sales, distributors, and sales representatives. Flowserve Corporation was incorporated in 1912 and is headquartered in Irving, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.32B | 3.62B | 3.54B | 3.73B | 3.94B | 3.83B | 3.66B | 3.99B | 4.56B | 4.88B | 4.95B | 4.75B | 4.51B | 4.03B | 4.37B | 4.47B | 3.76B | 3.06B | 2.70B | 2.64B | 2.40B | 2.25B | 1.92B | 1.54B | 1.06B | 1.08B | 1.15B | 605.45M | 532.73M | 345.39M | 313.90M | 300.40M | 296.50M | 296.80M | 281.00M | 230.90M | 182.10M | 144.30M | 146.00M |

| Cost of Revenue | 3.02B | 2.62B | 2.49B | 2.61B | 2.65B | 2.64B | 2.58B | 2.76B | 3.07B | 3.16B | 3.27B | 3.17B | 3.00B | 2.62B | 2.82B | 2.89B | 2.51B | 2.05B | 1.83B | 1.86B | 1.68B | 1.57B | 1.30B | 974.34M | 658.30M | 628.50M | 664.30M | 361.35M | 317.31M | 217.25M | 184.00M | 177.10M | 174.10M | 173.40M | 168.80M | 134.30M | 110.70M | 93.30M | 91.40M |

| Gross Profit | 1.30B | 994.30M | 1.05B | 1.12B | 1.30B | 1.19B | 1.09B | 1.23B | 1.49B | 1.71B | 1.69B | 1.58B | 1.51B | 1.41B | 1.55B | 1.58B | 1.25B | 1.01B | 861.83M | 778.82M | 722.42M | 685.53M | 614.55M | 563.95M | 403.00M | 454.60M | 487.90M | 244.10M | 215.42M | 128.14M | 129.90M | 123.30M | 122.40M | 123.40M | 112.20M | 96.60M | 71.40M | 51.00M | 54.60M |

| Gross Profit Ratio | 30.04% | 27.50% | 29.64% | 29.96% | 32.84% | 30.99% | 29.65% | 30.85% | 32.61% | 35.15% | 34.07% | 33.27% | 33.56% | 34.96% | 35.46% | 35.33% | 33.16% | 32.91% | 31.98% | 29.52% | 30.05% | 30.45% | 32.05% | 36.66% | 37.97% | 41.97% | 42.35% | 40.32% | 40.44% | 37.10% | 41.38% | 41.05% | 41.28% | 41.58% | 39.93% | 41.84% | 39.21% | 35.34% | 37.40% |

| Research & Development | 48.70M | 39.90M | 34.20M | 36.10M | 42.00M | 39.60M | 38.60M | 42.80M | 45.90M | 40.90M | 37.80M | 38.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 24.80M | 25.60M | 26.40M | 26.90M | 15.48M | 14.97M | 9.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 943.71M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 961.17M | 815.55M | 797.08M | 878.25M | 899.81M | 943.71M | 903.86M | 965.32M | 971.61M | 936.90M | 966.83M | 922.13M | 914.08M | 844.99M | 934.45M | 984.40M | 856.50M | 782.50M | 671.74M | 623.04M | 539.78M | 476.92M | 410.56M | 335.51M | 275.90M | 265.60M | 285.90M | 147.22M | 137.35M | 85.35M | 88.10M | 81.40M | 78.40M | 74.10M | 67.50M | 57.50M | 48.80M | 39.00M | 37.00M |

| Other Expenses | -45.58M | -559.00K | -36.14M | -10.25M | -17.62M | -19.57M | -16.11M | 3.30M | -40.17M | 2.00M | -14.28M | -21.65M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 964.29M | 815.55M | 797.08M | 878.25M | 899.81M | 943.71M | 903.86M | 965.32M | 971.61M | 936.90M | 966.83M | 922.13M | 894.97M | 844.99M | 934.45M | 984.40M | 837.81M | 767.68M | 671.74M | 623.04M | 559.55M | 493.10M | 410.56M | 417.34M | 341.10M | 331.30M | 351.80M | 169.25M | 152.15M | 96.86M | 99.90M | 93.20M | 88.30M | 83.00M | 75.10M | 65.20M | 56.10M | 44.90M | 42.90M |

| Cost & Expenses | 3.99B | 3.44B | 3.29B | 3.49B | 3.55B | 3.59B | 3.48B | 3.73B | 4.05B | 4.10B | 4.23B | 4.09B | 3.89B | 3.47B | 3.75B | 3.88B | 3.35B | 2.82B | 2.51B | 2.48B | 2.24B | 2.06B | 1.71B | 1.39B | 999.40M | 959.80M | 1.02B | 530.60M | 469.45M | 314.10M | 283.90M | 270.30M | 262.40M | 256.40M | 243.90M | 199.50M | 166.80M | 138.20M | 134.30M |

| Interest Income | 6.99M | 3.96M | 2.76M | 4.18M | 8.41M | 6.47M | 3.43M | 2.80M | 2.07M | 1.68M | 1.43M | 954.00K | 1.58M | 1.58M | 3.25M | 8.39M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 66.92M | 46.25M | 57.62M | 57.39M | 54.98M | 58.16M | 59.73M | 60.14M | 65.27M | 60.32M | 54.41M | 43.52M | 36.18M | 34.30M | 40.01M | 51.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 83.75M | 90.95M | 99.82M | 100.75M | 105.90M | 112.47M | 118.45M | 116.75M | 127.09M | 110.28M | 106.39M | 107.23M | 104.82M | 101.29M | 95.45M | 81.44M | 79.46M | 72.71M | 73.48M | 78.21M | 77.59M | 70.46M | 80.59M | 57.04M | 39.60M | 39.30M | 39.00M | 20.09M | 19.09M | 14.02M | -11.80M | -11.80M | -9.90M | -8.90M | -7.60M | 7.70M | 7.30M | 5.90M | 5.90M |

| EBITDA | 374.42M | 291.58M | 385.19M | 351.06M | 501.12M | 372.46M | 325.97M | 389.80M | 631.89M | 870.15M | 838.36M | 762.31M | 728.76M | 665.87M | 720.05M | 721.13M | 409.92M | 239.62M | 272.31M | 244.28M | 248.64M | 254.52M | 209.75M | 203.64M | 101.50M | 162.60M | 175.10M | 100.72M | 82.37M | 45.30M | 41.50M | 41.90M | 44.00M | 49.30M | 45.50M | 41.60M | 23.00M | 12.70M | 17.50M |

| EBITDA Ratio | 8.67% | 8.07% | 9.47% | 9.25% | 12.71% | 9.25% | 8.19% | 10.03% | 13.47% | 18.53% | 17.23% | 16.04% | 16.08% | 16.56% | 16.32% | 15.71% | 12.85% | 10.02% | 11.12% | 9.52% | 11.19% | 12.73% | 17.99% | 16.69% | 12.21% | 18.43% | 18.06% | 16.63% | 16.41% | 13.12% | 13.22% | 16.15% | 14.84% | 17.79% | 16.19% | 18.02% | 12.63% | 8.80% | 11.99% |

| Operating Income | 333.55M | 197.22M | 270.76M | 250.28M | 406.04M | 247.54M | 335.42M | 277.46M | 525.57M | 789.83M | 760.28M | 675.78M | 618.68M | 581.35M | 629.52M | 612.87M | 409.92M | 239.62M | 190.09M | 155.78M | 159.99M | 188.08M | 142.15M | 146.61M | 61.90M | 123.30M | 136.10M | 69.07M | 58.23M | 31.28M | 53.30M | 60.30M | 53.90M | 61.70M | 53.10M | 33.90M | 15.70M | 6.80M | 11.60M |

| Operating Income Ratio | 7.72% | 5.46% | 7.65% | 6.71% | 10.29% | 6.46% | 9.16% | 6.95% | 11.52% | 16.19% | 15.34% | 14.22% | 13.72% | 14.42% | 14.42% | 13.70% | 10.89% | 7.83% | 7.05% | 5.90% | 6.65% | 8.35% | 7.41% | 9.53% | 5.83% | 11.38% | 11.81% | 11.41% | 10.93% | 9.06% | 16.98% | 20.07% | 18.18% | 20.79% | 18.90% | 14.68% | 8.62% | 4.71% | 7.95% |

| Total Other Income/Expenses | -109.80M | -42.84M | -137.17M | -47.99M | -64.19M | -51.43M | -78.13M | -63.77M | -102.30M | -56.64M | -67.26M | -64.21M | -30.92M | -51.08M | -44.73M | -22.74M | -49.85M | -52.34M | -106.82M | -84.93M | -79.72M | -107.41M | -153.23M | -123.42M | -43.60M | -50.10M | -46.30M | -4.87M | -8.11M | -4.35M | -3.60M | -9.50M | -22.80M | -7.00M | -4.80M | -6.70M | -4.30M | -2.40M | -1.70M |

| Income Before Tax | 223.75M | 154.38M | 133.59M | 186.81M | 341.85M | 176.27M | 263.01M | 223.42M | 422.20M | 733.19M | 693.02M | 611.57M | 587.76M | 530.28M | 584.79M | 590.13M | 360.07M | 187.28M | -83.27M | 59.62M | 73.84M | 92.07M | 25.63M | 23.18M | 18.30M | 73.20M | 89.80M | 64.15M | 50.12M | 26.94M | 26.40M | 20.60M | 31.10M | 33.40M | 32.30M | 24.70M | 11.00M | 3.70M | 10.00M |

| Income Before Tax Ratio | 5.18% | 4.27% | 3.77% | 5.01% | 8.67% | 4.60% | 7.18% | 5.60% | 9.26% | 15.03% | 13.99% | 12.87% | 13.03% | 13.15% | 13.40% | 13.19% | 9.57% | 6.12% | -3.09% | 2.26% | 3.07% | 4.09% | 1.34% | 1.51% | 1.72% | 6.76% | 7.79% | 10.60% | 9.41% | 7.80% | 8.41% | 6.86% | 10.49% | 11.25% | 11.49% | 10.70% | 6.04% | 2.56% | 6.85% |

| Income Tax Expense | 18.56M | -43.64M | -2.59M | 60.03M | 80.07M | 51.22M | 258.68M | 75.29M | 148.92M | 208.31M | 204.70M | 160.77M | 158.52M | 141.60M | 156.46M | 147.72M | 104.29M | 73.24M | 37.09M | 39.47M | 20.95M | 31.67M | 9.28M | 7.88M | 6.10M | 25.50M | 38.20M | 20.90M | 19.45M | 9.78M | 9.90M | 7.40M | 11.50M | 12.50M | 12.60M | 9.70M | 4.80M | 1.70M | 4.10M |

| Net Income | 186.74M | 188.69M | 125.95M | 130.42M | 253.67M | 119.67M | 2.65M | 145.06M | 267.67M | 518.82M | 485.53M | 448.34M | 428.58M | 388.29M | 427.89M | 442.41M | 255.77M | 115.03M | 11.84M | 24.20M | 98.31M | 53.03M | -1.50M | 13.24M | 12.20M | 48.90M | 51.60M | 43.25M | 30.67M | 17.16M | 16.10M | -7.90M | 19.60M | 20.90M | 19.70M | 15.00M | 6.20M | 2.00M | 5.90M |

| Net Income Ratio | 4.32% | 5.22% | 3.56% | 3.50% | 6.43% | 3.12% | 0.07% | 3.63% | 5.87% | 10.64% | 9.80% | 9.44% | 9.50% | 9.63% | 9.80% | 9.89% | 6.80% | 3.76% | 0.44% | 0.92% | 4.09% | 2.36% | -0.08% | 0.86% | 1.15% | 4.51% | 4.48% | 7.14% | 5.76% | 4.97% | 5.13% | -2.63% | 6.61% | 7.04% | 7.01% | 6.50% | 3.40% | 1.39% | 4.04% |

| EPS | 1.42 | 1.44 | 0.97 | 1.00 | 1.82 | 0.91 | 0.02 | 1.02 | 1.94 | 3.75 | 3.43 | 2.86 | 2.57 | 2.32 | 2.55 | 2.61 | 1.51 | 0.69 | 0.10 | 0.16 | 0.27 | 0.16 | -0.01 | 0.12 | 0.11 | 0.41 | 0.42 | 0.59 | 0.41 | 0.30 | 0.19 | -0.14 | 0.23 | 0.25 | 0.23 | 0.13 | 0.06 | 0.02 | 0.06 |

| EPS Diluted | 1.42 | 1.44 | 0.96 | 1.00 | 1.81 | 0.91 | 0.02 | 1.01 | 1.93 | 3.72 | 3.41 | 2.84 | 2.55 | 2.29 | 2.53 | 2.58 | 1.49 | 0.67 | 0.10 | 0.16 | 0.27 | 0.16 | -0.01 | 0.12 | 0.11 | 0.41 | 0.42 | 0.59 | 0.41 | 0.30 | 0.19 | -0.14 | 0.23 | 0.25 | 0.23 | 0.13 | 0.06 | 0.02 | 0.06 |

| Weighted Avg Shares Out | 131.51M | 130.63M | 130.31M | 130.40M | 131.03M | 130.82M | 130.57M | 130.43M | 133.07M | 136.91M | 141.60M | 156.85M | 166.63M | 167.29M | 167.52M | 169.80M | 169.39M | 167.52M | 165.23M | 165.21M | 165.41M | 152.36M | 113.74M | 113.53M | 113.57M | 119.69M | 122.69M | 73.39M | 74.21M | 57.44M | 56.83M | 56.66M | 56.46M | 55.98M | 55.87M | 53.25M | 47.24M | 46.92M | 46.91M |

| Weighted Avg Shares Out (Dil) | 131.93M | 131.32M | 130.86M | 131.05M | 131.72M | 131.27M | 131.18M | 130.98M | 133.81M | 137.84M | 142.43M | 157.97M | 168.31M | 169.25M | 169.09M | 171.54M | 172.05M | 170.84M | 170.74M | 166.95M | 165.41M | 152.36M | 115.40M | 113.53M | 113.57M | 121.46M | 122.77M | 73.39M | 74.21M | 57.44M | 56.83M | 56.66M | 56.46M | 55.98M | 55.87M | 53.25M | 47.24M | 46.92M | 46.91M |

Flowserve (FLS) Is Up 4.57% in One Week: What You Should Know

Here's Why Flowserve (FLS) is a Strong Momentum Stock

Flowserve Corporation: Capitalize On Booming End-Market Trends And Solid Execution

Flowserve: More Room To Run Despite The Stock's Recent Rally

Flowserve Announces Dates for Third Quarter 2024 Financial Results

Flowserve Acquires MOGAS Industries & Enhances Product Portfolio

Flowserve (FLS) Earnings Expected to Grow: Should You Buy?

Flowserve Completes Acquisition of MOGAS Industries

Flowserve Corporation (FLS) Hits Fresh High: Is There Still Room to Run?

4 Industrial Manufacturing Stocks to Gain on Promising Industry Trends

Source: https://incomestatements.info

Category: Stock Reports