See more : Stella International Holdings Limited (SLNLY) Income Statement Analysis – Financial Results

Complete financial analysis of Five Point Holdings, LLC (FPH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Five Point Holdings, LLC, a leading company in the Real Estate – Development industry within the Real Estate sector.

- Andritz AG (AZ2.DE) Income Statement Analysis – Financial Results

- InterGlobe Aviation Limited (INDIGO.NS) Income Statement Analysis – Financial Results

- Photosynth inc. (4379.T) Income Statement Analysis – Financial Results

- James Fisher and Sons plc (FSJ.L) Income Statement Analysis – Financial Results

- Carlsberg A/S (CABJF) Income Statement Analysis – Financial Results

Five Point Holdings, LLC (FPH)

About Five Point Holdings, LLC

Five Point Holdings, LLC, through its subsidiary, Five Point Operating Company, LP, owns and develops mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County. The company operates in four segments: Valencia, San Francisco, Great Park, and Commercial. It sells residential and commercial land sites to homebuilders, commercial developers, and commercial buyers; operates and owns a commercial office, medical campus, and other properties; and provides development and property management services. The company was formerly known as Newhall Holding Company, LLC and changed its name to Five Point Holdings, LLC in May 2016. Five Point Holdings, LLC was incorporated in 2009 and is headquartered in Irvine, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 211.73M | 42.69M | 224.39M | 153.62M | 184.38M | 48.99M | 139.43M | 39.37M | 35.58M | 78.35M | 89.51M |

| Cost of Revenue | 133.99M | 27.50M | 144.29M | 111.37M | 131.17M | 28.87M | 106.90M | 21.85M | 12.41M | 17.00M | 18.66M |

| Gross Profit | 77.74M | 15.20M | 80.10M | 42.25M | 53.21M | 20.12M | 32.53M | 17.52M | 23.17M | 61.35M | 70.86M |

| Gross Profit Ratio | 36.72% | 35.60% | 35.70% | 27.51% | 28.86% | 41.06% | 23.33% | 44.50% | 65.13% | 78.30% | 79.16% |

| Research & Development | 0.00 | -0.85 | 0.06 | 0.02 | 0.13 | -1.20 | 0.17 | -2.65 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 51.58M | 54.35M | 76.83M | 0.00 | 103.59M | 98.98M | 122.27M | 1.72M | 32.65M | 4.86M | 5.85M |

| Selling & Marketing | 0.00 | 245.00K | 290.00K | 0.00 | 0.00 | 0.00 | 0.00 | 118.95M | -5.11M | 21.83M | 22.58M |

| SG&A | 51.58M | 54.59M | 77.12M | 83.50M | 103.59M | 98.98M | 122.27M | 120.67M | 27.54M | 26.69M | 28.43M |

| Other Expenses | 0.00 | 245.00K | 3.72M | 356.00K | 48.00K | 10.50M | 105.59M | -4.46M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 51.58M | 54.59M | 77.12M | 83.50M | 103.59M | 98.98M | 122.27M | 120.67M | 27.54M | 26.69M | 28.43M |

| Cost & Expenses | 185.48M | 82.09M | 221.41M | 194.87M | 234.76M | 127.86M | 229.17M | 142.52M | 39.95M | 43.68M | 47.08M |

| Interest Income | 7.23M | 826.00K | 94.00K | 1.37M | 7.84M | 11.77M | 2.58M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 826.00K | 0.00 | 0.00 | 0.00 | 11.77M | 2.58M | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 19.93M | 82.09M | 221.41M | 194.87M | 234.76M | 127.86M | 229.17M | 142.52M | -179.00K | 714.00K | 592.00K |

| EBITDA | 46.10M | -22.20M | 2.98M | -27.11M | -29.74M | -65.61M | -89.74M | -100.11M | -4.37M | 35.38M | 43.02M |

| EBITDA Ratio | 21.77% | -46.74% | 1.33% | -26.85% | -62.50% | -160.99% | -64.36% | -254.29% | -12.28% | 45.16% | 48.06% |

| Operating Income | 26.25M | -36.90M | -23.01M | -55.39M | -135.88M | -78.87M | 89.74M | 103.15M | 4.37M | 34.67M | 42.43M |

| Operating Income Ratio | 12.40% | -86.43% | -10.25% | -36.06% | -73.70% | -160.99% | 64.36% | 262.01% | 12.28% | 44.25% | 47.40% |

| Total Other Income/Expenses | 83.05M | 2.90M | 9.71M | 44.09M | 75.09M | 20.11M | 113.94M | -1.36M | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 109.30M | -36.25M | 12.99M | 2.84M | 24.71M | -58.76M | 24.20M | -104.51M | -4.37M | 34.67M | 42.43M |

| Income Before Tax Ratio | 51.62% | -84.89% | 5.79% | 1.85% | 13.40% | -119.95% | 17.35% | -265.46% | -12.28% | 44.25% | 47.40% |

| Income Tax Expense | -4.42M | -1.47M | -325.00K | 1.74M | 2.45M | 9.18M | -53.12M | -7.89M | -546.00K | 9.17M | 9.82M |

| Net Income | 55.39M | -34.77M | 13.31M | 1.09M | 22.27M | -34.71M | 73.24M | -33.27M | -2.69M | 16.50M | 32.61M |

| Net Income Ratio | 26.16% | -81.45% | 5.93% | 0.71% | 12.08% | -70.86% | 52.52% | -84.50% | -7.55% | 21.05% | 36.43% |

| EPS | 1.53 | -0.24 | 0.20 | 0.02 | 0.15 | -0.53 | 1.33 | -0.88 | -0.07 | 0.45 | 0.89 |

| EPS Diluted | 0.76 | -0.24 | 0.20 | 0.02 | 0.15 | -0.53 | 0.18 | -0.86 | -0.07 | 0.45 | 0.89 |

| Weighted Avg Shares Out | 72.43M | 143.51M | 67.39M | 66.43M | 145.52M | 65.03M | 54.03M | 37.81M | 36.61M | 36.59M | 36.51M |

| Weighted Avg Shares Out (Dil) | 145.15M | 143.51M | 67.39M | 66.72M | 145.52M | 65.03M | 133.03M | 38.48M | 38.48M | 36.59M | 36.51M |

Philly Shipyard Will Participate in the U.S. Navy T-AGOS Industry Studies

Cannabis According To Tommy Chong: 'The Only Bad Weed Is No Weed'

Five Point Holdings' (FPH) CEO Emile Haddad on Q2 2020 Results - Earnings Call Transcript

565 New Coronavirus Cases In Orange County: Sunday Updates

Five Point Holdings, LLC Sets Date for Second Quarter 2020 Earnings Announcement and Investor Conference Call

NFL: Dozens of players positive for COVID-19 since training camps open, opt-out deadline looms

Man City new boy Torres hits out at Valencia captain Dani Parejo

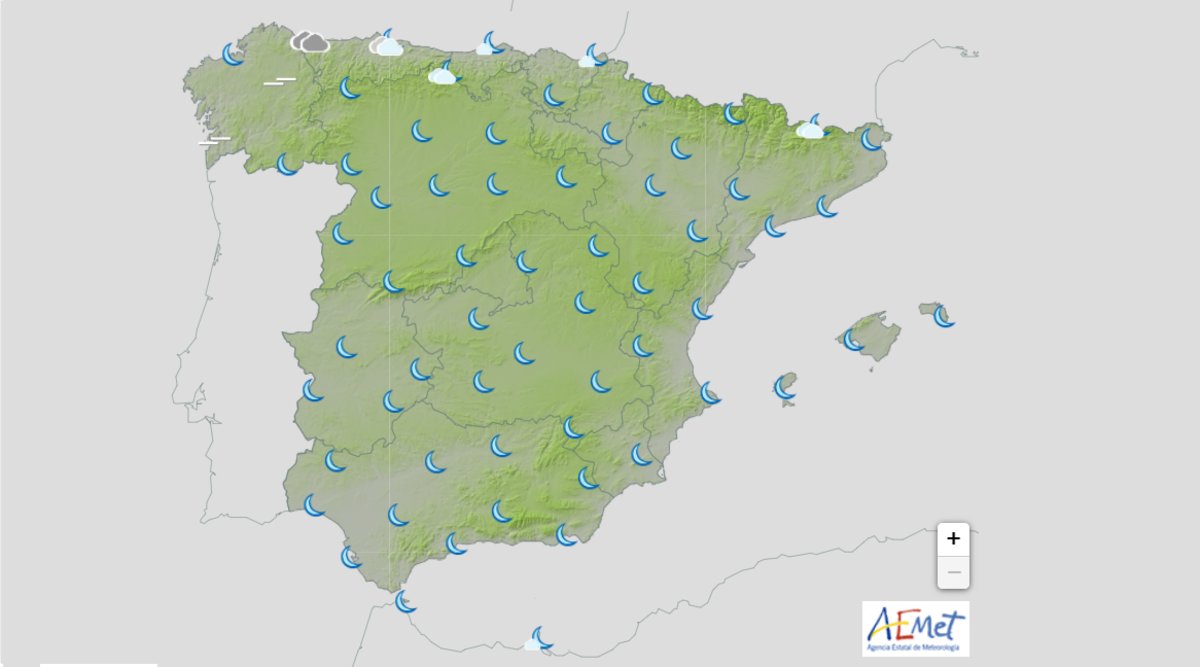

Aemet: Pronóstico del tiempo en toda España hoy miércoles 5 de agosto de 2020

El tiempo en Valencia: previsión meteorológica de hoy, miércoles 5 de agosto

Las hospitalizaciones por Covid se cuadruplican en solo un mes

Source: https://incomestatements.info

Category: Stock Reports