Complete financial analysis of Geely Automobile Holdings Limited (GELYF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Geely Automobile Holdings Limited, a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- Illumina, Inc. (0J8Z.L) Income Statement Analysis – Financial Results

- Shanghai Newtouch Software Co., Ltd. (688590.SS) Income Statement Analysis – Financial Results

- Electronic Arts Inc. (ERT.DE) Income Statement Analysis – Financial Results

- Vitrolife AB (publ) (0YAY.L) Income Statement Analysis – Financial Results

- Sembcorp Marine Ltd (SMBMF) Income Statement Analysis – Financial Results

Geely Automobile Holdings Limited (GELYF)

About Geely Automobile Holdings Limited

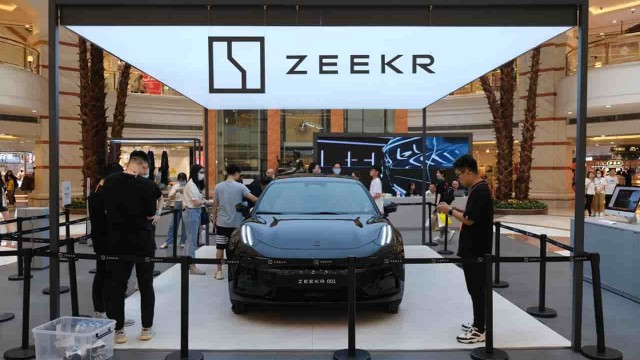

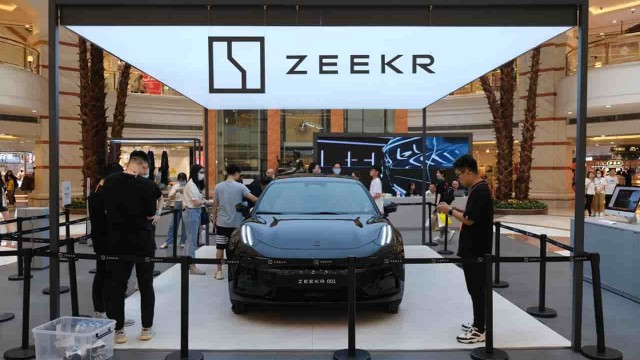

Geely Automobile Holdings Limited, an investment holding company, operates as an automobile manufacturer primarily in the People's Republic of China. The company engages in the research and development, production, marketing, and sale of vehicles, automobile parts, and related automobile components, as well as provision of related after-sales and technical services. It primarily offers sedans, wagons, sport utility cars, and electric vehicles under the Geely, Geometry, and ZEEKR brands. The company also provides vehicles design, technology consulting, general logistics, packing, and storage services; researches and develops technology; procures mechanical and electrical equipment; and manufactures and sells vehicle engines. It operates in Malaysia, Eastern Europe, the Middle East, Northern Europe, the Philippines, Central and South America, Africa, and other countries. The company is headquartered in Wan Chai, Hong Kong.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 179.20B | 147.96B | 101.61B | 92.11B | 97.40B | 106.60B | 92.76B | 53.72B | 30.14B | 21.74B | 28.71B | 24.63B | 20.96B | 20.10B | 14.07B | 4.29B | 128.54M | 127.35M | 105.56M | 43.81M | 42.51M | 76.22M |

| Cost of Revenue | 151.79B | 127.07B | 84.20B | 77.38B | 80.48B | 85.08B | 74.78B | 43.88B | 24.67B | 17.78B | 22.94B | 20.07B | 17.14B | 16.40B | 11.53B | 3.64B | 113.59M | 110.33M | 94.36M | 40.98M | 34.01M | 55.06M |

| Gross Profit | 27.42B | 20.90B | 17.41B | 14.74B | 16.92B | 21.51B | 17.98B | 9.84B | 5.47B | 3.96B | 5.77B | 4.56B | 3.82B | 3.70B | 2.54B | 651.29M | 14.95M | 17.02M | 11.20M | 2.83M | 8.50M | 21.16M |

| Gross Profit Ratio | 15.30% | 14.12% | 17.14% | 16.00% | 17.37% | 20.18% | 19.38% | 18.32% | 18.15% | 18.23% | 20.08% | 18.51% | 18.22% | 18.41% | 18.06% | 15.18% | 11.63% | 13.36% | 10.61% | 6.46% | 19.99% | 27.77% |

| Research & Development | 0.00 | 6.76B | 0.00 | 3.74B | 3.07B | 2.19B | 1.78B | 1.22B | 924.85M | 628.41M | 900.88M | 518.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 12.02B | 10.29B | 7.91B | 5.75B | 5.12B | 3.78B | 2.92B | 2.56B | 2.18B | 1.77B | 1.68B | 1.32B | 962.98M | 922.88M | 524.13M | 282.54M | 47.28M | 25.63M | 19.52M | 16.49M | 21.79M | 38.25M |

| Selling & Marketing | 11.83B | 8.23B | 6.32B | 5.05B | 4.33B | 4.52B | 4.06B | 2.50B | 1.57B | 1.25B | 1.71B | 1.48B | 1.36B | 1.19B | 764.56M | 219.81M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 23.85B | 18.52B | 14.23B | 10.80B | 9.45B | 8.30B | 6.98B | 5.06B | 3.74B | 3.02B | 3.39B | 2.80B | 2.32B | 2.11B | 1.29B | 502.34M | 47.28M | 25.63M | 19.52M | 16.49M | 21.79M | 38.25M |

| Other Expenses | 3.56B | 1.13B | 118.74M | -1.00B | -886.80M | 213.94M | 171.43M | 76.17M | 92.12M | 82.09M | 129.65M | 103.65M | 0.00 | 0.00 | -10.74M | 346.09M | 331.89M | 224.93M | 128.42M | 110.11M | 72.71M | -92.52M |

| Operating Expenses | 27.42B | 19.65B | 14.35B | 9.80B | 8.57B | 7.29B | 6.07B | 4.29B | 2.91B | 2.18B | 2.63B | 1.95B | 1.42B | 1.55B | 857.16M | 144.83M | 47.28M | 25.63M | 19.52M | 16.39M | 22.60M | 49.81M |

| Cost & Expenses | 174.80B | 146.72B | 98.55B | 87.17B | 89.05B | 92.37B | 80.85B | 48.17B | 27.57B | 19.96B | 25.57B | 22.02B | 18.56B | 17.95B | 12.39B | 3.78B | 160.86M | 135.96M | 113.88M | 57.37M | 56.61M | 104.87M |

| Interest Income | 961.36M | 931.16M | 544.98M | 375.30M | 235.60M | 192.92M | 127.06M | 85.43M | 96.91M | 57.63M | 59.26M | 42.16M | 44.08M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 417.01M | 550.69M | 264.83M | 166.98M | 127.58M | 113.93M | 110.28M | 115.53M | 103.35M | 81.33M | 99.24M | 236.76M | 211.36M | 0.00 | 0.00 | 60.95M | 33.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 8.20B | 8.32B | 6.89B | 5.49B | 3.73B | 2.41B | 1.94B | 1.65B | 1.14B | 873.55M | 1.08B | 860.10M | 641.91M | 524.72M | 364.60M | 141.05M | 2.14M | 0.00 | 844.20K | 757.50K | 1.31M | 2.00M |

| EBITDA | 13.57B | 13.45B | 11.82B | 12.10B | 13.50B | 17.49B | 14.82B | 7.97B | 4.12B | 2.90B | 4.48B | 3.63B | 3.04B | 2.68B | 2.05B | 647.51M | 343.26M | -7.20M | -7.48M | -12.81M | -12.10M | -26.65M |

| EBITDA Ratio | 7.57% | 7.86% | 11.68% | 12.71% | 13.67% | 16.40% | 15.39% | 14.14% | 13.43% | 12.99% | 15.31% | 14.66% | 14.52% | 13.32% | 14.56% | 26.11% | -23.49% | -6.76% | -7.08% | -29.23% | -30.07% | -34.97% |

| Operating Income | 3.92B | 3.31B | 4.98B | 6.22B | 9.58B | 15.03B | 13.18B | 5.87B | 2.73B | 1.93B | 3.22B | 2.73B | 2.40B | 2.15B | 1.58B | 506.45M | -32.33M | -8.61M | -8.32M | -13.56M | -13.41M | -26.03M |

| Operating Income Ratio | 2.19% | 2.24% | 4.90% | 6.75% | 9.84% | 14.10% | 14.21% | 10.92% | 9.06% | 8.90% | 11.22% | 11.07% | 11.46% | 10.71% | 11.20% | 11.81% | -25.15% | -6.76% | -7.88% | -30.96% | -31.54% | -34.16% |

| Total Other Income/Expenses | 1.03B | 1.37B | -314.18M | 223.98M | 56.12M | 737.55M | -404.33M | 1.47B | 1.21B | 8.79M | 83.24M | 851.37M | -218.56M | -252.09M | -25.89M | 411.47M | 339.70M | 224.93M | 128.42M | 110.11M | 72.71M | -92.52M |

| Income Before Tax | 4.95B | 4.68B | 4.67B | 6.44B | 9.64B | 14.96B | 12.77B | 6.20B | 2.87B | 1.94B | 3.30B | 2.53B | 2.18B | 1.90B | 1.55B | 917.92M | 299.56M | 216.32M | 120.10M | 96.55M | 59.30M | -118.55M |

| Income Before Tax Ratio | 2.76% | 3.16% | 4.59% | 6.99% | 9.89% | 14.03% | 13.77% | 11.55% | 9.54% | 8.94% | 11.51% | 10.27% | 10.41% | 9.45% | 11.02% | 21.40% | 233.06% | 169.86% | 113.77% | 220.36% | 139.50% | -155.54% |

| Income Tax Expense | 14.92M | 32.28M | 312.17M | 866.35M | 1.37B | 2.28B | 2.04B | 1.03B | 586.14M | 494.18M | 623.93M | 479.29M | 467.36M | 350.61M | 231.43M | 51.87M | 1.57M | 1.59M | 0.42 | 7.13M | 252.70K | 55.19K |

| Net Income | 5.31B | 5.26B | 4.85B | 5.53B | 8.19B | 12.55B | 10.63B | 5.11B | 2.26B | 1.43B | 2.66B | 2.04B | 1.54B | 1.37B | 1.18B | 879.05M | 297.99M | 214.73M | 120.10M | 89.91M | 61.29M | -112.47M |

| Net Income Ratio | 2.96% | 3.56% | 4.77% | 6.01% | 8.41% | 11.78% | 11.46% | 9.52% | 7.50% | 6.58% | 9.28% | 8.28% | 7.36% | 6.81% | 8.41% | 20.50% | 231.84% | 168.61% | 113.77% | 205.22% | 144.18% | -147.56% |

| EPS | 0.51 | 0.51 | 0.48 | 0.56 | 0.90 | 1.40 | 1.19 | 0.58 | 0.26 | 0.16 | 0.32 | 0.27 | 0.21 | 0.19 | 0.17 | 0.15 | 0.06 | 0.05 | 0.03 | 0.02 | 0.02 | -0.05 |

| EPS Diluted | 0.51 | 0.50 | 0.48 | 0.56 | 0.89 | 1.37 | 1.16 | 0.57 | 0.26 | 0.16 | 0.30 | 0.26 | 0.19 | 0.17 | 0.17 | 0.14 | 0.06 | 0.05 | 0.03 | 0.02 | 0.02 | -0.05 |

| Weighted Avg Shares Out | 10.06B | 10.03B | 9.82B | 9.55B | 9.08B | 8.98B | 8.93B | 8.82B | 8.80B | 8.80B | 8.39B | 7.54B | 7.45B | 7.31B | 6.93B | 5.85B | 4.93B | 4.13B | 4.12B | 4.13B | 3.59B | 2.46B |

| Weighted Avg Shares Out (Dil) | 10.13B | 10.15B | 9.89B | 9.56B | 9.18B | 9.17B | 9.16B | 8.92B | 8.81B | 8.80B | 8.80B | 8.10B | 8.53B | 7.36B | 7.18B | 6.23B | 5.01B | 4.22B | 4.12B | 4.13B | 3.59B | 2.46B |

Geely Automobile Holdings Limited (GELYF) Q4 2023 Earnings Call Transcript

Geely-backed car tech company takes aim at Nvidia's growing auto business

China's Geely launches 11 low-orbit satellites for autonomous cars

China's Zeekr is revving up for an IPO in the US. What do we know?

China's Zeekr is revving up for an IPO in the US. What do we know?

Zeekr makes US IPO filing public

Future of Flight: 3 Stocks in the Aerial Car Market With Huge Potential

Thanks To EV Push, China Is Now The World's Largest Exporter Of Vehicles

Waymo-Zeekr robotaxi poised for US testing by end of 2023

The 3 Most Undervalued Flying Car Stocks to Buy in September 2023

Source: https://incomestatements.info

Category: Stock Reports