See more : Pluri Inc. (PLUR) Income Statement Analysis – Financial Results

Complete financial analysis of Intel Corporation (INTC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Intel Corporation, a leading company in the Semiconductors industry within the Technology sector.

- ICL Group Ltd (ICL) Income Statement Analysis – Financial Results

- GCS Holdings, Inc. (4991.TWO) Income Statement Analysis – Financial Results

- Shandong Fengxiang Co., Ltd (9977.HK) Income Statement Analysis – Financial Results

- FAST Acquisition Corp. II (FZT-UN) Income Statement Analysis – Financial Results

- SSAB AB (publ) (SSABBH.HE) Income Statement Analysis – Financial Results

Intel Corporation (INTC)

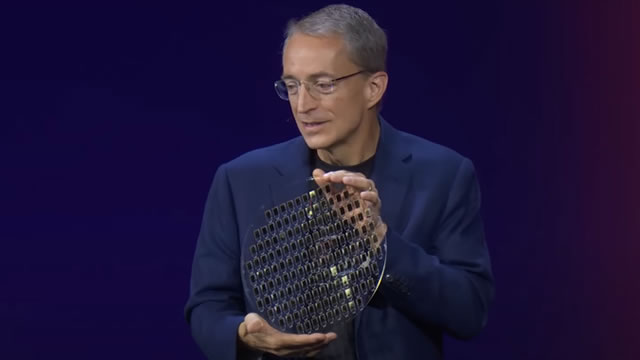

About Intel Corporation

Intel Corporation engages in the design, manufacture, and sale of computer products and technologies worldwide. The company operates through CCG, DCG, IOTG, Mobileye, NSG, PSG, and All Other segments. It offers platform products, such as central processing units and chipsets, and system-on-chip and multichip packages; and non-platform or adjacent products, including accelerators, boards and systems, connectivity products, graphics, and memory and storage products. The company also provides high-performance compute solutions for targeted verticals and embedded applications for retail, industrial, and healthcare markets; and solutions for assisted and autonomous driving comprising compute platforms, computer vision and machine learning-based sensing, mapping and localization, driving policy, and active sensors. In addition, it offers workload-optimized platforms and related products for cloud service providers, enterprise and government, and communications service providers. The company serves original equipment manufacturers, original design manufacturers, and cloud service providers. Intel Corporation has a strategic partnership with MILA to develop and apply advances in artificial intelligence methods for enhancing the search in the space of drugs. The company was incorporated in 1968 and is headquartered in Santa Clara, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 54.23B | 63.05B | 79.02B | 77.87B | 71.97B | 70.85B | 62.76B | 59.39B | 55.36B | 55.87B | 52.71B | 53.34B | 54.00B | 43.62B | 35.13B | 37.59B | 38.33B | 35.38B | 38.83B | 34.21B | 30.14B | 26.76B | 26.54B | 33.73B | 29.39B | 26.27B | 25.07B | 20.85B | 16.20B | 11.52B | 8.78B | 5.84B | 4.78B | 3.92B | 3.13B | 2.87B | 1.91B | 1.27B | 1.37B |

| Cost of Revenue | 32.52B | 36.19B | 35.21B | 34.26B | 29.83B | 27.11B | 23.69B | 23.20B | 20.68B | 20.26B | 21.19B | 20.19B | 20.24B | 14.81B | 15.57B | 16.74B | 18.43B | 17.16B | 15.78B | 14.46B | 13.05B | 13.45B | 13.49B | 12.65B | 11.84B | 12.14B | 9.95B | 9.16B | 7.81B | 5.58B | 2.54B | 2.04B | 1.90B | 1.64B | 1.48B | 1.30B | 872.10M | 687.20M | 777.20M |

| Gross Profit | 21.71B | 26.87B | 43.82B | 43.61B | 42.14B | 43.74B | 39.07B | 36.19B | 34.68B | 35.61B | 31.52B | 33.15B | 33.76B | 28.82B | 19.56B | 20.84B | 19.90B | 18.22B | 23.05B | 19.75B | 17.09B | 13.32B | 13.05B | 21.08B | 17.55B | 14.13B | 15.13B | 11.68B | 8.39B | 5.95B | 6.25B | 3.80B | 2.88B | 2.28B | 1.64B | 1.58B | 1.04B | 577.80M | 587.80M |

| Gross Profit Ratio | 40.04% | 42.61% | 55.45% | 56.01% | 58.56% | 61.73% | 62.25% | 60.94% | 62.65% | 63.74% | 59.80% | 62.15% | 62.51% | 66.05% | 55.69% | 55.46% | 51.92% | 51.49% | 59.36% | 57.72% | 56.71% | 49.76% | 49.18% | 62.49% | 59.73% | 53.78% | 60.33% | 56.04% | 51.79% | 51.60% | 71.13% | 65.10% | 60.30% | 58.23% | 52.55% | 54.95% | 54.27% | 45.68% | 43.06% |

| Research & Development | 16.05B | 17.53B | 15.19B | 13.56B | 13.36B | 13.54B | 13.10B | 12.74B | 12.13B | 11.54B | 10.61B | 10.15B | 8.35B | 6.58B | 5.65B | 5.72B | 5.76B | 5.87B | 5.15B | 4.78B | 4.36B | 4.03B | 3.80B | 3.90B | 3.11B | 2.51B | 2.35B | 1.81B | 1.30B | 1.11B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.68B | 5.80B | 5.44B | 5.42B | 5.32B | 5.55B | 6.07B | 6.60B | 6.13B | 6.34B | 6.19B | 6.06B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 950.00M | 1.20B | 1.10B | 763.00M | 832.00M | 1.20B | 1.40B | 1.80B | 1.80B | 1.80B | 1.90B | 2.00B | 0.00 | 6.31B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 5.63B | 7.00B | 6.54B | 6.18B | 6.15B | 6.75B | 7.47B | 8.40B | 7.93B | 8.14B | 8.09B | 8.06B | 7.67B | 6.31B | 6.68B | 5.46B | 5.40B | 6.10B | 5.69B | 4.66B | 4.28B | 4.33B | 4.46B | 5.09B | 3.87B | 3.08B | 2.89B | 2.32B | 1.84B | 1.45B | 2.14B | 1.80B | 1.38B | 1.13B | 848.50M | 774.50M | 617.70M | 539.60M | 481.70M |

| Other Expenses | 0.00 | 0.00 | 2.63B | -147.00M | 490.00M | 156.00M | -30.00M | 67.00M | 108.00M | 94.00M | -11.00M | 87.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 21.68B | 24.53B | 21.73B | 19.74B | 19.71B | 20.49B | 20.75B | 21.43B | 20.32B | 19.97B | 18.99B | 18.51B | 16.28B | 12.90B | 13.62B | 11.67B | 11.40B | 12.01B | 10.96B | 9.62B | 9.56B | 8.92B | 10.60B | 10.57B | 7.39B | 5.59B | 5.24B | 4.13B | 3.14B | 2.56B | 2.86B | 2.31B | 1.80B | 1.43B | 1.09B | 985.40M | 789.10M | 713.10M | 648.00M |

| Cost & Expenses | 54.20B | 60.72B | 56.94B | 53.99B | 49.54B | 47.60B | 44.44B | 44.63B | 41.00B | 40.23B | 40.18B | 38.70B | 36.52B | 27.71B | 29.19B | 28.41B | 29.83B | 29.18B | 26.74B | 24.08B | 22.60B | 22.36B | 24.09B | 23.22B | 19.23B | 17.73B | 15.18B | 13.29B | 10.95B | 8.13B | 5.39B | 4.35B | 3.70B | 3.06B | 2.57B | 2.28B | 1.66B | 1.40B | 1.43B |

| Interest Income | 1.34B | 589.00M | 144.00M | 272.00M | 483.00M | 438.00M | 441.00M | 222.00M | 124.00M | 141.00M | 104.00M | 97.00M | 98.00M | 119.00M | 168.00M | 488.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 878.00M | 496.00M | 597.00M | 629.00M | 489.00M | 468.00M | 646.00M | 733.00M | 337.00M | 192.00M | 244.00M | 90.00M | 41.00M | 10.00M | 1.00M | 8.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 9.60B | 13.04B | 11.79B | 12.24B | 10.83B | 9.09B | 8.13B | 7.79B | 265.00M | 294.00M | 291.00M | 308.00M | 260.00M | 18.00M | 35.00M | 4.62B | 4.80B | 4.91B | 4.60B | 4.89B | 5.07B | 5.34B | 6.47B | 4.84B | 3.60B | 2.81B | 2.19B | 1.89B | 1.38B | 1.05B | 717.00M | 517.60M | 418.30M | 292.40M | 237.20M | 210.90M | 171.40M | 173.50M | 166.30M |

| EBITDA | 11.24B | 15.61B | 33.87B | 36.12B | 33.25B | 32.33B | 26.56B | 22.80B | 23.07B | 24.19B | 20.56B | 22.49B | 23.89B | 20.68B | 10.76B | 12.31B | 13.98B | 12.00B | 16.69B | 15.02B | 12.61B | 9.75B | 9.01B | 15.34B | 13.27B | 11.41B | 12.08B | 9.44B | 6.63B | 4.43B | 4.11B | 2.01B | 1.50B | 1.15B | 794.50M | 805.30M | 417.30M | 38.20M | 106.10M |

| EBITDA Ratio | 20.73% | 25.43% | 43.01% | 46.54% | 44.62% | 33.17% | 25.86% | 27.67% | 26.48% | 28.32% | 23.89% | 27.76% | 32.64% | 35.72% | 17.69% | 30.97% | 36.04% | 31.33% | 42.96% | 43.79% | 43.87% | 36.56% | 34.99% | 34.36% | 45.15% | 43.83% | 48.18% | 45.29% | 40.93% | 38.49% | 44.65% | 32.08% | 27.24% | 23.55% | 21.51% | 26.81% | 16.38% | 6.13% | 2.34% |

| Operating Income | 93.00M | 2.33B | 19.46B | 23.68B | 22.04B | 23.32B | 17.94B | 12.87B | 14.00B | 15.35B | 12.29B | 14.64B | 17.48B | 15.91B | 5.71B | 8.95B | 8.22B | 5.65B | 12.09B | 10.13B | 7.53B | 4.38B | 2.26B | 10.40B | 9.77B | 8.38B | 9.89B | 7.55B | 5.25B | 3.39B | 3.39B | 1.49B | 1.08B | 858.30M | 557.30M | 594.40M | 245.90M | -135.30M | -60.20M |

| Operating Income Ratio | 0.17% | 3.70% | 24.62% | 30.41% | 30.62% | 32.91% | 28.58% | 21.68% | 25.29% | 27.47% | 23.32% | 27.44% | 32.37% | 36.48% | 16.26% | 23.82% | 21.43% | 15.97% | 31.14% | 29.61% | 24.99% | 16.37% | 8.50% | 30.82% | 33.23% | 31.89% | 39.44% | 36.23% | 32.42% | 29.40% | 38.62% | 25.50% | 22.60% | 21.89% | 17.82% | 20.68% | 12.89% | -10.70% | -4.41% |

| Total Other Income/Expenses | 669.00M | 5.43B | 2.25B | 1.40B | 2.02B | 1.00M | 2.30B | -197.00M | 210.00M | 454.00M | 320.00M | 235.00M | 304.00M | 781.00M | -7.00M | -1.27B | 950.00M | 861.00M | 520.00M | 287.00M | -91.00M | -178.00M | -73.00M | 4.75B | 1.46B | 758.00M | 772.00M | 381.00M | 386.00M | 216.00M | 138.00M | 78.90M | 114.70M | 128.00M | 25.70M | 34.60M | 41.90M | -39.30M | 54.80M |

| Income Before Tax | 762.00M | 7.77B | 21.70B | 25.08B | 24.06B | 23.32B | 20.35B | 12.94B | 14.21B | 15.80B | 12.61B | 14.87B | 17.78B | 16.37B | 5.70B | 7.69B | 9.17B | 7.07B | 12.61B | 10.42B | 7.44B | 4.20B | 2.18B | 15.14B | 11.23B | 9.14B | 10.66B | 7.93B | 5.64B | 3.60B | 3.53B | 1.57B | 1.19B | 986.30M | 583.00M | 629.00M | 287.80M | -174.60M | -5.40M |

| Income Before Tax Ratio | 1.41% | 12.32% | 27.46% | 32.21% | 33.43% | 32.91% | 32.43% | 21.78% | 25.67% | 28.28% | 23.93% | 27.88% | 32.93% | 37.52% | 16.24% | 20.45% | 23.91% | 19.98% | 32.48% | 30.45% | 24.69% | 15.71% | 8.23% | 44.89% | 38.20% | 34.78% | 42.52% | 38.06% | 34.80% | 31.27% | 40.20% | 26.84% | 25.00% | 25.15% | 18.65% | 21.88% | 15.09% | -13.80% | -0.40% |

| Income Tax Expense | -913.00M | -249.00M | 1.84B | 4.18B | 3.01B | 2.26B | 10.75B | 2.62B | 2.79B | 4.10B | 2.99B | 3.87B | 4.84B | 4.70B | 1.34B | 2.39B | 2.19B | 2.02B | 3.95B | 2.90B | 1.80B | 1.09B | 892.00M | 4.61B | 3.91B | 3.07B | 3.71B | 2.78B | 2.07B | 1.32B | 1.24B | 502.00M | 376.00M | 336.00M | 192.00M | 176.10M | 112.30M | 8.70M | -7.00M |

| Net Income | 1.69B | 8.01B | 19.87B | 20.90B | 21.05B | 21.05B | 9.60B | 10.32B | 11.42B | 11.70B | 9.62B | 11.01B | 12.94B | 11.67B | 4.37B | 5.29B | 6.98B | 5.04B | 8.66B | 7.52B | 5.64B | 3.12B | 1.29B | 10.54B | 7.31B | 6.07B | 6.95B | 5.16B | 3.57B | 2.29B | 2.30B | 1.07B | 818.60M | 650.30M | 391.00M | 452.90M | 175.50M | -183.30M | 1.60M |

| Net Income Ratio | 3.11% | 12.71% | 25.14% | 26.84% | 29.25% | 29.72% | 15.30% | 17.37% | 20.63% | 20.95% | 18.25% | 20.63% | 23.97% | 26.76% | 12.44% | 14.08% | 18.20% | 14.26% | 22.31% | 21.97% | 18.72% | 11.65% | 4.86% | 31.24% | 24.89% | 23.10% | 27.70% | 24.74% | 22.01% | 19.86% | 26.13% | 18.25% | 17.13% | 16.58% | 12.50% | 15.75% | 9.20% | -14.49% | 0.12% |

| EPS | 0.40 | 1.95 | 4.89 | 4.98 | 4.77 | 4.57 | 2.04 | 2.18 | 2.41 | 2.39 | 1.94 | 2.20 | 2.46 | 2.10 | 0.79 | 0.93 | 1.20 | 0.87 | 1.42 | 1.17 | 0.86 | 0.47 | 0.19 | 1.57 | 1.10 | 0.91 | 1.07 | 0.79 | 0.54 | 0.35 | 0.35 | 0.16 | 0.13 | 0.11 | 0.07 | 0.09 | 0.04 | -0.04 | 0.01 |

| EPS Diluted | 0.40 | 1.94 | 4.86 | 4.94 | 4.71 | 4.48 | 1.99 | 2.12 | 2.33 | 2.31 | 1.89 | 2.13 | 2.39 | 2.05 | 0.77 | 0.92 | 1.18 | 0.86 | 1.40 | 1.16 | 0.85 | 0.46 | 0.19 | 1.51 | 1.05 | 0.87 | 0.97 | 0.73 | 0.51 | 0.33 | 0.33 | 0.16 | 0.13 | 0.10 | 0.07 | 0.08 | 0.04 | -0.04 | 0.01 |

| Weighted Avg Shares Out | 4.19B | 4.11B | 4.06B | 4.20B | 4.42B | 4.61B | 4.70B | 4.73B | 4.74B | 4.90B | 4.97B | 5.00B | 5.26B | 5.56B | 5.56B | 5.66B | 5.82B | 5.80B | 6.11B | 6.40B | 6.53B | 6.65B | 6.79B | 6.71B | 6.65B | 6.67B | 6.54B | 6.58B | 6.60B | 6.99B | 7.06B | 6.86B | 6.30B | 5.91B | 5.59B | 5.03B | 4.39B | 4.58B | 5.57B |

| Weighted Avg Shares Out (Dil) | 4.21B | 4.12B | 4.09B | 4.23B | 4.47B | 4.70B | 4.84B | 4.88B | 4.89B | 5.06B | 5.10B | 5.16B | 5.41B | 5.70B | 5.65B | 5.75B | 5.94B | 5.88B | 6.18B | 6.49B | 6.62B | 6.76B | 6.88B | 6.99B | 6.94B | 7.03B | 7.18B | 7.10B | 7.07B | 6.99B | 7.06B | 6.86B | 6.30B | 6.50B | 5.59B | 5.66B | 4.39B | 4.58B | 5.57B |

Intel shares fall after CEO exit

Pat Gelsinger had the right plan to lead Intel, but patience ran out, says Futurum CEO Daniel Newman

Why Intel Stock Is Sinking Today

Intel's New CEO Change Unlikely To Help Gain Traction Versus Taiwan Semi And Nvidia: Analysts

Intel considers an outside CEO, taps headhunters

Intel shares slide as Gelsinger exit leaves chipmaker without a 'quick fix'

Intel split ‘more likely' as chief executive's departure leaves uncertainty - analysts

Pat Gelsinger inherited major problems at Intel. Its next CEO may have to navigate worse.

Intel shares fall after CEO leaves

Intel's CEO hunt: If Gelsinger can't turn around Intel, who can?

Source: https://incomestatements.info

Category: Stock Reports