Complete financial analysis of Barings Corporate Investors (MCI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barings Corporate Investors, a leading company in the Asset Management industry within the Financial Services sector.

- Guangdong Jiayuan Technology Co.,Ltd. (688388.SS) Income Statement Analysis – Financial Results

- Innodata Inc. (INOD) Income Statement Analysis – Financial Results

- HilleVax, Inc. (HLVX) Income Statement Analysis – Financial Results

- Landi Renzo S.p.A. (0ND3.L) Income Statement Analysis – Financial Results

- Shanghai MicroPort Endovascular MedTech Co., Ltd. (688016.SS) Income Statement Analysis – Financial Results

Barings Corporate Investors (MCI)

Industry: Asset Management

Sector: Financial Services

Website: https://www.babsoncapital.com/Strategies/Trusts/MCI/Default.aspx

About Barings Corporate Investors

Babson Capital Corporate Investors trust is a closed ended fixed income mutual fund launched and managed by Barings LLC. It invests in fixed income markets of the United States. The fund seeks to invest in securities of companies operating across diversified sectors. It primarily invests in a portfolio of privately placed, below-investment grade, long term corporate debt obligations. The fund also invests in marketable investment grade debt securities, other marketable debt securities, and marketable common stocks. It was formerly known as Babson Capital Corporate Investors. Babson Capital Corporate Investors trust was formed in 1971 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 41.19M | 16.21M | 54.45M | 16.22M | 39.95M | 10.99M | 44.54M | 28.18M | 26.80M | 30.20M | 28.88M | 30.25M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 41.19M | 16.21M | 54.45M | 16.22M | 39.95M | 10.99M | 44.54M | 28.18M | 26.80M | 30.20M | 28.88M | 30.25M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 4.43M | 4.79M | 4.63M | 4.43M | 4.16M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 4.43M | 4.79M | 4.63M | 4.43M | 4.16M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 641.25K | 7.93M | 4.14M | 4.88M | 11.15M |

| Cost & Expenses | 5.62M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 641.25K | 7.93M | 4.14M | 4.88M | 11.15M |

| Interest Income | 40.63M | 28.08M | 24.33M | 28.70M | 27.60M | 29.45M | 27.96M | 1.58M | 1.58M | 1.58M | 1.58M | 1.58M |

| Interest Expense | 2.08M | 1.71M | 1.07M | 1.06M | 1.06M | 1.06M | 1.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -46.47K | -23.32M | -20.54M | -25.45M | -23.64M | -25.27M | -26.77M | -23.76M | -22.01M | -25.57M | -24.45M | -26.09M |

| EBITDA | 0.00 | 0.00 | 67.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.73M |

| EBITDA Ratio | 0.00% | 103.28% | 98.07% | 94.52% | 97.65% | 96.88% | 101.24% | 12.36% | -17.63% | 23.80% | 26.74% | 45.38% |

| Operating Income | 35.57M | 16.74M | 53.39M | 15.33M | 39.01M | 10.65M | 45.10M | 23.76M | 22.01M | 25.57M | 24.45M | 26.09M |

| Operating Income Ratio | 86.36% | 103.28% | 98.07% | 94.52% | 97.65% | 96.88% | 101.24% | 84.29% | 82.13% | 84.68% | 84.68% | 86.25% |

| Total Other Income/Expenses | 2.09M | -7.91M | 406.60K | -10.11M | 15.37M | -15.68M | 16.81M | 3.48M | -4.72M | 7.19M | 7.72M | 13.73M |

| Income Before Tax | 37.67M | 15.03M | 53.39M | 15.33M | 39.01M | 9.59M | 43.58M | 27.24M | 17.28M | 32.76M | 32.18M | 39.82M |

| Income Before Tax Ratio | 91.45% | 92.72% | 98.07% | 94.52% | 97.65% | 87.24% | 97.83% | 96.65% | 64.49% | 108.48% | 111.41% | 131.63% |

| Income Tax Expense | 706.22K | 766.22K | 585.25K | 15.33M | 39.01M | -161.14K | 26.77M | 3.48M | -4.72M | 7.19M | 7.72M | 2.12M |

| Net Income | 36.96M | 14.26M | 52.81M | 15.33M | 39.01M | 9.59M | 43.58M | 27.24M | 17.28M | 32.76M | 32.18M | 37.70M |

| Net Income Ratio | 89.73% | 88.00% | 96.99% | 94.52% | 97.65% | 87.24% | 97.83% | 96.65% | 64.49% | 108.48% | 111.41% | 124.63% |

| EPS | 1.82 | 0.71 | 2.60 | 0.76 | 1.93 | 0.48 | 2.19 | 1.38 | 0.88 | 1.68 | 1.66 | 1.96 |

| EPS Diluted | 1.82 | 0.71 | 2.60 | 0.76 | 1.93 | 0.48 | 2.19 | 1.38 | 0.88 | 1.68 | 1.66 | 1.96 |

| Weighted Avg Shares Out | 20.26M | 20.09M | 20.26M | 20.18M | 20.21M | 19.97M | 19.90M | 19.79M | 19.66M | 19.53M | 19.39M | 19.24M |

| Weighted Avg Shares Out (Dil) | 20.26M | 20.09M | 20.31M | 20.18M | 20.21M | 19.97M | 19.90M | 19.79M | 19.66M | 19.53M | 19.39M | 19.24M |

5 Best CEFs To Buy This Month (April 2020)

Upbeat results from Nestlé help European stocks pare losses after EU summit disappoints

Straight From PIMCO: Dislocations In Corporate Credit Markets

2 Lessons From The 2008 And 2020 Stock Market Crashes

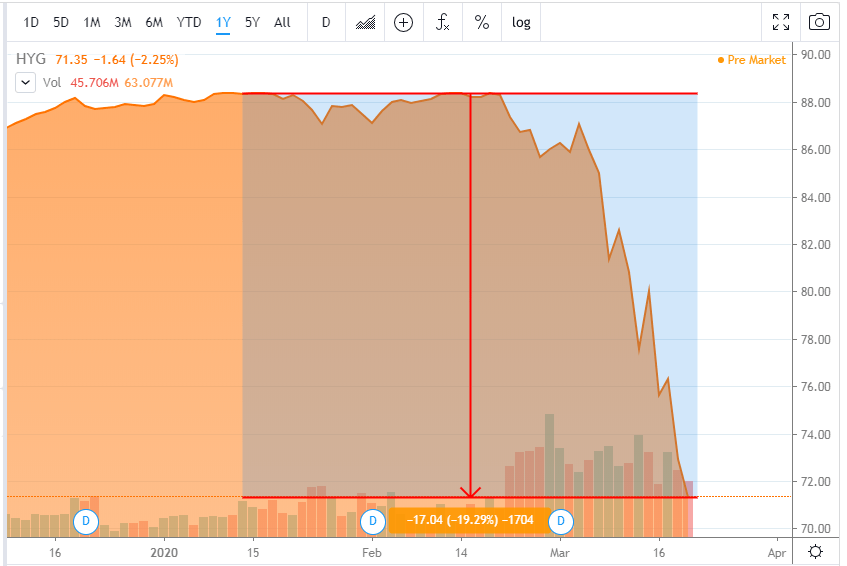

Keep An Eye On The Corporate Credit Market During The COVID-19 Crisis

The Barings collapse 25 years on: What the industry learned after one man broke a bank

ALEX BRUMMER: Foul play in the Sports Direct boardroom

Source: https://incomestatements.info

Category: Stock Reports