See more : Workforce Holdings Limited (WKF.JO) Income Statement Analysis – Financial Results

Complete financial analysis of Barings Corporate Investors (MCI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barings Corporate Investors, a leading company in the Asset Management industry within the Financial Services sector.

- Golden Independence Mining Corp. (GIDMF) Income Statement Analysis – Financial Results

- Real Brands, Inc. (RLBD) Income Statement Analysis – Financial Results

- Changzhou Xingyu Automotive Lighting Systems Co.,Ltd. (601799.SS) Income Statement Analysis – Financial Results

- Hongta Securities Co., Ltd. (601236.SS) Income Statement Analysis – Financial Results

- Masco Corporation (0JZ1.L) Income Statement Analysis – Financial Results

Barings Corporate Investors (MCI)

Industry: Asset Management

Sector: Financial Services

Website: https://www.babsoncapital.com/Strategies/Trusts/MCI/Default.aspx

About Barings Corporate Investors

Babson Capital Corporate Investors trust is a closed ended fixed income mutual fund launched and managed by Barings LLC. It invests in fixed income markets of the United States. The fund seeks to invest in securities of companies operating across diversified sectors. It primarily invests in a portfolio of privately placed, below-investment grade, long term corporate debt obligations. The fund also invests in marketable investment grade debt securities, other marketable debt securities, and marketable common stocks. It was formerly known as Babson Capital Corporate Investors. Babson Capital Corporate Investors trust was formed in 1971 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 41.19M | 16.21M | 54.45M | 16.22M | 39.95M | 10.99M | 44.54M | 28.18M | 26.80M | 30.20M | 28.88M | 30.25M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 41.19M | 16.21M | 54.45M | 16.22M | 39.95M | 10.99M | 44.54M | 28.18M | 26.80M | 30.20M | 28.88M | 30.25M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 4.43M | 4.79M | 4.63M | 4.43M | 4.16M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 4.43M | 4.79M | 4.63M | 4.43M | 4.16M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 1.34M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 641.25K | 7.93M | 4.14M | 4.88M | 11.15M |

| Cost & Expenses | 5.62M | 1.18M | 1.05M | 889.01K | 937.22K | 1.40M | 964.49K | 641.25K | 7.93M | 4.14M | 4.88M | 11.15M |

| Interest Income | 40.63M | 28.08M | 24.33M | 28.70M | 27.60M | 29.45M | 27.96M | 1.58M | 1.58M | 1.58M | 1.58M | 1.58M |

| Interest Expense | 2.08M | 1.71M | 1.07M | 1.06M | 1.06M | 1.06M | 1.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -46.47K | -23.32M | -20.54M | -25.45M | -23.64M | -25.27M | -26.77M | -23.76M | -22.01M | -25.57M | -24.45M | -26.09M |

| EBITDA | 0.00 | 0.00 | 67.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.73M |

| EBITDA Ratio | 0.00% | 103.28% | 98.07% | 94.52% | 97.65% | 96.88% | 101.24% | 12.36% | -17.63% | 23.80% | 26.74% | 45.38% |

| Operating Income | 35.57M | 16.74M | 53.39M | 15.33M | 39.01M | 10.65M | 45.10M | 23.76M | 22.01M | 25.57M | 24.45M | 26.09M |

| Operating Income Ratio | 86.36% | 103.28% | 98.07% | 94.52% | 97.65% | 96.88% | 101.24% | 84.29% | 82.13% | 84.68% | 84.68% | 86.25% |

| Total Other Income/Expenses | 2.09M | -7.91M | 406.60K | -10.11M | 15.37M | -15.68M | 16.81M | 3.48M | -4.72M | 7.19M | 7.72M | 13.73M |

| Income Before Tax | 37.67M | 15.03M | 53.39M | 15.33M | 39.01M | 9.59M | 43.58M | 27.24M | 17.28M | 32.76M | 32.18M | 39.82M |

| Income Before Tax Ratio | 91.45% | 92.72% | 98.07% | 94.52% | 97.65% | 87.24% | 97.83% | 96.65% | 64.49% | 108.48% | 111.41% | 131.63% |

| Income Tax Expense | 706.22K | 766.22K | 585.25K | 15.33M | 39.01M | -161.14K | 26.77M | 3.48M | -4.72M | 7.19M | 7.72M | 2.12M |

| Net Income | 36.96M | 14.26M | 52.81M | 15.33M | 39.01M | 9.59M | 43.58M | 27.24M | 17.28M | 32.76M | 32.18M | 37.70M |

| Net Income Ratio | 89.73% | 88.00% | 96.99% | 94.52% | 97.65% | 87.24% | 97.83% | 96.65% | 64.49% | 108.48% | 111.41% | 124.63% |

| EPS | 1.82 | 0.71 | 2.60 | 0.76 | 1.93 | 0.48 | 2.19 | 1.38 | 0.88 | 1.68 | 1.66 | 1.96 |

| EPS Diluted | 1.82 | 0.71 | 2.60 | 0.76 | 1.93 | 0.48 | 2.19 | 1.38 | 0.88 | 1.68 | 1.66 | 1.96 |

| Weighted Avg Shares Out | 20.26M | 20.09M | 20.26M | 20.18M | 20.21M | 19.97M | 19.90M | 19.79M | 19.66M | 19.53M | 19.39M | 19.24M |

| Weighted Avg Shares Out (Dil) | 20.26M | 20.09M | 20.31M | 20.18M | 20.21M | 19.97M | 19.90M | 19.79M | 19.66M | 19.53M | 19.39M | 19.24M |

Asia Real Estate People in the News 2020-06-22

Grantham: 'This Is The Real McCoy Of Bubbles... Crazy Stuff'

Weekly Commentary June 14, 2020: Buying (And Selling) Opportunities Emerge

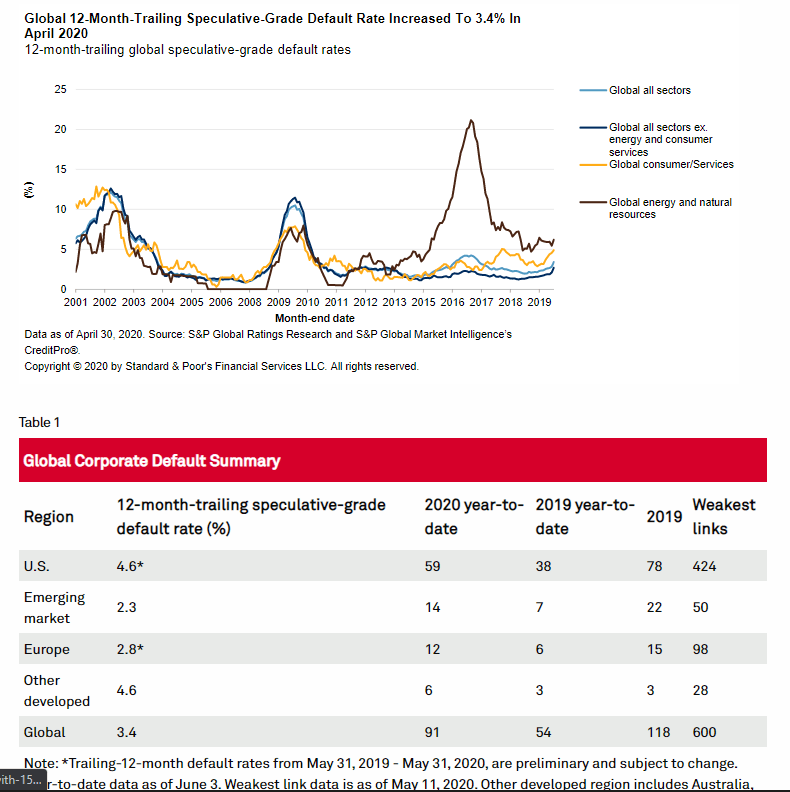

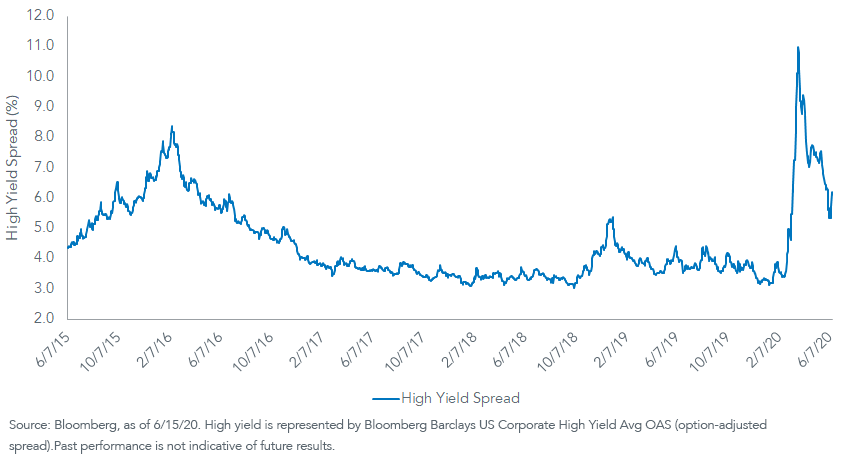

Corporate Credit Spreads Continue To Improve

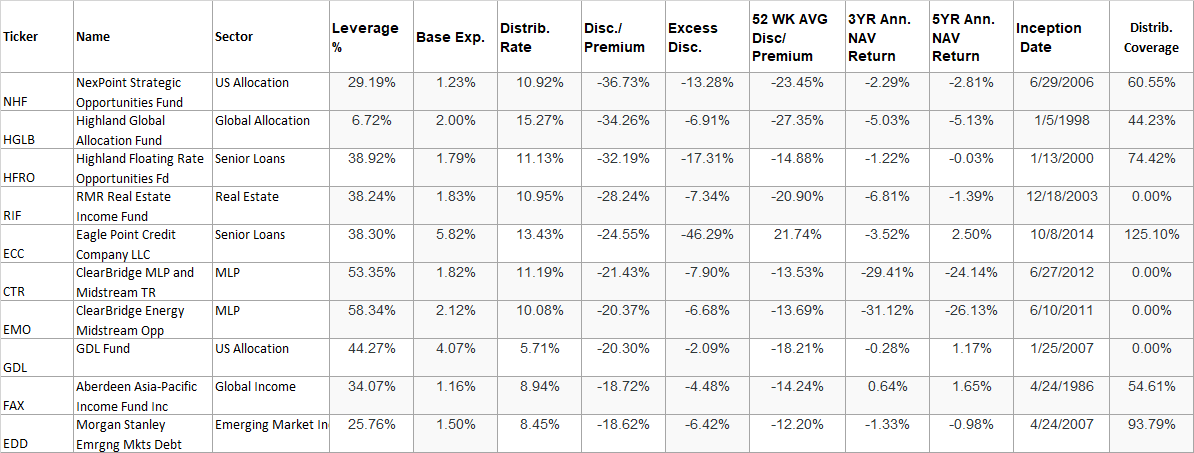

5 Best CEFs To Buy This Month (June 2020)

High Hopes

Virtual certainty? Bankers ask if success of remote roadshows will last

Chinese Bond Yields Climb

BlackRock TCP Capital (NASDAQ:TCPC) Upgraded at BidaskClub

Source: https://incomestatements.info

Category: Stock Reports