See more : Palm Jewels Limited (PALMJEWELS.BO) Income Statement Analysis – Financial Results

Complete financial analysis of MMA Capital Holdings, Inc. (MMAC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MMA Capital Holdings, Inc., a leading company in the Financial – Mortgages industry within the Financial Services sector.

- The Detroit Legal News Company (DTRL) Income Statement Analysis – Financial Results

- Squirrel Media, S.A. (SQRL.MC) Income Statement Analysis – Financial Results

- AnyMind Group Inc. (5027.T) Income Statement Analysis – Financial Results

- Hellenic Dynamics Plc (HELD.L) Income Statement Analysis – Financial Results

- Ilustrato Pictures International Inc. (ILUS) Income Statement Analysis – Financial Results

MMA Capital Holdings, Inc. (MMAC)

About MMA Capital Holdings, Inc.

MMA Capital Holdings, Inc. engages in investing in debt associated with renewable energy infrastructure and real estate. The company is headquartered in Baltimore, Maryland and currently employs 216 full-time employees. The firm operates through three segments: United States (U.S.) Operations, International Operations and Corporate Operations. The U.S. Operations segment consists of three business lines: Leveraged Bonds, Low-Income Housing Tax Credits (LIHTC) and Energy Capital and Other Investments. In Leveraged Bonds business line, it owns and manages bonds that finance housing and infrastructure in the United States. In LIHTC business line, it owns and manages limited partner and general partner investments in affordable housing communities in the United States. In Energy Capital and Other Investments business line, it provides project capital necessary to develop and build renewable energy systems. The company manages International Operations segment through a subsidiary, International Housing Solutions S.a r.l. (IHS).

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Other Expenses | -1.51M | 16.70M | 21.21M | 12.61M | 21.09M | 27.04M | 115.85M | 107.98M | 80.54M | 101.91M | 85.36M | -162.98M | 272.00M | 195.50M | 258.62M | 222.67M | -26.45M | -12.16M | -7.02M | -21.38M | 34.60M | 8.10M | 2.10M | -2.55M | 0.00 | 0.00 | 2.00M |

| Operating Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Cost & Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.34M | 6.42M | 7.09M | 6.73M | 6.60M | 9.63M | 16.90M | 39.24M | 45.22M | 57.02M | 66.57M | 79.57M | -91.10M | -34.40M | 161.88M | 100.53M | 87.20M | 49.70M | 36.60M | 30.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 166.00K | -2.46M | -891.00K | 2.65M | 1.49M | 2.54M | 8.16M | 18.34M | 9.78M | 18.03M | 71.19M | 8.85M | -199.60M | -22.40M | 24.56M | 24.30M | 20.82M | 10.83M | 1.86M | 2.88M | 2.10M | 400.00K | 0.00 | 58.00K | -5.43M | 0.00 | -11.90M |

| EBITDA | 9.50M | 44.45M | 67.23M | 28.17M | 51.12M | 30.28M | 42.48M | 187.83M | 67.66M | 112.89M | 37.09M | -63.67M | -464.90M | -129.60M | 236.77M | 214.58M | 137.80M | 132.88M | 68.89M | 60.84M | 35.70M | 32.60M | 27.40M | 18.86M | 10.87M | 13.20M | 1.30M |

| EBITDA Ratio | 435,626,200.00% | 196.37% | 241.33% | 692.89% | 125.96% | 64.02% | 93.71% | 179.54% | 144.57% | 262.28% | 90.24% | -115.33% | -252.53% | -50.19% | 86.34% | 148.72% | 190.17% | 209.53% | 237.56% | 310.27% | 35.42% | 60.82% | 77.40% | 88.33% | 66.68% | 74.58% | 7.39% |

| Operating Income | 8.37 | 46.91M | 68.12M | 25.52M | -38.54M | -48.03M | -87.58M | -49.06M | -17.70M | 94.86M | -34.10M | -72.52M | -265.30M | -107.20M | -303.45M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 42.10M | 35.60M | 27.40M | 18.80M | 16.30M | 13.20M | 13.20M |

| Operating Income Ratio | 383.95% | 207.22% | 244.53% | 627.70% | -94.96% | -101.55% | -193.22% | -46.89% | -37.83% | 220.39% | -82.96% | -131.36% | -144.11% | -41.52% | -110.66% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 41.77% | 66.42% | 77.40% | 88.06% | 100.00% | 74.58% | 75.00% |

| Total Other Income/Expenses | -1.23 | -6.41M | -42.44M | -52.50M | 33.43M | 10.83M | -13.26M | 120.87M | -23.24M | -118.45M | -35.07M | -72.54M | -107.60M | -31.20M | 0.00 | -75.26M | -63.16M | -9.59M | 13.41M | 30.71M | -8.50M | -3.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 7.15 | 40.50M | 25.68M | -26.98M | -5.11M | -37.20M | -100.85M | 71.82M | -40.94M | -23.59M | -69.17M | -145.05M | -372.90M | -138.40M | -303.45M | 69.02M | 9.30M | 53.83M | 42.41M | 50.32M | 33.60M | 32.20M | 27.40M | 0.00 | 0.00 | 13.20M | 13.20M |

| Income Before Tax Ratio | 327.60% | 178.92% | 92.18% | -663.81% | -12.60% | -78.66% | -222.47% | 68.65% | -87.48% | -54.80% | -168.28% | -262.75% | -202.55% | -53.60% | -110.66% | 47.84% | 12.83% | 84.87% | 146.26% | 256.61% | 33.33% | 60.07% | 77.40% | 0.00% | 0.00% | 74.58% | 75.00% |

| Income Tax Expense | 9.33M | -60.48M | 32.00K | -615.00K | 679.00K | 263.00K | -45.00K | -1.30M | 101.00K | 239.00K | -772.00K | 608.00K | 100.00K | 3.00M | -3.32M | 2.34M | 2.74M | -138.00K | 1.48M | 1.38M | 2.00M | 700.00K | 0.00 | 0.00 | 5.43M | 0.00 | 11.90M |

| Net Income | 8.37 | 100.98M | 61.00M | 19.40M | 42.35M | 17.84M | 17.47M | 131.55M | 12.56M | 37.60M | -28.71M | -143.84M | -373.90M | -98.20M | 53.65M | 87.40M | 27.04M | 72.50M | 28.95M | 25.88M | 31.60M | 31.50M | 27.40M | 18.80M | 10.87M | 13.20M | 1.30M |

| Net Income Ratio | 383.95% | 446.05% | 218.98% | 477.29% | 104.35% | 37.72% | 38.53% | 125.75% | 26.83% | 87.35% | -69.84% | -260.56% | -203.10% | -38.03% | 19.56% | 60.58% | 37.31% | 114.31% | 99.83% | 131.98% | 31.35% | 58.77% | 77.40% | 88.06% | 66.68% | 74.58% | 7.39% |

| EPS | 0.00 | 17.18 | 10.10 | 3.31 | 6.77 | 2.59 | 2.28 | 15.62 | 1.49 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.96 | 11.57 | 3.92 | 12.33 | 5.81 | 6.10 | 8.78 | 9.00 | 8.56 | 8.47 | 4.89 | 6.00 | 0.59 |

| EPS Diluted | 0.00 | 17.18 | 10.10 | 3.31 | 6.39 | 2.59 | 2.28 | 15.09 | 1.48 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.86 | 11.45 | 3.89 | 12.18 | 5.68 | 5.94 | 8.78 | 9.00 | 8.56 | 7.50 | 4.89 | 6.00 | 0.59 |

| Weighted Avg Shares Out | 5.82M | 5.88M | 6.04M | 5.86M | 6.25M | 6.88M | 7.65M | 8.42M | 8.45M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.71M | 7.55M | 6.90M | 5.88M | 4.98M | 4.24M | 3.60M | 3.50M | 3.20M | 2.22M | 2.22M | 2.20M | 2.20M |

| Weighted Avg Shares Out (Dil) | 5.82M | 5.88M | 6.04M | 5.86M | 6.63M | 6.88M | 7.65M | 8.72M | 8.49M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.82M | 7.64M | 6.96M | 5.95M | 5.09M | 4.36M | 3.60M | 3.50M | 3.20M | 2.51M | 2.22M | 2.20M | 2.20M |

Partnership Brings Autonomous Vessel Systems Program to Maine Maritime Academy

Sea Machines Partners with Maine Maritime Academy & MARAD to Include Intelligent Vessel Systems in Curriculum

UFC: Nurmagomedov agrees to return Oct. 24 against Gaethje

Arquitos Capital Management 2Q 2020 Investor Letter

Cyberattaque : remise en ordre de marche chez MMA

The top 10 public colleges that pay off the most in 2020

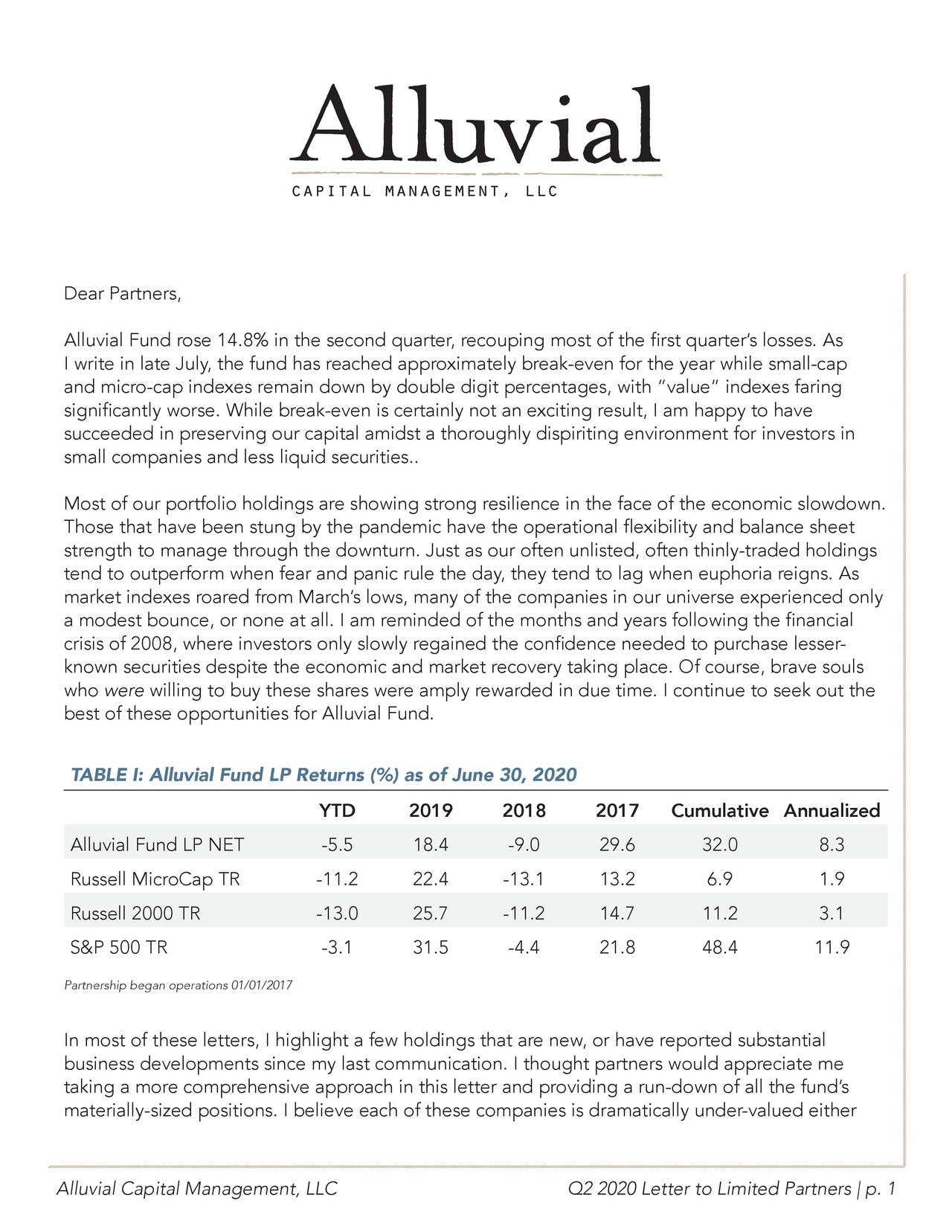

Alluvial Capital Management Q2 2020 Letter To Partners

Best Money Market Account Rates for July 2020

UFC stars turn nocturnal on Fight Island to beat jetlag and early morning bouts

Source: https://incomestatements.info

Category: Stock Reports