See more : MYR Group Inc. (MYRG) Income Statement Analysis – Financial Results

Complete financial analysis of MMA Capital Holdings, Inc. (MMAC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MMA Capital Holdings, Inc., a leading company in the Financial – Mortgages industry within the Financial Services sector.

- Andatee China Marine Fuel Services Corporation (AMCF) Income Statement Analysis – Financial Results

- GigInternational1, Inc. Warrant (GIWWW) Income Statement Analysis – Financial Results

- Anheuser-Busch InBev SA/NV (BUD) Income Statement Analysis – Financial Results

- Ecolutions GmbH&Co KGaA (MLECO.PA) Income Statement Analysis – Financial Results

- Fund.com Inc. (FNDM) Income Statement Analysis – Financial Results

MMA Capital Holdings, Inc. (MMAC)

About MMA Capital Holdings, Inc.

MMA Capital Holdings, Inc. engages in investing in debt associated with renewable energy infrastructure and real estate. The company is headquartered in Baltimore, Maryland and currently employs 216 full-time employees. The firm operates through three segments: United States (U.S.) Operations, International Operations and Corporate Operations. The U.S. Operations segment consists of three business lines: Leveraged Bonds, Low-Income Housing Tax Credits (LIHTC) and Energy Capital and Other Investments. In Leveraged Bonds business line, it owns and manages bonds that finance housing and infrastructure in the United States. In LIHTC business line, it owns and manages limited partner and general partner investments in affordable housing communities in the United States. In Energy Capital and Other Investments business line, it provides project capital necessary to develop and build renewable energy systems. The company manages International Operations segment through a subsidiary, International Housing Solutions S.a r.l. (IHS).

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Other Expenses | -1.51M | 16.70M | 21.21M | 12.61M | 21.09M | 27.04M | 115.85M | 107.98M | 80.54M | 101.91M | 85.36M | -162.98M | 272.00M | 195.50M | 258.62M | 222.67M | -26.45M | -12.16M | -7.02M | -21.38M | 34.60M | 8.10M | 2.10M | -2.55M | 0.00 | 0.00 | 2.00M |

| Operating Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Cost & Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.34M | 6.42M | 7.09M | 6.73M | 6.60M | 9.63M | 16.90M | 39.24M | 45.22M | 57.02M | 66.57M | 79.57M | -91.10M | -34.40M | 161.88M | 100.53M | 87.20M | 49.70M | 36.60M | 30.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 166.00K | -2.46M | -891.00K | 2.65M | 1.49M | 2.54M | 8.16M | 18.34M | 9.78M | 18.03M | 71.19M | 8.85M | -199.60M | -22.40M | 24.56M | 24.30M | 20.82M | 10.83M | 1.86M | 2.88M | 2.10M | 400.00K | 0.00 | 58.00K | -5.43M | 0.00 | -11.90M |

| EBITDA | 9.50M | 44.45M | 67.23M | 28.17M | 51.12M | 30.28M | 42.48M | 187.83M | 67.66M | 112.89M | 37.09M | -63.67M | -464.90M | -129.60M | 236.77M | 214.58M | 137.80M | 132.88M | 68.89M | 60.84M | 35.70M | 32.60M | 27.40M | 18.86M | 10.87M | 13.20M | 1.30M |

| EBITDA Ratio | 435,626,200.00% | 196.37% | 241.33% | 692.89% | 125.96% | 64.02% | 93.71% | 179.54% | 144.57% | 262.28% | 90.24% | -115.33% | -252.53% | -50.19% | 86.34% | 148.72% | 190.17% | 209.53% | 237.56% | 310.27% | 35.42% | 60.82% | 77.40% | 88.33% | 66.68% | 74.58% | 7.39% |

| Operating Income | 8.37 | 46.91M | 68.12M | 25.52M | -38.54M | -48.03M | -87.58M | -49.06M | -17.70M | 94.86M | -34.10M | -72.52M | -265.30M | -107.20M | -303.45M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 42.10M | 35.60M | 27.40M | 18.80M | 16.30M | 13.20M | 13.20M |

| Operating Income Ratio | 383.95% | 207.22% | 244.53% | 627.70% | -94.96% | -101.55% | -193.22% | -46.89% | -37.83% | 220.39% | -82.96% | -131.36% | -144.11% | -41.52% | -110.66% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 41.77% | 66.42% | 77.40% | 88.06% | 100.00% | 74.58% | 75.00% |

| Total Other Income/Expenses | -1.23 | -6.41M | -42.44M | -52.50M | 33.43M | 10.83M | -13.26M | 120.87M | -23.24M | -118.45M | -35.07M | -72.54M | -107.60M | -31.20M | 0.00 | -75.26M | -63.16M | -9.59M | 13.41M | 30.71M | -8.50M | -3.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 7.15 | 40.50M | 25.68M | -26.98M | -5.11M | -37.20M | -100.85M | 71.82M | -40.94M | -23.59M | -69.17M | -145.05M | -372.90M | -138.40M | -303.45M | 69.02M | 9.30M | 53.83M | 42.41M | 50.32M | 33.60M | 32.20M | 27.40M | 0.00 | 0.00 | 13.20M | 13.20M |

| Income Before Tax Ratio | 327.60% | 178.92% | 92.18% | -663.81% | -12.60% | -78.66% | -222.47% | 68.65% | -87.48% | -54.80% | -168.28% | -262.75% | -202.55% | -53.60% | -110.66% | 47.84% | 12.83% | 84.87% | 146.26% | 256.61% | 33.33% | 60.07% | 77.40% | 0.00% | 0.00% | 74.58% | 75.00% |

| Income Tax Expense | 9.33M | -60.48M | 32.00K | -615.00K | 679.00K | 263.00K | -45.00K | -1.30M | 101.00K | 239.00K | -772.00K | 608.00K | 100.00K | 3.00M | -3.32M | 2.34M | 2.74M | -138.00K | 1.48M | 1.38M | 2.00M | 700.00K | 0.00 | 0.00 | 5.43M | 0.00 | 11.90M |

| Net Income | 8.37 | 100.98M | 61.00M | 19.40M | 42.35M | 17.84M | 17.47M | 131.55M | 12.56M | 37.60M | -28.71M | -143.84M | -373.90M | -98.20M | 53.65M | 87.40M | 27.04M | 72.50M | 28.95M | 25.88M | 31.60M | 31.50M | 27.40M | 18.80M | 10.87M | 13.20M | 1.30M |

| Net Income Ratio | 383.95% | 446.05% | 218.98% | 477.29% | 104.35% | 37.72% | 38.53% | 125.75% | 26.83% | 87.35% | -69.84% | -260.56% | -203.10% | -38.03% | 19.56% | 60.58% | 37.31% | 114.31% | 99.83% | 131.98% | 31.35% | 58.77% | 77.40% | 88.06% | 66.68% | 74.58% | 7.39% |

| EPS | 0.00 | 17.18 | 10.10 | 3.31 | 6.77 | 2.59 | 2.28 | 15.62 | 1.49 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.96 | 11.57 | 3.92 | 12.33 | 5.81 | 6.10 | 8.78 | 9.00 | 8.56 | 8.47 | 4.89 | 6.00 | 0.59 |

| EPS Diluted | 0.00 | 17.18 | 10.10 | 3.31 | 6.39 | 2.59 | 2.28 | 15.09 | 1.48 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.86 | 11.45 | 3.89 | 12.18 | 5.68 | 5.94 | 8.78 | 9.00 | 8.56 | 7.50 | 4.89 | 6.00 | 0.59 |

| Weighted Avg Shares Out | 5.82M | 5.88M | 6.04M | 5.86M | 6.25M | 6.88M | 7.65M | 8.42M | 8.45M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.71M | 7.55M | 6.90M | 5.88M | 4.98M | 4.24M | 3.60M | 3.50M | 3.20M | 2.22M | 2.22M | 2.20M | 2.20M |

| Weighted Avg Shares Out (Dil) | 5.82M | 5.88M | 6.04M | 5.86M | 6.63M | 6.88M | 7.65M | 8.72M | 8.49M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.82M | 7.64M | 6.96M | 5.95M | 5.09M | 4.36M | 3.60M | 3.50M | 3.20M | 2.51M | 2.22M | 2.20M | 2.20M |

Usman retains title over Masvidal as UFC rises before dawn on 'Fight Island'

UFC Fight Island delivers goods as Kamaru Usman reigns supreme in Abu Dhabi

UFC 251 LIVE: Masvidal vs Usman results, live stream, reaction, and more from Fight Island

How to watch UFC 251: live stream Usman vs Masvidal in the US with ESPN+ right now

Who is Paige VanZant? Fighter takes on Amanda Ribas at UFC 251

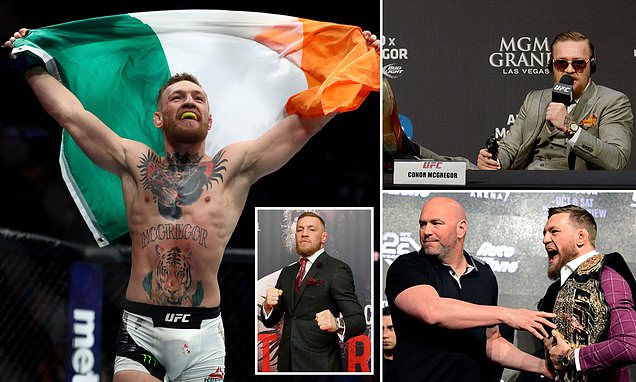

How Conor McGregor took the UFC mainstream and changed MMA forever

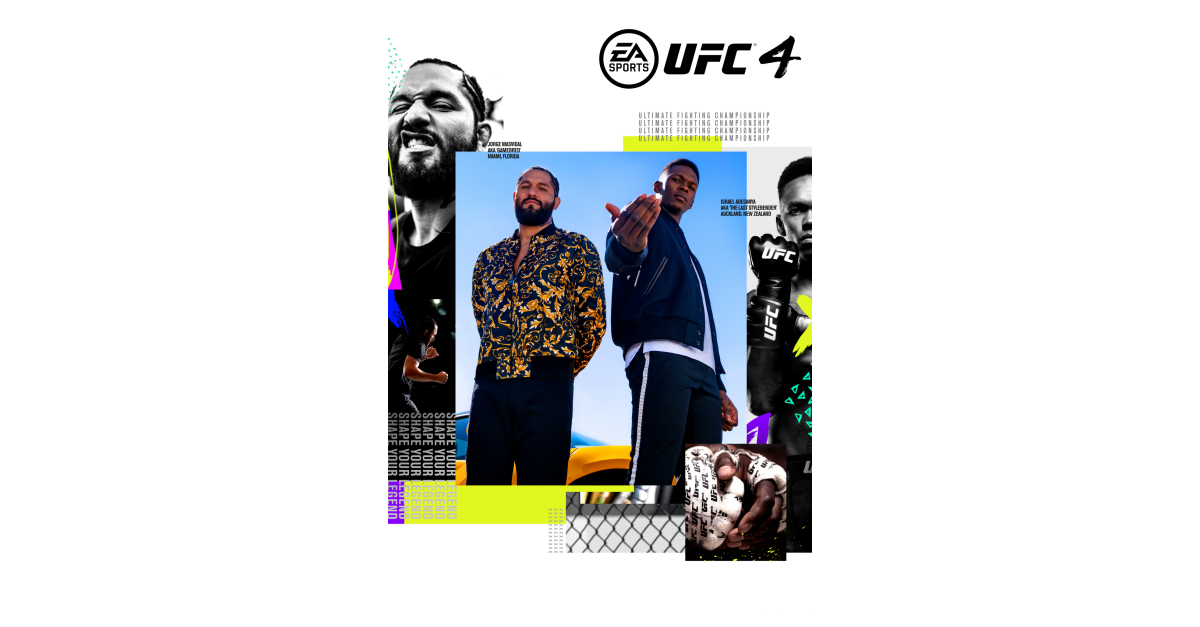

EA SPORTS UFC 4 Officially Revealed With UFC Middleweight Champion Israel Adesanya and UFC Welterweight Jorge Masvidal as Cover Athletes

Source: https://incomestatements.info

Category: Stock Reports