See more : Chengbang Eco-Environment Co.,Ltd. (603316.SS) Income Statement Analysis – Financial Results

Complete financial analysis of MMA Capital Holdings, Inc. (MMAC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of MMA Capital Holdings, Inc., a leading company in the Financial – Mortgages industry within the Financial Services sector.

- ENAV S.p.A. (ENAV.MI) Income Statement Analysis – Financial Results

- Chambal Fertilisers and Chemicals Limited (CHAMBLFERT.BO) Income Statement Analysis – Financial Results

- Times Guaranty Limited (TIMESGTY.NS) Income Statement Analysis – Financial Results

- WarpSpeed Taxi Inc. (WRPT) Income Statement Analysis – Financial Results

- Natural Food International Holding Limited (1837.HK) Income Statement Analysis – Financial Results

MMA Capital Holdings, Inc. (MMAC)

About MMA Capital Holdings, Inc.

MMA Capital Holdings, Inc. engages in investing in debt associated with renewable energy infrastructure and real estate. The company is headquartered in Baltimore, Maryland and currently employs 216 full-time employees. The firm operates through three segments: United States (U.S.) Operations, International Operations and Corporate Operations. The U.S. Operations segment consists of three business lines: Leveraged Bonds, Low-Income Housing Tax Credits (LIHTC) and Energy Capital and Other Investments. In Leveraged Bonds business line, it owns and manages bonds that finance housing and infrastructure in the United States. In LIHTC business line, it owns and manages limited partner and general partner investments in affordable housing communities in the United States. In Energy Capital and Other Investments business line, it provides project capital necessary to develop and build renewable energy systems. The company manages International Operations segment through a subsidiary, International Housing Solutions S.a r.l. (IHS).

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.18 | 22.64M | 27.86M | 4.07M | 40.59M | 47.30M | 45.33M | 104.62M | 46.80M | 43.04M | 41.10M | 55.21M | 184.10M | 258.20M | 274.21M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 100.80M | 53.60M | 35.40M | 21.35M | 16.30M | 17.70M | 17.60M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.51M | 1.30M | 2.80M | 22.39M | 19.91M | 18.96M | 16.16M | 17.02M | 15.46M | 16.10M | 19.65M | 35.26M | 177.40M | 169.80M | 110.38M | 32.33M | 26.45M | 12.16M | 7.02M | 21.38M | 24.20M | 9.80M | 6.00M | 0.00 | 0.00 | 4.50M | 2.40M |

| Other Expenses | -1.51M | 16.70M | 21.21M | 12.61M | 21.09M | 27.04M | 115.85M | 107.98M | 80.54M | 101.91M | 85.36M | -162.98M | 272.00M | 195.50M | 258.62M | 222.67M | -26.45M | -12.16M | -7.02M | -21.38M | 34.60M | 8.10M | 2.10M | -2.55M | 0.00 | 0.00 | 2.00M |

| Operating Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Cost & Expenses | 1.51 | 18.00M | 24.00M | 35.00M | 41.00M | 46.00M | 132.00M | 125.00M | 96.00M | 118.00M | 105.00M | -127.72M | 449.40M | 365.30M | 369.00M | 255.00M | 0.00 | 0.00 | 0.00 | 0.00 | 58.80M | 17.90M | 8.10M | -2.55M | 0.00 | 4.50M | 4.40M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.34M | 6.42M | 7.09M | 6.73M | 6.60M | 9.63M | 16.90M | 39.24M | 45.22M | 57.02M | 66.57M | 79.57M | -91.10M | -34.40M | 161.88M | 100.53M | 87.20M | 49.70M | 36.60M | 30.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 166.00K | -2.46M | -891.00K | 2.65M | 1.49M | 2.54M | 8.16M | 18.34M | 9.78M | 18.03M | 71.19M | 8.85M | -199.60M | -22.40M | 24.56M | 24.30M | 20.82M | 10.83M | 1.86M | 2.88M | 2.10M | 400.00K | 0.00 | 58.00K | -5.43M | 0.00 | -11.90M |

| EBITDA | 9.50M | 44.45M | 67.23M | 28.17M | 51.12M | 30.28M | 42.48M | 187.83M | 67.66M | 112.89M | 37.09M | -63.67M | -464.90M | -129.60M | 236.77M | 214.58M | 137.80M | 132.88M | 68.89M | 60.84M | 35.70M | 32.60M | 27.40M | 18.86M | 10.87M | 13.20M | 1.30M |

| EBITDA Ratio | 435,626,200.00% | 196.37% | 241.33% | 692.89% | 125.96% | 64.02% | 93.71% | 179.54% | 144.57% | 262.28% | 90.24% | -115.33% | -252.53% | -50.19% | 86.34% | 148.72% | 190.17% | 209.53% | 237.56% | 310.27% | 35.42% | 60.82% | 77.40% | 88.33% | 66.68% | 74.58% | 7.39% |

| Operating Income | 8.37 | 46.91M | 68.12M | 25.52M | -38.54M | -48.03M | -87.58M | -49.06M | -17.70M | 94.86M | -34.10M | -72.52M | -265.30M | -107.20M | -303.45M | 144.28M | 72.46M | 63.42M | 29.00M | 19.61M | 42.10M | 35.60M | 27.40M | 18.80M | 16.30M | 13.20M | 13.20M |

| Operating Income Ratio | 383.95% | 207.22% | 244.53% | 627.70% | -94.96% | -101.55% | -193.22% | -46.89% | -37.83% | 220.39% | -82.96% | -131.36% | -144.11% | -41.52% | -110.66% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 41.77% | 66.42% | 77.40% | 88.06% | 100.00% | 74.58% | 75.00% |

| Total Other Income/Expenses | -1.23 | -6.41M | -42.44M | -52.50M | 33.43M | 10.83M | -13.26M | 120.87M | -23.24M | -118.45M | -35.07M | -72.54M | -107.60M | -31.20M | 0.00 | -75.26M | -63.16M | -9.59M | 13.41M | 30.71M | -8.50M | -3.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax | 7.15 | 40.50M | 25.68M | -26.98M | -5.11M | -37.20M | -100.85M | 71.82M | -40.94M | -23.59M | -69.17M | -145.05M | -372.90M | -138.40M | -303.45M | 69.02M | 9.30M | 53.83M | 42.41M | 50.32M | 33.60M | 32.20M | 27.40M | 0.00 | 0.00 | 13.20M | 13.20M |

| Income Before Tax Ratio | 327.60% | 178.92% | 92.18% | -663.81% | -12.60% | -78.66% | -222.47% | 68.65% | -87.48% | -54.80% | -168.28% | -262.75% | -202.55% | -53.60% | -110.66% | 47.84% | 12.83% | 84.87% | 146.26% | 256.61% | 33.33% | 60.07% | 77.40% | 0.00% | 0.00% | 74.58% | 75.00% |

| Income Tax Expense | 9.33M | -60.48M | 32.00K | -615.00K | 679.00K | 263.00K | -45.00K | -1.30M | 101.00K | 239.00K | -772.00K | 608.00K | 100.00K | 3.00M | -3.32M | 2.34M | 2.74M | -138.00K | 1.48M | 1.38M | 2.00M | 700.00K | 0.00 | 0.00 | 5.43M | 0.00 | 11.90M |

| Net Income | 8.37 | 100.98M | 61.00M | 19.40M | 42.35M | 17.84M | 17.47M | 131.55M | 12.56M | 37.60M | -28.71M | -143.84M | -373.90M | -98.20M | 53.65M | 87.40M | 27.04M | 72.50M | 28.95M | 25.88M | 31.60M | 31.50M | 27.40M | 18.80M | 10.87M | 13.20M | 1.30M |

| Net Income Ratio | 383.95% | 446.05% | 218.98% | 477.29% | 104.35% | 37.72% | 38.53% | 125.75% | 26.83% | 87.35% | -69.84% | -260.56% | -203.10% | -38.03% | 19.56% | 60.58% | 37.31% | 114.31% | 99.83% | 131.98% | 31.35% | 58.77% | 77.40% | 88.06% | 66.68% | 74.58% | 7.39% |

| EPS | 0.00 | 17.18 | 10.10 | 3.31 | 6.77 | 2.59 | 2.28 | 15.62 | 1.49 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.96 | 11.57 | 3.92 | 12.33 | 5.81 | 6.10 | 8.78 | 9.00 | 8.56 | 8.47 | 4.89 | 6.00 | 0.59 |

| EPS Diluted | 0.00 | 17.18 | 10.10 | 3.31 | 6.39 | 2.59 | 2.28 | 15.09 | 1.48 | 4.57 | -3.54 | -17.96 | -47.33 | -12.43 | 6.86 | 11.45 | 3.89 | 12.18 | 5.68 | 5.94 | 8.78 | 9.00 | 8.56 | 7.50 | 4.89 | 6.00 | 0.59 |

| Weighted Avg Shares Out | 5.82M | 5.88M | 6.04M | 5.86M | 6.25M | 6.88M | 7.65M | 8.42M | 8.45M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.71M | 7.55M | 6.90M | 5.88M | 4.98M | 4.24M | 3.60M | 3.50M | 3.20M | 2.22M | 2.22M | 2.20M | 2.20M |

| Weighted Avg Shares Out (Dil) | 5.82M | 5.88M | 6.04M | 5.86M | 6.63M | 6.88M | 7.65M | 8.72M | 8.49M | 8.23M | 8.11M | 8.01M | 7.90M | 7.90M | 7.82M | 7.64M | 6.96M | 5.95M | 5.09M | 4.36M | 3.60M | 3.50M | 3.20M | 2.51M | 2.22M | 2.20M | 2.20M |

UFC 251: all you need to know about Usman vs Masvidal and the rest of Saturday's card

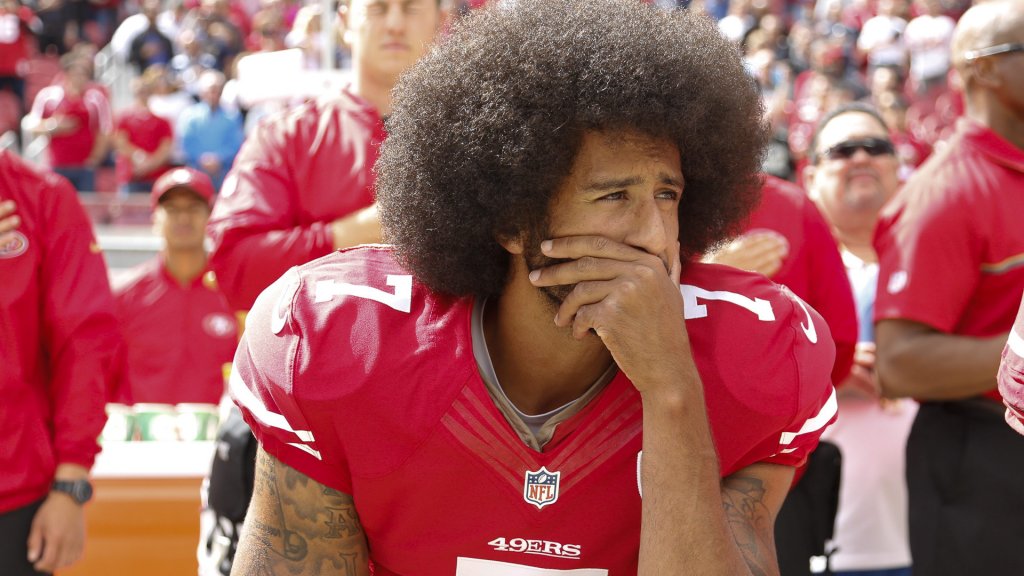

25 Athletes Who Have a Made a Social Impact in the World

Advancing Your Business Career From Anywhere, Anytime

Welsh fighters heading to UFC's 'fight island' in Abu Dhabi

Nick Nolte's 10 Best Movies, According To Rotten Tomatoes

Meet Leah McCourt, the MMA star who is destined for the top

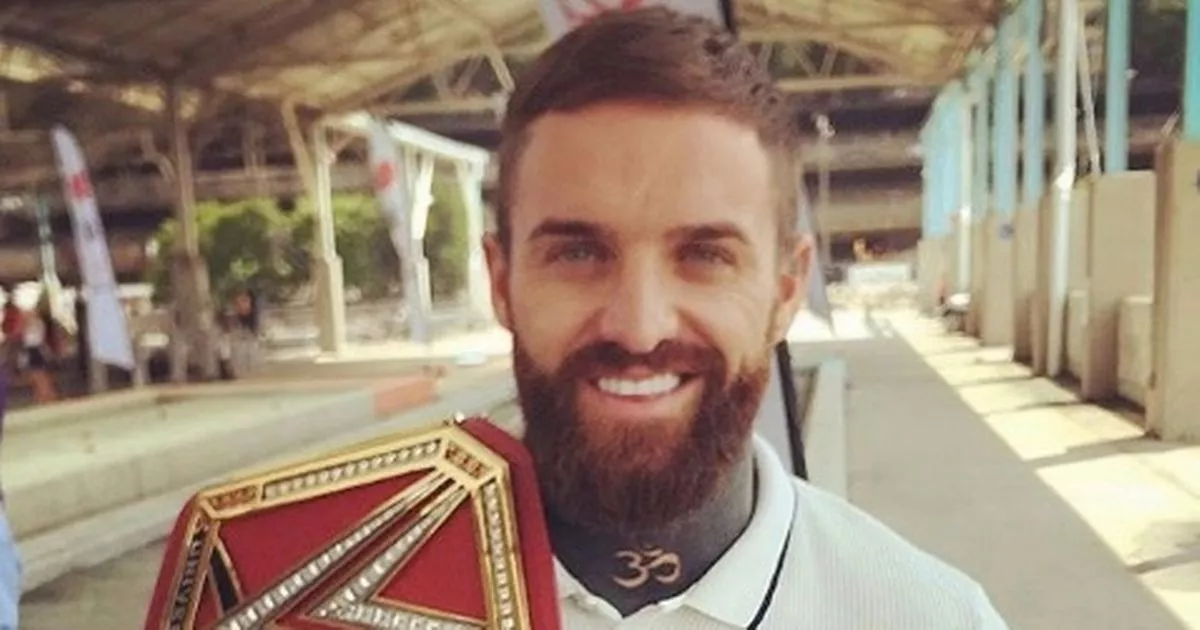

Ex-Geordie Shore star Aaron Chalmers in talks to launch WWE career

Ex-Geordie Shore star Aaron Chalmers holds talks with WWE over wrestling switch

MMA and QAnon: How fake news and conspiracies permeated the octagon

Source: https://incomestatements.info

Category: Stock Reports