See more : Entera Bio Ltd. WT EXP 062723 (ENTXW) Income Statement Analysis – Financial Results

Complete financial analysis of Barings Participation Investors (MPV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barings Participation Investors, a leading company in the Asset Management industry within the Financial Services sector.

- Apollo Micro Systems Limited (APOLLO.BO) Income Statement Analysis – Financial Results

- Feedone Co., Ltd. (2060.T) Income Statement Analysis – Financial Results

- Adcore Inc. (ADCO.TO) Income Statement Analysis – Financial Results

- Enapter AG (H2O.F) Income Statement Analysis – Financial Results

- Kusuri No Aoki Holdings Co., Ltd. (3549.T) Income Statement Analysis – Financial Results

Barings Participation Investors (MPV)

About Barings Participation Investors

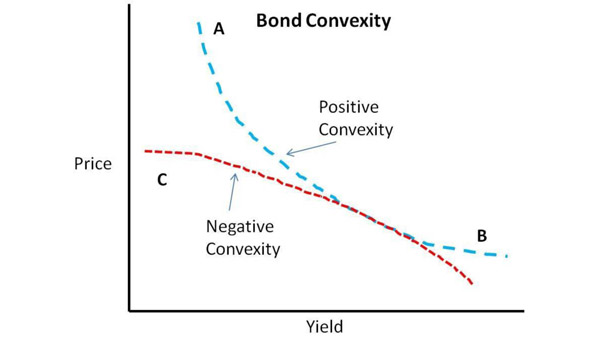

Barings Participation Investors is a closed ended fixed income mutual fund launched and managed by Barings LLC. The fund invests in the fixed income markets of the United States. It primarily invests in below-investment grade, long-term corporate debt obligations which are directly purchased from its issuers. The fund also seeks to invest in warrants, conversion rights, or other equity related instruments. It benchmarks the performance of its portfolio against Standard and Poor's Industrials Composite, Russell 2000 Index, Lehman Brothers U.S. High Yield Index, and Lehman Brothers Intermediate U.S. Credit Index. The fund was formerly known as Babson Capital Participation Investors. Barings Participation Investors was formed on April 7, 1988 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 20.12M | 8.26M | 26.45M | 7.04M | 18.59M | 4.61M | 19.96M | 12.81M | 12.47M | 13.32M | 12.83M | 13.45M | 0.00 |

| Cost of Revenue | 2.17M | 1.87M | 1.84M | 1.64M | 1.69M | 1.68M | 1.66M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 17.95M | 6.39M | 24.60M | 5.40M | 16.90M | 2.93M | 18.30M | 12.81M | 12.47M | 13.32M | 12.83M | 13.45M | 0.00 |

| Gross Profit Ratio | 89.22% | 77.31% | 93.03% | 76.71% | 90.90% | 63.61% | 91.70% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.55 | 1.48 | 0.45 | 1.26 | 0.23 | 1.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 1.88M | 2.09M | 2.04M | 1.99M | 1.87M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 1.88M | 2.09M | 2.04M | 1.99M | 1.87M | 0.00 |

| Other Expenses | 0.00 | -3.23M | 11.16M | -4.84M | 6.06M | -613.49K | -613.50K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 557.63K | 3.30M | 3.79M | 1.55M | 4.67M | 0.00 |

| Cost & Expenses | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 557.63K | 3.30M | 3.79M | 1.55M | 4.67M | 0.00 |

| Interest Income | 19.84M | 13.78M | 11.62M | 12.79M | 12.93M | 13.20M | 12.46M | 613.50K | 613.50K | 613.50K | 613.50K | 613.50K | 0.00 |

| Interest Expense | 1.25M | 1.01M | 622.86K | 613.50K | 613.50K | 613.50K | 613.50K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -25.77K | 5.11M | -9.31M | 6.48M | -3.76M | 13.47M | -3.13M | -10.94M | -10.38M | -11.28M | -10.84M | -11.58M | 0.00 |

| EBITDA | 19.82M | 8.55M | 0.00 | 6.35M | 0.00 | 4.25M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.93M | 0.00 |

| EBITDA Ratio | 98.53% | 101.07% | 96.91% | 90.17% | 95.80% | 92.35% | 98.95% | 5.50% | -14.60% | 39.17% | 22.77% | 44.11% | 0.00% |

| Operating Income | 17.56M | 8.35M | 25.63M | 6.35M | 17.81M | 4.25M | 19.75M | 10.94M | 10.38M | 11.28M | 10.84M | 11.58M | 0.00 |

| Operating Income Ratio | 87.32% | 101.07% | 96.91% | 90.17% | 95.80% | 92.35% | 98.95% | 85.36% | 83.21% | 84.69% | 84.50% | 86.07% | 0.00% |

| Total Other Income/Expenses | 996.70K | 1.87M | 0.00 | 1.64M | 0.00 | -613.50K | 7.18M | 704.89K | -1.82M | 5.22M | 2.92M | 5.93M | 0.00 |

| Income Before Tax | 18.56M | 7.34M | 25.63M | 6.35M | 17.81M | 3.64M | 19.14M | 11.64M | 8.56M | 16.50M | 13.76M | 17.51M | 0.00 |

| Income Before Tax Ratio | 92.27% | 88.82% | 96.91% | 90.17% | 95.80% | 79.03% | 95.87% | 90.86% | 68.61% | 123.87% | 107.27% | 130.18% | 0.00% |

| Income Tax Expense | 441.37K | 377.85K | 247.15K | -474.93K | 566.90K | -161.14K | 21.99M | 704.89K | -1.82M | 5.22M | 2.92M | 5.93M | 0.00 |

| Net Income | 18.12M | 6.96M | 25.38M | 6.35M | 17.81M | 3.64M | 19.14M | 11.64M | 8.56M | 16.50M | 13.76M | 17.51M | 0.00 |

| Net Income Ratio | 90.08% | 84.24% | 95.98% | 90.17% | 95.80% | 79.03% | 95.87% | 90.86% | 68.61% | 123.87% | 107.27% | 130.18% | 0.00% |

| EPS | 1.71 | 0.66 | 2.39 | 0.60 | 1.69 | 0.35 | 1.84 | 1.12 | 0.83 | 1.60 | 1.34 | 1.72 | 0.00 |

| EPS Diluted | 1.71 | 0.66 | 2.39 | 0.60 | 1.69 | 0.35 | 1.84 | 1.12 | 0.83 | 1.60 | 1.34 | 1.72 | 0.00 |

| Weighted Avg Shares Out | 10.60M | 10.60M | 10.60M | 10.60M | 10.54M | 10.40M | 10.40M | 10.39M | 10.33M | 10.30M | 10.24M | 10.18M | 10.05M |

| Weighted Avg Shares Out (Dil) | 10.60M | 10.60M | 10.60M | 10.60M | 10.54M | 10.40M | 10.40M | 10.39M | 10.33M | 10.30M | 10.24M | 10.18M | 10.05M |

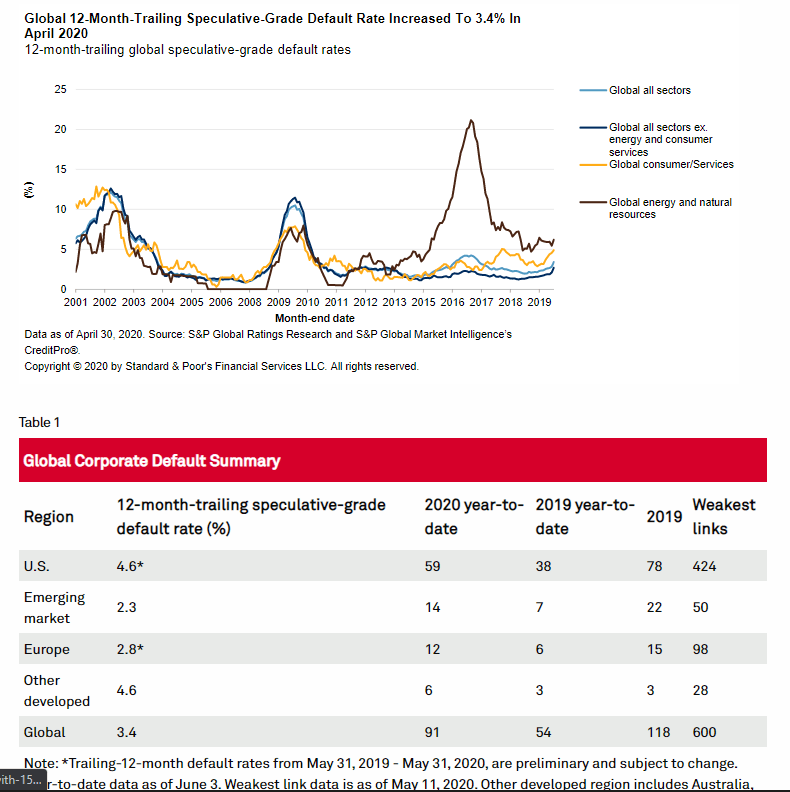

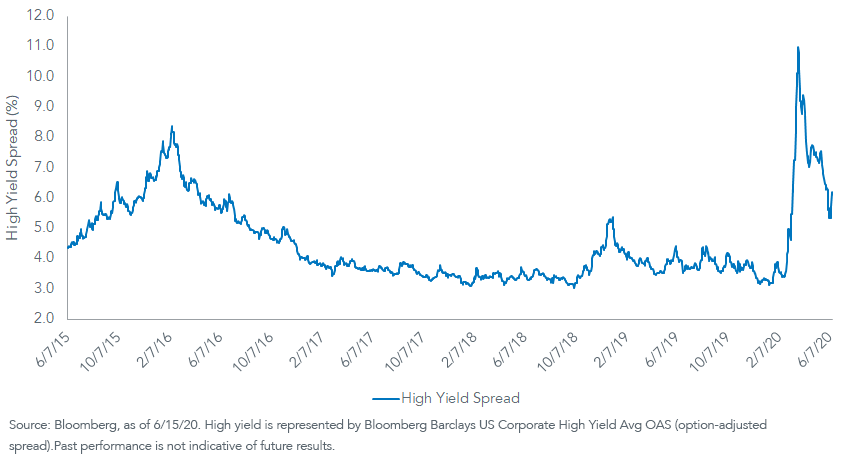

Corporate Credit Spreads Continue To Improve

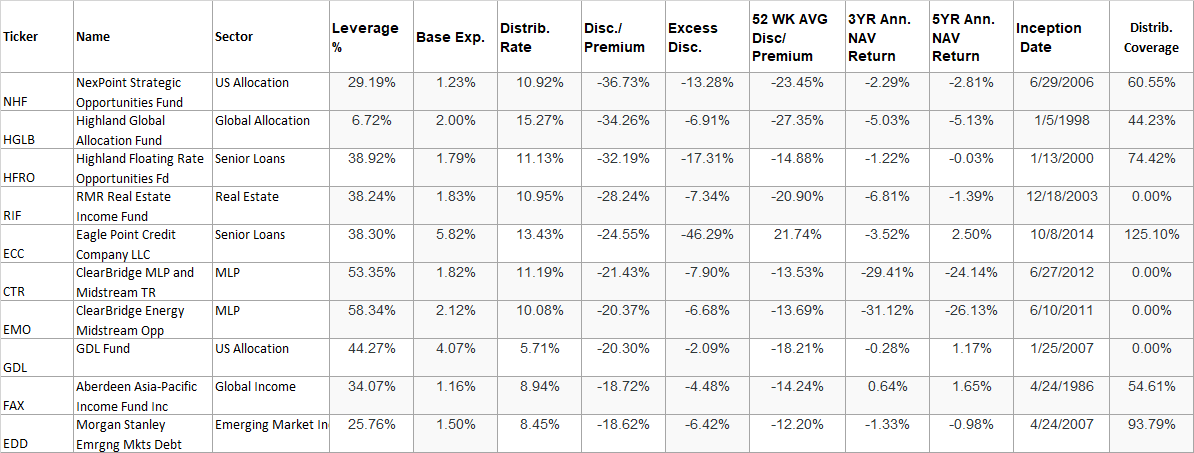

5 Best CEFs To Buy This Month (June 2020)

High Hopes

Virtual certainty? Bankers ask if success of remote roadshows will last

Chinese Bond Yields Climb

BlackRock TCP Capital (NASDAQ:TCPC) Upgraded at BidaskClub

Upbeat results from Nestlé help European stocks pare losses after EU summit disappoints

Straight From PIMCO: Dislocations In Corporate Credit Markets

2 Lessons From The 2008 And 2020 Stock Market Crashes

Source: https://incomestatements.info

Category: Stock Reports