See more : Jiangxi Tianli Technology, INC. (300399.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Barings Participation Investors (MPV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barings Participation Investors, a leading company in the Asset Management industry within the Financial Services sector.

- WISeKey International Holding AG (0RF1.L) Income Statement Analysis – Financial Results

- Lotus Health Group Company (600186.SS) Income Statement Analysis – Financial Results

- Southern ITS International, Inc. (SITS) Income Statement Analysis – Financial Results

- Redbubble Limited (RDBBF) Income Statement Analysis – Financial Results

- Roots Sustainable Agricultural Technologies Ltd (ROO.AX) Income Statement Analysis – Financial Results

Barings Participation Investors (MPV)

About Barings Participation Investors

Barings Participation Investors is a closed ended fixed income mutual fund launched and managed by Barings LLC. The fund invests in the fixed income markets of the United States. It primarily invests in below-investment grade, long-term corporate debt obligations which are directly purchased from its issuers. The fund also seeks to invest in warrants, conversion rights, or other equity related instruments. It benchmarks the performance of its portfolio against Standard and Poor's Industrials Composite, Russell 2000 Index, Lehman Brothers U.S. High Yield Index, and Lehman Brothers Intermediate U.S. Credit Index. The fund was formerly known as Babson Capital Participation Investors. Barings Participation Investors was formed on April 7, 1988 and is domiciled in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 20.12M | 8.26M | 26.45M | 7.04M | 18.59M | 4.61M | 19.96M | 12.81M | 12.47M | 13.32M | 12.83M | 13.45M | 0.00 |

| Cost of Revenue | 2.17M | 1.87M | 1.84M | 1.64M | 1.69M | 1.68M | 1.66M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 17.95M | 6.39M | 24.60M | 5.40M | 16.90M | 2.93M | 18.30M | 12.81M | 12.47M | 13.32M | 12.83M | 13.45M | 0.00 |

| Gross Profit Ratio | 89.22% | 77.31% | 93.03% | 76.71% | 90.90% | 63.61% | 91.70% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.55 | 1.48 | 0.45 | 1.26 | 0.23 | 1.17 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 1.88M | 2.09M | 2.04M | 1.99M | 1.87M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 1.88M | 2.09M | 2.04M | 1.99M | 1.87M | 0.00 |

| Other Expenses | 0.00 | -3.23M | 11.16M | -4.84M | 6.06M | -613.49K | -613.50K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 557.63K | 3.30M | 3.79M | 1.55M | 4.67M | 0.00 |

| Cost & Expenses | 2.55M | 924.15K | 816.76K | 692.25K | 780.77K | 965.61K | 823.76K | 557.63K | 3.30M | 3.79M | 1.55M | 4.67M | 0.00 |

| Interest Income | 19.84M | 13.78M | 11.62M | 12.79M | 12.93M | 13.20M | 12.46M | 613.50K | 613.50K | 613.50K | 613.50K | 613.50K | 0.00 |

| Interest Expense | 1.25M | 1.01M | 622.86K | 613.50K | 613.50K | 613.50K | 613.50K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -25.77K | 5.11M | -9.31M | 6.48M | -3.76M | 13.47M | -3.13M | -10.94M | -10.38M | -11.28M | -10.84M | -11.58M | 0.00 |

| EBITDA | 19.82M | 8.55M | 0.00 | 6.35M | 0.00 | 4.25M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.93M | 0.00 |

| EBITDA Ratio | 98.53% | 101.07% | 96.91% | 90.17% | 95.80% | 92.35% | 98.95% | 5.50% | -14.60% | 39.17% | 22.77% | 44.11% | 0.00% |

| Operating Income | 17.56M | 8.35M | 25.63M | 6.35M | 17.81M | 4.25M | 19.75M | 10.94M | 10.38M | 11.28M | 10.84M | 11.58M | 0.00 |

| Operating Income Ratio | 87.32% | 101.07% | 96.91% | 90.17% | 95.80% | 92.35% | 98.95% | 85.36% | 83.21% | 84.69% | 84.50% | 86.07% | 0.00% |

| Total Other Income/Expenses | 996.70K | 1.87M | 0.00 | 1.64M | 0.00 | -613.50K | 7.18M | 704.89K | -1.82M | 5.22M | 2.92M | 5.93M | 0.00 |

| Income Before Tax | 18.56M | 7.34M | 25.63M | 6.35M | 17.81M | 3.64M | 19.14M | 11.64M | 8.56M | 16.50M | 13.76M | 17.51M | 0.00 |

| Income Before Tax Ratio | 92.27% | 88.82% | 96.91% | 90.17% | 95.80% | 79.03% | 95.87% | 90.86% | 68.61% | 123.87% | 107.27% | 130.18% | 0.00% |

| Income Tax Expense | 441.37K | 377.85K | 247.15K | -474.93K | 566.90K | -161.14K | 21.99M | 704.89K | -1.82M | 5.22M | 2.92M | 5.93M | 0.00 |

| Net Income | 18.12M | 6.96M | 25.38M | 6.35M | 17.81M | 3.64M | 19.14M | 11.64M | 8.56M | 16.50M | 13.76M | 17.51M | 0.00 |

| Net Income Ratio | 90.08% | 84.24% | 95.98% | 90.17% | 95.80% | 79.03% | 95.87% | 90.86% | 68.61% | 123.87% | 107.27% | 130.18% | 0.00% |

| EPS | 1.71 | 0.66 | 2.39 | 0.60 | 1.69 | 0.35 | 1.84 | 1.12 | 0.83 | 1.60 | 1.34 | 1.72 | 0.00 |

| EPS Diluted | 1.71 | 0.66 | 2.39 | 0.60 | 1.69 | 0.35 | 1.84 | 1.12 | 0.83 | 1.60 | 1.34 | 1.72 | 0.00 |

| Weighted Avg Shares Out | 10.60M | 10.60M | 10.60M | 10.60M | 10.54M | 10.40M | 10.40M | 10.39M | 10.33M | 10.30M | 10.24M | 10.18M | 10.05M |

| Weighted Avg Shares Out (Dil) | 10.60M | 10.60M | 10.60M | 10.60M | 10.54M | 10.40M | 10.40M | 10.39M | 10.33M | 10.30M | 10.24M | 10.18M | 10.05M |

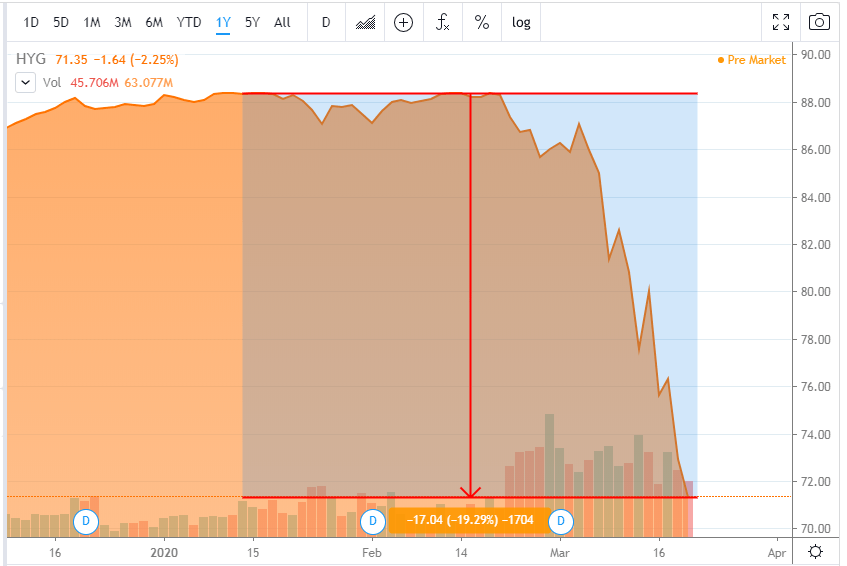

Keep An Eye On The Corporate Credit Market During The COVID-19 Crisis

The Barings collapse 25 years on: What the industry learned after one man broke a bank

ALEX BRUMMER: Foul play in the Sports Direct boardroom

Source: https://incomestatements.info

Category: Stock Reports