See more : Deutsche Telekom AG (DTEGF) Income Statement Analysis – Financial Results

Complete financial analysis of Newcrest Mining Limited (NCMGY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Newcrest Mining Limited, a leading company in the Gold industry within the Basic Materials sector.

- Allied Telesis Holdings K.K. (6835.T) Income Statement Analysis – Financial Results

- Genesis Resources Limited (GES.AX) Income Statement Analysis – Financial Results

- Gulf Energy Development Public Company Limited (GULF-R.BK) Income Statement Analysis – Financial Results

- ENM Holdings Limited (0128.HK) Income Statement Analysis – Financial Results

- Kapil Raj Finance Limited (KAPILRAJ.BO) Income Statement Analysis – Financial Results

Newcrest Mining Limited (NCMGY)

About Newcrest Mining Limited

Newcrest Mining Limited, together with its subsidiaries, engages in the exploration, mine development, mine operation, and sale of gold and gold/copper concentrates. It is also involved in the exploration and production of silver deposits. The company primarily owns and operates mines and projects located in Cadia, Telfer, and Havieron, Australia; Lihir and Wafi-Golpu, Papua New Guinea; Red Chris in British Columbia, Canada; and Fruta Del Norte, Ecuador. Newcrest Mining Limited was founded in 1966 and is headquartered in Melbourne, Australia.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.51B | 4.21B | 4.58B | 3.92B | 3.74B | 3.56B | 3.48B | 3.30B | 3.33B | 3.80B | 3.45B | 4.52B | 4.38B | 2.38B | 2.04B | 2.26B | 1.45B | 1.05B | 752.05M | 497.79M | 409.85M | 270.05M | 2.30M | 0.00 | 0.00 | 0.00 | 210.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.41B | 2.12B | 2.16B | 1.95B | 1.92B | 1.97B | 2.61B | 1.92B | 2.04B | 2.29B | 1.88B | 1.98B | 1.90B | 1.02B | 1.06B | 1.12B | 1.06B | 806.31M | 501.04M | 331.76M | 304.75M | 222.57M | 2.30M | 0.00 | 0.00 | 0.00 | 210.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 2.10B | 2.09B | 2.42B | 1.98B | 1.82B | 1.59B | 868.00M | 1.37B | 1.29B | 1.52B | 1.57B | 2.54B | 2.48B | 1.36B | 977.66M | 1.15B | 386.26M | 242.35M | 251.01M | 166.02M | 105.10M | 47.48M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 46.58% | 49.56% | 52.91% | 50.38% | 48.66% | 44.64% | 24.96% | 41.70% | 38.86% | 39.85% | 45.48% | 56.18% | 56.63% | 57.16% | 47.87% | 50.65% | 26.69% | 23.11% | 33.38% | 33.35% | 25.64% | 17.58% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 300.00K | 200.00K | 600.00K | 425.00K | 0.00 | 521.00K | 0.00 | 0.00 | 0.00 | 0.00 | 502.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 121.00M | 119.00M | 120.00M | 95.00M | 101.00M | 90.00M | 66.00M | 61.00M | 66.73M | 98.86M | 100.39M | 123.83M | 84.43M | 69.52M | 52.86M | 50.42M | 35.28M | 33.54M | 29.43M | 14.22M | 12.78M | 8.59M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 121.00M | 119.00M | 120.00M | 95.00M | 101.00M | 90.00M | 66.00M | 61.00M | 66.73M | 98.86M | 100.39M | 123.83M | 84.43M | 69.52M | 52.86M | 50.42M | 35.28M | 33.54M | 29.43M | 14.22M | 12.78M | 8.59M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 164.00M | 119.00M | 185.00M | 44.00M | 43.00M | 160.00M | -93.00M | 17.00M | 213.23M | -10.36M | -163.36M | -95.18M | -350.55M | -43.68M | -26.15M | -548.88M | -112.81M | 25.67M | 1.75M | 5.00M | -68.73K | -2.58M | -398.82M | 14.17M | 30.07M | 3.41M | -335.32M | -274.39M | -356.43M | -339.07M | -335.71M | -178.88M | -97.52M | 14.23M |

| Operating Expenses | 1.13B | 945.00M | 862.00M | 807.00M | 922.00M | 1.08B | 834.00M | 1.49B | 630.47M | 2.49B | 1.76B | 793.13M | 704.32M | 359.75M | 314.83M | 361.36M | 288.30M | 216.23M | 172.71M | 120.23M | 107.85M | 137.31M | 36.67M | 14.17M | 30.07M | 3.41M | 34.07M | 38.10M | 81.41M | 85.13M | 59.97M | 36.20M | 24.03M | 14.23M |

| Cost & Expenses | 5.05B | 4.24B | 3.80B | 4.14B | 4.05B | 3.05B | 3.44B | 3.41B | 2.67B | 4.78B | 3.64B | 2.77B | 2.61B | 1.38B | 1.38B | 1.48B | 1.35B | 1.02B | 673.74M | 451.99M | 412.59M | 359.88M | 38.96M | 14.17M | 30.07M | 3.41M | 34.28M | 38.10M | 81.41M | 85.13M | 59.97M | 36.20M | 24.03M | 14.23M |

| Interest Income | 41.00M | 25.00M | 27.00M | 19.00M | 26.00M | 8.00M | 2.00M | 1.00M | 767.00K | 941.50K | 912.60K | 2.05M | 9.62M | 10.37M | 6.21M | 18.08M | 3.82M | 3.41M | 4.04M | 1.66M | 3.32M | 829.30K | 0.00 | 0.00 | 0.00 | 0.00 | 7.81M | 7.96M | 1.20M | 509.00K | 1.09M | 800.00K | 800.00K | 0.00 |

| Interest Expense | 132.00M | 96.00M | 127.00M | 188.00M | 120.00M | 122.00M | 134.00M | 148.00M | 145.73M | 164.76M | 100.39M | 44.01M | 47.03M | 27.20M | 28.00M | 60.85M | 91.43M | 52.46M | 17.38M | 8.43M | 10.09M | 6.00M | 9.48M | 15.25M | 8.92M | 7.44M | 10.53M | 5.64M | 428.73K | 428.74K | 1.83M | 1.23M | 3.38M | 359.28K |

| Depreciation & Amortization | 906.00M | 750.00M | 673.00M | 644.00M | 746.00M | 791.00M | 689.00M | 698.00M | 531.53M | 652.46M | 557.60M | 574.12M | 550.41M | 262.19M | 215.32M | 266.55M | 190.33M | 138.47M | 95.62M | 78.34M | 65.76M | 57.15M | 36.67M | 0.00 | 0.00 | 0.00 | 34.07M | 38.10M | 62.07M | 54.39M | 38.94M | 24.53M | 14.62M | 10.19M |

| EBITDA | 2.11B | 3.14B | 2.47B | 1.84B | 1.70B | 1.47B | 1.32B | 1.72B | 1.42B | -315.40M | 104.04M | 2.24B | 1.99B | 1.23B | 858.06M | 518.75M | 369.47M | 327.47M | 269.62M | 209.13M | 156.92M | 22.73M | 36.00M | 14.17M | 30.07M | 3.41M | 6.19M | 65.11M | 38.37M | 1.07M | 27.13M | 36.11M | 9.77M | 44.41M |

| EBITDA Ratio | 46.89% | 49.32% | 53.93% | 46.84% | 45.32% | 41.18% | 37.99% | 39.42% | 42.75% | -8.29% | 3.02% | 49.62% | 45.32% | 51.62% | 42.01% | 22.94% | 25.53% | 31.23% | 35.85% | 42.01% | 38.29% | 8.42% | 1,568.00% | 0.00% | 0.00% | 0.00% | 2,945.51% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | 1.49B | 1.57B | 2.24B | 1.75B | 1.27B | 676.00M | 632.00M | 601.00M | 892.79M | -967.86M | -453.56M | 1.67B | 1.44B | 967.07M | 642.73M | 252.20M | 179.13M | 189.00M | 174.00M | 130.79M | 91.16M | -34.42M | -36.67M | 14.17M | 30.07M | 3.41M | -34.07M | -38.10M | -23.69M | 356.43M | 339.07M | 335.71M | 178.88M | 118.27M |

| Operating Income Ratio | 33.07% | 37.39% | 48.87% | 44.56% | 34.07% | 18.98% | 18.18% | 18.24% | 26.80% | -25.45% | -13.17% | 36.91% | 32.76% | 40.61% | 31.47% | 11.15% | 12.38% | 18.02% | 23.14% | 26.27% | 22.24% | -12.75% | -1,596.98% | 0.00% | 0.00% | 0.00% | -16,224.34% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 289.19M | 651.48M | -124.41M | -205.11M | -149.55M | -47.57M | -23.92M | -148.00M | -145.73M | -1.55B | -5.19B | -54.24M | -47.03M | -277.82M | -312.09M | -60.85M | -91.43M | -52.46M | -17.54M | -8.43M | -10.09M | -6.48M | 63.19M | -15.25M | -8.92M | -7.44M | -4.34M | 59.47M | 61.64M | -355.79M | -313.77M | -300.82M | -172.49M | -84.76M |

| Income Before Tax | 1.08B | 1.23B | 1.67B | 985.00M | 830.00M | 327.00M | 483.00M | 453.00M | 747.06M | -2.57B | -5.65B | 1.61B | 1.39B | 689.24M | 330.65M | 191.35M | 87.70M | 136.54M | 156.46M | 122.37M | 81.07M | -40.91M | 26.52M | -1.07M | 21.15M | -4.02M | -38.42M | 21.37M | 37.95M | 636.58K | 25.30M | 34.88M | 6.39M | 33.51M |

| Income Before Tax Ratio | 23.87% | 29.21% | 36.45% | 25.11% | 22.18% | 9.18% | 13.89% | 13.75% | 22.42% | -67.45% | -163.92% | 35.71% | 31.69% | 28.95% | 16.19% | 8.46% | 6.06% | 13.02% | 20.81% | 24.58% | 19.78% | -15.15% | 1,155.20% | 0.00% | 0.00% | 0.00% | -18,293.16% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 298.00M | 357.00M | 504.00M | 350.00M | 272.00M | 118.00M | 164.00M | 118.00M | 317.54M | -480.16M | -375.99M | 411.40M | 356.97M | 177.28M | 102.98M | 35.02M | 8.82M | 34.80M | 156.46M | 122.37M | 81.07M | -40.91M | 26.52M | -1.07M | 21.15M | -4.02M | -38.42M | 21.37M | 37.95M | 636.58K | 25.30M | 34.88M | 6.39M | 33.51M |

| Net Income | 778.00M | 872.00M | 1.16B | 647.00M | 561.00M | 202.00M | 308.00M | 332.00M | 418.78M | -2.09B | -5.27B | 1.14B | 970.44M | 473.29M | 200.23M | 128.49M | 61.07M | 259.35M | -5.11M | -741.80K | 715.58K | -990.88K | -885.37K | -1.13M | 833.10K | 108.02K | -67.21M | 0.00 | 0.00 | 0.00 | 0.00 | -198.76M | -1.97M | 343.56K |

| Net Income Ratio | 17.26% | 20.73% | 25.44% | 16.50% | 14.99% | 5.67% | 8.86% | 10.08% | 12.57% | -54.98% | -153.06% | 25.29% | 22.14% | 19.88% | 9.80% | 5.68% | 4.22% | 24.73% | -0.68% | -0.15% | 0.17% | -0.37% | -38.56% | 0.00% | 0.00% | 0.00% | -32,006.56% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | 0.87 | 1.03 | 1.90 | 0.83 | 0.73 | 0.26 | 0.40 | 0.43 | 0.55 | -2.73 | -6.89 | 1.49 | 1.35 | 0.98 | 0.43 | 0.30 | 0.16 | 0.66 | -0.01 | 0.00 | 0.17 | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 | -0.24 | 0.00 | 0.00 | 0.00 | 0.00 | -0.74 | -0.01 | 0.00 |

| EPS Diluted | 0.87 | 1.03 | 1.90 | 0.83 | 0.73 | 0.26 | 0.40 | 0.43 | 0.55 | -2.73 | -6.89 | 1.49 | 1.35 | 0.98 | 0.43 | 0.30 | 0.15 | 0.66 | -0.01 | 0.00 | 0.17 | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 | -0.24 | 0.00 | 0.00 | 0.00 | 0.00 | -0.74 | -0.01 | 0.00 |

| Weighted Avg Shares Out | 896.31M | 816.72M | 778.58M | 768.20M | 767.41M | 766.65M | 766.65M | 766.51M | 766.39M | 765.83M | 765.54M | 765.05M | 718.08M | 483.50M | 467.95M | 432.89M | 393.17M | 390.44M | 387.79M | 385.79M | 366.39M | 325.56M | 287.58M | 285.27M | 284.98M | 284.89M | 283.60M | 275.14M | 272.60M | 270.86M | 269.73M | 269.73M | 269.73M | 269.73M |

| Weighted Avg Shares Out (Dil) | 896.31M | 845.78M | 819.14M | 778.58M | 770.60M | 770.99M | 770.00M | 772.09M | 766.51M | 766.51M | 765.54M | 766.12M | 719.49M | 484.68M | 469.00M | 434.63M | 395.83M | 393.48M | 387.79M | 385.79M | 366.39M | 325.56M | 287.58M | 285.27M | 284.98M | 284.89M | 283.60M | 275.14M | 272.60M | 270.86M | 269.73M | 269.73M | 269.73M | 269.73M |

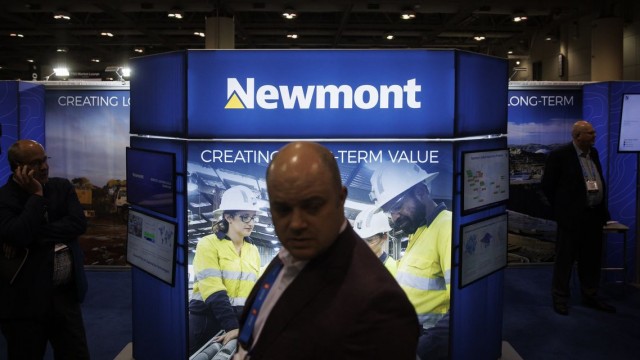

Newmont's move on Newcrest may spark a new round of consolidation in mining, even if there are still significant headwinds

Gold miner Newmont stock sinks to lead S&P 500 decliners after confirmation of bid to buy Australia's Newcrest Mining

Newmont Makes $17 Billion Offer for Australia's Newcrest. A Bidding War Could Be Coming.

Newmont bids for Australian gold champion Newcrest

Newcrest pops on news of Newmont's $16.9 million bid

Newmont Proposes $17 Billion Takeover of Australia's Newcrest Mining

Newcrest Announces Non-Binding Indicative Offer from Newmont

Australian gold miner Newcrest gets $16.9 bln buyout offer from Newmont Corp

Newcrest produces 512koz of gold in December quarter, endorses Lihir phase 14A project

Newcrest Mining Limited: An Undervalued Stock In A Future Star Industry

Source: https://incomestatements.info

Category: Stock Reports