See more : Fitaihi Holding Group (4180.SR) Income Statement Analysis – Financial Results

Complete financial analysis of National Bankshares, Inc. (NKSH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of National Bankshares, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Washington Business Bank (WBZB) Income Statement Analysis – Financial Results

- LiveVox Holding, Inc. (LVOXW) Income Statement Analysis – Financial Results

- RTCORE Inc (RTME) Income Statement Analysis – Financial Results

- NiSource Inc. (NIMC) Income Statement Analysis – Financial Results

- Tomra Systems ASA (TMRAY) Income Statement Analysis – Financial Results

National Bankshares, Inc. (NKSH)

About National Bankshares, Inc.

National Bankshares, Inc. operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking products and services to individuals, businesses, non-profits, and local governments. The company accepts interest-bearing and non-interest bearing demand deposit accounts, money market deposit accounts, savings accounts, certificates of deposit, health savings accounts, and individual retirement accounts. Its loan products include commercial and agricultural, commercial real estate, residential real estate, home equity, and various consumer loan products, as well as loans for the construction of commercial and residential properties. The company also provides business and consumer debit and credit cards; letters of credit, night depository services, safe deposit boxes, utility payment services, and automatic funds transfer; wealth management, trust, and estate services; non-deposit investment and insurance products; and telephone, mobile, and Internet banking services. It operates 23 branch offices, a loan production office, and 22 automated teller machines in Southwest Virginia. National Bankshares, Inc. was founded in 1891 and is headquartered in Blacksburg, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 46.64M | 59.43M | 50.32M | 46.12M | 46.56M | 45.91M | 44.77M | 43.91M | 45.53M | 45.66M | 46.46M | 47.08M | 49.17M | 46.33M | 43.47M | 40.38M | 37.78M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Cost of Revenue | 4.94M | 3.03M | 3.55M | 3.84M | 3.87M | 3.89M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 41.71M | 56.39M | 46.76M | 42.28M | 42.69M | 42.02M | 40.34M | 39.87M | 41.93M | 41.95M | 42.94M | 43.98M | 46.03M | 43.18M | 40.33M | 35.98M | 33.86M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Gross Profit Ratio | 89.42% | 94.89% | 92.94% | 91.68% | 91.68% | 91.52% | 90.10% | 90.80% | 92.10% | 91.88% | 92.43% | 93.42% | 93.62% | 93.20% | 92.79% | 89.11% | 89.61% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.29M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Selling & Marketing | 19.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 24.61M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Other Expenses | 0.00 | -38.54M | -41.85M | -41.75M | -41.35M | -39.80M | -29.13M | -29.28M | -29.49M | -26.45M | -25.69M | -24.82M | -29.39M | -30.33M | -20.45M | -11.09M | -6.48M | -14.62M | -19.55M | -20.90M | -17.65M | -12.83M | -3.68M | -2.40M | -5.00M | -3.60M | 13.50M | 13.19M | 5.86M |

| Operating Expenses | 46.64M | -21.55M | -25.68M | -26.96M | -25.88M | -22.15M | -15.02M | -16.01M | -16.43M | -14.23M | -13.16M | -12.34M | -13.17M | -11.34M | -5.62M | 75.00K | 4.29M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Cost & Expenses | 46.64M | 3.03M | -25.68M | -26.96M | -25.88M | -22.15M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Interest Income | 58.83M | 50.11M | 44.99M | 44.01M | 45.15M | 43.22M | 41.26M | 40.93M | 42.91M | 44.10M | 46.13M | 48.67M | 49.95M | 49.14M | 50.49M | 50.11M | 50.77M | 47.90M | 45.38M | 41.49M | 41.08M | 42.75M | 45.53M | 38.36M | 33.60M | 31.80M | 29.80M | 28.65M | 16.07M |

| Interest Expense | 21.55M | 3.08M | 3.10M | 5.84M | 7.38M | 5.05M | 4.13M | 4.17M | 4.18M | 4.90M | 5.96M | 7.89M | 9.18M | 11.16M | 15.83M | 18.82M | 21.75M | 18.56M | 14.18M | 11.13M | 12.25M | 15.76M | 22.77M | 18.16M | 14.20M | 13.90M | 13.11M | 13.04M | 6.70M |

| Depreciation & Amortization | 754.00K | 609.00K | 636.00K | 708.00K | 739.00K | 816.00K | 873.00K | 1.06M | 999.00K | 1.08M | 1.08M | 1.08M | 1.08M | 1.08M | 1.09M | 2.33M | 2.39M | 2.38M | 2.53M | 2.26M | 2.24M | 2.32M | 2.39M | 1.38M | 1.40M | 1.00M | 707.00K | 638.00K | 506.00K |

| EBITDA | 19.43M | 32.37M | 25.27M | 19.86M | 21.42M | 19.53M | 21.26M | 19.95M | 22.32M | 23.90M | 24.91M | 24.84M | 24.77M | 21.76M | 19.98M | 19.32M | 0.00 | 18.80M | 18.88M | 18.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 41.66% | 59.66% | 50.22% | 43.07% | 46.00% | 53.53% | 56.70% | 54.92% | 58.22% | 63.07% | 66.43% | 69.51% | 69.05% | 71.06% | 82.37% | 95.07% | 107.29% | 97.98% | 85.17% | 78.29% | 83.30% | 95.13% | 124.31% | 121.97% | 110.48% | 115.17% | 699.66% | 731.88% | 560.04% |

| Operating Income | 18.68M | 34.85M | 24.63M | 19.15M | 20.68M | 23.76M | 25.32M | 23.86M | 25.51M | 27.72M | 29.79M | 31.64M | 32.87M | 31.84M | 34.71M | 36.06M | 38.15M | 34.98M | 30.53M | 27.11M | 26.93M | 28.78M | 32.37M | 28.24M | 23.90M | 23.30M | 22.17M | 21.49M | 10.99M |

| Operating Income Ratio | 40.04% | 58.64% | 48.96% | 41.54% | 44.41% | 51.75% | 56.55% | 54.34% | 56.02% | 60.72% | 64.11% | 67.21% | 66.84% | 68.72% | 79.86% | 89.29% | 100.97% | 91.73% | 78.65% | 72.27% | 76.91% | 88.03% | 115.77% | 116.30% | 104.37% | 110.43% | 678.04% | 710.78% | 535.38% |

| Total Other Income/Expenses | 0.00 | -4.32M | -5.45M | -5.41M | -5.26M | -8.14M | -6.46M | -6.65M | -9.71M | -9.47M | -9.08M | -1.77M | -1.88M | -1.97M | -309.00K | -11.00K | 0.00 | 0.00 | -2.53M | -2.26M | -12.25M | -15.76M | -22.77M | -18.16M | -14.20M | -13.90M | -13.11M | -13.04M | -6.70M |

| Income Before Tax | 18.68M | 31.76M | 24.63M | 19.15M | 20.68M | 18.71M | 20.39M | 18.89M | 20.57M | 22.09M | 23.11M | 22.99M | 22.89M | 19.79M | 17.98M | 17.24M | 16.41M | 16.42M | 16.35M | 15.98M | 14.68M | 13.02M | 9.60M | 10.07M | 9.70M | 9.40M | 9.06M | 8.46M | 4.29M |

| Income Before Tax Ratio | 40.04% | 53.45% | 48.96% | 41.54% | 44.41% | 40.76% | 45.54% | 43.03% | 45.19% | 48.39% | 49.73% | 48.84% | 46.54% | 42.72% | 41.36% | 42.69% | 43.42% | 43.05% | 42.12% | 42.61% | 41.92% | 39.81% | 34.33% | 41.49% | 42.36% | 44.55% | 277.12% | 279.70% | 209.06% |

| Income Tax Expense | 2.98M | 5.83M | 4.25M | 3.08M | 3.21M | 2.56M | 6.29M | 3.95M | 4.74M | 5.18M | 5.32M | 5.25M | 5.25M | 4.22M | 3.66M | 3.65M | 3.73M | 3.79M | 3.92M | 3.75M | 3.24M | 3.00M | 2.29M | 2.76M | 2.60M | 2.60M | 2.50M | 2.34M | 1.03M |

| Net Income | 15.69M | 25.93M | 20.38M | 16.08M | 17.47M | 16.15M | 14.09M | 14.94M | 15.83M | 16.91M | 17.79M | 17.75M | 17.64M | 15.57M | 14.32M | 13.59M | 12.68M | 12.63M | 12.42M | 12.23M | 11.44M | 10.01M | 7.31M | 7.31M | 7.10M | 6.80M | 6.56M | 6.12M | 3.26M |

| Net Income Ratio | 33.64% | 43.64% | 40.51% | 34.86% | 37.52% | 35.18% | 31.48% | 34.03% | 34.78% | 37.05% | 38.29% | 37.70% | 35.87% | 33.61% | 32.94% | 33.66% | 33.55% | 33.12% | 32.01% | 32.61% | 32.68% | 30.63% | 26.16% | 30.11% | 31.00% | 32.23% | 200.67% | 202.28% | 158.67% |

| EPS | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.56 | 2.56 | 2.54 | 2.25 | 2.07 | 1.96 | 1.82 | 1.80 | 0.89 | 1.74 | 1.63 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| EPS Diluted | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.55 | 2.55 | 2.54 | 2.24 | 2.06 | 1.96 | 1.82 | 1.80 | 0.88 | 1.73 | 1.62 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| Weighted Avg Shares Out | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.94M | 6.93M | 6.93M | 6.93M | 6.96M | 7.02M | 7.03M | 7.03M | 7.02M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

| Weighted Avg Shares Out (Dil) | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.96M | 6.96M | 6.97M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.96M | 7.02M | 7.07M | 7.07M | 7.06M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

Top Ranked Income Stocks to Buy for April 28th

Is National Bankshares (NKSH) A Good Stock To Buy?

CEF Weekly Commentary: Aug. 30, 2020

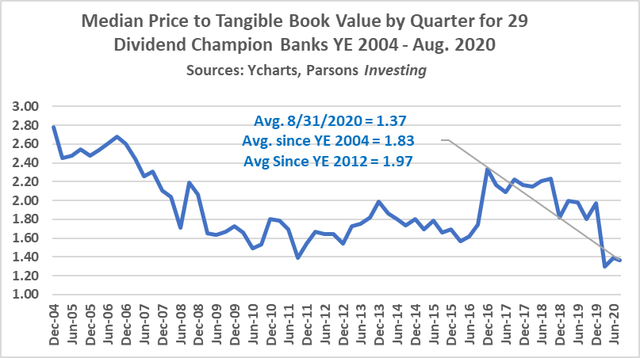

Contrarian Value Play: Dividend Champion Banks For Double-Digit Return

HYD: High-Yield Munis Have Rallied, But Risks Remain (BATS:HYD)

NBB: I Just Bought This Fund For Its Relative Value (NYSE:NBB)

How To Retire With $1.5 Million Starting At 40

Analyzing National Bankshares (NASDAQ:NKSH) and Trustmark (NASDAQ:TRMK)

The Passive DGI Core Portfolio: Retirement Strategy That Allows You To Sleep Well

Source: https://incomestatements.info

Category: Stock Reports