See more : GS Retail Co., Ltd. (007070.KS) Income Statement Analysis – Financial Results

Complete financial analysis of National Bankshares, Inc. (NKSH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of National Bankshares, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Ameren Illinois Company PFD 4.26% (AILIO) Income Statement Analysis – Financial Results

- Nanoform Finland Oyj (NANOFH.HE) Income Statement Analysis – Financial Results

- Keck Seng Investments (Hong Kong) Limited (0184.HK) Income Statement Analysis – Financial Results

- Delaware Investments Colorado Municipal Income Fund, Inc. (VCF) Income Statement Analysis – Financial Results

- PT Eterindo Wahanatama Tbk (ETWA.JK) Income Statement Analysis – Financial Results

National Bankshares, Inc. (NKSH)

About National Bankshares, Inc.

National Bankshares, Inc. operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking products and services to individuals, businesses, non-profits, and local governments. The company accepts interest-bearing and non-interest bearing demand deposit accounts, money market deposit accounts, savings accounts, certificates of deposit, health savings accounts, and individual retirement accounts. Its loan products include commercial and agricultural, commercial real estate, residential real estate, home equity, and various consumer loan products, as well as loans for the construction of commercial and residential properties. The company also provides business and consumer debit and credit cards; letters of credit, night depository services, safe deposit boxes, utility payment services, and automatic funds transfer; wealth management, trust, and estate services; non-deposit investment and insurance products; and telephone, mobile, and Internet banking services. It operates 23 branch offices, a loan production office, and 22 automated teller machines in Southwest Virginia. National Bankshares, Inc. was founded in 1891 and is headquartered in Blacksburg, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 46.64M | 59.43M | 50.32M | 46.12M | 46.56M | 45.91M | 44.77M | 43.91M | 45.53M | 45.66M | 46.46M | 47.08M | 49.17M | 46.33M | 43.47M | 40.38M | 37.78M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Cost of Revenue | 4.94M | 3.03M | 3.55M | 3.84M | 3.87M | 3.89M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 41.71M | 56.39M | 46.76M | 42.28M | 42.69M | 42.02M | 40.34M | 39.87M | 41.93M | 41.95M | 42.94M | 43.98M | 46.03M | 43.18M | 40.33M | 35.98M | 33.86M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Gross Profit Ratio | 89.42% | 94.89% | 92.94% | 91.68% | 91.68% | 91.52% | 90.10% | 90.80% | 92.10% | 91.88% | 92.43% | 93.42% | 93.62% | 93.20% | 92.79% | 89.11% | 89.61% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.29M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Selling & Marketing | 19.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 24.61M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Other Expenses | 0.00 | -38.54M | -41.85M | -41.75M | -41.35M | -39.80M | -29.13M | -29.28M | -29.49M | -26.45M | -25.69M | -24.82M | -29.39M | -30.33M | -20.45M | -11.09M | -6.48M | -14.62M | -19.55M | -20.90M | -17.65M | -12.83M | -3.68M | -2.40M | -5.00M | -3.60M | 13.50M | 13.19M | 5.86M |

| Operating Expenses | 46.64M | -21.55M | -25.68M | -26.96M | -25.88M | -22.15M | -15.02M | -16.01M | -16.43M | -14.23M | -13.16M | -12.34M | -13.17M | -11.34M | -5.62M | 75.00K | 4.29M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Cost & Expenses | 46.64M | 3.03M | -25.68M | -26.96M | -25.88M | -22.15M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Interest Income | 58.83M | 50.11M | 44.99M | 44.01M | 45.15M | 43.22M | 41.26M | 40.93M | 42.91M | 44.10M | 46.13M | 48.67M | 49.95M | 49.14M | 50.49M | 50.11M | 50.77M | 47.90M | 45.38M | 41.49M | 41.08M | 42.75M | 45.53M | 38.36M | 33.60M | 31.80M | 29.80M | 28.65M | 16.07M |

| Interest Expense | 21.55M | 3.08M | 3.10M | 5.84M | 7.38M | 5.05M | 4.13M | 4.17M | 4.18M | 4.90M | 5.96M | 7.89M | 9.18M | 11.16M | 15.83M | 18.82M | 21.75M | 18.56M | 14.18M | 11.13M | 12.25M | 15.76M | 22.77M | 18.16M | 14.20M | 13.90M | 13.11M | 13.04M | 6.70M |

| Depreciation & Amortization | 754.00K | 609.00K | 636.00K | 708.00K | 739.00K | 816.00K | 873.00K | 1.06M | 999.00K | 1.08M | 1.08M | 1.08M | 1.08M | 1.08M | 1.09M | 2.33M | 2.39M | 2.38M | 2.53M | 2.26M | 2.24M | 2.32M | 2.39M | 1.38M | 1.40M | 1.00M | 707.00K | 638.00K | 506.00K |

| EBITDA | 19.43M | 32.37M | 25.27M | 19.86M | 21.42M | 19.53M | 21.26M | 19.95M | 22.32M | 23.90M | 24.91M | 24.84M | 24.77M | 21.76M | 19.98M | 19.32M | 0.00 | 18.80M | 18.88M | 18.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 41.66% | 59.66% | 50.22% | 43.07% | 46.00% | 53.53% | 56.70% | 54.92% | 58.22% | 63.07% | 66.43% | 69.51% | 69.05% | 71.06% | 82.37% | 95.07% | 107.29% | 97.98% | 85.17% | 78.29% | 83.30% | 95.13% | 124.31% | 121.97% | 110.48% | 115.17% | 699.66% | 731.88% | 560.04% |

| Operating Income | 18.68M | 34.85M | 24.63M | 19.15M | 20.68M | 23.76M | 25.32M | 23.86M | 25.51M | 27.72M | 29.79M | 31.64M | 32.87M | 31.84M | 34.71M | 36.06M | 38.15M | 34.98M | 30.53M | 27.11M | 26.93M | 28.78M | 32.37M | 28.24M | 23.90M | 23.30M | 22.17M | 21.49M | 10.99M |

| Operating Income Ratio | 40.04% | 58.64% | 48.96% | 41.54% | 44.41% | 51.75% | 56.55% | 54.34% | 56.02% | 60.72% | 64.11% | 67.21% | 66.84% | 68.72% | 79.86% | 89.29% | 100.97% | 91.73% | 78.65% | 72.27% | 76.91% | 88.03% | 115.77% | 116.30% | 104.37% | 110.43% | 678.04% | 710.78% | 535.38% |

| Total Other Income/Expenses | 0.00 | -4.32M | -5.45M | -5.41M | -5.26M | -8.14M | -6.46M | -6.65M | -9.71M | -9.47M | -9.08M | -1.77M | -1.88M | -1.97M | -309.00K | -11.00K | 0.00 | 0.00 | -2.53M | -2.26M | -12.25M | -15.76M | -22.77M | -18.16M | -14.20M | -13.90M | -13.11M | -13.04M | -6.70M |

| Income Before Tax | 18.68M | 31.76M | 24.63M | 19.15M | 20.68M | 18.71M | 20.39M | 18.89M | 20.57M | 22.09M | 23.11M | 22.99M | 22.89M | 19.79M | 17.98M | 17.24M | 16.41M | 16.42M | 16.35M | 15.98M | 14.68M | 13.02M | 9.60M | 10.07M | 9.70M | 9.40M | 9.06M | 8.46M | 4.29M |

| Income Before Tax Ratio | 40.04% | 53.45% | 48.96% | 41.54% | 44.41% | 40.76% | 45.54% | 43.03% | 45.19% | 48.39% | 49.73% | 48.84% | 46.54% | 42.72% | 41.36% | 42.69% | 43.42% | 43.05% | 42.12% | 42.61% | 41.92% | 39.81% | 34.33% | 41.49% | 42.36% | 44.55% | 277.12% | 279.70% | 209.06% |

| Income Tax Expense | 2.98M | 5.83M | 4.25M | 3.08M | 3.21M | 2.56M | 6.29M | 3.95M | 4.74M | 5.18M | 5.32M | 5.25M | 5.25M | 4.22M | 3.66M | 3.65M | 3.73M | 3.79M | 3.92M | 3.75M | 3.24M | 3.00M | 2.29M | 2.76M | 2.60M | 2.60M | 2.50M | 2.34M | 1.03M |

| Net Income | 15.69M | 25.93M | 20.38M | 16.08M | 17.47M | 16.15M | 14.09M | 14.94M | 15.83M | 16.91M | 17.79M | 17.75M | 17.64M | 15.57M | 14.32M | 13.59M | 12.68M | 12.63M | 12.42M | 12.23M | 11.44M | 10.01M | 7.31M | 7.31M | 7.10M | 6.80M | 6.56M | 6.12M | 3.26M |

| Net Income Ratio | 33.64% | 43.64% | 40.51% | 34.86% | 37.52% | 35.18% | 31.48% | 34.03% | 34.78% | 37.05% | 38.29% | 37.70% | 35.87% | 33.61% | 32.94% | 33.66% | 33.55% | 33.12% | 32.01% | 32.61% | 32.68% | 30.63% | 26.16% | 30.11% | 31.00% | 32.23% | 200.67% | 202.28% | 158.67% |

| EPS | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.56 | 2.56 | 2.54 | 2.25 | 2.07 | 1.96 | 1.82 | 1.80 | 0.89 | 1.74 | 1.63 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| EPS Diluted | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.55 | 2.55 | 2.54 | 2.24 | 2.06 | 1.96 | 1.82 | 1.80 | 0.88 | 1.73 | 1.62 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| Weighted Avg Shares Out | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.94M | 6.93M | 6.93M | 6.93M | 6.96M | 7.02M | 7.03M | 7.03M | 7.02M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

| Weighted Avg Shares Out (Dil) | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.96M | 6.96M | 6.97M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.96M | 7.02M | 7.07M | 7.07M | 7.06M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

McLaren arranges $185 mln financing facility with Bahraini bank | Business

Norman Broadbent Group returns to profit - DirectorsTalk

FTSE 100 LIVE: Dow set to SOAR as futures turn higher - major boost for US after chaos

Back to the future? - DirectorsTalk

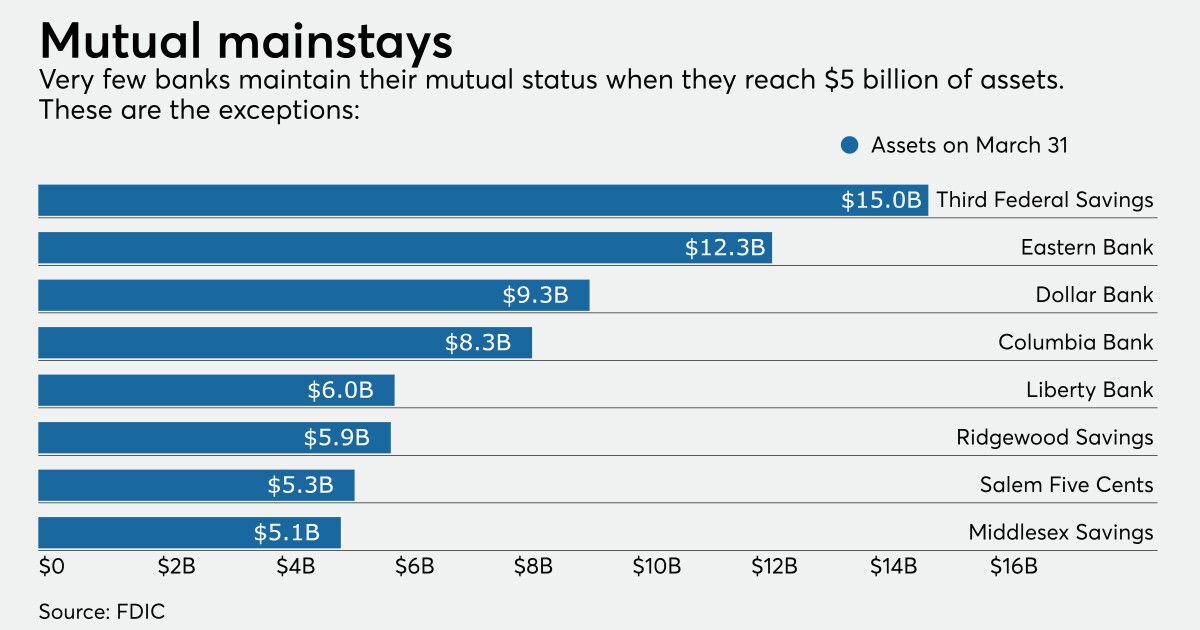

Nation's oldest mutual bank plans IPO to meet post-pandemic challenges

Belarus looking forward to a long hot summer as presidential elections loom

A sticky situation

National Bankshares Inc. (NASDAQ:NKSH) Receives Consensus Recommendation of “Hold” from Analysts

Belarus central bank puts interim management in charge of Belgazprombank, charges top management with money laundering

Source: https://incomestatements.info

Category: Stock Reports