See more : Grand Canal Land Public Company Limited (GLAND.BK) Income Statement Analysis – Financial Results

Complete financial analysis of National Bankshares, Inc. (NKSH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of National Bankshares, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Alpha Systems Inc. (4719.T) Income Statement Analysis – Financial Results

- Havila Shipping ASA (HAVI.OL) Income Statement Analysis – Financial Results

- Petkim Petrokimya Holding Anonim Sirketi (PETKM.IS) Income Statement Analysis – Financial Results

- A. Libental Holdings Ltd (LBTL.TA) Income Statement Analysis – Financial Results

- Chemfab Alkalis Limited (CHEMFABALKA.BO) Income Statement Analysis – Financial Results

National Bankshares, Inc. (NKSH)

About National Bankshares, Inc.

National Bankshares, Inc. operates as the bank holding company for the National Bank of Blacksburg that provides retail and commercial banking products and services to individuals, businesses, non-profits, and local governments. The company accepts interest-bearing and non-interest bearing demand deposit accounts, money market deposit accounts, savings accounts, certificates of deposit, health savings accounts, and individual retirement accounts. Its loan products include commercial and agricultural, commercial real estate, residential real estate, home equity, and various consumer loan products, as well as loans for the construction of commercial and residential properties. The company also provides business and consumer debit and credit cards; letters of credit, night depository services, safe deposit boxes, utility payment services, and automatic funds transfer; wealth management, trust, and estate services; non-deposit investment and insurance products; and telephone, mobile, and Internet banking services. It operates 23 branch offices, a loan production office, and 22 automated teller machines in Southwest Virginia. National Bankshares, Inc. was founded in 1891 and is headquartered in Blacksburg, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 46.64M | 59.43M | 50.32M | 46.12M | 46.56M | 45.91M | 44.77M | 43.91M | 45.53M | 45.66M | 46.46M | 47.08M | 49.17M | 46.33M | 43.47M | 40.38M | 37.78M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Cost of Revenue | 4.94M | 3.03M | 3.55M | 3.84M | 3.87M | 3.89M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 41.71M | 56.39M | 46.76M | 42.28M | 42.69M | 42.02M | 40.34M | 39.87M | 41.93M | 41.95M | 42.94M | 43.98M | 46.03M | 43.18M | 40.33M | 35.98M | 33.86M | 38.14M | 38.81M | 37.51M | 35.02M | 32.70M | 27.96M | 24.28M | 22.90M | 21.10M | 3.27M | 3.02M | 2.05M |

| Gross Profit Ratio | 89.42% | 94.89% | 92.94% | 91.68% | 91.68% | 91.52% | 90.10% | 90.80% | 92.10% | 91.88% | 92.43% | 93.42% | 93.62% | 93.20% | 92.79% | 89.11% | 89.61% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 5.29M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Selling & Marketing | 19.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 24.61M | 17.00M | 16.17M | 14.79M | 15.47M | 14.87M | 14.11M | 13.27M | 13.07M | 12.22M | 12.53M | 12.48M | 16.22M | 18.99M | 14.83M | 11.17M | 10.77M | 11.47M | 11.27M | 10.50M | 9.57M | 8.91M | 8.09M | 6.36M | 6.00M | 5.80M | 5.40M | 5.28M | 3.07M |

| Other Expenses | 0.00 | -38.54M | -41.85M | -41.75M | -41.35M | -39.80M | -29.13M | -29.28M | -29.49M | -26.45M | -25.69M | -24.82M | -29.39M | -30.33M | -20.45M | -11.09M | -6.48M | -14.62M | -19.55M | -20.90M | -17.65M | -12.83M | -3.68M | -2.40M | -5.00M | -3.60M | 13.50M | 13.19M | 5.86M |

| Operating Expenses | 46.64M | -21.55M | -25.68M | -26.96M | -25.88M | -22.15M | -15.02M | -16.01M | -16.43M | -14.23M | -13.16M | -12.34M | -13.17M | -11.34M | -5.62M | 75.00K | 4.29M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Cost & Expenses | 46.64M | 3.03M | -25.68M | -26.96M | -25.88M | -22.15M | 4.43M | 4.04M | 3.60M | 3.71M | 3.52M | 3.10M | 3.14M | 3.15M | 3.14M | 4.40M | 3.93M | -3.16M | -8.29M | -10.40M | -8.09M | -3.91M | 4.41M | 3.96M | 1.00M | 2.20M | 18.90M | 18.47M | 8.93M |

| Interest Income | 58.83M | 50.11M | 44.99M | 44.01M | 45.15M | 43.22M | 41.26M | 40.93M | 42.91M | 44.10M | 46.13M | 48.67M | 49.95M | 49.14M | 50.49M | 50.11M | 50.77M | 47.90M | 45.38M | 41.49M | 41.08M | 42.75M | 45.53M | 38.36M | 33.60M | 31.80M | 29.80M | 28.65M | 16.07M |

| Interest Expense | 21.55M | 3.08M | 3.10M | 5.84M | 7.38M | 5.05M | 4.13M | 4.17M | 4.18M | 4.90M | 5.96M | 7.89M | 9.18M | 11.16M | 15.83M | 18.82M | 21.75M | 18.56M | 14.18M | 11.13M | 12.25M | 15.76M | 22.77M | 18.16M | 14.20M | 13.90M | 13.11M | 13.04M | 6.70M |

| Depreciation & Amortization | 754.00K | 609.00K | 636.00K | 708.00K | 739.00K | 816.00K | 873.00K | 1.06M | 999.00K | 1.08M | 1.08M | 1.08M | 1.08M | 1.08M | 1.09M | 2.33M | 2.39M | 2.38M | 2.53M | 2.26M | 2.24M | 2.32M | 2.39M | 1.38M | 1.40M | 1.00M | 707.00K | 638.00K | 506.00K |

| EBITDA | 19.43M | 32.37M | 25.27M | 19.86M | 21.42M | 19.53M | 21.26M | 19.95M | 22.32M | 23.90M | 24.91M | 24.84M | 24.77M | 21.76M | 19.98M | 19.32M | 0.00 | 18.80M | 18.88M | 18.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 41.66% | 59.66% | 50.22% | 43.07% | 46.00% | 53.53% | 56.70% | 54.92% | 58.22% | 63.07% | 66.43% | 69.51% | 69.05% | 71.06% | 82.37% | 95.07% | 107.29% | 97.98% | 85.17% | 78.29% | 83.30% | 95.13% | 124.31% | 121.97% | 110.48% | 115.17% | 699.66% | 731.88% | 560.04% |

| Operating Income | 18.68M | 34.85M | 24.63M | 19.15M | 20.68M | 23.76M | 25.32M | 23.86M | 25.51M | 27.72M | 29.79M | 31.64M | 32.87M | 31.84M | 34.71M | 36.06M | 38.15M | 34.98M | 30.53M | 27.11M | 26.93M | 28.78M | 32.37M | 28.24M | 23.90M | 23.30M | 22.17M | 21.49M | 10.99M |

| Operating Income Ratio | 40.04% | 58.64% | 48.96% | 41.54% | 44.41% | 51.75% | 56.55% | 54.34% | 56.02% | 60.72% | 64.11% | 67.21% | 66.84% | 68.72% | 79.86% | 89.29% | 100.97% | 91.73% | 78.65% | 72.27% | 76.91% | 88.03% | 115.77% | 116.30% | 104.37% | 110.43% | 678.04% | 710.78% | 535.38% |

| Total Other Income/Expenses | 0.00 | -4.32M | -5.45M | -5.41M | -5.26M | -8.14M | -6.46M | -6.65M | -9.71M | -9.47M | -9.08M | -1.77M | -1.88M | -1.97M | -309.00K | -11.00K | 0.00 | 0.00 | -2.53M | -2.26M | -12.25M | -15.76M | -22.77M | -18.16M | -14.20M | -13.90M | -13.11M | -13.04M | -6.70M |

| Income Before Tax | 18.68M | 31.76M | 24.63M | 19.15M | 20.68M | 18.71M | 20.39M | 18.89M | 20.57M | 22.09M | 23.11M | 22.99M | 22.89M | 19.79M | 17.98M | 17.24M | 16.41M | 16.42M | 16.35M | 15.98M | 14.68M | 13.02M | 9.60M | 10.07M | 9.70M | 9.40M | 9.06M | 8.46M | 4.29M |

| Income Before Tax Ratio | 40.04% | 53.45% | 48.96% | 41.54% | 44.41% | 40.76% | 45.54% | 43.03% | 45.19% | 48.39% | 49.73% | 48.84% | 46.54% | 42.72% | 41.36% | 42.69% | 43.42% | 43.05% | 42.12% | 42.61% | 41.92% | 39.81% | 34.33% | 41.49% | 42.36% | 44.55% | 277.12% | 279.70% | 209.06% |

| Income Tax Expense | 2.98M | 5.83M | 4.25M | 3.08M | 3.21M | 2.56M | 6.29M | 3.95M | 4.74M | 5.18M | 5.32M | 5.25M | 5.25M | 4.22M | 3.66M | 3.65M | 3.73M | 3.79M | 3.92M | 3.75M | 3.24M | 3.00M | 2.29M | 2.76M | 2.60M | 2.60M | 2.50M | 2.34M | 1.03M |

| Net Income | 15.69M | 25.93M | 20.38M | 16.08M | 17.47M | 16.15M | 14.09M | 14.94M | 15.83M | 16.91M | 17.79M | 17.75M | 17.64M | 15.57M | 14.32M | 13.59M | 12.68M | 12.63M | 12.42M | 12.23M | 11.44M | 10.01M | 7.31M | 7.31M | 7.10M | 6.80M | 6.56M | 6.12M | 3.26M |

| Net Income Ratio | 33.64% | 43.64% | 40.51% | 34.86% | 37.52% | 35.18% | 31.48% | 34.03% | 34.78% | 37.05% | 38.29% | 37.70% | 35.87% | 33.61% | 32.94% | 33.66% | 33.55% | 33.12% | 32.01% | 32.61% | 32.68% | 30.63% | 26.16% | 30.11% | 31.00% | 32.23% | 200.67% | 202.28% | 158.67% |

| EPS | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.56 | 2.56 | 2.54 | 2.25 | 2.07 | 1.96 | 1.82 | 1.80 | 0.89 | 1.74 | 1.63 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| EPS Diluted | 2.66 | 4.33 | 3.28 | 2.48 | 2.65 | 2.32 | 2.03 | 2.15 | 2.28 | 2.43 | 2.55 | 2.55 | 2.54 | 2.24 | 2.06 | 1.96 | 1.82 | 1.80 | 0.88 | 1.73 | 1.62 | 1.43 | 1.04 | 1.04 | 0.98 | 0.90 | 0.87 | 0.81 | 0.86 |

| Weighted Avg Shares Out | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.94M | 6.93M | 6.93M | 6.93M | 6.96M | 7.02M | 7.03M | 7.03M | 7.02M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

| Weighted Avg Shares Out (Dil) | 5.89M | 5.99M | 6.21M | 6.48M | 6.58M | 6.96M | 6.96M | 6.96M | 6.96M | 6.96M | 6.97M | 6.96M | 6.95M | 6.95M | 6.95M | 6.94M | 6.96M | 7.02M | 7.07M | 7.07M | 7.06M | 7.03M | 7.03M | 7.03M | 7.24M | 7.60M | 7.58M | 7.60M | 3.81M |

Nuneaton councillor refuses to attend Black Lives Matter protest

5 Safe And Cheap Dividend Stocks To Invest In (June 2020)

Dividends By The Numbers In May 2020

An Assessment Of Nuveen CEFs' Fundamental Health

Dividend Champions For June 2020

Retirement: Earn 5% Safe Income From A Fund Portfolio

“In the end, it’s all about the people …” - DirectorsTalk

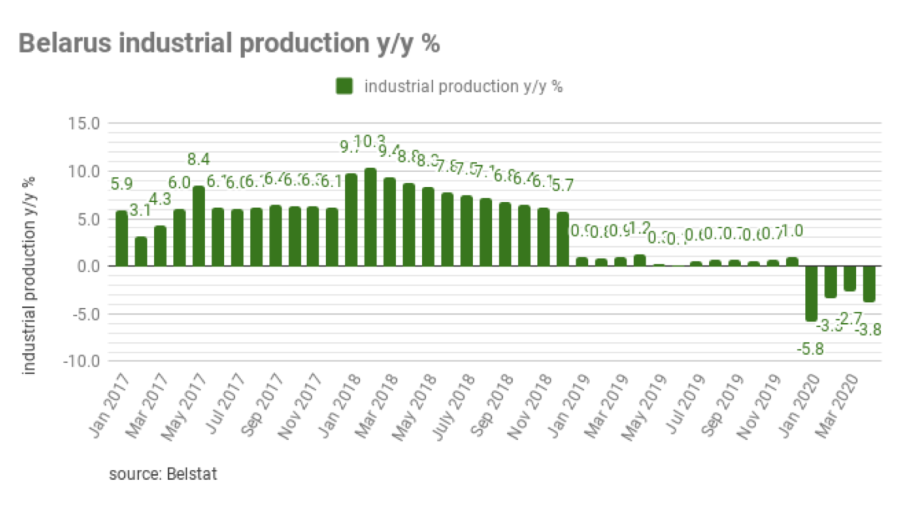

Belarus industrial output declined 3.8% year on year in 4M20

Dividend Champion And Contender Highlights: Week Of May 24

Source: https://incomestatements.info

Category: Stock Reports