See more : RailTel Corporation of India Limited (RAILTEL.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Ponce Financial Group, Inc. (PDLB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ponce Financial Group, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Banco Macro S.A. (BMA.BA) Income Statement Analysis – Financial Results

- 360 Security Technology Inc. (601360.SS) Income Statement Analysis – Financial Results

- Emerson Electric Co. (EMR.SW) Income Statement Analysis – Financial Results

- Jervois Global Limited (JRV.AX) Income Statement Analysis – Financial Results

- Summit Hotel Properties, Inc. (INN-PF) Income Statement Analysis – Financial Results

Ponce Financial Group, Inc. (PDLB)

About Ponce Financial Group, Inc.

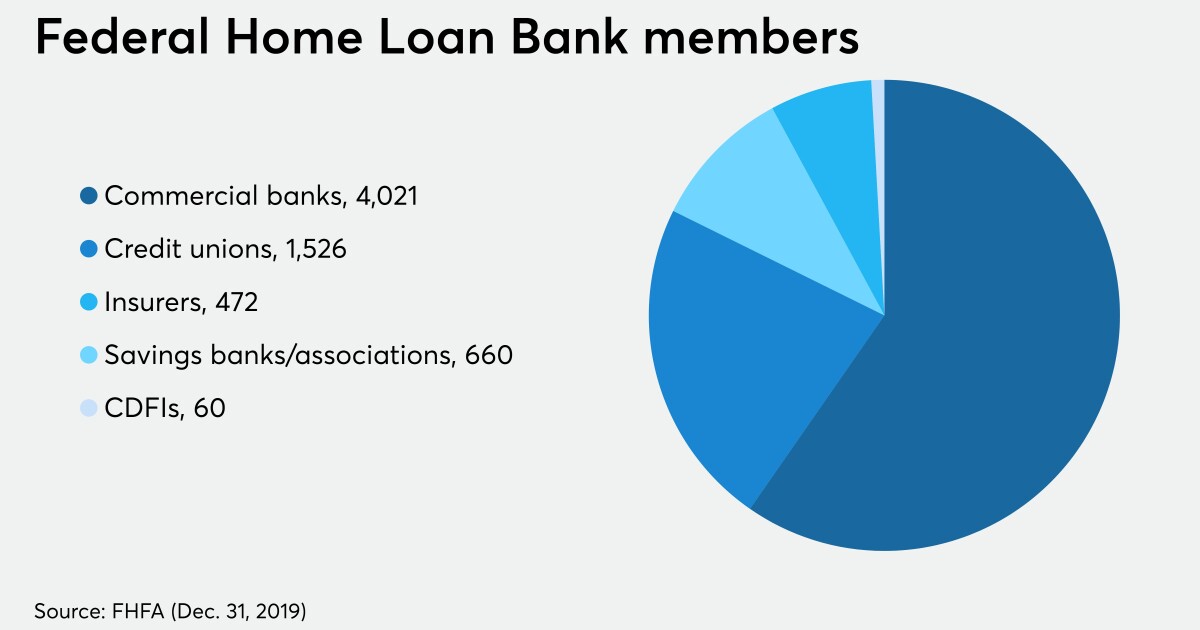

Ponce Financial Group, Inc. operates as the bank holding company for Ponce Bank that provides various banking products and services. It accepts various deposit products, including demand accounts, NOW/IOLA accounts, money market accounts, reciprocal deposits, savings accounts, and certificates of deposit. The company also provides one-to-four family investor-owned and owner-occupied residential, multifamily residential, nonresidential property, construction and land, commercial and industrial, business, and consumer loans; lines of credit; and paycheck protection program. In addition, it invests in securities, which consist of U.S. Government and federal agency securities and securities issued by government-sponsored or government-owned enterprises, as well as mortgage-backed securities, corporate bonds and obligations, and Federal Home Loan Bank stock. It operates 4 banking offices in Bronx, 2 banking offices in Manhattan, 3 banking offices in Queens, and 3 banking offices in Brooklyn, New York; 1 banking office in Union City, New Jersey; and 2 mortgage loan offices in Queens, 1 mortgage loan office in Brooklyn, New York; and 1 mortgage loan office in Englewood Cliffs and 1 mortgage loan office in Bergenfield, New Jersey. Ponce Financial Group, Inc. was founded in 1960 and is headquartered in Bronx, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 73.87M | 70.97M | 69.33M | 49.59M | 40.12M | 38.82M | 34.57M | 29.38M | 29.68M |

| Cost of Revenue | 4.79M | 5.11M | 4.57M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 69.08M | 65.86M | 64.76M | 49.59M | 40.12M | 38.82M | 34.57M | 29.38M | 29.68M |

| Gross Profit Ratio | 93.52% | 92.80% | 93.41% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 32.37M | 29.15M | 24.13M | 22.88M | 19.59M | 18.86M | 17.63M | 16.27M | 15.06M |

| Selling & Marketing | 825.00K | 593.00K | 206.00K | 488.00K | 158.00K | 215.00K | 308.00K | 198.00K | 0.00 |

| SG&A | 61.46M | 29.75M | 24.34M | 23.37M | 19.75M | 19.07M | 17.63M | 16.47M | 15.06M |

| Other Expenses | 0.00 | -25.98M | -60.04M | -67.73M | -65.92M | -47.56M | -48.38M | -43.41M | -40.91M |

| Operating Expenses | 68.66M | 6.50M | -35.70M | -44.36M | -46.17M | -25.53M | -30.75M | -26.95M | -25.84M |

| Cost & Expenses | 73.87M | 6.50M | -35.70M | -44.36M | -46.17M | -25.53M | -30.75M | -26.95M | -25.84M |

| Interest Income | 125.87M | 82.75M | 67.10M | 53.34M | 50.49M | 46.16M | 38.99M | 33.74M | 33.59M |

| Interest Expense | 60.60M | 16.15M | 8.25M | 11.37M | 12.36M | 9.49M | 6.78M | 5.94M | 5.65M |

| Depreciation & Amortization | 4.53M | 4.27M | 2.47M | 2.52M | 2.22M | 1.80M | 1.63M | 1.81M | 1.96M |

| EBITDA | 10.38M | -32.58M | 36.10M | 7.75M | -3.83M | 0.00 | 0.00 | 4.24M | 5.79M |

| EBITDA Ratio | 14.05% | -29.16% | 52.07% | 15.64% | -9.54% | 38.87% | 15.76% | 34.63% | 38.56% |

| Operating Income | 4.37M | -24.96M | 33.62M | 5.24M | -6.05M | 13.29M | 3.82M | 2.43M | 3.83M |

| Operating Income Ratio | 5.92% | -35.17% | 48.50% | 10.56% | -15.08% | 34.23% | 11.05% | 8.27% | 12.92% |

| Total Other Income/Expenses | 1.48M | -4.27M | -21.07M | 0.00 | -2.22M | -11.29M | -2.96M | 0.00 | 0.00 |

| Income Before Tax | 5.85M | -36.85M | 33.62M | 5.24M | -6.05M | 3.80M | -2.96M | 2.43M | 3.83M |

| Income Before Tax Ratio | 7.92% | -51.92% | 48.50% | 10.56% | -15.08% | 9.78% | -8.57% | 8.27% | 12.92% |

| Income Tax Expense | 2.50M | -6.85M | 8.21M | 1.38M | -924.00K | 1.12M | 1.42M | 1.01M | 1.32M |

| Net Income | 3.35M | -30.00M | 25.42M | 3.85M | -5.13M | 2.68M | -4.39M | 1.43M | 2.52M |

| Net Income Ratio | 4.54% | -42.27% | 36.66% | 7.77% | -12.77% | 6.90% | -12.69% | 4.85% | 8.48% |

| EPS | 0.15 | -1.32 | 1.52 | 0.23 | -0.29 | 0.15 | -0.24 | 0.08 | 0.14 |

| EPS Diluted | 0.15 | -1.32 | 1.51 | 0.23 | -0.29 | 0.15 | -0.24 | 0.08 | 0.14 |

| Weighted Avg Shares Out | 22.75M | 22.69M | 16.74M | 16.67M | 17.43M | 17.81M | 18.46M | 17.75M | 17.75M |

| Weighted Avg Shares Out (Dil) | 22.82M | 22.69M | 16.79M | 16.68M | 17.43M | 17.81M | 18.46M | 17.79M | 17.79M |

Triumph Bancorp Inc (NASDAQ: TBK) Q1 2020 Earnings Call Transcript | AlphaStreet

Truist Financial Corp (NYSE: TFC) Q1 2020 Earnings Call Transcript | AlphaStreet

Community Bank System Inc (NYSE: CBU) Q1 2020 Earnings Call Transcript | AlphaStreet

Critical Review: PDL Community Bancorp (NASDAQ:PDLB) vs. Axos Financial (NASDAQ:AX)

Should regulators close the door to new FHLB entrants, or open it wide?

PDL Community Bancorp Announces 2019 Fourth Quarter Results

FHFA to take closer look at FHLB membership rules

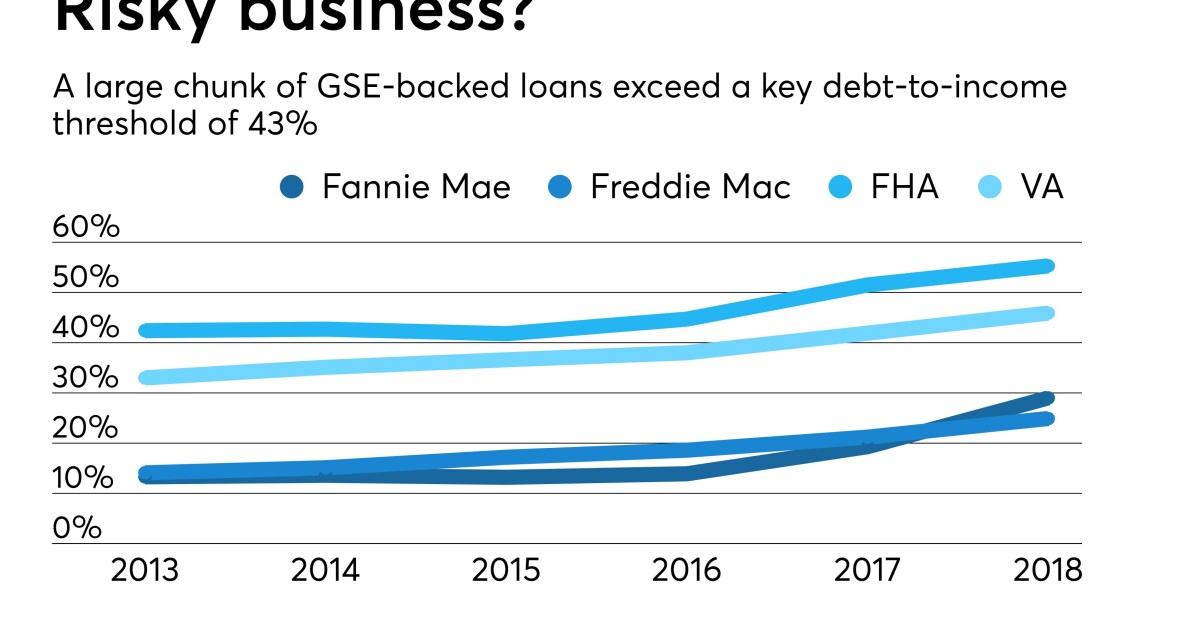

Tearing up CFPB’s mortgage underwriting rule is the easy part

Financial Comparison: PDL Community Bancorp (NASDAQ:PDLB) & Northfield Bancorp (NASDAQ:NFBK)

Source: https://incomestatements.info

Category: Stock Reports