See more : Rio Paranapanema Energia S.A. (GEPA3.SA) Income Statement Analysis – Financial Results

Complete financial analysis of Ponce Financial Group, Inc. (PDLB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ponce Financial Group, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Roboserver Systems Corp. (RBSY) Income Statement Analysis – Financial Results

- Healwell AI Inc. (AIDX.TO) Income Statement Analysis – Financial Results

- Clean TeQ Water Limited (CNQ.AX) Income Statement Analysis – Financial Results

- BOC Hong Kong (Holdings) Limited (BHKLY) Income Statement Analysis – Financial Results

- PayPal Holdings, Inc. (2PP.F) Income Statement Analysis – Financial Results

Ponce Financial Group, Inc. (PDLB)

About Ponce Financial Group, Inc.

Ponce Financial Group, Inc. operates as the bank holding company for Ponce Bank that provides various banking products and services. It accepts various deposit products, including demand accounts, NOW/IOLA accounts, money market accounts, reciprocal deposits, savings accounts, and certificates of deposit. The company also provides one-to-four family investor-owned and owner-occupied residential, multifamily residential, nonresidential property, construction and land, commercial and industrial, business, and consumer loans; lines of credit; and paycheck protection program. In addition, it invests in securities, which consist of U.S. Government and federal agency securities and securities issued by government-sponsored or government-owned enterprises, as well as mortgage-backed securities, corporate bonds and obligations, and Federal Home Loan Bank stock. It operates 4 banking offices in Bronx, 2 banking offices in Manhattan, 3 banking offices in Queens, and 3 banking offices in Brooklyn, New York; 1 banking office in Union City, New Jersey; and 2 mortgage loan offices in Queens, 1 mortgage loan office in Brooklyn, New York; and 1 mortgage loan office in Englewood Cliffs and 1 mortgage loan office in Bergenfield, New Jersey. Ponce Financial Group, Inc. was founded in 1960 and is headquartered in Bronx, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 73.87M | 70.97M | 69.33M | 49.59M | 40.12M | 38.82M | 34.57M | 29.38M | 29.68M |

| Cost of Revenue | 4.79M | 5.11M | 4.57M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 69.08M | 65.86M | 64.76M | 49.59M | 40.12M | 38.82M | 34.57M | 29.38M | 29.68M |

| Gross Profit Ratio | 93.52% | 92.80% | 93.41% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 32.37M | 29.15M | 24.13M | 22.88M | 19.59M | 18.86M | 17.63M | 16.27M | 15.06M |

| Selling & Marketing | 825.00K | 593.00K | 206.00K | 488.00K | 158.00K | 215.00K | 308.00K | 198.00K | 0.00 |

| SG&A | 61.46M | 29.75M | 24.34M | 23.37M | 19.75M | 19.07M | 17.63M | 16.47M | 15.06M |

| Other Expenses | 0.00 | -25.98M | -60.04M | -67.73M | -65.92M | -47.56M | -48.38M | -43.41M | -40.91M |

| Operating Expenses | 68.66M | 6.50M | -35.70M | -44.36M | -46.17M | -25.53M | -30.75M | -26.95M | -25.84M |

| Cost & Expenses | 73.87M | 6.50M | -35.70M | -44.36M | -46.17M | -25.53M | -30.75M | -26.95M | -25.84M |

| Interest Income | 125.87M | 82.75M | 67.10M | 53.34M | 50.49M | 46.16M | 38.99M | 33.74M | 33.59M |

| Interest Expense | 60.60M | 16.15M | 8.25M | 11.37M | 12.36M | 9.49M | 6.78M | 5.94M | 5.65M |

| Depreciation & Amortization | 4.53M | 4.27M | 2.47M | 2.52M | 2.22M | 1.80M | 1.63M | 1.81M | 1.96M |

| EBITDA | 10.38M | -32.58M | 36.10M | 7.75M | -3.83M | 0.00 | 0.00 | 4.24M | 5.79M |

| EBITDA Ratio | 14.05% | -29.16% | 52.07% | 15.64% | -9.54% | 38.87% | 15.76% | 34.63% | 38.56% |

| Operating Income | 4.37M | -24.96M | 33.62M | 5.24M | -6.05M | 13.29M | 3.82M | 2.43M | 3.83M |

| Operating Income Ratio | 5.92% | -35.17% | 48.50% | 10.56% | -15.08% | 34.23% | 11.05% | 8.27% | 12.92% |

| Total Other Income/Expenses | 1.48M | -4.27M | -21.07M | 0.00 | -2.22M | -11.29M | -2.96M | 0.00 | 0.00 |

| Income Before Tax | 5.85M | -36.85M | 33.62M | 5.24M | -6.05M | 3.80M | -2.96M | 2.43M | 3.83M |

| Income Before Tax Ratio | 7.92% | -51.92% | 48.50% | 10.56% | -15.08% | 9.78% | -8.57% | 8.27% | 12.92% |

| Income Tax Expense | 2.50M | -6.85M | 8.21M | 1.38M | -924.00K | 1.12M | 1.42M | 1.01M | 1.32M |

| Net Income | 3.35M | -30.00M | 25.42M | 3.85M | -5.13M | 2.68M | -4.39M | 1.43M | 2.52M |

| Net Income Ratio | 4.54% | -42.27% | 36.66% | 7.77% | -12.77% | 6.90% | -12.69% | 4.85% | 8.48% |

| EPS | 0.15 | -1.32 | 1.52 | 0.23 | -0.29 | 0.15 | -0.24 | 0.08 | 0.14 |

| EPS Diluted | 0.15 | -1.32 | 1.51 | 0.23 | -0.29 | 0.15 | -0.24 | 0.08 | 0.14 |

| Weighted Avg Shares Out | 22.75M | 22.69M | 16.74M | 16.67M | 17.43M | 17.81M | 18.46M | 17.75M | 17.75M |

| Weighted Avg Shares Out (Dil) | 22.82M | 22.69M | 16.79M | 16.68M | 17.43M | 17.81M | 18.46M | 17.79M | 17.79M |

10-Q: HOMESTREET, INC.

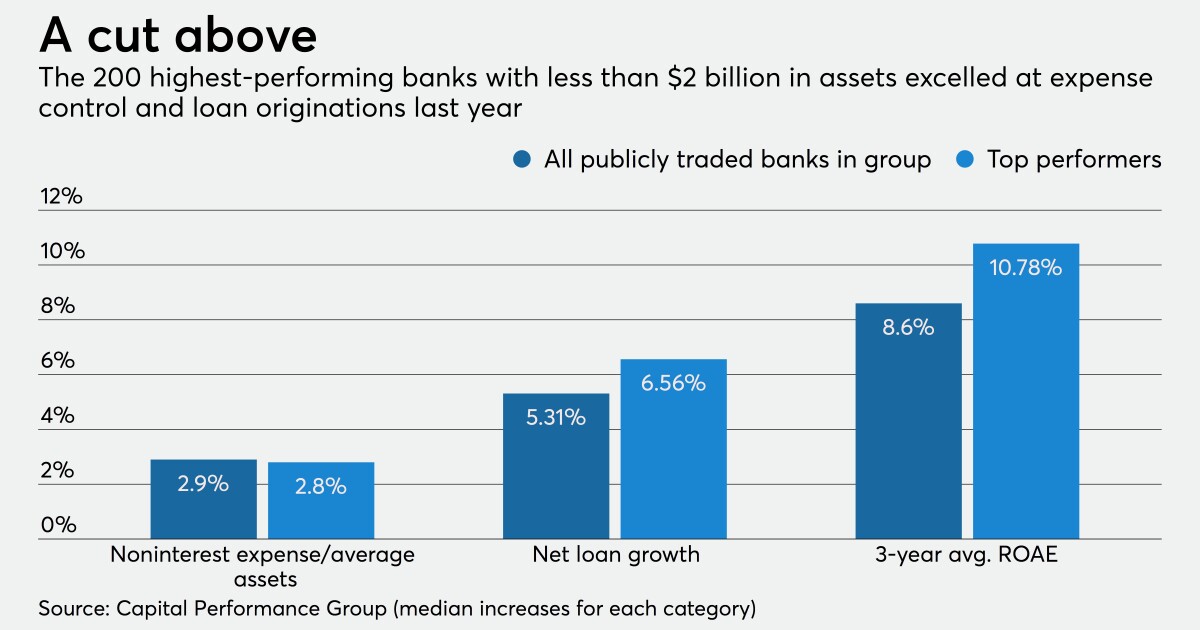

Will pandemic reshuffle the top 200 publicly traded community banks?

Bogota Financial Corp. Reports Results for the Three Months Ended March 31, 2020

8-K: HV Bancorp, Inc.

Glacier Bancorp Inc (NASDAQ: GBCI) Q1 2020 Earnings Call Transcript | AlphaStreet

People's United Financial Inc (NASDAQ: PBCT) Q1 2020 Earnings Call Transcript | AlphaStreet

Huntington Bancshares Inc (NASDAQ: HBAN) Q1 2020 Earnings Call Transcript | AlphaStreet

Federal Home Loan banks to offer more liquidity for PPP lenders

Comerica Inc (NYSE: CMA) Q1 2020 Earnings Call Transcript | AlphaStreet

Source: https://incomestatements.info

Category: Stock Reports