See more : Meten EdtechX Education Group Ltd. (METXW) Income Statement Analysis – Financial Results

Complete financial analysis of Uber Technologies, Inc. (UBER) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Uber Technologies, Inc., a leading company in the Software – Application industry within the Technology sector.

- Ubiqconn Technology, Inc. (6928.TW) Income Statement Analysis – Financial Results

- NMDC Limited (NMDC.NS) Income Statement Analysis – Financial Results

- Sunflag Iron and Steel Company Limited (SUNFLAG.BO) Income Statement Analysis – Financial Results

- Metatron, Inc. (MRNJ) Income Statement Analysis – Financial Results

- Rockcliff Metals Corporation (RKCLF) Income Statement Analysis – Financial Results

Uber Technologies, Inc. (UBER)

About Uber Technologies, Inc.

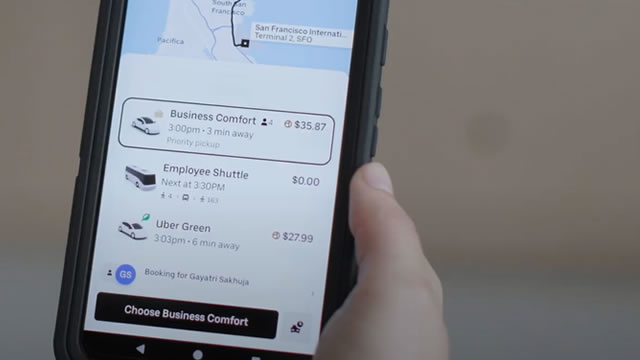

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. It connects consumers with independent providers of ride services for ridesharing services; and connects riders and other consumers with restaurants, grocers, and other stores with delivery service providers for meal preparation, grocery, and other delivery services. The company operates through three segments: Mobility, Delivery, and Freight. The Mobility segment provides products that connect consumers with mobility drivers who provide rides in a range of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. It also offers financial partnerships, transit, and vehicle solutions offerings. The Delivery segment allows consumers to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered; and offers grocery, alcohol, and convenience store delivery, as well as select other goods. The Freight segment connects carriers with shippers on the company's platform and enable carriers upfront, transparent pricing, and the ability to book a shipment, as well as transportation management and other logistics services offerings. The company was formerly known as Ubercab, Inc. and changed its name to Uber Technologies, Inc. in February 2011. Uber Technologies, Inc. was founded in 2009 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 37.28B | 31.88B | 17.46B | 11.14B | 14.15B | 11.27B | 7.93B | 3.85B |

| Cost of Revenue | 22.46B | 19.66B | 9.35B | 5.15B | 7.21B | 5.62B | 4.16B | 2.23B |

| Gross Profit | 14.82B | 12.22B | 8.10B | 5.99B | 6.94B | 5.65B | 3.77B | 1.62B |

| Gross Profit Ratio | 39.76% | 38.33% | 46.43% | 53.73% | 49.05% | 50.11% | 47.55% | 42.05% |

| Research & Development | 3.16B | 2.80B | 2.05B | 2.21B | 4.84B | 1.51B | 1.20B | 864.00M |

| General & Administrative | 2.68B | 3.14B | 2.32B | 2.67B | 3.30B | 2.08B | 2.26B | 981.00M |

| Selling & Marketing | 4.36B | 4.76B | 4.79B | 3.58B | 4.63B | 3.15B | 2.52B | 1.59B |

| SG&A | 7.04B | 7.89B | 7.11B | 6.25B | 7.93B | 5.23B | 4.79B | 2.58B |

| Other Expenses | 3.51B | 3.36B | 2.78B | 2.39B | 2.77B | 225.00M | 44.00M | 66.00M |

| Operating Expenses | 13.71B | 14.05B | 11.94B | 10.85B | 15.54B | 8.68B | 7.85B | 4.64B |

| Cost & Expenses | 36.17B | 33.71B | 21.29B | 16.00B | 22.74B | 14.30B | 12.01B | 6.87B |

| Interest Income | 484.00M | 139.00M | 37.00M | 55.00M | 234.00M | 104.00M | 71.00M | 22.00M |

| Interest Expense | 633.00M | 565.00M | 483.00M | 458.00M | 559.00M | 648.00M | 479.00M | 334.00M |

| Depreciation & Amortization | 823.00M | 947.00M | 902.00M | 575.00M | 472.00M | 426.00M | 510.00M | 320.00M |

| EBITDA | 1.93B | -7.91B | 360.00M | -5.91B | -7.40B | 2.39B | -3.59B | -2.56B |

| EBITDA Ratio | 5.18% | -2.34% | -16.11% | -37.47% | -55.60% | -20.21% | -43.56% | -67.31% |

| Operating Income | 1.11B | -1.83B | -3.83B | -4.86B | -8.60B | -3.03B | -4.08B | -3.02B |

| Operating Income Ratio | 2.98% | -5.75% | -21.97% | -43.66% | -60.76% | -26.91% | -51.44% | -78.62% |

| Total Other Income/Expenses | 1.21B | -7.59B | 2.81B | -2.08B | 163.00M | 4.35B | -495.00M | -195.00M |

| Income Before Tax | 2.32B | -9.43B | -1.03B | -6.95B | -8.43B | 1.31B | -4.58B | -3.22B |

| Income Before Tax Ratio | 6.23% | -29.57% | -5.87% | -62.36% | -59.61% | 11.64% | -57.68% | -83.69% |

| Income Tax Expense | 213.00M | -181.00M | -492.00M | -192.00M | 45.00M | 283.00M | -542.00M | 28.00M |

| Net Income | 1.89B | -9.25B | -533.00M | -6.75B | -8.48B | 997.00M | -4.03B | -370.00M |

| Net Income Ratio | 5.06% | -29.00% | -3.05% | -60.63% | -59.93% | 8.85% | -50.84% | -9.62% |

| EPS | 0.90 | -4.69 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.25 |

| EPS Diluted | 0.87 | -4.68 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.24 |

| Weighted Avg Shares Out | 2.04B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.46B |

| Weighted Avg Shares Out (Dil) | 2.09B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.53B |

The Best Stocks to Invest $50,000 In Right Now

Billionaires Are Buying Up This Millionaire-Maker Stock

Tesla To Partner With Lyft, Uber? Analyst Has 'Rising Conviction' For Future Partnership

Tesla is new pick for Daniel Loeb's Third Point, as hedge fund ditches Uber

Uber rival Bolt's annual revenue hits 2 billion euros

Inside Uber's Double-Digit Growth Engine

The Zacks Analyst Blog Amazon, KLA, Newmont, Uber Technologies and S&P Global

Uber: These Are The Long-Term, Secular And Durable Tailwinds That Make It A Buy

5 U.S. Corporate Behemoths to Buy as Short-Term Momentum Plays

Uber Q3 Earnings: Reaction Overdone, But Landscape More Competitive

Source: https://incomestatements.info

Category: Stock Reports