See more : Arlington Asset Investment Corp. (AAIC) Income Statement Analysis – Financial Results

Complete financial analysis of Uber Technologies, Inc. (UBER) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Uber Technologies, Inc., a leading company in the Software – Application industry within the Technology sector.

- JPMorgan Emerging Europe Middle East & Africa Securities Plc (JEMA.L) Income Statement Analysis – Financial Results

- A/S Kurzemes Atslega 1 (UKH.MU) Income Statement Analysis – Financial Results

- Parkway Acquisition Corp. (PKKW) Income Statement Analysis – Financial Results

- giftee Inc. (4449.T) Income Statement Analysis – Financial Results

- Jeisys Medical Inc. (287410.KQ) Income Statement Analysis – Financial Results

Uber Technologies, Inc. (UBER)

About Uber Technologies, Inc.

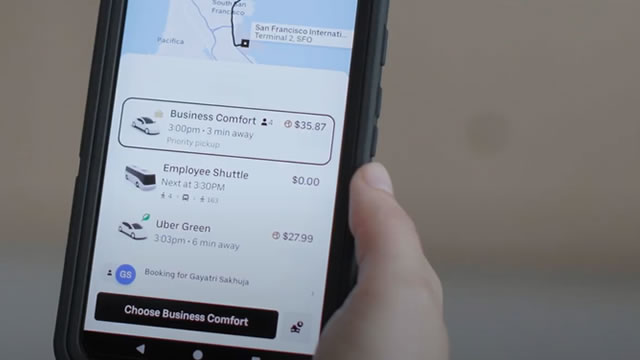

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. It connects consumers with independent providers of ride services for ridesharing services; and connects riders and other consumers with restaurants, grocers, and other stores with delivery service providers for meal preparation, grocery, and other delivery services. The company operates through three segments: Mobility, Delivery, and Freight. The Mobility segment provides products that connect consumers with mobility drivers who provide rides in a range of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. It also offers financial partnerships, transit, and vehicle solutions offerings. The Delivery segment allows consumers to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered; and offers grocery, alcohol, and convenience store delivery, as well as select other goods. The Freight segment connects carriers with shippers on the company's platform and enable carriers upfront, transparent pricing, and the ability to book a shipment, as well as transportation management and other logistics services offerings. The company was formerly known as Ubercab, Inc. and changed its name to Uber Technologies, Inc. in February 2011. Uber Technologies, Inc. was founded in 2009 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 37.28B | 31.88B | 17.46B | 11.14B | 14.15B | 11.27B | 7.93B | 3.85B |

| Cost of Revenue | 22.46B | 19.66B | 9.35B | 5.15B | 7.21B | 5.62B | 4.16B | 2.23B |

| Gross Profit | 14.82B | 12.22B | 8.10B | 5.99B | 6.94B | 5.65B | 3.77B | 1.62B |

| Gross Profit Ratio | 39.76% | 38.33% | 46.43% | 53.73% | 49.05% | 50.11% | 47.55% | 42.05% |

| Research & Development | 3.16B | 2.80B | 2.05B | 2.21B | 4.84B | 1.51B | 1.20B | 864.00M |

| General & Administrative | 2.68B | 3.14B | 2.32B | 2.67B | 3.30B | 2.08B | 2.26B | 981.00M |

| Selling & Marketing | 4.36B | 4.76B | 4.79B | 3.58B | 4.63B | 3.15B | 2.52B | 1.59B |

| SG&A | 7.04B | 7.89B | 7.11B | 6.25B | 7.93B | 5.23B | 4.79B | 2.58B |

| Other Expenses | 3.51B | 3.36B | 2.78B | 2.39B | 2.77B | 225.00M | 44.00M | 66.00M |

| Operating Expenses | 13.71B | 14.05B | 11.94B | 10.85B | 15.54B | 8.68B | 7.85B | 4.64B |

| Cost & Expenses | 36.17B | 33.71B | 21.29B | 16.00B | 22.74B | 14.30B | 12.01B | 6.87B |

| Interest Income | 484.00M | 139.00M | 37.00M | 55.00M | 234.00M | 104.00M | 71.00M | 22.00M |

| Interest Expense | 633.00M | 565.00M | 483.00M | 458.00M | 559.00M | 648.00M | 479.00M | 334.00M |

| Depreciation & Amortization | 823.00M | 947.00M | 902.00M | 575.00M | 472.00M | 426.00M | 510.00M | 320.00M |

| EBITDA | 1.93B | -7.91B | 360.00M | -5.91B | -7.40B | 2.39B | -3.59B | -2.56B |

| EBITDA Ratio | 5.18% | -2.34% | -16.11% | -37.47% | -55.60% | -20.21% | -43.56% | -67.31% |

| Operating Income | 1.11B | -1.83B | -3.83B | -4.86B | -8.60B | -3.03B | -4.08B | -3.02B |

| Operating Income Ratio | 2.98% | -5.75% | -21.97% | -43.66% | -60.76% | -26.91% | -51.44% | -78.62% |

| Total Other Income/Expenses | 1.21B | -7.59B | 2.81B | -2.08B | 163.00M | 4.35B | -495.00M | -195.00M |

| Income Before Tax | 2.32B | -9.43B | -1.03B | -6.95B | -8.43B | 1.31B | -4.58B | -3.22B |

| Income Before Tax Ratio | 6.23% | -29.57% | -5.87% | -62.36% | -59.61% | 11.64% | -57.68% | -83.69% |

| Income Tax Expense | 213.00M | -181.00M | -492.00M | -192.00M | 45.00M | 283.00M | -542.00M | 28.00M |

| Net Income | 1.89B | -9.25B | -533.00M | -6.75B | -8.48B | 997.00M | -4.03B | -370.00M |

| Net Income Ratio | 5.06% | -29.00% | -3.05% | -60.63% | -59.93% | 8.85% | -50.84% | -9.62% |

| EPS | 0.90 | -4.69 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.25 |

| EPS Diluted | 0.87 | -4.68 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.24 |

| Weighted Avg Shares Out | 2.04B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.46B |

| Weighted Avg Shares Out (Dil) | 2.09B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.53B |

Uber and Lyft Drivers in Massachusetts Win Right to Unionize

Massachusetts voters allow Uber, Lyft drivers to unionize

The Discounted Gift That Keeps On Giving: Maintaining Uber With A Buy

Uber Technologies, Inc. (UBER) is Attracting Investor Attention: Here is What You Should Know

Attention, Growth Investors: These 3 Artificial Intelligence (AI) Stocks Should Be on Your Radar

Uber's Real Threat Isn't From Robots

Uber Suggests NYC Driver Pay Cuts in Bid to Woo Riders

Uber asks NYC to cut minimum driver pay as price of used cars, gasoline drops

Expedia chairman Barry Diller on potential deal with Uber and Washington Post's ‘blunder'

Should You Bet on UBER Stock Following Q3 Earnings Beat?

Source: https://incomestatements.info

Category: Stock Reports