See more : Madison Metals Inc. (GREN.CN) Income Statement Analysis – Financial Results

Complete financial analysis of Uber Technologies, Inc. (UBER) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Uber Technologies, Inc., a leading company in the Software – Application industry within the Technology sector.

- Green Bridge Industries, Inc. (GRBG) Income Statement Analysis – Financial Results

- ELAN Microelectronics Corporation (2458.TW) Income Statement Analysis – Financial Results

- Smith & Wesson Brands, Inc. (SWBI) Income Statement Analysis – Financial Results

- Darden Restaurants, Inc. (DRI) Income Statement Analysis – Financial Results

- Osisko Development Corp. Warrant expiring 5/27/2027 (ODVWZ) Income Statement Analysis – Financial Results

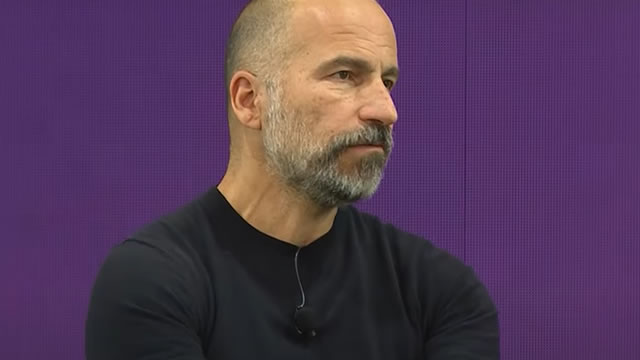

Uber Technologies, Inc. (UBER)

About Uber Technologies, Inc.

Uber Technologies, Inc. develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific. It connects consumers with independent providers of ride services for ridesharing services; and connects riders and other consumers with restaurants, grocers, and other stores with delivery service providers for meal preparation, grocery, and other delivery services. The company operates through three segments: Mobility, Delivery, and Freight. The Mobility segment provides products that connect consumers with mobility drivers who provide rides in a range of vehicles, such as cars, auto rickshaws, motorbikes, minibuses, or taxis. It also offers financial partnerships, transit, and vehicle solutions offerings. The Delivery segment allows consumers to search for and discover local restaurants, order a meal, and either pick-up at the restaurant or have the meal delivered; and offers grocery, alcohol, and convenience store delivery, as well as select other goods. The Freight segment connects carriers with shippers on the company's platform and enable carriers upfront, transparent pricing, and the ability to book a shipment, as well as transportation management and other logistics services offerings. The company was formerly known as Ubercab, Inc. and changed its name to Uber Technologies, Inc. in February 2011. Uber Technologies, Inc. was founded in 2009 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 37.28B | 31.88B | 17.46B | 11.14B | 14.15B | 11.27B | 7.93B | 3.85B |

| Cost of Revenue | 22.46B | 19.66B | 9.35B | 5.15B | 7.21B | 5.62B | 4.16B | 2.23B |

| Gross Profit | 14.82B | 12.22B | 8.10B | 5.99B | 6.94B | 5.65B | 3.77B | 1.62B |

| Gross Profit Ratio | 39.76% | 38.33% | 46.43% | 53.73% | 49.05% | 50.11% | 47.55% | 42.05% |

| Research & Development | 3.16B | 2.80B | 2.05B | 2.21B | 4.84B | 1.51B | 1.20B | 864.00M |

| General & Administrative | 2.68B | 3.14B | 2.32B | 2.67B | 3.30B | 2.08B | 2.26B | 981.00M |

| Selling & Marketing | 4.36B | 4.76B | 4.79B | 3.58B | 4.63B | 3.15B | 2.52B | 1.59B |

| SG&A | 7.04B | 7.89B | 7.11B | 6.25B | 7.93B | 5.23B | 4.79B | 2.58B |

| Other Expenses | 3.51B | 3.36B | 2.78B | 2.39B | 2.77B | 225.00M | 44.00M | 66.00M |

| Operating Expenses | 13.71B | 14.05B | 11.94B | 10.85B | 15.54B | 8.68B | 7.85B | 4.64B |

| Cost & Expenses | 36.17B | 33.71B | 21.29B | 16.00B | 22.74B | 14.30B | 12.01B | 6.87B |

| Interest Income | 484.00M | 139.00M | 37.00M | 55.00M | 234.00M | 104.00M | 71.00M | 22.00M |

| Interest Expense | 633.00M | 565.00M | 483.00M | 458.00M | 559.00M | 648.00M | 479.00M | 334.00M |

| Depreciation & Amortization | 823.00M | 947.00M | 902.00M | 575.00M | 472.00M | 426.00M | 510.00M | 320.00M |

| EBITDA | 1.93B | -7.91B | 360.00M | -5.91B | -7.40B | 2.39B | -3.59B | -2.56B |

| EBITDA Ratio | 5.18% | -2.34% | -16.11% | -37.47% | -55.60% | -20.21% | -43.56% | -67.31% |

| Operating Income | 1.11B | -1.83B | -3.83B | -4.86B | -8.60B | -3.03B | -4.08B | -3.02B |

| Operating Income Ratio | 2.98% | -5.75% | -21.97% | -43.66% | -60.76% | -26.91% | -51.44% | -78.62% |

| Total Other Income/Expenses | 1.21B | -7.59B | 2.81B | -2.08B | 163.00M | 4.35B | -495.00M | -195.00M |

| Income Before Tax | 2.32B | -9.43B | -1.03B | -6.95B | -8.43B | 1.31B | -4.58B | -3.22B |

| Income Before Tax Ratio | 6.23% | -29.57% | -5.87% | -62.36% | -59.61% | 11.64% | -57.68% | -83.69% |

| Income Tax Expense | 213.00M | -181.00M | -492.00M | -192.00M | 45.00M | 283.00M | -542.00M | 28.00M |

| Net Income | 1.89B | -9.25B | -533.00M | -6.75B | -8.48B | 997.00M | -4.03B | -370.00M |

| Net Income Ratio | 5.06% | -29.00% | -3.05% | -60.63% | -59.93% | 8.85% | -50.84% | -9.62% |

| EPS | 0.90 | -4.69 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.25 |

| EPS Diluted | 0.87 | -4.68 | -0.28 | -3.85 | -6.79 | 0.91 | -3.69 | -0.24 |

| Weighted Avg Shares Out | 2.04B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.46B |

| Weighted Avg Shares Out (Dil) | 2.09B | 1.97B | 1.89B | 1.75B | 1.25B | 1.09B | 1.09B | 1.53B |

Craveable Groceries, Delivered: Stew Leonard's Now Available on Uber Eats

Tuesday's big stock stories: What's likely to move the market in the next trading session

Uber: Buy The Drop (Technical Analysis) (Rating Upgrade)

Zacks Industry Outlook Shopify, Alphabet and Uber

3 Stocks Poised for a Breakout

Internet Services Industry Is Hot: Buy SHOP, GOOGL, UBER

Trade Tracker: Bryn Talkington buys Uber

Uber Q3 2024: One-Time Speed Bump; Super App Ambition Unshaken

Lyft's Bookings Guidance Bests Uber, Analyst Says: 'Better Than Feared'

Massachusetts becomes first state to allow Uber, Lyft drivers to unionize

Source: https://incomestatements.info

Category: Stock Reports