See more : Alpha Healthcare Acquisition Corp. III (ALPAU) Income Statement Analysis – Financial Results

Complete financial analysis of Badger Meter, Inc. (BMI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Badger Meter, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- YanTai Yuancheng Gold Co., Ltd. (600766.SS) Income Statement Analysis – Financial Results

- TravelSky Technology Limited (TSYHY) Income Statement Analysis – Financial Results

- SHANTI GURU INDUSTRIES LIMITED (SHANTIGURU.BO) Income Statement Analysis – Financial Results

- Humana Inc. (0J6Z.L) Income Statement Analysis – Financial Results

- GREE, Inc. (3632.T) Income Statement Analysis – Financial Results

Badger Meter, Inc. (BMI)

About Badger Meter, Inc.

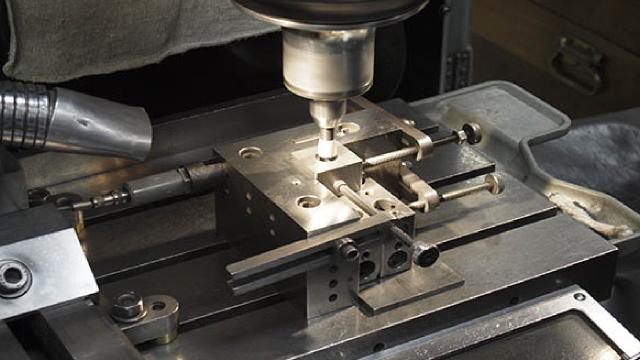

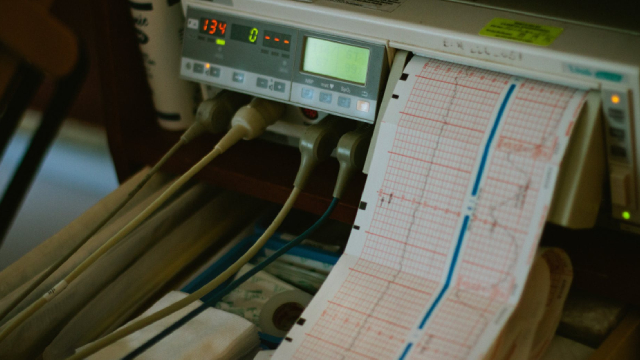

Badger Meter, Inc. manufactures and markets flow measurement, quality, control, and communication solutions in the United States, Asia, Canada, Europe, Mexico, the Middle East, and internationally. It offers mechanical or static water meters, and related radio and software technologies and services to municipal water utilities. The company also provides flow instrumentation products, including meters, valves, and other sensing instruments to measure and control fluids going through a pipe or pipeline, including water, air, steam, oil, and other liquids and gases to original equipment manufacturers as the primary flow measurement device within a product or system, as well as through manufacturers' representatives. Its flow instrumentation products are used in water/wastewater, heating, ventilating and air conditioning, and corporate sustainability markets. In addition, the company offers ORION Migratable for automatic meter reading; ORION (SE) for traditional fixed network applications; and ORION Cellular for infrastructure-free fixed network meter reading solution, as well as BEACON advanced metering analytics, a secure cloud-hosted software suite that establishes alerts for specific conditions and allows consumer engagement tools that permit end water customers to view and manage their water usage activity. It also serves water utilities, industrial, and other industries. The company sells its products directly, as well as through resellers and representatives. Badger Meter, Inc. was incorporated in 1905 and is headquartered in Milwaukee, Wisconsin.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 703.59M | 565.57M | 505.20M | 425.54M | 424.63M | 433.73M | 402.44M | 393.76M | 377.70M | 364.77M | 334.12M | 319.66M | 262.92M | 276.63M | 250.34M | 279.55M | 234.82M | 229.75M | 216.65M | 205.01M | 183.99M | 167.32M | 138.54M | 146.39M | 150.90M | 143.80M | 130.80M | 116.00M | 108.60M | 99.20M | 84.50M | 82.10M | 78.40M | 77.10M | 72.30M | 71.10M | 66.70M | 60.90M | 55.90M |

| Cost of Revenue | 427.15M | 345.60M | 299.71M | 257.30M | 261.10M | 271.38M | 246.69M | 243.19M | 241.92M | 233.63M | 217.13M | 197.41M | 173.10M | 173.81M | 153.32M | 181.09M | 153.42M | 153.13M | 142.79M | 137.53M | 123.47M | 111.32M | 94.04M | 87.30M | 86.00M | 81.80M | 78.00M | 69.40M | 65.10M | 58.40M | 47.80M | 48.20M | 45.20M | 42.90M | 41.30M | 41.10M | 38.60M | 35.10M | 36.30M |

| Gross Profit | 276.44M | 219.97M | 205.48M | 168.25M | 163.53M | 162.35M | 155.75M | 150.58M | 135.78M | 131.14M | 116.99M | 122.25M | 89.82M | 102.82M | 97.01M | 98.46M | 81.40M | 76.63M | 73.86M | 67.48M | 60.52M | 56.00M | 44.50M | 59.09M | 64.90M | 62.00M | 52.80M | 46.60M | 43.50M | 40.80M | 36.70M | 33.90M | 33.20M | 34.20M | 31.00M | 30.00M | 28.10M | 25.80M | 19.60M |

| Gross Profit Ratio | 39.29% | 38.89% | 40.67% | 39.54% | 38.51% | 37.43% | 38.70% | 38.24% | 35.95% | 35.95% | 35.01% | 38.24% | 34.16% | 37.17% | 38.75% | 35.22% | 34.66% | 33.35% | 34.09% | 32.91% | 32.89% | 33.47% | 32.12% | 40.36% | 43.01% | 43.12% | 40.37% | 40.17% | 40.06% | 41.13% | 43.43% | 41.29% | 42.35% | 44.36% | 42.88% | 42.19% | 42.13% | 42.36% | 35.06% |

| Research & Development | 19.00M | 15.80M | 14.70M | 11.60M | 11.90M | 11.10M | 10.60M | 10.60M | 10.65M | 9.50M | 10.50M | 9.57M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.50M | 6.40M | 6.50M | 5.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 158.52M | 132.81M | 126.88M | 103.24M | 101.67M | 125.34M | 100.12M | 99.81M | 93.41M | 85.10M | 77.88M | 77.78M | 62.29M | 58.00M | 54.77M | 57.56M | 50.78M | 47.84M | 49.92M | 47.28M | 46.42M | 42.81M | 38.43M | 42.00M | 42.50M | 43.30M | 30.30M | 27.30M | 25.60M | 24.50M | 28.40M | 27.70M | 25.90M | 25.50M | 22.80M | 22.30M | 21.00M | 20.50M | 14.80M |

| Selling & Marketing | -19.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 139.39M | 132.81M | 126.88M | 103.24M | 101.67M | 125.34M | 100.12M | 99.81M | 93.41M | 85.10M | 77.88M | 77.78M | 62.29M | 58.00M | 54.77M | 57.56M | 50.78M | 47.84M | 49.92M | 47.28M | 46.42M | 42.81M | 38.43M | 42.00M | 42.50M | 43.30M | 30.30M | 27.30M | 25.60M | 24.50M | 28.40M | 27.70M | 25.90M | 25.50M | 22.80M | 22.30M | 21.00M | 20.50M | 14.80M |

| Other Expenses | 0.00 | 0.00 | -120.00K | -145.00K | -288.00K | -19.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.07M | 5.70M | 4.70M | 4.00M | 4.10M | 4.40M | 4.40M | 4.30M | 4.10M | 4.00M | 3.80M | 3.20M | 3.10M | 3.00M | 2.80M | 2.20M |

| Operating Expenses | 158.39M | 132.81M | 126.88M | 103.24M | 101.67M | 125.34M | 100.12M | 99.81M | 93.41M | 85.10M | 77.88M | 77.78M | 62.29M | 58.00M | 54.77M | 57.56M | 50.78M | 47.84M | 49.92M | 47.28M | 46.42M | 42.81M | 38.43M | 48.07M | 48.20M | 48.00M | 41.80M | 37.80M | 36.50M | 34.80M | 32.70M | 31.80M | 29.90M | 29.30M | 26.00M | 25.40M | 24.00M | 23.30M | 17.00M |

| Cost & Expenses | 585.54M | 478.40M | 426.60M | 360.53M | 362.77M | 396.72M | 346.82M | 343.00M | 335.33M | 318.72M | 295.02M | 275.19M | 235.38M | 231.81M | 208.09M | 238.65M | 204.20M | 200.97M | 192.71M | 184.81M | 169.89M | 154.12M | 132.47M | 135.37M | 134.20M | 129.80M | 119.80M | 107.20M | 101.60M | 93.20M | 80.50M | 80.00M | 75.10M | 72.20M | 67.30M | 66.50M | 62.60M | 58.40M | 53.30M |

| Interest Income | 4.05M | 552.00K | 20.00K | 30.00K | 253.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 770.00K | 0.00 | 2.69M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 552.00K | 0.00 | 30.00K | 253.00K | 1.16M | 789.00K | 921.00K | 1.22M | 1.14M | 1.10M | 998.00K | 185.00K | 385.00K | 90.00K | 1.35M | 1.29M | 1.30M | 1.61M | 1.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 28.11M | 26.24M | 27.86M | 25.22M | 24.15M | 24.32M | 24.40M | 22.44M | 20.60M | 15.66M | 13.49M | 12.05M | 9.49M | 8.46M | 8.16M | 7.05M | 6.47M | 7.01M | 6.36M | 7.25M | 7.83M | 7.98M | 6.80M | 6.07M | 5.70M | 4.70M | 4.00M | 4.10M | 4.40M | 4.40M | 4.30M | 4.10M | 4.00M | 3.80M | 3.20M | 3.10M | 3.00M | 2.80M | 2.20M |

| EBITDA | 146.03M | 113.41M | 106.47M | 90.23M | 86.01M | 61.32M | 80.02M | 73.21M | 62.97M | 61.71M | 52.60M | 56.52M | 37.03M | 53.28M | 42.24M | 47.95M | 37.08M | 35.80M | 33.52M | 28.05M | 21.86M | 21.18M | 12.87M | 17.09M | 22.40M | 18.70M | 14.70M | 12.60M | 11.40M | 10.40M | 8.30M | 6.20M | 7.30M | 8.70M | 8.20M | 7.70M | 7.10M | 5.30M | 4.80M |

| EBITDA Ratio | 20.75% | 20.05% | 21.07% | 21.20% | 20.25% | 8.53% | 13.82% | 12.89% | 11.22% | 12.62% | 11.70% | 13.91% | 10.47% | 16.20% | 16.95% | 17.15% | 15.79% | 15.58% | 13.78% | 13.68% | 11.38% | 12.60% | 9.05% | 10.37% | 14.65% | 13.00% | 11.70% | 11.29% | 10.87% | 10.58% | 9.82% | 7.67% | 9.31% | 11.67% | 11.48% | 11.25% | 10.64% | 9.20% | 8.94% |

| Operating Income | 118.05M | 87.30M | 78.72M | 65.16M | 62.15M | 56.87M | 55.62M | 50.77M | 42.37M | 46.05M | 39.11M | 44.47M | 27.53M | 44.82M | 42.24M | 40.90M | 30.62M | 28.79M | 23.95M | 20.20M | 14.10M | 13.20M | 6.07M | 11.02M | 16.70M | 14.00M | 11.00M | 8.80M | 7.00M | 6.00M | 4.00M | 2.10M | 3.30M | 4.90M | 5.00M | 4.60M | 4.10M | 2.50M | 2.60M |

| Operating Income Ratio | 16.78% | 15.43% | 15.58% | 15.31% | 14.64% | 13.11% | 13.82% | 12.89% | 11.22% | 12.62% | 11.70% | 13.91% | 10.47% | 16.20% | 16.87% | 14.63% | 13.04% | 12.53% | 11.05% | 9.85% | 7.66% | 7.89% | 4.38% | 7.53% | 11.07% | 9.74% | 8.41% | 7.59% | 6.45% | 6.05% | 4.73% | 2.56% | 4.21% | 6.36% | 6.92% | 6.47% | 6.15% | 4.11% | 4.65% |

| Total Other Income/Expenses | 3.92M | 422.00K | -100.00K | -175.00K | -541.00K | -21.02M | -789.00K | -921.00K | -1.22M | -1.14M | -1.10M | -998.00K | -185.00K | -385.00K | 90.00K | -1.35M | -1.29M | -1.30M | -1.49M | -2.22M | -749.00K | -1.76M | -1.06M | -292.00K | -1.00M | -700.00K | -500.00K | -400.00K | -1.10M | -1.00M | -700.00K | -900.00K | -900.00K | -1.40M | -1.20M | -1.20M | -1.00M | -1.20M | -900.00K |

| Income Before Tax | 121.97M | 87.72M | 78.62M | 64.98M | 61.61M | 35.85M | 54.83M | 49.84M | 41.15M | 44.91M | 38.01M | 43.47M | 27.35M | 44.44M | 42.33M | 39.56M | 29.33M | 27.49M | 22.80M | 17.98M | 13.35M | 11.44M | 5.01M | 10.73M | 15.70M | 13.30M | 10.20M | 8.10M | 5.90M | 5.00M | 3.30M | 1.20M | 2.40M | 3.50M | 3.80M | 3.40M | 3.10M | 1.30M | 1.70M |

| Income Before Tax Ratio | 17.33% | 15.51% | 15.56% | 15.27% | 14.51% | 8.27% | 13.63% | 12.66% | 10.90% | 12.31% | 11.38% | 13.60% | 10.40% | 16.06% | 16.91% | 14.15% | 12.49% | 11.96% | 10.52% | 8.77% | 7.26% | 6.84% | 3.62% | 7.33% | 10.40% | 9.25% | 7.80% | 6.98% | 5.43% | 5.04% | 3.91% | 1.46% | 3.06% | 4.54% | 5.26% | 4.78% | 4.65% | 2.13% | 3.04% |

| Income Tax Expense | 29.37M | 21.22M | 17.74M | 15.64M | 14.43M | 8.06M | 20.26M | 17.55M | 15.21M | 15.23M | 13.39M | 15.44M | 8.19M | 15.78M | 15.55M | 14.47M | 10.94M | 10.92M | 9.55M | 8.35M | 5.77M | 4.17M | 1.65M | 3.79M | 6.00M | 5.10M | 3.70M | 3.00M | 2.20M | 1.80M | 1.10M | 400.00K | 800.00K | 1.20M | 1.40M | 1.30M | 1.30M | 100.00K | 400.00K |

| Net Income | 92.60M | 66.50M | 60.88M | 49.34M | 47.18M | 27.79M | 34.57M | 32.30M | 25.94M | 29.68M | 24.62M | 28.03M | 19.16M | 28.66M | 34.17M | 25.08M | 16.46M | 7.55M | 13.25M | 9.63M | 7.58M | 7.27M | 3.36M | 6.94M | 9.70M | 8.20M | 6.50M | 5.10M | 3.70M | 3.20M | 2.20M | -3.90M | 1.60M | 2.30M | 2.40M | 2.10M | 1.80M | 1.20M | 1.30M |

| Net Income Ratio | 13.16% | 11.76% | 12.05% | 11.60% | 11.11% | 6.41% | 8.59% | 8.20% | 6.87% | 8.14% | 7.37% | 8.77% | 7.29% | 10.36% | 13.65% | 8.97% | 7.01% | 3.29% | 6.12% | 4.70% | 4.12% | 4.35% | 2.43% | 4.74% | 6.43% | 5.70% | 4.97% | 4.40% | 3.41% | 3.23% | 2.60% | -4.75% | 2.04% | 2.98% | 3.32% | 2.95% | 2.70% | 1.97% | 2.33% |

| EPS | 3.16 | 2.28 | 2.09 | 1.70 | 1.63 | 0.96 | 1.20 | 1.12 | 0.90 | 1.03 | 0.86 | 0.98 | 0.64 | 0.96 | 1.16 | 0.86 | 0.58 | 0.27 | 0.49 | 0.37 | 0.30 | 0.29 | 0.13 | 0.26 | 0.35 | 0.28 | 0.23 | 0.18 | 0.13 | 0.12 | 0.08 | -0.14 | 0.06 | 0.09 | 0.10 | 0.09 | 0.08 | 0.05 | 0.06 |

| EPS Diluted | 3.14 | 2.26 | 2.08 | 1.69 | 1.61 | 0.95 | 1.19 | 1.11 | 0.90 | 1.03 | 0.85 | 0.98 | 0.64 | 0.96 | 1.14 | 0.85 | 0.56 | 0.26 | 0.48 | 0.36 | 0.29 | 0.28 | 0.13 | 0.25 | 0.33 | 0.27 | 0.21 | 0.17 | 0.13 | 0.12 | 0.08 | -0.14 | 0.06 | 0.09 | 0.10 | 0.09 | 0.08 | 0.05 | 0.06 |

| Weighted Avg Shares Out | 29.28M | 29.22M | 29.14M | 29.05M | 29.03M | 28.99M | 28.93M | 28.89M | 28.76M | 28.61M | 28.72M | 28.66M | 29.94M | 29.81M | 29.61M | 29.11M | 28.42M | 27.74M | 26.98M | 26.39M | 25.68M | 25.32M | 25.30M | 26.46M | 27.91M | 28.77M | 28.42M | 27.95M | 27.92M | 27.53M | 27.50M | 27.37M | 26.12M | 25.21M | 24.94M | 24.35M | 23.61M | 24.00M | 22.61M |

| Weighted Avg Shares Out (Dil) | 29.46M | 29.38M | 29.34M | 29.23M | 29.22M | 29.19M | 29.11M | 29.05M | 28.89M | 28.76M | 28.88M | 28.80M | 30.10M | 30.01M | 29.91M | 29.67M | 29.23M | 28.78M | 28.04M | 27.14M | 26.13M | 26.43M | 26.20M | 27.76M | 29.85M | 30.94M | 31.52M | 29.35M | 27.92M | 27.53M | 27.50M | 27.37M | 26.12M | 25.21M | 24.94M | 24.35M | 23.61M | 24.00M | 22.61M |

Badger Meter's Q3 Earnings Beat Estimates, Sales Up Y/Y, Stock Down

Badger Meter (BMI) Forms 'Hammer Chart Pattern': Time for Bottom Fishing?

Badger Meter, Inc. (BMI) Q3 2024 Earnings Call Transcript

Why Badger Meter Stock Plunged Today

Badger Meter (BMI) Q3 Earnings Top Estimates

Badger Meter Reports Third Quarter 2024 Financial Results

Badger Meter (BMI) Is Up 1.17% in One Week: What You Should Know

Why Badger Meter (BMI) is a Top Momentum Stock for the Long-Term

Here's Why Badger Meter (BMI) is a Strong Growth Stock

What to Expect From Badger Meter Stock Ahead of its Q3 Earnings

Source: https://incomestatements.info

Category: Stock Reports