See more : Enservco Corporation (ENSV) Income Statement Analysis – Financial Results

Complete financial analysis of Freeport-McMoRan Inc. (FCX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Freeport-McMoRan Inc., a leading company in the Copper industry within the Basic Materials sector.

- Acorda Therapeutics, Inc. (ACOR) Income Statement Analysis – Financial Results

- Changjiang Publishing & Media Co.,Ltd (600757.SS) Income Statement Analysis – Financial Results

- Flag Ship Acquisition Corp. Unit (FSHPU) Income Statement Analysis – Financial Results

- ArtGo Holdings Limited (3313.HK) Income Statement Analysis – Financial Results

- ASAP, Inc. (WTRH) Income Statement Analysis – Financial Results

Freeport-McMoRan Inc. (FCX)

About Freeport-McMoRan Inc.

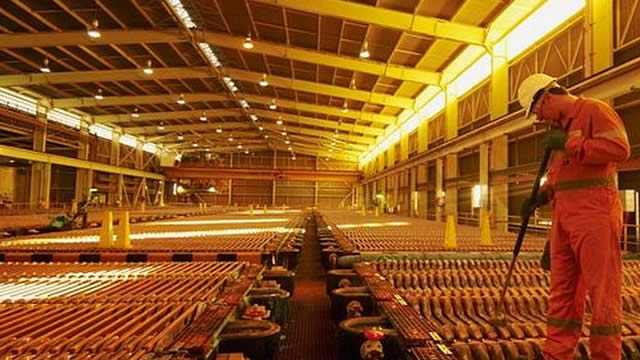

Freeport-McMoRan Inc. engages in the mining of mineral properties in North America, South America, and Indonesia. The company primarily explores for copper, gold, molybdenum, silver, and other metals, as well as oil and gas. Its assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Tyrone and Chino in New Mexico; and Henderson and Climax in Colorado, North America, as well as Cerro Verde in Peru and El Abra in Chile. The company also operates a portfolio of oil and gas properties primarily located in offshore California and the Gulf of Mexico. As of December 31, 2021, it operated approximately 135 wells. The company was formerly known as Freeport-McMoRan Copper & Gold Inc. and changed its name to Freeport-McMoRan Inc. in July 2014. Freeport-McMoRan Inc. was incorporated in 1987 and is headquartered in Phoenix, Arizona.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 22.86B | 22.78B | 22.85B | 14.20B | 14.40B | 18.63B | 16.40B | 14.83B | 15.88B | 21.44B | 20.92B | 18.01B | 20.88B | 18.98B | 15.04B | 17.80B | 16.94B | 5.79B | 4.18B | 2.37B | 2.21B | 1.91B | 1.84B | 1.87B | 1.89B | 1.76B | 2.00B | 1.91B | 1.83B | 1.21B | 925.90M | 714.30M | 467.50M | 434.10M | 367.90M | 335.00M | 190.00M |

| Cost of Revenue | 15.83B | 15.09B | 14.03B | 11.66B | 13.11B | 13.45B | 12.02B | 17.58B | 28.52B | 19.50B | 14.64B | 11.56B | 10.92B | 9.53B | 8.14B | 12.98B | 9.92B | 2.54B | 1.65B | 1.46B | 1.08B | 941.57M | 952.63M | 1.02B | 940.30M | 817.60M | 1.03B | 951.90M | 932.40M | 780.60M | 567.10M | 291.60M | 204.40M | 160.00M | 118.50M | 98.60M | 79.60M |

| Gross Profit | 7.03B | 7.69B | 8.82B | 2.54B | 1.30B | 5.18B | 4.38B | -2.75B | -12.65B | 1.93B | 6.28B | 6.45B | 9.96B | 9.45B | 6.90B | 4.82B | 7.02B | 3.25B | 2.53B | 912.91M | 1.13B | 968.89M | 886.24M | 848.84M | 947.00M | 939.50M | 974.70M | 953.10M | 901.90M | 431.70M | 358.80M | 422.70M | 263.10M | 274.10M | 249.40M | 236.40M | 110.40M |

| Gross Profit Ratio | 30.75% | 33.76% | 38.59% | 17.91% | 9.01% | 27.82% | 26.71% | -18.54% | -79.66% | 9.02% | 30.04% | 35.81% | 47.70% | 49.78% | 45.88% | 27.06% | 41.45% | 56.18% | 60.60% | 38.49% | 51.28% | 50.71% | 48.19% | 45.43% | 50.18% | 53.47% | 48.71% | 50.03% | 49.17% | 35.61% | 38.75% | 59.18% | 56.28% | 63.14% | 67.79% | 70.57% | 58.11% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 271.00M | 0.00 | 90.00M | 292.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.91M | 19.43M | 18.06M | 14.94M | 4.33M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 131.16M | 84.45M | 71.87M | 65.34M | 63.98M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 479.00M | 420.00M | 383.00M | 370.00M | 414.00M | 443.00M | 484.00M | 607.00M | 569.00M | 592.00M | 657.00M | 431.00M | 415.00M | 381.00M | 321.00M | 269.00M | 466.00M | 157.07M | 103.89M | 89.93M | 80.28M | 68.31M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 135.90M | 80.70M | 47.10M | 34.10M | 21.20M | 15.50M | 9.90M |

| Other Expenses | 456.00M | 236.00M | 146.00M | 209.00M | 209.00M | 76.00M | 49.00M | 49.00M | -86.00M | 36.00M | -13.00M | 27.00M | 0.00 | 0.00 | 0.00 | 0.00 | -173.00M | 195.52M | 251.51M | 119.41M | 196.21M | 260.45M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| Operating Expenses | 935.00M | 656.00M | 529.00M | 579.00M | 623.00M | 637.00M | 829.00M | 691.00M | 774.00M | 837.00M | 933.00M | 694.00M | 686.00M | 381.00M | 321.00M | 17.53B | 293.00M | 352.59M | 355.40M | 209.34M | 276.49M | 328.75M | 343.31M | 354.51M | 363.80M | 365.20M | 310.50M | 314.90M | 309.40M | 184.10M | 203.80M | 146.30M | 85.50M | 69.60M | 45.80M | 36.40M | 33.20M |

| Cost & Expenses | 16.63B | 15.75B | 14.56B | 12.23B | 13.73B | 14.08B | 12.85B | 18.27B | 29.30B | 20.34B | 15.57B | 12.26B | 11.61B | 9.91B | 8.46B | 30.51B | 10.21B | 2.89B | 2.00B | 1.67B | 1.35B | 1.27B | 1.30B | 1.37B | 1.30B | 1.18B | 1.34B | 1.27B | 1.24B | 964.70M | 770.90M | 437.90M | 289.90M | 229.60M | 164.30M | 135.00M | 112.80M |

| Interest Income | 0.00 | 419.00M | 559.00M | 563.00M | 542.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 515.00M | 560.00M | 602.00M | 598.00M | 620.00M | 945.00M | 801.00M | 755.00M | 645.00M | 630.00M | 518.00M | 186.00M | 312.00M | 462.00M | 586.00M | 584.00M | 513.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.07B | 2.02B | 2.00B | 1.53B | 1.41B | 1.75B | 1.71B | 2.53B | 3.50B | 3.86B | 2.80B | 1.18B | 1.02B | 1.13B | 1.14B | 1.78B | 1.26B | 232.54M | 259.11M | 214.91M | 247.00M | 272.48M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| EBITDA | 8.59B | 9.29B | 10.26B | 3.92B | 2.25B | 6.22B | 5.27B | -187.00M | -10.27B | 4.07B | 8.23B | 6.85B | 10.15B | 10.01B | 7.42B | -10.94B | 7.91B | 3.13B | 2.44B | 918.49M | 1.10B | 912.61M | 826.82M | 777.89M | 876.40M | 851.70M | 878.10M | 812.20M | 716.60M | 322.70M | 222.90M | 342.00M | 216.00M | 240.00M | 228.20M | 220.90M | 100.50M |

| EBITDA Ratio | 37.58% | 40.65% | 44.56% | 25.01% | 13.53% | 34.23% | 32.40% | -5.27% | -63.05% | 23.30% | 39.50% | 38.65% | 49.31% | 53.71% | 51.31% | -61.28% | 47.80% | 54.21% | 58.73% | 34.35% | 53.69% | 48.56% | 45.26% | 42.47% | 46.88% | 48.89% | 43.67% | 42.58% | 39.07% | 24.01% | 24.31% | 46.87% | 45.45% | 55.01% | 61.32% | 65.64% | 52.42% |

| Operating Income | 6.23B | 7.04B | 8.37B | 2.44B | 536.00M | 4.75B | 3.63B | -2.79B | -13.38B | 97.00M | 5.35B | 5.81B | 9.14B | 9.07B | 6.50B | -12.71B | 6.56B | 2.87B | 2.18B | 703.58M | 823.31M | 640.14M | 542.93M | 494.33M | 583.20M | 574.30M | 664.20M | 638.20M | 592.50M | 247.60M | 155.00M | 276.40M | 177.60M | 204.50M | 203.60M | 200.00M | 77.20M |

| Operating Income Ratio | 27.24% | 30.89% | 36.62% | 17.16% | 3.72% | 25.52% | 22.15% | -18.83% | -84.29% | 0.45% | 25.58% | 32.28% | 43.77% | 47.77% | 43.24% | -71.42% | 38.70% | 49.54% | 52.10% | 29.66% | 37.22% | 33.51% | 29.53% | 26.45% | 30.90% | 32.68% | 33.20% | 33.50% | 32.30% | 20.42% | 16.74% | 38.70% | 37.99% | 47.11% | 55.34% | 59.70% | 40.63% |

| Total Other Income/Expenses | -219.00M | -322.00M | -707.00M | -640.00M | -785.00M | -862.00M | -731.00M | 360.00M | -746.00M | -521.00M | -438.00M | -327.00M | -322.00M | -556.00M | -687.00M | -599.00M | -444.00M | -42.88M | -140.35M | -129.19M | -239.53M | -226.92M | -184.15M | -257.77M | -251.00M | -249.90M | -187.80M | -164.80M | -104.90M | 6.00M | -26.70M | -42.80M | -30.00M | -26.30M | -15.00M | -17.00M | -9.30M |

| Income Before Tax | 6.01B | 6.72B | 7.66B | 1.80B | 306.00M | 3.89B | 2.90B | -3.47B | -14.02B | -424.00M | 4.91B | 5.49B | 8.82B | 8.51B | 5.82B | -13.31B | 6.13B | 2.83B | 2.04B | 574.38M | 583.78M | 413.22M | 358.78M | 236.56M | 332.20M | 324.40M | 476.40M | 473.40M | 487.60M | 253.60M | 128.30M | 233.60M | 147.60M | 178.20M | 188.60M | 183.00M | 67.90M |

| Income Before Tax Ratio | 26.28% | 29.48% | 33.53% | 12.66% | 2.12% | 20.89% | 17.69% | -23.41% | -88.31% | -1.98% | 23.48% | 30.47% | 42.23% | 44.84% | 38.67% | -74.79% | 36.21% | 48.80% | 48.74% | 24.22% | 26.39% | 21.63% | 19.51% | 12.66% | 17.60% | 18.46% | 23.81% | 24.85% | 26.58% | 20.92% | 13.86% | 32.70% | 31.57% | 41.05% | 51.26% | 54.63% | 35.74% |

| Income Tax Expense | 2.27B | 2.27B | 2.30B | 944.00M | 510.00M | 1.37B | 883.00M | 371.00M | -1.94B | 324.00M | 1.48B | 1.51B | 3.09B | 2.98B | 2.31B | -2.84B | 2.40B | 1.20B | 915.07M | 330.68M | 338.05M | 245.52M | 202.98M | 159.57M | 195.70M | 170.60M | 231.30M | 247.20M | 234.00M | 123.40M | 67.60M | 103.70M | 45.60M | 85.60M | 89.90M | 88.80M | 24.50M |

| Net Income | 1.84B | 3.47B | 4.31B | 853.00M | -204.00M | 2.26B | 1.82B | -4.32B | -12.20B | -1.27B | 2.66B | 3.04B | 4.56B | 4.34B | 2.75B | -11.07B | 2.98B | 1.46B | 995.13M | 202.27M | 181.66M | 164.65M | 113.03M | 76.99M | 136.50M | 153.80M | 245.10M | 226.20M | 253.60M | 130.20M | 50.80M | 129.90M | 96.20M | 92.60M | 98.70M | 94.20M | 43.40M |

| Net Income Ratio | 8.06% | 15.22% | 18.85% | 6.01% | -1.42% | 12.12% | 11.08% | -29.10% | -76.81% | -5.91% | 12.70% | 16.89% | 21.84% | 22.84% | 18.28% | -62.19% | 17.57% | 25.15% | 23.81% | 8.53% | 8.21% | 8.62% | 6.15% | 4.12% | 7.23% | 8.75% | 12.25% | 11.87% | 13.83% | 10.74% | 5.49% | 18.19% | 20.58% | 21.33% | 26.83% | 28.12% | 22.84% |

| EPS | 1.29 | 2.40 | 2.93 | 0.59 | -0.14 | 1.56 | 1.25 | -3.27 | -11.27 | -1.22 | 2.65 | 3.20 | 4.81 | 4.67 | 3.05 | -14.49 | 4.06 | 3.66 | 2.59 | 0.43 | 0.50 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| EPS Diluted | 1.28 | 2.39 | 2.90 | 0.58 | -0.14 | 1.55 | 1.25 | -3.27 | -11.27 | -1.22 | 2.64 | 3.19 | 4.78 | 4.57 | 2.93 | -14.49 | 3.75 | 3.32 | 2.34 | 0.43 | 0.49 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| Weighted Avg Shares Out | 1.43B | 1.44B | 1.47B | 1.45B | 1.45B | 1.45B | 1.45B | 1.32B | 1.08B | 1.04B | 1.00B | 949.00M | 947.00M | 916.00M | 828.00M | 764.00M | 682.00M | 382.00M | 360.54M | 364.54M | 311.61M | 289.30M | 287.90M | 307.99M | 327.23M | 350.71M | 393.40M | 388.00M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

| Weighted Avg Shares Out (Dil) | 1.44B | 1.45B | 1.48B | 1.46B | 1.45B | 1.46B | 1.45B | 1.32B | 1.08B | 1.04B | 1.01B | 954.00M | 955.00M | 948.00M | 938.00M | 764.00M | 794.00M | 442.00M | 440.94M | 369.85M | 318.20M | 292.84M | 289.88M | 309.04M | 329.13M | 350.71M | 393.40M | 392.36M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

Freeport-McMoRan (FCX) Registers a Bigger Fall Than the Market: Important Facts to Note

Prediction: Freeport McMoRan Stock Will Soar Over the Next 10 Years. 1 Reason Why.

Freeport-McMoRan (FCX) Rises Higher Than Market: Key Facts

Freeport-McMoRan Inc. (FCX) is Attracting Investor Attention: Here is What You Should Know

Freeport-McMoRan, Copper Demand Short-Term Pain, Long-Term Gain

Freeport-McMoRan Inc. (FCX) Is a Trending Stock: Facts to Know Before Betting on It

3 No-Brainer Long-Term Growth Stocks to Buy Right Now

Final Trades: Starbucks, Freeport-McMoran, Constellation Energy and the XLU

Gold At Record High: Why Isn't FCX Stock Following Suite?

Should You Buy Freeport McMoRan While It's Below $50?

Source: https://incomestatements.info

Category: Stock Reports