See more : Universal Health Services, Inc. (UHS) Income Statement Analysis – Financial Results

Complete financial analysis of Freeport-McMoRan Inc. (FCX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Freeport-McMoRan Inc., a leading company in the Copper industry within the Basic Materials sector.

- CES Energy Solutions Corp. (CEU.TO) Income Statement Analysis – Financial Results

- Grupo Bafar, S.A.B. de C.V. (BAFARB.MX) Income Statement Analysis – Financial Results

- Operadora de Sites Mexicanos, S.A.B. de C.V. (OPMXF) Income Statement Analysis – Financial Results

- DKS Co. Ltd. (4461.T) Income Statement Analysis – Financial Results

- Microchip Technology Incorporated (0K19.L) Income Statement Analysis – Financial Results

Freeport-McMoRan Inc. (FCX)

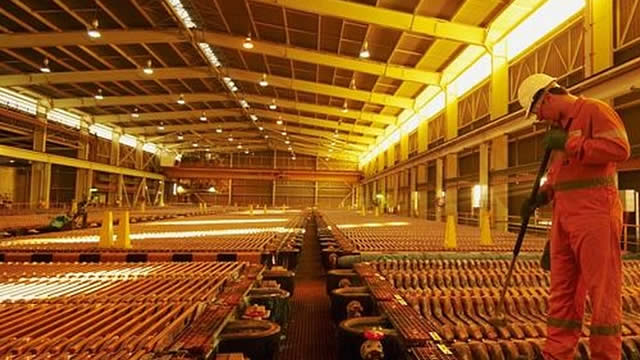

About Freeport-McMoRan Inc.

Freeport-McMoRan Inc. engages in the mining of mineral properties in North America, South America, and Indonesia. The company primarily explores for copper, gold, molybdenum, silver, and other metals, as well as oil and gas. Its assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Tyrone and Chino in New Mexico; and Henderson and Climax in Colorado, North America, as well as Cerro Verde in Peru and El Abra in Chile. The company also operates a portfolio of oil and gas properties primarily located in offshore California and the Gulf of Mexico. As of December 31, 2021, it operated approximately 135 wells. The company was formerly known as Freeport-McMoRan Copper & Gold Inc. and changed its name to Freeport-McMoRan Inc. in July 2014. Freeport-McMoRan Inc. was incorporated in 1987 and is headquartered in Phoenix, Arizona.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 22.86B | 22.78B | 22.85B | 14.20B | 14.40B | 18.63B | 16.40B | 14.83B | 15.88B | 21.44B | 20.92B | 18.01B | 20.88B | 18.98B | 15.04B | 17.80B | 16.94B | 5.79B | 4.18B | 2.37B | 2.21B | 1.91B | 1.84B | 1.87B | 1.89B | 1.76B | 2.00B | 1.91B | 1.83B | 1.21B | 925.90M | 714.30M | 467.50M | 434.10M | 367.90M | 335.00M | 190.00M |

| Cost of Revenue | 15.70B | 15.09B | 14.03B | 11.66B | 13.11B | 13.45B | 12.02B | 17.58B | 28.52B | 19.50B | 14.64B | 11.56B | 10.92B | 9.53B | 8.14B | 12.98B | 9.92B | 2.54B | 1.65B | 1.46B | 1.08B | 941.57M | 952.63M | 1.02B | 940.30M | 817.60M | 1.03B | 951.90M | 932.40M | 780.60M | 567.10M | 291.60M | 204.40M | 160.00M | 118.50M | 98.60M | 79.60M |

| Gross Profit | 7.16B | 7.69B | 8.82B | 2.54B | 1.30B | 5.18B | 4.38B | -2.75B | -12.65B | 1.93B | 6.28B | 6.45B | 9.96B | 9.45B | 6.90B | 4.82B | 7.02B | 3.25B | 2.53B | 912.91M | 1.13B | 968.89M | 886.24M | 848.84M | 947.00M | 939.50M | 974.70M | 953.10M | 901.90M | 431.70M | 358.80M | 422.70M | 263.10M | 274.10M | 249.40M | 236.40M | 110.40M |

| Gross Profit Ratio | 31.33% | 33.76% | 38.59% | 17.91% | 9.01% | 27.82% | 26.71% | -18.54% | -79.66% | 9.02% | 30.04% | 35.81% | 47.70% | 49.78% | 45.88% | 27.06% | 41.45% | 56.18% | 60.60% | 38.49% | 51.28% | 50.71% | 48.19% | 45.43% | 50.18% | 53.47% | 48.71% | 50.03% | 49.17% | 35.61% | 38.75% | 59.18% | 56.28% | 63.14% | 67.79% | 70.57% | 58.11% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 271.00M | 0.00 | 90.00M | 292.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.91M | 19.43M | 18.06M | 14.94M | 4.33M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 131.16M | 84.45M | 71.87M | 65.34M | 63.98M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 479.00M | 420.00M | 383.00M | 370.00M | 414.00M | 443.00M | 484.00M | 607.00M | 569.00M | 592.00M | 657.00M | 431.00M | 415.00M | 381.00M | 321.00M | 269.00M | 466.00M | 157.07M | 103.89M | 89.93M | 80.28M | 68.31M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 135.90M | 80.70M | 47.10M | 34.10M | 21.20M | 15.50M | 9.90M |

| Other Expenses | 456.00M | 236.00M | 146.00M | 209.00M | 209.00M | 76.00M | 49.00M | 49.00M | -86.00M | 36.00M | -13.00M | 27.00M | 0.00 | 0.00 | 0.00 | 0.00 | -173.00M | 195.52M | 251.51M | 119.41M | 196.21M | 260.45M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| Operating Expenses | 935.00M | 656.00M | 529.00M | 579.00M | 623.00M | 637.00M | 829.00M | 691.00M | 774.00M | 837.00M | 933.00M | 694.00M | 686.00M | 381.00M | 321.00M | 17.53B | 293.00M | 352.59M | 355.40M | 209.34M | 276.49M | 328.75M | 343.31M | 354.51M | 363.80M | 365.20M | 310.50M | 314.90M | 309.40M | 184.10M | 203.80M | 146.30M | 85.50M | 69.60M | 45.80M | 36.40M | 33.20M |

| Cost & Expenses | 16.62B | 15.75B | 14.56B | 12.23B | 13.73B | 14.08B | 12.85B | 18.27B | 29.30B | 20.34B | 15.57B | 12.26B | 11.61B | 9.91B | 8.46B | 30.51B | 10.21B | 2.89B | 2.00B | 1.67B | 1.35B | 1.27B | 1.30B | 1.37B | 1.30B | 1.18B | 1.34B | 1.27B | 1.24B | 964.70M | 770.90M | 437.90M | 289.90M | 229.60M | 164.30M | 135.00M | 112.80M |

| Interest Income | 0.00 | 419.00M | 559.00M | 563.00M | 542.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 515.00M | 560.00M | 602.00M | 598.00M | 620.00M | 945.00M | 801.00M | 755.00M | 645.00M | 630.00M | 518.00M | 186.00M | 312.00M | 462.00M | 586.00M | 584.00M | 513.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.07B | 2.02B | 2.00B | 1.53B | 1.41B | 1.75B | 1.71B | 2.53B | 3.50B | 3.86B | 2.80B | 1.18B | 1.02B | 1.13B | 1.14B | 1.78B | 1.26B | 232.54M | 259.11M | 214.91M | 247.00M | 272.48M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| EBITDA | 8.59B | 9.29B | 10.26B | 3.92B | 2.25B | 6.22B | 5.27B | -187.00M | -10.27B | 4.07B | 8.23B | 6.85B | 10.15B | 10.01B | 7.42B | -10.94B | 7.91B | 3.13B | 2.44B | 918.49M | 1.10B | 912.61M | 826.82M | 777.89M | 876.40M | 851.70M | 878.10M | 812.20M | 716.60M | 322.70M | 222.90M | 342.00M | 216.00M | 240.00M | 228.20M | 220.90M | 100.50M |

| EBITDA Ratio | 37.58% | 40.65% | 44.56% | 25.01% | 13.53% | 34.23% | 32.40% | -5.27% | -63.05% | 23.30% | 39.50% | 38.65% | 49.31% | 53.71% | 51.31% | -61.28% | 47.80% | 54.21% | 58.73% | 34.35% | 53.69% | 48.56% | 45.26% | 42.47% | 46.88% | 48.89% | 43.67% | 42.58% | 39.07% | 24.01% | 24.31% | 46.87% | 45.45% | 55.01% | 61.32% | 65.64% | 52.42% |

| Operating Income | 6.23B | 7.04B | 8.37B | 2.44B | 536.00M | 4.75B | 3.63B | -2.79B | -13.38B | 97.00M | 5.35B | 5.81B | 9.14B | 9.07B | 6.50B | -12.71B | 6.56B | 2.87B | 2.18B | 703.58M | 823.31M | 640.14M | 542.93M | 494.33M | 583.20M | 574.30M | 664.20M | 638.20M | 592.50M | 247.60M | 155.00M | 276.40M | 177.60M | 204.50M | 203.60M | 200.00M | 77.20M |

| Operating Income Ratio | 27.24% | 30.89% | 36.62% | 17.16% | 3.72% | 25.52% | 22.15% | -18.83% | -84.29% | 0.45% | 25.58% | 32.28% | 43.77% | 47.77% | 43.24% | -71.42% | 38.70% | 49.54% | 52.10% | 29.66% | 37.22% | 33.51% | 29.53% | 26.45% | 30.90% | 32.68% | 33.20% | 33.50% | 32.30% | 20.42% | 16.74% | 38.70% | 37.99% | 47.11% | 55.34% | 59.70% | 40.63% |

| Total Other Income/Expenses | -219.00M | -322.00M | -707.00M | -640.00M | -785.00M | -862.00M | -731.00M | 360.00M | -746.00M | -521.00M | -438.00M | -327.00M | -322.00M | -556.00M | -687.00M | -599.00M | -444.00M | -42.88M | -140.35M | -129.19M | -239.53M | -226.92M | -184.15M | -257.77M | -251.00M | -249.90M | -187.80M | -164.80M | -104.90M | 6.00M | -26.70M | -42.80M | -30.00M | -26.30M | -15.00M | -17.00M | -9.30M |

| Income Before Tax | 6.01B | 6.72B | 7.66B | 1.80B | 306.00M | 3.89B | 2.90B | -3.47B | -14.02B | -424.00M | 4.91B | 5.49B | 8.82B | 8.51B | 5.82B | -13.31B | 6.13B | 2.83B | 2.04B | 574.38M | 583.78M | 413.22M | 358.78M | 236.56M | 332.20M | 324.40M | 476.40M | 473.40M | 487.60M | 253.60M | 128.30M | 233.60M | 147.60M | 178.20M | 188.60M | 183.00M | 67.90M |

| Income Before Tax Ratio | 26.28% | 29.48% | 33.53% | 12.66% | 2.12% | 20.89% | 17.69% | -23.41% | -88.31% | -1.98% | 23.48% | 30.47% | 42.23% | 44.84% | 38.67% | -74.79% | 36.21% | 48.80% | 48.74% | 24.22% | 26.39% | 21.63% | 19.51% | 12.66% | 17.60% | 18.46% | 23.81% | 24.85% | 26.58% | 20.92% | 13.86% | 32.70% | 31.57% | 41.05% | 51.26% | 54.63% | 35.74% |

| Income Tax Expense | 2.27B | 2.27B | 2.30B | 944.00M | 510.00M | 1.37B | 883.00M | 371.00M | -1.94B | 324.00M | 1.48B | 1.51B | 3.09B | 2.98B | 2.31B | -2.84B | 2.40B | 1.20B | 915.07M | 330.68M | 338.05M | 245.52M | 202.98M | 159.57M | 195.70M | 170.60M | 231.30M | 247.20M | 234.00M | 123.40M | 67.60M | 103.70M | 45.60M | 85.60M | 89.90M | 88.80M | 24.50M |

| Net Income | 1.84B | 3.47B | 4.31B | 853.00M | -204.00M | 2.26B | 1.82B | -4.32B | -12.20B | -1.27B | 2.66B | 3.04B | 4.56B | 4.34B | 2.75B | -11.07B | 2.98B | 1.46B | 995.13M | 202.27M | 181.66M | 164.65M | 113.03M | 76.99M | 136.50M | 153.80M | 245.10M | 226.20M | 253.60M | 130.20M | 50.80M | 129.90M | 96.20M | 92.60M | 98.70M | 94.20M | 43.40M |

| Net Income Ratio | 8.06% | 15.22% | 18.85% | 6.01% | -1.42% | 12.12% | 11.08% | -29.10% | -76.81% | -5.91% | 12.70% | 16.89% | 21.84% | 22.84% | 18.28% | -62.19% | 17.57% | 25.15% | 23.81% | 8.53% | 8.21% | 8.62% | 6.15% | 4.12% | 7.23% | 8.75% | 12.25% | 11.87% | 13.83% | 10.74% | 5.49% | 18.19% | 20.58% | 21.33% | 26.83% | 28.12% | 22.84% |

| EPS | 1.29 | 2.40 | 2.93 | 0.59 | -0.14 | 1.56 | 1.25 | -3.27 | -11.27 | -1.22 | 2.65 | 3.20 | 4.81 | 4.67 | 3.05 | -14.49 | 4.06 | 3.66 | 2.59 | 0.43 | 0.50 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| EPS Diluted | 1.28 | 2.39 | 2.90 | 0.58 | -0.14 | 1.55 | 1.25 | -3.27 | -11.27 | -1.22 | 2.64 | 3.19 | 4.78 | 4.57 | 2.93 | -14.49 | 3.75 | 3.32 | 2.34 | 0.43 | 0.49 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| Weighted Avg Shares Out | 1.43B | 1.44B | 1.47B | 1.45B | 1.45B | 1.45B | 1.45B | 1.32B | 1.08B | 1.04B | 1.00B | 949.00M | 947.00M | 916.00M | 828.00M | 764.00M | 682.00M | 382.00M | 360.54M | 364.54M | 311.61M | 289.30M | 287.90M | 307.99M | 327.23M | 350.71M | 393.40M | 388.00M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

| Weighted Avg Shares Out (Dil) | 1.44B | 1.45B | 1.48B | 1.46B | 1.45B | 1.46B | 1.45B | 1.32B | 1.08B | 1.04B | 1.01B | 954.00M | 955.00M | 948.00M | 938.00M | 764.00M | 794.00M | 442.00M | 440.94M | 369.85M | 318.20M | 292.84M | 289.88M | 309.04M | 329.13M | 350.71M | 393.40M | 392.36M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

Freeport-McMoRan: Good Value Proposition If You Know What You Are Buying

Freeport-McMoRan Inc. (FCX) is Attracting Investor Attention: Here is What You Should Know

Freeport-McMoRan Q3 Earnings: The Market Is Not Impressed

Freeport-McMoRan Inc. (FCX) Q3 2024 Earnings Call Transcript

Freeport-McMoRan's Earnings Miss Estimates in Q3, Revenues Beat

Freeport-McMoRan (FCX) Lags Q3 Earnings Estimates

What's in Store for Freeport-McMoRan Stock This Earnings Season?

Prediction: Freeport McMoRan Will Soar Over the Next 10 Years. Here's Why.

Freeport-McMoRan Stock: Buy, Sell, or Hold?

Teck Resources Vs. Freeport-McMoRan: China Stimulus Boost Or Trump Tariff Blues?

Source: https://incomestatements.info

Category: Stock Reports