See more : Kensington Capital Acquisition Corp. IV (KCAC-UN) Income Statement Analysis – Financial Results

Complete financial analysis of Freeport-McMoRan Inc. (FCX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Freeport-McMoRan Inc., a leading company in the Copper industry within the Basic Materials sector.

- Phillips 66 (0KHZ.L) Income Statement Analysis – Financial Results

- Kurita Water Industries Ltd. (KTWIF) Income Statement Analysis – Financial Results

- Jiangyin Haida Rubber And Plastic Co., Ltd. (300320.SZ) Income Statement Analysis – Financial Results

- SPARINVEST BÆREDYGTIGE AKTIER AKK (SPIBDAAKKKLA.CO) Income Statement Analysis – Financial Results

- SiS Distribution (Thailand) Public Company Limited (SIS.BK) Income Statement Analysis – Financial Results

Freeport-McMoRan Inc. (FCX)

About Freeport-McMoRan Inc.

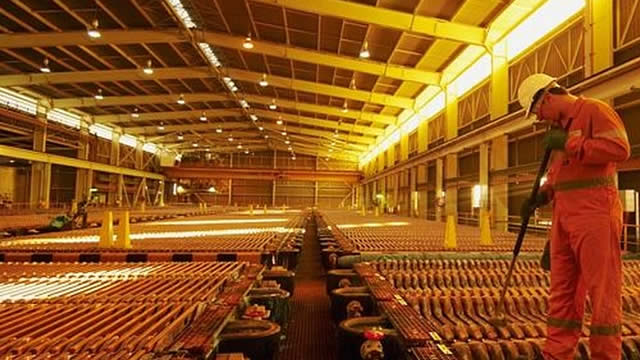

Freeport-McMoRan Inc. engages in the mining of mineral properties in North America, South America, and Indonesia. The company primarily explores for copper, gold, molybdenum, silver, and other metals, as well as oil and gas. Its assets include the Grasberg minerals district in Indonesia; Morenci, Bagdad, Safford, Sierrita, and Miami in Arizona; Tyrone and Chino in New Mexico; and Henderson and Climax in Colorado, North America, as well as Cerro Verde in Peru and El Abra in Chile. The company also operates a portfolio of oil and gas properties primarily located in offshore California and the Gulf of Mexico. As of December 31, 2021, it operated approximately 135 wells. The company was formerly known as Freeport-McMoRan Copper & Gold Inc. and changed its name to Freeport-McMoRan Inc. in July 2014. Freeport-McMoRan Inc. was incorporated in 1987 and is headquartered in Phoenix, Arizona.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 22.86B | 22.78B | 22.85B | 14.20B | 14.40B | 18.63B | 16.40B | 14.83B | 15.88B | 21.44B | 20.92B | 18.01B | 20.88B | 18.98B | 15.04B | 17.80B | 16.94B | 5.79B | 4.18B | 2.37B | 2.21B | 1.91B | 1.84B | 1.87B | 1.89B | 1.76B | 2.00B | 1.91B | 1.83B | 1.21B | 925.90M | 714.30M | 467.50M | 434.10M | 367.90M | 335.00M | 190.00M |

| Cost of Revenue | 15.70B | 15.09B | 14.03B | 11.66B | 13.11B | 13.45B | 12.02B | 17.58B | 28.52B | 19.50B | 14.64B | 11.56B | 10.92B | 9.53B | 8.14B | 12.98B | 9.92B | 2.54B | 1.65B | 1.46B | 1.08B | 941.57M | 952.63M | 1.02B | 940.30M | 817.60M | 1.03B | 951.90M | 932.40M | 780.60M | 567.10M | 291.60M | 204.40M | 160.00M | 118.50M | 98.60M | 79.60M |

| Gross Profit | 7.16B | 7.69B | 8.82B | 2.54B | 1.30B | 5.18B | 4.38B | -2.75B | -12.65B | 1.93B | 6.28B | 6.45B | 9.96B | 9.45B | 6.90B | 4.82B | 7.02B | 3.25B | 2.53B | 912.91M | 1.13B | 968.89M | 886.24M | 848.84M | 947.00M | 939.50M | 974.70M | 953.10M | 901.90M | 431.70M | 358.80M | 422.70M | 263.10M | 274.10M | 249.40M | 236.40M | 110.40M |

| Gross Profit Ratio | 31.33% | 33.76% | 38.59% | 17.91% | 9.01% | 27.82% | 26.71% | -18.54% | -79.66% | 9.02% | 30.04% | 35.81% | 47.70% | 49.78% | 45.88% | 27.06% | 41.45% | 56.18% | 60.60% | 38.49% | 51.28% | 50.71% | 48.19% | 45.43% | 50.18% | 53.47% | 48.71% | 50.03% | 49.17% | 35.61% | 38.75% | 59.18% | 56.28% | 63.14% | 67.79% | 70.57% | 58.11% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 271.00M | 0.00 | 90.00M | 292.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 25.91M | 19.43M | 18.06M | 14.94M | 4.33M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 131.16M | 84.45M | 71.87M | 65.34M | 63.98M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 479.00M | 420.00M | 383.00M | 370.00M | 414.00M | 443.00M | 484.00M | 607.00M | 569.00M | 592.00M | 657.00M | 431.00M | 415.00M | 381.00M | 321.00M | 269.00M | 466.00M | 157.07M | 103.89M | 89.93M | 80.28M | 68.31M | 59.42M | 70.95M | 70.60M | 87.80M | 96.60M | 140.90M | 185.30M | 109.00M | 135.90M | 80.70M | 47.10M | 34.10M | 21.20M | 15.50M | 9.90M |

| Other Expenses | 456.00M | 236.00M | 146.00M | 209.00M | 209.00M | 76.00M | 49.00M | 49.00M | -86.00M | 36.00M | -13.00M | 27.00M | 0.00 | 0.00 | 0.00 | 0.00 | -173.00M | 195.52M | 251.51M | 119.41M | 196.21M | 260.45M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| Operating Expenses | 935.00M | 656.00M | 529.00M | 579.00M | 623.00M | 637.00M | 829.00M | 691.00M | 774.00M | 837.00M | 933.00M | 694.00M | 686.00M | 381.00M | 321.00M | 17.53B | 293.00M | 352.59M | 355.40M | 209.34M | 276.49M | 328.75M | 343.31M | 354.51M | 363.80M | 365.20M | 310.50M | 314.90M | 309.40M | 184.10M | 203.80M | 146.30M | 85.50M | 69.60M | 45.80M | 36.40M | 33.20M |

| Cost & Expenses | 16.62B | 15.75B | 14.56B | 12.23B | 13.73B | 14.08B | 12.85B | 18.27B | 29.30B | 20.34B | 15.57B | 12.26B | 11.61B | 9.91B | 8.46B | 30.51B | 10.21B | 2.89B | 2.00B | 1.67B | 1.35B | 1.27B | 1.30B | 1.37B | 1.30B | 1.18B | 1.34B | 1.27B | 1.24B | 964.70M | 770.90M | 437.90M | 289.90M | 229.60M | 164.30M | 135.00M | 112.80M |

| Interest Income | 0.00 | 419.00M | 559.00M | 563.00M | 542.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 515.00M | 560.00M | 602.00M | 598.00M | 620.00M | 945.00M | 801.00M | 755.00M | 645.00M | 630.00M | 518.00M | 186.00M | 312.00M | 462.00M | 586.00M | 584.00M | 513.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.07B | 2.02B | 2.00B | 1.53B | 1.41B | 1.75B | 1.71B | 2.53B | 3.50B | 3.86B | 2.80B | 1.18B | 1.02B | 1.13B | 1.14B | 1.78B | 1.26B | 232.54M | 259.11M | 214.91M | 247.00M | 272.48M | 283.89M | 283.56M | 293.20M | 277.40M | 213.90M | 174.00M | 124.10M | 75.10M | 67.90M | 65.60M | 38.40M | 35.50M | 24.60M | 20.90M | 23.30M |

| EBITDA | 8.59B | 9.29B | 10.26B | 3.92B | 2.25B | 6.22B | 5.27B | -187.00M | -10.27B | 4.07B | 8.23B | 6.85B | 10.15B | 10.01B | 7.42B | -10.94B | 7.91B | 3.13B | 2.44B | 918.49M | 1.10B | 912.61M | 826.82M | 777.89M | 876.40M | 851.70M | 878.10M | 812.20M | 716.60M | 322.70M | 222.90M | 342.00M | 216.00M | 240.00M | 228.20M | 220.90M | 100.50M |

| EBITDA Ratio | 37.58% | 40.65% | 44.56% | 25.01% | 13.53% | 34.23% | 32.40% | -5.27% | -63.05% | 23.30% | 39.50% | 38.65% | 49.31% | 53.71% | 51.31% | -61.28% | 47.80% | 54.21% | 58.73% | 34.35% | 53.69% | 48.56% | 45.26% | 42.47% | 46.88% | 48.89% | 43.67% | 42.58% | 39.07% | 24.01% | 24.31% | 46.87% | 45.45% | 55.01% | 61.32% | 65.64% | 52.42% |

| Operating Income | 6.23B | 7.04B | 8.37B | 2.44B | 536.00M | 4.75B | 3.63B | -2.79B | -13.38B | 97.00M | 5.35B | 5.81B | 9.14B | 9.07B | 6.50B | -12.71B | 6.56B | 2.87B | 2.18B | 703.58M | 823.31M | 640.14M | 542.93M | 494.33M | 583.20M | 574.30M | 664.20M | 638.20M | 592.50M | 247.60M | 155.00M | 276.40M | 177.60M | 204.50M | 203.60M | 200.00M | 77.20M |

| Operating Income Ratio | 27.24% | 30.89% | 36.62% | 17.16% | 3.72% | 25.52% | 22.15% | -18.83% | -84.29% | 0.45% | 25.58% | 32.28% | 43.77% | 47.77% | 43.24% | -71.42% | 38.70% | 49.54% | 52.10% | 29.66% | 37.22% | 33.51% | 29.53% | 26.45% | 30.90% | 32.68% | 33.20% | 33.50% | 32.30% | 20.42% | 16.74% | 38.70% | 37.99% | 47.11% | 55.34% | 59.70% | 40.63% |

| Total Other Income/Expenses | -219.00M | -322.00M | -707.00M | -640.00M | -785.00M | -862.00M | -731.00M | 360.00M | -746.00M | -521.00M | -438.00M | -327.00M | -322.00M | -556.00M | -687.00M | -599.00M | -444.00M | -42.88M | -140.35M | -129.19M | -239.53M | -226.92M | -184.15M | -257.77M | -251.00M | -249.90M | -187.80M | -164.80M | -104.90M | 6.00M | -26.70M | -42.80M | -30.00M | -26.30M | -15.00M | -17.00M | -9.30M |

| Income Before Tax | 6.01B | 6.72B | 7.66B | 1.80B | 306.00M | 3.89B | 2.90B | -3.47B | -14.02B | -424.00M | 4.91B | 5.49B | 8.82B | 8.51B | 5.82B | -13.31B | 6.13B | 2.83B | 2.04B | 574.38M | 583.78M | 413.22M | 358.78M | 236.56M | 332.20M | 324.40M | 476.40M | 473.40M | 487.60M | 253.60M | 128.30M | 233.60M | 147.60M | 178.20M | 188.60M | 183.00M | 67.90M |

| Income Before Tax Ratio | 26.28% | 29.48% | 33.53% | 12.66% | 2.12% | 20.89% | 17.69% | -23.41% | -88.31% | -1.98% | 23.48% | 30.47% | 42.23% | 44.84% | 38.67% | -74.79% | 36.21% | 48.80% | 48.74% | 24.22% | 26.39% | 21.63% | 19.51% | 12.66% | 17.60% | 18.46% | 23.81% | 24.85% | 26.58% | 20.92% | 13.86% | 32.70% | 31.57% | 41.05% | 51.26% | 54.63% | 35.74% |

| Income Tax Expense | 2.27B | 2.27B | 2.30B | 944.00M | 510.00M | 1.37B | 883.00M | 371.00M | -1.94B | 324.00M | 1.48B | 1.51B | 3.09B | 2.98B | 2.31B | -2.84B | 2.40B | 1.20B | 915.07M | 330.68M | 338.05M | 245.52M | 202.98M | 159.57M | 195.70M | 170.60M | 231.30M | 247.20M | 234.00M | 123.40M | 67.60M | 103.70M | 45.60M | 85.60M | 89.90M | 88.80M | 24.50M |

| Net Income | 1.84B | 3.47B | 4.31B | 853.00M | -204.00M | 2.26B | 1.82B | -4.32B | -12.20B | -1.27B | 2.66B | 3.04B | 4.56B | 4.34B | 2.75B | -11.07B | 2.98B | 1.46B | 995.13M | 202.27M | 181.66M | 164.65M | 113.03M | 76.99M | 136.50M | 153.80M | 245.10M | 226.20M | 253.60M | 130.20M | 50.80M | 129.90M | 96.20M | 92.60M | 98.70M | 94.20M | 43.40M |

| Net Income Ratio | 8.06% | 15.22% | 18.85% | 6.01% | -1.42% | 12.12% | 11.08% | -29.10% | -76.81% | -5.91% | 12.70% | 16.89% | 21.84% | 22.84% | 18.28% | -62.19% | 17.57% | 25.15% | 23.81% | 8.53% | 8.21% | 8.62% | 6.15% | 4.12% | 7.23% | 8.75% | 12.25% | 11.87% | 13.83% | 10.74% | 5.49% | 18.19% | 20.58% | 21.33% | 26.83% | 28.12% | 22.84% |

| EPS | 1.29 | 2.40 | 2.93 | 0.59 | -0.14 | 1.56 | 1.25 | -3.27 | -11.27 | -1.22 | 2.65 | 3.20 | 4.81 | 4.67 | 3.05 | -14.49 | 4.06 | 3.66 | 2.59 | 0.43 | 0.50 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| EPS Diluted | 1.28 | 2.39 | 2.90 | 0.58 | -0.14 | 1.55 | 1.25 | -3.27 | -11.27 | -1.22 | 2.64 | 3.19 | 4.78 | 4.57 | 2.93 | -14.49 | 3.75 | 3.32 | 2.34 | 0.43 | 0.49 | 0.44 | 0.27 | 0.13 | 0.31 | 0.34 | 0.53 | 0.45 | 0.49 | 0.19 | 0.06 | 0.33 | 0.27 | 0.27 | 0.29 | 0.23 | 0.11 |

| Weighted Avg Shares Out | 1.43B | 1.44B | 1.47B | 1.45B | 1.45B | 1.45B | 1.45B | 1.32B | 1.08B | 1.04B | 1.00B | 949.00M | 947.00M | 916.00M | 828.00M | 764.00M | 682.00M | 382.00M | 360.54M | 364.54M | 311.61M | 289.30M | 287.90M | 307.99M | 327.23M | 350.71M | 393.40M | 388.00M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

| Weighted Avg Shares Out (Dil) | 1.44B | 1.45B | 1.48B | 1.46B | 1.45B | 1.46B | 1.45B | 1.32B | 1.08B | 1.04B | 1.01B | 954.00M | 955.00M | 948.00M | 938.00M | 764.00M | 794.00M | 442.00M | 440.94M | 369.85M | 318.20M | 292.84M | 289.88M | 309.04M | 329.13M | 350.71M | 393.40M | 392.36M | 408.81M | 411.51M | 396.36M | 372.42M | 363.02M | 342.96M | 339.66M | 412.68M | 412.68M |

Why Shares in This Hot Copper Mining Stock Soared This Week

Copper Loves the Fed Cut. 6 Sleeper Stocks to Play Catch-Up.

Investors Heavily Search Freeport-McMoRan Inc. (FCX): Here is What You Need to Know

5 Non-Ferrous Metal Mining Stocks to Watch Despite Industry Concerns

Freeport-McMoRan (FCX) Moves 7.9% Higher: Will This Strength Last?

S&P 500 Gains and Losses Today: Economic Stimulus Boosts China-Facing Stocks

Freeport-McMoRan Stock Soars as Copper and Gold Prices Rise

3 Mining Stocks Up on China Tailwinds

Freeport-McMoRan (FCX) Falls More Steeply Than Broader Market: What Investors Need to Know

Trade Tracker: Kevin Simpson buys more Freeport-McMoran

Source: https://incomestatements.info

Category: Stock Reports