See more : WashTec AG (WHTAF) Income Statement Analysis – Financial Results

Complete financial analysis of Gravity Co., Ltd. (GRVY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gravity Co., Ltd., a leading company in the Electronic Gaming & Multimedia industry within the Technology sector.

- Kutcho Copper Corp. (KCCFF) Income Statement Analysis – Financial Results

- Sourcenext Corporation (4344.T) Income Statement Analysis – Financial Results

- Caribbean Utilities Company, Ltd. (CUP-U.TO) Income Statement Analysis – Financial Results

- Belysse Group NV (0RQK.L) Income Statement Analysis – Financial Results

- V-Guard Industries Limited (VGUARD.NS) Income Statement Analysis – Financial Results

Gravity Co., Ltd. (GRVY)

About Gravity Co., Ltd.

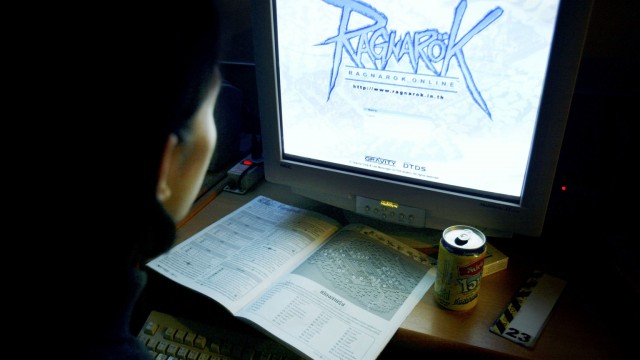

Gravity Co., Ltd. develops and publishes online and mobile games in South Korea, Taiwan, Thailand, and Japan. The company offers a massively multiplayer online role-playing game, including Ragnarok Online, Dragonica, Ragnarok Online II, and Ragnarok Prequel II. Its mobile games portfolio includes Ragnarok M: Eternal Love; Ragnarok Origin; Ragnarok X: Next Generation; the Labyrinth of Ragnarok; Ragnarok Poring Merge; Tera Classic; Ragnarok: The Lost Memories; Sadako M; NBA: Rise To Stardom; Milkmaid Of The Milky Way; and Paladog Tactics. The company also provides console games, such as Ragnarok DS for Nintendo DS; Ragnarok: The Princess of Light and Darkness for PlayStation Portable; Ragnarok Odyssey for PlayStation Vita; Double Dragon II for Xbox 360; Ragnarok Odyssey Ace for PlayStation Vita and PlayStation 3; and GRANDIA HD Collection for Nintendo Switch. In addition, it offers games for IPTV, including Pororo: The Little Penguin; and markets dolls, stationery, food, and other character-based merchandises, as well as game manuals, monthly magazines, and other publications. Further, the company provides system development and maintenance services, as well as system integration services to third parties. As of December 31, 2021, it owned 156 registered domain names. The company was incorporated in 2000 and is headquartered in Seoul, South Korea. Gravity Co., Ltd. is a subsidiary of GungHo Online Entertainment, Inc.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 725.52B | 463.62B | 413.94B | 405.95B | 360.97B | 286.77B | 141.62B | 34.96B | 35.66B | 35.36B | 42.44B | 51.95B | 40.22B | 38.98B | 43.95B | 53.17B | 40.25B | 39.07B | 52.82B | 62.26B | 46.04B | 9.49B | 0.00 | 405.00M |

| Cost of Revenue | 484.96B | 267.37B | 224.17B | 239.04B | 265.79B | 210.04B | 94.23B | 14.05B | 30.28B | 30.62B | 30.92B | 28.67B | 11.33B | 12.13B | 13.78B | 27.77B | 19.49B | 16.93B | 15.87B | 9.96B | 7.45B | 1.19B | 0.00 | 336.00M |

| Gross Profit | 240.56B | 196.25B | 189.77B | 166.91B | 95.18B | 76.73B | 47.39B | 20.91B | 5.38B | 4.75B | 11.51B | 23.28B | 28.90B | 26.85B | 30.17B | 25.40B | 20.76B | 22.14B | 36.95B | 52.30B | 38.59B | 8.30B | 0.00 | 69.00M |

| Gross Profit Ratio | 33.16% | 42.33% | 45.84% | 41.12% | 26.37% | 26.76% | 33.46% | 59.80% | 15.08% | 13.42% | 27.13% | 44.81% | 71.84% | 68.89% | 68.65% | 47.77% | 51.58% | 56.68% | 69.96% | 84.00% | 83.82% | 87.50% | 0.00% | 17.04% |

| Research & Development | 13.49B | 13.80B | 16.57B | 15.03B | 9.50B | 7.08B | 5.24B | 1.97B | 5.28B | 4.85B | 6.22B | 5.13B | 1.74B | 4.65B | 1.80B | 2.15B | 5.76B | 8.81B | 9.12B | 1.96B | 1.73B | 1.19B | 1.31B | 208.00M |

| General & Administrative | 47.70B | 43.59B | 36.59B | 30.29B | 20.42B | 17.68B | 15.27B | 12.81B | 9.60B | 14.26B | 10.91B | 12.52B | 10.21B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 13.66B | 29.90B | 35.95B | 30.08B | 14.95B | 17.26B | 12.53B | 2.41B | 1.88B | 1.61B | 2.62B | 4.37B | 6.80B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 61.36B | 91.41B | 92.20B | 60.38B | 35.37B | 34.94B | 33.25B | 15.22B | 11.48B | 15.87B | 13.54B | 16.89B | 17.01B | 20.41B | 18.40B | 23.49B | 29.05B | 26.28B | 30.47B | 13.25B | 12.06B | 4.74B | 0.00 | 211.00M |

| Other Expenses | 5.35B | -13.80B | -16.57B | 1.97B | 1.47B | 92.04M | -64.87M | 290.59M | 624.00M | 57.81M | 209.00M | 702.84M | 5.75B | 20.42B | 23.30B | 23.49B | 37.67B | 24.97B | 30.47B | 13.25B | 12.06B | 4.74B | 0.00 | 211.00M |

| Operating Expenses | 80.19B | 91.41B | 92.20B | 77.38B | 46.34B | 42.84B | 33.25B | 15.22B | 16.76B | 15.87B | 20.24B | 22.55B | 20.43B | 20.41B | 18.40B | 25.63B | 43.43B | 33.78B | 39.59B | 15.22B | 13.79B | 5.93B | 1.31B | 419.00M |

| Cost & Expenses | 565.15B | 358.78B | 316.37B | 316.43B | 312.13B | 252.88B | 127.49B | 29.27B | 47.04B | 46.49B | 51.17B | 51.22B | 31.76B | 32.54B | 32.18B | 53.41B | 62.92B | 50.71B | 55.46B | 25.17B | 21.24B | 7.12B | 1.31B | 755.00M |

| Interest Income | 11.49B | 13.21B | 1.27B | 902.00M | 1.35B | 807.22M | 541.00M | 522.00M | 671.00M | 1.13B | 1.29B | 1.80B | 1.65B | 1.83B | 2.27B | 2.86B | 0.00 | 2.84B | 2.82B | 0.00 | 102.50M | 0.00 | 0.00 | 0.00 |

| Interest Expense | 162.00M | 127.00M | 115.00M | 186.00M | 277.45M | 12.17M | 209.97M | 0.00 | 4.00M | 11.00M | 41.00M | 55.00M | 58.00M | 32.00M | 41.00M | 31.00M | 0.00 | 90.48M | 2.14B | 0.00 | 6.45B | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.66B | 7.06B | 6.32B | 4.92B | 3.65B | 1.41B | 520.00M | 236.54M | 4.76B | 5.45B | 6.71B | 5.86B | 664.76M | 2.95B | 5.14B | 8.50B | 7.49B | 7.11B | 5.31B | 3.19B | 1.78B | 1.19B | 0.00 | 0.00 |

| EBITDA | 176.52B | 117.07B | 101.99B | 93.12B | 49.51B | 34.71B | 14.66B | 4.38B | -10.91B | -5.60B | -6.75B | -9.23B | 9.18B | 9.39B | 18.63B | 14.33B | -15.19B | -4.52B | 2.67B | 40.42B | 32.74B | 3.56B | -1.31B | -350.00M |

| EBITDA Ratio | 24.33% | 26.03% | 24.64% | 23.64% | 15.08% | 12.43% | 10.36% | 18.46% | -14.91% | -15.84% | 5.57% | 33.46% | 32.61% | 24.09% | 53.57% | 20.92% | -17.53% | -13.44% | 7.83% | 65.80% | 57.24% | 37.50% | 0.00% | -86.42% |

| Operating Income | 160.37B | 104.84B | 97.56B | 89.47B | 48.80B | 33.89B | 14.14B | 5.69B | -17.23B | -11.12B | -8.73B | 727.71M | 8.46B | 6.44B | 11.77B | -236.00M | -22.67B | -11.63B | -2.64B | 37.08B | 24.80B | 2.37B | -1.31B | -350.00M |

| Operating Income Ratio | 22.10% | 22.61% | 23.57% | 22.04% | 13.52% | 11.82% | 9.98% | 16.27% | -48.31% | -31.45% | -20.57% | 1.40% | 21.04% | 16.52% | 26.78% | -0.44% | -56.33% | -29.78% | -5.00% | 59.56% | 53.86% | 25.00% | 0.00% | -86.42% |

| Total Other Income/Expenses | 8.33B | 5.04B | 2.58B | -357.00M | 2.45B | 550.00M | 423.00M | -7.00M | 1.55B | 977.00M | 2.09B | -18.35B | -3.43B | 1.84B | -4.70B | 6.03B | 3.44B | 2.16B | -779.45M | -4.71B | -267.50M | -2.37B | 0.00 | 350.00M |

| Income Before Tax | 168.70B | 109.88B | 99.30B | 88.01B | 51.26B | 34.44B | 14.46B | 2.48B | -15.68B | -11.03B | -12.75B | -11.25B | 7.99B | 7.78B | 7.07B | 5.79B | -19.23B | -9.47B | -3.42B | 32.69B | 18.67B | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 23.25% | 23.70% | 23.99% | 21.68% | 14.20% | 12.01% | 10.21% | 7.10% | -43.97% | -31.18% | -30.03% | -21.65% | 19.86% | 19.96% | 16.09% | 10.90% | -47.77% | -24.25% | -6.47% | 52.51% | 40.55% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 36.72B | 26.82B | 33.42B | 25.46B | 11.53B | 3.05B | 1.14B | 3.22B | 1.35B | 9.16B | 5.24B | 2.98B | -6.78B | 3.64B | 3.99B | 3.38B | 2.92B | 11.51B | -808.43M | 4.25B | 2.75B | 0.00 | 1.31B | 350.00M |

| Net Income | 132.02B | 83.16B | 65.95B | 62.70B | 39.88B | 31.44B | 13.32B | -736.60M | -16.97B | -20.03B | -17.95B | -14.28B | 14.77B | 4.14B | 3.08B | -2.77B | -23.21B | -21.24B | -3.00B | 28.21B | 15.92B | 0.00 | -1.31B | -350.00M |

| Net Income Ratio | 18.20% | 17.94% | 15.93% | 15.45% | 11.05% | 10.96% | 9.40% | -2.11% | -47.57% | -56.64% | -42.31% | -27.48% | 36.72% | 10.61% | 7.01% | -5.22% | -57.67% | -54.36% | -5.68% | 45.32% | 34.57% | 0.00% | 0.00% | -86.42% |

| EPS | 19.00K | 11.97K | 9.49K | 9.02K | 5.74K | 4.52K | 1.92K | -106.00 | -2.44K | -2.88K | -2.58K | -2.05K | 2.13K | 595.00 | 444.00 | -399.06 | -3.34K | -3.06K | -440.66 | 4.88K | 3.91K | -96.02 | -711.62 | -350.00 |

| EPS Diluted | 19.00K | 11.97K | 9.49K | 9.02K | 5.74K | 4.52K | 1.92K | -106.00 | -2.44K | -2.88K | -2.58K | -2.05K | 2.13K | 595.00 | 444.00 | -399.06 | -3.34K | -3.06K | -438.34 | 4.88K | 3.91K | -96.02 | -711.62 | -350.00 |

| Weighted Avg Shares Out | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.80M | 5.55M | 5.13M | 3.36M | 1.85M | 1.00M |

| Weighted Avg Shares Out (Dil) | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.84M | 5.55M | 5.13M | 3.36M | 1.85M | 1.00M |

Celebrating Seeking Alpha's New Analysts - November 2023 Edition

Gravity: Overlooked And Undervalued

Gravity: A Classic Mohnish Pabrai - Huge Upside Limited Downside Risk

Gravity Reports Third Quarter of 2023 Results and Business Updates

Gravity's Impressive 2023: A Strong Buy With The Potential Behind Ragnarok Online

Gravity Officially Launches New Roguelike Game Wetory on Nintendo Switch and Steam

Buffett Says Rising Interest Rates Are Gravity To Asset Prices - Our Picks

Ragnarok Landverse, Grand Launch on September 20, 2023!

Crude Oil Price Forecast – Crude Oil Markets Facing Gravity

Ragnarok Origin Received a Foreign Version Number by Chinese Government

Source: https://incomestatements.info

Category: Stock Reports