See more : Orion Acquisition Corp. (OHPAW) Income Statement Analysis – Financial Results

Complete financial analysis of Gravity Co., Ltd. (GRVY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Gravity Co., Ltd., a leading company in the Electronic Gaming & Multimedia industry within the Technology sector.

- Cloudflare, Inc. (NET) Income Statement Analysis – Financial Results

- Luxi Chemical Group Co., Ltd. (000830.SZ) Income Statement Analysis – Financial Results

- ARCL Organics Ltd (ARCL.BO) Income Statement Analysis – Financial Results

- Chengzhi Shareholding Co., Ltd. (000990.SZ) Income Statement Analysis – Financial Results

- Lovable Lingerie Limited (LOVABLE.BO) Income Statement Analysis – Financial Results

Gravity Co., Ltd. (GRVY)

About Gravity Co., Ltd.

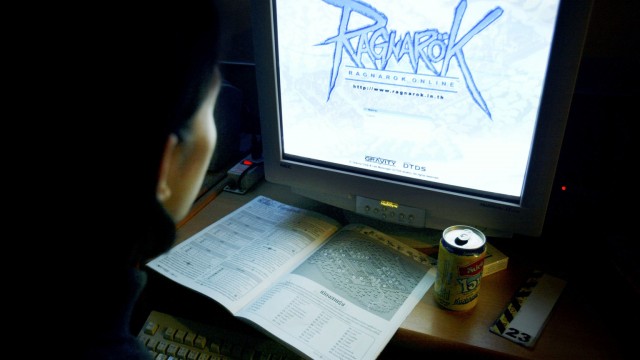

Gravity Co., Ltd. develops and publishes online and mobile games in South Korea, Taiwan, Thailand, and Japan. The company offers a massively multiplayer online role-playing game, including Ragnarok Online, Dragonica, Ragnarok Online II, and Ragnarok Prequel II. Its mobile games portfolio includes Ragnarok M: Eternal Love; Ragnarok Origin; Ragnarok X: Next Generation; the Labyrinth of Ragnarok; Ragnarok Poring Merge; Tera Classic; Ragnarok: The Lost Memories; Sadako M; NBA: Rise To Stardom; Milkmaid Of The Milky Way; and Paladog Tactics. The company also provides console games, such as Ragnarok DS for Nintendo DS; Ragnarok: The Princess of Light and Darkness for PlayStation Portable; Ragnarok Odyssey for PlayStation Vita; Double Dragon II for Xbox 360; Ragnarok Odyssey Ace for PlayStation Vita and PlayStation 3; and GRANDIA HD Collection for Nintendo Switch. In addition, it offers games for IPTV, including Pororo: The Little Penguin; and markets dolls, stationery, food, and other character-based merchandises, as well as game manuals, monthly magazines, and other publications. Further, the company provides system development and maintenance services, as well as system integration services to third parties. As of December 31, 2021, it owned 156 registered domain names. The company was incorporated in 2000 and is headquartered in Seoul, South Korea. Gravity Co., Ltd. is a subsidiary of GungHo Online Entertainment, Inc.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 725.52B | 463.62B | 413.94B | 405.95B | 360.97B | 286.77B | 141.62B | 34.96B | 35.66B | 35.36B | 42.44B | 51.95B | 40.22B | 38.98B | 43.95B | 53.17B | 40.25B | 39.07B | 52.82B | 62.26B | 46.04B | 9.49B | 0.00 | 405.00M |

| Cost of Revenue | 484.96B | 267.37B | 224.17B | 239.04B | 265.79B | 210.04B | 94.23B | 14.05B | 30.28B | 30.62B | 30.92B | 28.67B | 11.33B | 12.13B | 13.78B | 27.77B | 19.49B | 16.93B | 15.87B | 9.96B | 7.45B | 1.19B | 0.00 | 336.00M |

| Gross Profit | 240.56B | 196.25B | 189.77B | 166.91B | 95.18B | 76.73B | 47.39B | 20.91B | 5.38B | 4.75B | 11.51B | 23.28B | 28.90B | 26.85B | 30.17B | 25.40B | 20.76B | 22.14B | 36.95B | 52.30B | 38.59B | 8.30B | 0.00 | 69.00M |

| Gross Profit Ratio | 33.16% | 42.33% | 45.84% | 41.12% | 26.37% | 26.76% | 33.46% | 59.80% | 15.08% | 13.42% | 27.13% | 44.81% | 71.84% | 68.89% | 68.65% | 47.77% | 51.58% | 56.68% | 69.96% | 84.00% | 83.82% | 87.50% | 0.00% | 17.04% |

| Research & Development | 13.49B | 13.80B | 16.57B | 15.03B | 9.50B | 7.08B | 5.24B | 1.97B | 5.28B | 4.85B | 6.22B | 5.13B | 1.74B | 4.65B | 1.80B | 2.15B | 5.76B | 8.81B | 9.12B | 1.96B | 1.73B | 1.19B | 1.31B | 208.00M |

| General & Administrative | 47.70B | 43.59B | 36.59B | 30.29B | 20.42B | 17.68B | 15.27B | 12.81B | 9.60B | 14.26B | 10.91B | 12.52B | 10.21B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 13.66B | 29.90B | 35.95B | 30.08B | 14.95B | 17.26B | 12.53B | 2.41B | 1.88B | 1.61B | 2.62B | 4.37B | 6.80B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 61.36B | 91.41B | 92.20B | 60.38B | 35.37B | 34.94B | 33.25B | 15.22B | 11.48B | 15.87B | 13.54B | 16.89B | 17.01B | 20.41B | 18.40B | 23.49B | 29.05B | 26.28B | 30.47B | 13.25B | 12.06B | 4.74B | 0.00 | 211.00M |

| Other Expenses | 5.35B | -13.80B | -16.57B | 1.97B | 1.47B | 92.04M | -64.87M | 290.59M | 624.00M | 57.81M | 209.00M | 702.84M | 5.75B | 20.42B | 23.30B | 23.49B | 37.67B | 24.97B | 30.47B | 13.25B | 12.06B | 4.74B | 0.00 | 211.00M |

| Operating Expenses | 80.19B | 91.41B | 92.20B | 77.38B | 46.34B | 42.84B | 33.25B | 15.22B | 16.76B | 15.87B | 20.24B | 22.55B | 20.43B | 20.41B | 18.40B | 25.63B | 43.43B | 33.78B | 39.59B | 15.22B | 13.79B | 5.93B | 1.31B | 419.00M |

| Cost & Expenses | 565.15B | 358.78B | 316.37B | 316.43B | 312.13B | 252.88B | 127.49B | 29.27B | 47.04B | 46.49B | 51.17B | 51.22B | 31.76B | 32.54B | 32.18B | 53.41B | 62.92B | 50.71B | 55.46B | 25.17B | 21.24B | 7.12B | 1.31B | 755.00M |

| Interest Income | 11.49B | 13.21B | 1.27B | 902.00M | 1.35B | 807.22M | 541.00M | 522.00M | 671.00M | 1.13B | 1.29B | 1.80B | 1.65B | 1.83B | 2.27B | 2.86B | 0.00 | 2.84B | 2.82B | 0.00 | 102.50M | 0.00 | 0.00 | 0.00 |

| Interest Expense | 162.00M | 127.00M | 115.00M | 186.00M | 277.45M | 12.17M | 209.97M | 0.00 | 4.00M | 11.00M | 41.00M | 55.00M | 58.00M | 32.00M | 41.00M | 31.00M | 0.00 | 90.48M | 2.14B | 0.00 | 6.45B | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 7.66B | 7.06B | 6.32B | 4.92B | 3.65B | 1.41B | 520.00M | 236.54M | 4.76B | 5.45B | 6.71B | 5.86B | 664.76M | 2.95B | 5.14B | 8.50B | 7.49B | 7.11B | 5.31B | 3.19B | 1.78B | 1.19B | 0.00 | 0.00 |

| EBITDA | 176.52B | 117.07B | 101.99B | 93.12B | 49.51B | 34.71B | 14.66B | 4.38B | -10.91B | -5.60B | -6.75B | -9.23B | 9.18B | 9.39B | 18.63B | 14.33B | -15.19B | -4.52B | 2.67B | 40.42B | 32.74B | 3.56B | -1.31B | -350.00M |

| EBITDA Ratio | 24.33% | 26.03% | 24.64% | 23.64% | 15.08% | 12.43% | 10.36% | 18.46% | -14.91% | -15.84% | 5.57% | 33.46% | 32.61% | 24.09% | 53.57% | 20.92% | -17.53% | -13.44% | 7.83% | 65.80% | 57.24% | 37.50% | 0.00% | -86.42% |

| Operating Income | 160.37B | 104.84B | 97.56B | 89.47B | 48.80B | 33.89B | 14.14B | 5.69B | -17.23B | -11.12B | -8.73B | 727.71M | 8.46B | 6.44B | 11.77B | -236.00M | -22.67B | -11.63B | -2.64B | 37.08B | 24.80B | 2.37B | -1.31B | -350.00M |

| Operating Income Ratio | 22.10% | 22.61% | 23.57% | 22.04% | 13.52% | 11.82% | 9.98% | 16.27% | -48.31% | -31.45% | -20.57% | 1.40% | 21.04% | 16.52% | 26.78% | -0.44% | -56.33% | -29.78% | -5.00% | 59.56% | 53.86% | 25.00% | 0.00% | -86.42% |

| Total Other Income/Expenses | 8.33B | 5.04B | 2.58B | -357.00M | 2.45B | 550.00M | 423.00M | -7.00M | 1.55B | 977.00M | 2.09B | -18.35B | -3.43B | 1.84B | -4.70B | 6.03B | 3.44B | 2.16B | -779.45M | -4.71B | -267.50M | -2.37B | 0.00 | 350.00M |

| Income Before Tax | 168.70B | 109.88B | 99.30B | 88.01B | 51.26B | 34.44B | 14.46B | 2.48B | -15.68B | -11.03B | -12.75B | -11.25B | 7.99B | 7.78B | 7.07B | 5.79B | -19.23B | -9.47B | -3.42B | 32.69B | 18.67B | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 23.25% | 23.70% | 23.99% | 21.68% | 14.20% | 12.01% | 10.21% | 7.10% | -43.97% | -31.18% | -30.03% | -21.65% | 19.86% | 19.96% | 16.09% | 10.90% | -47.77% | -24.25% | -6.47% | 52.51% | 40.55% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 36.72B | 26.82B | 33.42B | 25.46B | 11.53B | 3.05B | 1.14B | 3.22B | 1.35B | 9.16B | 5.24B | 2.98B | -6.78B | 3.64B | 3.99B | 3.38B | 2.92B | 11.51B | -808.43M | 4.25B | 2.75B | 0.00 | 1.31B | 350.00M |

| Net Income | 132.02B | 83.16B | 65.95B | 62.70B | 39.88B | 31.44B | 13.32B | -736.60M | -16.97B | -20.03B | -17.95B | -14.28B | 14.77B | 4.14B | 3.08B | -2.77B | -23.21B | -21.24B | -3.00B | 28.21B | 15.92B | 0.00 | -1.31B | -350.00M |

| Net Income Ratio | 18.20% | 17.94% | 15.93% | 15.45% | 11.05% | 10.96% | 9.40% | -2.11% | -47.57% | -56.64% | -42.31% | -27.48% | 36.72% | 10.61% | 7.01% | -5.22% | -57.67% | -54.36% | -5.68% | 45.32% | 34.57% | 0.00% | 0.00% | -86.42% |

| EPS | 19.00K | 11.97K | 9.49K | 9.02K | 5.74K | 4.52K | 1.92K | -106.00 | -2.44K | -2.88K | -2.58K | -2.05K | 2.13K | 595.00 | 444.00 | -399.06 | -3.34K | -3.06K | -440.66 | 4.88K | 3.91K | -96.02 | -711.62 | -350.00 |

| EPS Diluted | 19.00K | 11.97K | 9.49K | 9.02K | 5.74K | 4.52K | 1.92K | -106.00 | -2.44K | -2.88K | -2.58K | -2.05K | 2.13K | 595.00 | 444.00 | -399.06 | -3.34K | -3.06K | -438.34 | 4.88K | 3.91K | -96.02 | -711.62 | -350.00 |

| Weighted Avg Shares Out | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.80M | 5.55M | 5.13M | 3.36M | 1.85M | 1.00M |

| Weighted Avg Shares Out (Dil) | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.95M | 6.84M | 5.55M | 5.13M | 3.36M | 1.85M | 1.00M |

Gravity: What Goes Down Must Come Up

Can These Two Airline Stocks Overcome Gravity And Fly Higher?

Gravity: Cheap Beyond Rational

Ragnarok X: Next Generation Official Launch in Vietnam on September 1, 2021

Ragnarok The Lost Memories Official Launch in Thailand on August 26, 2021

Gravity Reports Second Quarter of 2021 Results and Business Update

4 Video Game Companies to Play With in July

Ragnarok Origin Hits No.1 in Free Download of Apple App Store and Google Play in Japan

Ragnarok X: Next Generation Hits the Top of Apple App Store in Southeast Asia

GRAVITY Interactive, Inc. Released a Major Update and Booster Promotion for Ragnarok Online

Source: https://incomestatements.info

Category: Stock Reports