See more : PT Aneka Tambang Tbk (PAEKY) Income Statement Analysis – Financial Results

Complete financial analysis of Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel (NILSY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Exchange Income Corporation (EIF.TO) Income Statement Analysis – Financial Results

- The Shyft Group, Inc. (SHYF) Income Statement Analysis – Financial Results

- JAPAN POST BANK Co., Ltd. (7182.T) Income Statement Analysis – Financial Results

- PT Primarindo Asia Infrastructure Tbk. (BIMA.JK) Income Statement Analysis – Financial Results

- Rajeshwari Cans Limited (RCAN.BO) Income Statement Analysis – Financial Results

Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel (NILSY)

About Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel

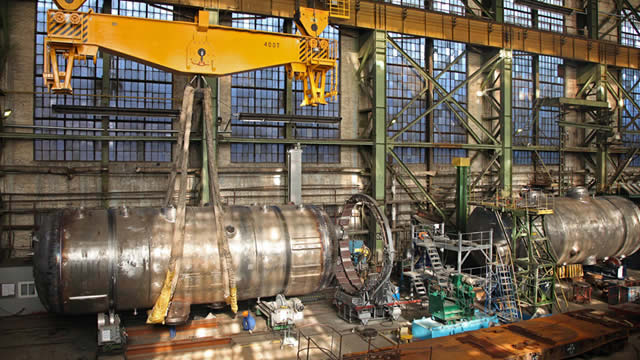

Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel, together with its subsidiaries, operates as a metals and mining company in Europe, Asia, North and South America, Russia, and the CIS countries. The company operates through GMK Group, South Cluster, KGMK Group, NN Harjavalta, GRK Bystrinskoye, Other Mining, and Other Non-Metallurgical segments. It explores for, extracts, and refines ore and nonmetallic minerals; and sale of base and precious metals produced from ore. The company's products include nickel, palladium, copper, platinum, cobalt, rhodium, iridium, ruthenium, silver, gold, selenium, tellurium, sulphur, sodium sulfate, and sodium chloride. It is also involved in property and equipment rental, gas extraction and transportation, electricity production and distribution, ore mining and processing, construction, mining and metallurgy repairs, spare parts production, geological works and construction, distribution, research, fuel supply, river shipping, and airport businesses, as well as acts as an air company. Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel was incorporated in 1997 and is based in Moscow, Russia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 14.41B | 16.88B | 17.85B | 15.55B | 13.56B | 11.67B | 9.15B | 8.26B | 8.54B | 11.87B | 11.50B | 12.37B | 14.12B | 12.78B | 10.16B | 13.98B | 17.12B | 11.55B | 7.17B | 7.03B | 5.20B | 3.09B | 4.38B |

| Cost of Revenue | 7.04B | 5.72B | 4.71B | 4.75B | 4.96B | 4.92B | 4.57B | 4.16B | 3.77B | 5.67B | 6.50B | 6.15B | 5.79B | 4.88B | 5.65B | 7.63B | 5.88B | 3.16B | 2.99B | 3.18B | 2.87B | 1.75B | 2.40B |

| Gross Profit | 7.37B | 11.16B | 13.14B | 10.80B | 8.61B | 6.76B | 4.58B | 4.10B | 4.77B | 6.20B | 5.00B | 6.22B | 8.33B | 7.89B | 4.50B | 6.35B | 11.24B | 8.39B | 4.18B | 3.85B | 2.33B | 1.34B | 1.98B |

| Gross Profit Ratio | 51.12% | 66.12% | 73.63% | 69.44% | 63.46% | 57.88% | 50.02% | 49.64% | 55.85% | 52.19% | 43.51% | 50.31% | 58.98% | 61.78% | 44.34% | 45.45% | 65.64% | 72.66% | 58.24% | 54.80% | 44.77% | 43.41% | 45.23% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 224.00M | 1.26B | 902.00M | 792.00M | 861.00M | 764.00M | 684.00M | 504.00M | 481.00M | 704.00M | 854.00M | 935.00M | 1.68B | 1.40B | 295.00M | 1.60B | 1.62B | 1.09B | 841.00M | 866.00M | 750.00M | 561.00M | 668.00M |

| Selling & Marketing | 215.00M | 250.00M | 191.00M | 167.00M | 133.00M | 92.00M | 75.00M | 50.00M | 51.00M | 110.00M | 71.00M | 63.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 439.00M | 1.51B | 1.09B | 959.00M | 994.00M | 879.00M | 784.00M | 127.00M | 249.00M | 557.00M | 297.00M | 321.00M | 1.68B | 1.40B | 295.00M | 1.60B | 1.62B | 1.09B | 841.00M | 866.00M | 750.00M | 561.00M | 668.00M |

| Other Expenses | 1.39B | 0.00 | 0.00 | 0.00 | 1.07B | 814.00M | 990.00M | 631.00M | 732.00M | 762.00M | 1.37B | 1.46B | 243.00M | 0.00 | 511.00M | 230.00M | 1.10B | 278.00M | 58.00M | 153.00M | 60.00M | -27.00M | 259.00M |

| Operating Expenses | 1.61B | 3.57B | 3.74B | 5.73B | 1.03B | 1.05B | 1.42B | 758.00M | 981.00M | 1.32B | 1.67B | 1.78B | 1.92B | 1.40B | 806.00M | 1.83B | 2.73B | 1.37B | 899.00M | 1.02B | 810.00M | 534.00M | 927.00M |

| Cost & Expenses | 8.87B | 9.28B | 8.45B | 10.48B | 5.98B | 7.43B | 5.99B | 4.69B | 6.23B | 9.17B | 9.91B | 8.99B | 7.71B | 6.28B | 6.46B | 9.45B | 8.61B | 4.53B | 3.89B | 4.20B | 3.68B | 2.29B | 3.33B |

| Interest Income | 7.00M | 214.00M | 120.00M | 485.00M | 55.00M | 340.00M | 309.00M | 289.00M | 66.00M | 41.00M | 260.00M | 236.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 519.00M | 36.77B | 299.00M | 437.00M | 436.00M | 484.00M | 519.00M | 449.00M | 325.00M | 178.00M | 375.00M | 289.00M | 151.00M | 138.00M | 147.00M | 397.00M | 307.00M | 21.00M | 95.00M | 72.00M | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.17B | 1.03B | 928.00M | 914.66M | 911.00M | 798.00M | 799.00M | 564.00M | 513.00M | 848.00M | 1.57B | 789.00M | 762.00M | 803.00M | 817.00M | 4.46B | 937.00M | 767.00M | 9.00M | -235.00M | -162.00M | 61.00M | 683.00M |

| EBITDA | 5.22B | 8.59B | 10.51B | 7.69B | 7.99B | 6.13B | 4.01B | 4.28B | 3.08B | 3.64B | 4.15B | 4.83B | 6.55B | 7.72B | 4.30B | 4.58B | 9.78B | 7.79B | 3.18B | 2.60B | 1.35B | 809.00M | 1.06B |

| EBITDA Ratio | 36.21% | 50.88% | 58.81% | 49.45% | 58.87% | 52.54% | 43.68% | 46.81% | 51.65% | 47.86% | 36.05% | 39.03% | 42.32% | 45.30% | 43.33% | 32.79% | 52.45% | 67.45% | 45.82% | 36.97% | 26.06% | 28.12% | 39.66% |

| Operating Income | 5.54B | 7.56B | 9.50B | 6.53B | 7.09B | 5.33B | 3.20B | 3.30B | 3.90B | 4.83B | 2.58B | 4.04B | 6.41B | 6.50B | 3.70B | 4.53B | 8.51B | 7.02B | 3.28B | 2.84B | 1.52B | 809.00M | 1.06B |

| Operating Income Ratio | 38.45% | 44.78% | 53.22% | 42.02% | 52.25% | 45.70% | 34.94% | 39.98% | 45.65% | 40.72% | 22.41% | 32.65% | 45.39% | 50.84% | 36.41% | 32.40% | 49.71% | 60.81% | 45.70% | 40.31% | 29.18% | 26.15% | 24.08% |

| Total Other Income/Expenses | -2.01B | -202.00M | -251.00M | -1.70B | 488.00M | -1.56B | -506.00M | -66.00M | -1.55B | -2.22B | -2.00B | -1.00B | -764.00M | 3.00M | -257.00M | -4.80B | -1.58B | -247.00M | -62.00M | -328.00M | -178.00M | 54.00M | 695.00M |

| Income Before Tax | 3.53B | 7.38B | 9.29B | 4.58B | 7.52B | 3.90B | 2.84B | 3.28B | 2.24B | 2.66B | 1.33B | 3.14B | 5.65B | 6.78B | 3.49B | -273.00M | 7.74B | 6.78B | 3.12B | 2.51B | 1.34B | 863.00M | 1.75B |

| Income Before Tax Ratio | 24.53% | 43.72% | 52.01% | 29.46% | 55.47% | 33.44% | 31.10% | 39.67% | 26.27% | 22.41% | 11.57% | 25.42% | 39.98% | 53.09% | 34.34% | -1.95% | 45.18% | 58.68% | 43.46% | 35.65% | 25.75% | 27.89% | 39.94% |

| Income Tax Expense | 664.00M | 1.53B | 2.31B | 945.00M | 1.56B | 843.00M | 721.00M | 745.00M | 528.00M | 660.00M | 565.00M | 1.00B | 1.46B | 1.55B | 836.00M | 282.00M | 2.46B | 1.81B | 838.00M | 696.00M | 493.00M | 286.00M | 503.00M |

| Net Income | 2.38B | 5.46B | 6.51B | 3.30B | 5.78B | 3.09B | 2.13B | 2.54B | 1.73B | 2.00B | 774.00M | 2.17B | 3.60B | 3.30B | 2.60B | -555.00M | 5.28B | 5.97B | 2.35B | 1.83B | 861.00M | 584.00M | 1.24B |

| Net Income Ratio | 16.55% | 32.34% | 36.48% | 21.21% | 42.63% | 26.44% | 23.28% | 30.71% | 20.30% | 16.88% | 6.73% | 17.55% | 25.52% | 25.82% | 25.60% | -3.97% | 30.82% | 51.65% | 32.81% | 26.05% | 16.57% | 18.88% | 28.18% |

| EPS | 0.16 | 0.10 | 0.42 | 0.21 | 36.69 | 0.20 | 13.98 | 16.67 | 11.39 | 13.15 | 5.07 | 14.18 | 21.53 | 19.46 | 15.42 | -0.03 | 30.23 | 32.82 | 12.11 | 9.23 | 4.35 | 1.55 | 2.46 |

| EPS Diluted | 0.16 | 0.10 | 0.42 | 0.21 | 36.69 | 0.20 | 13.98 | 16.67 | 11.39 | 13.15 | 5.07 | 14.18 | 21.53 | 19.46 | -12.11 | -0.03 | 30.23 | 32.82 | 12.11 | 9.23 | 4.35 | 1.55 | 2.02 |

| Weighted Avg Shares Out | 15.29B | 15.29B | 15.47B | 15.82B | 15.74B | 15.29B | 15.29B | 15.17B | 15.24B | 15.29B | 15.29B | 15.29B | 16.73B | 16.95B | 16.84B | 17.98B | 17.62B | 18.23B | 19.44B | 20.35B | 20.35B | 20.66B | 16.67B |

| Weighted Avg Shares Out (Dil) | 15.29B | 15.29B | 15.47B | 15.82B | 15.74B | 15.29B | 15.29B | 15.17B | 15.24B | 15.29B | 15.29B | 15.29B | 16.75B | 16.96B | 16.84B | 17.98B | 17.62B | 18.23B | 19.44B | 20.35B | 20.35B | 20.66B | 20.35B |

Norilsk Nickel: Idea And Long Term Outlook On Dividends

Norilsk Nickel: An Undervalued Opportunity

BATT: Lithium Battery Tech ETF Could Electrify Your Returns In New Year

Russian mining giant Nornickel supports rescue operation in the Arctic

Nornickel sets ambitious annual production goals for the next decade

Russia's Nornickel ups investment forecast by $6 billion over next decade

7 Stocks to Sell You Can Feel Good About Dumping

Russian mining giant Nornickel settles dispute with Botswana govt, receives cash compensation

Nickel Miners News For The Month Of October 2021

Cobalt Miners News For The Month Of October 2021

Source: https://incomestatements.info

Category: Stock Reports