See more : Royal India Corporation Limited (ROYALIND.BO) Income Statement Analysis – Financial Results

Complete financial analysis of The Boston Beer Company, Inc. (SAM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Boston Beer Company, Inc., a leading company in the Beverages – Alcoholic industry within the Consumer Defensive sector.

- Zoglo’s Incredible Food Corp. (ZOG.CN) Income Statement Analysis – Financial Results

- Lundin Gold Inc. (LUG.TO) Income Statement Analysis – Financial Results

- Alpha Star Acquisition Corporation (ALSAR) Income Statement Analysis – Financial Results

- BlackSky Technology Inc. (BKSY) Income Statement Analysis – Financial Results

- Alleghany Corporation (Y) Income Statement Analysis – Financial Results

The Boston Beer Company, Inc. (SAM)

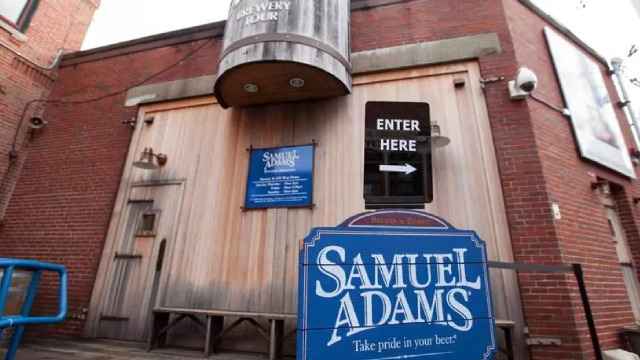

About The Boston Beer Company, Inc.

The Boston Beer Company, Inc. produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, and hard seltzers under the Samuel Adams, Twisted Tea, Truly Hard Seltzer, Angry Orchard, Dogfish Head, Angel City, Coney Island, Concrete Beach brand names. The company markets and sells its products to a network of approximately 400 wholesalers in the United States, as well as international wholesalers, importers, or other agencies that in turn sell to retailers, such as grocery stores, club stores, convenience stores, liquor stores, bars, restaurants, stadiums, and other retail outlets. It also sells in products in Canada, Europe, Israel, Australia, New Zealand, the Caribbean, the Pacific Rim, Mexico, and Central and South America. The Boston Beer Company, Inc. was founded in 1984 and is based in Boston, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.01B | 2.09B | 2.06B | 1.74B | 1.25B | 995.65M | 862.99M | 906.45M | 959.93M | 903.01M | 739.05M | 580.22M | 513.00M | 463.80M | 415.05M | 398.40M | 341.65M | 285.43M | 238.30M | 217.21M | 207.95M | 215.36M | 186.78M | 190.55M | 176.80M | 183.50M | 183.80M | 191.10M | 151.30M |

| Cost of Revenue | 1.16B | 1.23B | 1.26B | 921.98M | 635.66M | 483.41M | 413.09M | 446.78M | 458.32M | 438.00M | 354.13M | 265.01M | 228.43M | 207.47M | 201.24M | 214.51M | 152.29M | 121.16M | 96.83M | 87.97M | 85.61M | 88.37M | 81.69M | 77.62M | 72.50M | 84.20M | 85.50M | 92.80M | 72.20M |

| Gross Profit | 852.37M | 861.99M | 797.79M | 814.45M | 614.17M | 512.24M | 449.90M | 459.67M | 501.62M | 465.01M | 384.92M | 315.21M | 284.57M | 256.33M | 213.82M | 183.89M | 189.36M | 164.28M | 141.47M | 129.24M | 122.34M | 126.99M | 105.09M | 112.94M | 104.30M | 99.30M | 98.30M | 98.30M | 79.10M |

| Gross Profit Ratio | 42.44% | 41.24% | 38.77% | 46.90% | 49.14% | 51.45% | 52.13% | 50.71% | 52.26% | 51.50% | 52.08% | 54.33% | 55.47% | 55.27% | 51.52% | 46.16% | 55.43% | 57.55% | 59.37% | 59.50% | 58.83% | 58.97% | 56.26% | 59.27% | 58.99% | 54.11% | 53.48% | 51.44% | 52.28% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 174.55M | 157.53M | 133.62M | 118.21M | 112.73M | 90.86M | 73.13M | 78.03M | 71.56M | 65.97M | 62.33M | 50.17M | 43.49M | 39.11M | 36.94M | 34.99M | 24.57M | 22.66M | 17.29M | 14.84M | 14.63M | 14.59M | 13.53M | 12.54M | 11.57M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 556.00M | 578.40M | 606.99M | 447.57M | 355.61M | 304.85M | 258.65M | 244.21M | 273.63M | 250.70M | 207.93M | 169.31M | 157.26M | 135.74M | 121.56M | 132.90M | 124.46M | 113.67M | 100.87M | 94.91M | 91.84M | 100.73M | 80.12M | 77.84M | 69.94M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 730.55M | 735.93M | 740.62M | 565.78M | 468.34M | 395.71M | 331.78M | 322.25M | 345.19M | 316.67M | 270.26M | 219.48M | 200.75M | 174.85M | 158.50M | 167.89M | 149.03M | 136.33M | 118.16M | 109.75M | 106.47M | 115.32M | 93.65M | 90.38M | 81.50M | 79.50M | 81.20M | 82.10M | 68.00M |

| Other Expenses | 21.82M | -1.92M | -978.00K | 222.00K | -1.19M | -887.00K | -82.00K | -706.00K | -1.22M | -994.00K | -583.00K | -98.00K | 0.00 | 300.00K | 0.00 | 1.94M | 3.44M | 0.00 | 0.00 | 0.00 | -100.00K | 0.00 | 0.00 | 6.44M | 5.90M | 5.20M | 4.50M | 3.00M | 1.60M |

| Operating Expenses | 752.37M | 735.93M | 740.62M | 565.78M | 468.34M | 395.71M | 331.78M | 322.25M | 345.19M | 316.67M | 270.26M | 219.48M | 200.75M | 174.85M | 158.50M | 169.83M | 152.47M | 136.33M | 118.16M | 109.75M | 106.37M | 115.32M | 93.65M | 96.82M | 87.40M | 84.70M | 85.70M | 85.10M | 69.60M |

| Cost & Expenses | 1.91B | 1.96B | 2.00B | 1.49B | 1.10B | 879.12M | 744.87M | 769.02M | 803.50M | 754.66M | 624.39M | 484.49M | 429.18M | 382.32M | 359.73M | 384.34M | 304.76M | 257.48M | 214.99M | 197.72M | 191.98M | 203.69M | 175.35M | 174.43M | 159.90M | 168.90M | 171.20M | 177.90M | 141.80M |

| Interest Income | 0.00 | 2.56M | 110.00K | 199.00K | 647.00K | 1.29M | 549.00K | 168.00K | 56.00K | 21.00K | 31.00K | 31.00K | 54.00K | 79.00K | 112.00K | 1.60M | 4.25M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 2.56M | 110.00K | 199.00K | 0.00 | 1.29M | 549.00K | 168.00K | 56.00K | 21.00K | 31.00K | 31.00K | 54.00K | 79.00K | 112.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 88.14M | 89.33M | 80.11M | 73.01M | 56.27M | 51.97M | 51.26M | 49.56M | 42.89M | 35.14M | 25.90M | 20.21M | 18.79M | 17.43M | 16.92M | 12.50M | 6.65M | 4.99M | 4.52M | 5.03M | 7.11M | 6.15M | 6.66M | 6.44M | 5.90M | 5.20M | 4.50M | 3.00M | 1.60M |

| EBITDA | 209.96M | 242.67M | 87.13M | 317.44M | 202.09M | 168.50M | 169.38M | 186.98M | 199.32M | 183.48M | 140.56M | 115.94M | 122.29M | 98.54M | 71.29M | 28.34M | 48.30M | 32.94M | 27.84M | 24.51M | 23.08M | 11.67M | 11.44M | 22.56M | 22.80M | 19.80M | 17.10M | 16.20M | 11.10M |

| EBITDA Ratio | 10.45% | 11.61% | 8.67% | 18.36% | 16.24% | 16.99% | 19.91% | 20.60% | 20.79% | 20.52% | 19.23% | 20.01% | 16.18% | 21.42% | 17.66% | 7.11% | 13.60% | 11.31% | 11.50% | 11.40% | 11.09% | 7.67% | 9.52% | 10.79% | 12.84% | 10.57% | 8.49% | 7.48% | 6.54% |

| Operating Income | 100.00M | 161.31M | 106.35M | 244.21M | 144.91M | 115.88M | 115.68M | 137.66M | 156.17M | 146.57M | 113.09M | 95.58M | 103.66M | 81.18M | 54.27M | 14.06M | 36.89M | 27.95M | 23.32M | 19.49M | 15.87M | 11.67M | 11.44M | 16.12M | 16.90M | 14.60M | 12.60M | 13.20M | 9.50M |

| Operating Income Ratio | 4.98% | 7.72% | 5.17% | 14.06% | 11.59% | 11.64% | 13.40% | 15.19% | 16.27% | 16.23% | 15.30% | 16.47% | 20.21% | 17.50% | 13.08% | 3.53% | 10.80% | 9.79% | 9.78% | 8.97% | 7.63% | 5.42% | 6.12% | 8.46% | 9.56% | 7.96% | 6.86% | 6.91% | 6.28% |

| Total Other Income/Expenses | 9.59M | -34.62M | -1.09M | 23.00K | -542.00K | 405.00K | 467.00K | -538.00K | -1.16M | -973.00K | -552.00K | -216.00K | -155.00K | -70.00K | 96.00K | 1.78M | 1.32M | 3.82M | 2.20M | 593.00K | 1.10M | 2.42M | 1.78M | 2.93M | 2.20M | -300.00K | 700.00K | 1.70M | 900.00K |

| Income Before Tax | 109.59M | 91.44M | 6.91M | 244.23M | 144.37M | 116.29M | 116.14M | 137.12M | 155.01M | 145.59M | 112.54M | 95.52M | 103.50M | 81.11M | 54.37M | 15.84M | 41.64M | 31.77M | 25.52M | 20.08M | 16.97M | 14.09M | 13.22M | 19.05M | 19.10M | 14.30M | 13.30M | 14.90M | 10.40M |

| Income Before Tax Ratio | 5.46% | 4.37% | 0.34% | 14.07% | 11.55% | 11.68% | 13.46% | 15.13% | 16.15% | 16.12% | 15.23% | 16.46% | 20.18% | 17.49% | 13.10% | 3.98% | 12.19% | 11.13% | 10.71% | 9.24% | 8.16% | 6.54% | 7.08% | 10.00% | 10.80% | 7.79% | 7.24% | 7.80% | 6.87% |

| Income Tax Expense | 33.34M | 24.17M | -7.64M | 52.27M | 34.33M | 23.62M | 17.09M | 49.77M | 56.60M | 54.85M | 42.15M | 36.05M | 37.44M | 30.97M | 23.25M | 7.75M | 19.15M | 13.57M | 9.96M | 7.58M | 6.42M | 5.54M | 5.38M | 7.81M | 8.00M | 6.40M | 5.70M | 6.50M | -2.20M |

| Net Income | 76.25M | 67.26M | 14.55M | 191.96M | 110.04M | 92.66M | 99.05M | 87.35M | 98.41M | 90.74M | 70.39M | 59.47M | 66.06M | 50.14M | 31.12M | 8.09M | 22.49M | 18.19M | 15.56M | 12.50M | 10.56M | 8.55M | 7.83M | 11.24M | 11.10M | 7.90M | 7.60M | 8.40M | 12.60M |

| Net Income Ratio | 3.80% | 3.22% | 0.71% | 11.05% | 8.80% | 9.31% | 11.48% | 9.64% | 10.25% | 10.05% | 9.52% | 10.25% | 12.88% | 10.81% | 7.50% | 2.03% | 6.58% | 6.37% | 6.53% | 5.76% | 5.08% | 3.97% | 4.19% | 5.90% | 6.28% | 4.31% | 4.13% | 4.40% | 8.33% |

| EPS | 6.23 | 5.46 | 1.19 | 15.83 | 9.26 | 7.97 | 8.18 | 6.93 | 7.46 | 6.96 | 5.47 | 4.60 | 5.08 | 3.67 | 2.21 | 0.58 | 1.58 | 1.31 | 1.10 | 0.89 | 0.72 | 0.53 | 0.48 | 0.62 | 0.54 | 0.39 | 0.37 | 0.42 | 0.33 |

| EPS Diluted | 6.22 | 5.44 | 1.17 | 15.53 | 9.16 | 7.90 | 8.09 | 6.79 | 7.25 | 6.69 | 5.18 | 4.39 | 4.81 | 3.52 | 2.17 | 0.56 | 1.53 | 1.27 | 1.07 | 0.86 | 0.70 | 0.52 | 0.47 | 0.62 | 0.54 | 0.39 | 0.37 | 0.41 | 0.33 |

| Weighted Avg Shares Out | 12.24M | 12.32M | 12.28M | 12.13M | 11.89M | 11.62M | 12.04M | 12.53M | 13.12M | 12.97M | 12.77M | 12.91M | 13.01M | 13.66M | 14.06M | 13.93M | 14.19M | 13.90M | 14.13M | 14.13M | 14.72M | 16.08M | 16.41M | 18.06M | 20.56M | 20.26M | 20.54M | 20.00M | 19.75M |

| Weighted Avg Shares Out (Dil) | 12.26M | 12.35M | 12.44M | 12.28M | 11.91M | 11.73M | 12.18M | 12.80M | 13.52M | 13.48M | 13.50M | 13.44M | 13.74M | 14.23M | 14.36M | 14.34M | 14.70M | 14.38M | 14.52M | 14.52M | 15.00M | 16.41M | 16.59M | 18.11M | 20.56M | 20.26M | 20.54M | 20.49M | 19.75M |

Marijuana grower interested in merging with Sam Adams beer owner: report

Conquest Rolls Out Enhancements to SAM, An AI-Powered Solution Designed to Improve Plan Quality, Reveal Deeper Planning Insights

Why Boston Beer Stock Is Turning Sour Today

Boston Beer Stock Slips as Buyout Rumors Disappear

These Stocks Are Moving the Most Today: GameStop, AMC Entertainment, Boston Beer, Paramount, Nvidia, and More

Stocks Worth Watching: Sonos and Boston Beer

The Boston Beer Company Statement on Company Sale Speculation

Boston Beer Stock Jumps. Suntory Is in Talks to Buy the Sam Adams Maker, WSJ Reports.

Boston Beer in Talks to Sell Itself to Jim Beam Owner Suntory

Why Boston Beer (SAM) is a Top Value Stock for the Long-Term

Source: https://incomestatements.info

Category: Stock Reports