See more : CRRC Corporation Limited (1766.HK) Income Statement Analysis – Financial Results

Complete financial analysis of Vale S.A. (VALE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Vale S.A., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Visioneering Technologies, Inc. (VTI.AX) Income Statement Analysis – Financial Results

- TYC Brother Industrial Co., Ltd. (1522.TW) Income Statement Analysis – Financial Results

- Pierre et Vacances SA (VAC.PA) Income Statement Analysis – Financial Results

- Blue Prism Group plc (PRSM.L) Income Statement Analysis – Financial Results

- RiverNorth Opportunistic Municipal Income Fund, Inc. (RMI) Income Statement Analysis – Financial Results

Vale S.A. (VALE)

About Vale S.A.

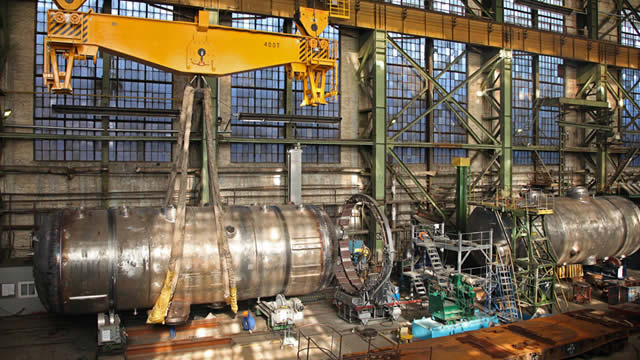

Vale S.A., together with its subsidiaries, produces and sells iron ore and iron ore pellets for use as raw materials in steelmaking in Brazil and internationally. The company operates through Ferrous Minerals and Base Metals segments. The Ferrous Minerals segment produces and extracts iron ore and pellets, manganese, ferroalloys, and other ferrous products; and provides related logistic services. The Base Metals segment produces and extracts nickel and its by-products, such as gold, silver, cobalt, precious metals, and others, as well as copper. The company was formerly known as Companhia Vale do Rio Doce and changed its name to Vale S.A. in May 2009. Vale S.A. was founded in 1942 and is headquartered in Rio de Janeiro, Brazil.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 41.78B | 43.84B | 54.50B | 40.02B | 37.57B | 36.58B | 33.97B | 27.49B | 25.61B | 38.24B | 46.77B | 47.69B | 58.99B | 45.29B | 27.80B | 37.43B | 32.24B | 19.65B | 14.55B | 8.07B | 5.35B | 4.12B | 3.99B | 3.94B |

| Cost of Revenue | 24.09B | 24.03B | 21.73B | 19.04B | 21.19B | 22.11B | 21.04B | 17.65B | 20.51B | 25.76B | 24.25B | 26.48B | 23.57B | 18.81B | 15.89B | 17.64B | 16.46B | 10.15B | 6.98B | 4.08B | 3.13B | 2.26B | 2.33B | 2.43B |

| Gross Profit | 17.70B | 19.81B | 32.77B | 20.98B | 16.38B | 14.47B | 12.93B | 9.84B | 5.10B | 12.48B | 22.52B | 21.21B | 35.42B | 26.48B | 11.91B | 19.79B | 15.78B | 9.50B | 7.57B | 3.99B | 2.22B | 1.86B | 1.66B | 1.51B |

| Gross Profit Ratio | 42.35% | 45.19% | 60.13% | 52.42% | 43.61% | 39.55% | 38.06% | 35.79% | 19.90% | 32.63% | 48.16% | 44.48% | 60.04% | 58.46% | 42.84% | 52.86% | 48.94% | 48.36% | 52.02% | 49.40% | 41.53% | 45.11% | 41.68% | 38.27% |

| Research & Development | 720.34M | 660.00M | 549.00M | 443.00M | 443.00M | 373.00M | 340.00M | 319.00M | 477.00M | 734.00M | 801.00M | 1.48B | 1.67B | 878.00M | 1.13B | 1.09B | 733.00M | 481.00M | 288.00M | 153.00M | 82.00M | 50.00M | 43.00M | 48.00M |

| General & Administrative | 480.00M | 366.00M | 332.00M | 400.00M | 339.00M | 366.00M | 428.00M | 366.00M | 491.00M | 858.00M | 955.00M | 1.58B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 26.39M | 108.00M | 107.00M | 105.00M | 92.00M | 95.00M | 103.00M | 8.00M | 12.00M | 120.00M | 129.00M | 389.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 506.00M | 474.00M | 439.00M | 505.00M | 487.00M | 461.00M | 531.00M | 374.00M | 503.00M | 1.10B | 1.08B | 1.97B | 2.33B | 1.70B | 1.36B | 1.75B | 1.25B | 816.00M | 693.00M | 709.00M | 297.00M | 381.00M | 691.00M | 225.00M |

| Other Expenses | 2.26B | 892.00M | 943.00M | 1.48B | 1.66B | -187.00M | -149.00M | -66.00M | 61.00M | -19.00M | -239.00M | -37.00M | 2.33B | 1.70B | 1.13B | 1.75B | 1.25B | 816.00M | 1.05B | 709.00M | 496.00M | 381.00M | 691.00M | 532.00M |

| Operating Expenses | 3.49B | 2.03B | 1.93B | 2.43B | 2.59B | 1.61B | 1.70B | 1.65B | 2.48B | 3.98B | 5.01B | 7.26B | 5.31B | 2.58B | 4.35B | 2.83B | 1.98B | 1.30B | 1.34B | 862.00M | 578.00M | 431.00M | 734.00M | 580.00M |

| Cost & Expenses | 27.58B | 26.05B | 23.66B | 21.47B | 23.78B | 23.72B | 22.74B | 19.30B | 23.00B | 29.74B | 29.26B | 33.74B | 28.88B | 21.39B | 20.24B | 20.47B | 18.44B | 11.44B | 8.32B | 4.94B | 3.71B | 2.69B | 3.06B | 3.01B |

| Interest Income | 123.00M | 659.00M | 226.46M | 375.00M | 527.00M | 423.00M | 481.00M | 92.00M | 965.00M | 401.00M | 101.00M | 401.00M | 718.00M | 290.00M | 381.00M | 602.00M | 295.00M | 327.00M | 123.00M | 82.00M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.34B | 894.00M | 1.45B | 2.44B | 3.81B | 1.54B | 3.28B | 1.53B | 891.00M | 2.94B | 1.72B | 1.72B | 2.47B | 2.65B | 1.12B | 1.77B | 1.59B | 1.34B | 560.00M | 671.00M | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 3.07B | 3.17B | 3.04B | 3.22B | 3.74B | 3.35B | 3.71B | 3.47B | 4.03B | 4.29B | 4.15B | 4.29B | 4.12B | 3.26B | 3.12B | 2.81B | 2.19B | 997.00M | 853.00M | 674.00M | 238.00M | 214.00M | 212.00M | 195.00M |

| EBITDA | 16.48B | 23.74B | 32.23B | 19.95B | 5.22B | 12.50B | 14.31B | 10.85B | -14.66B | 13.69B | 19.25B | 18.56B | 33.36B | 26.22B | 11.40B | 17.79B | 16.28B | 10.16B | 6.60B | 4.07B | 1.88B | 1.64B | 1.14B | 1.12B |

| EBITDA Ratio | 39.44% | 49.31% | 59.14% | 49.86% | 45.87% | 44.10% | 45.66% | 39.48% | 24.03% | 35.81% | 41.16% | 38.91% | 53.83% | 60.61% | -16.19% | 54.40% | 50.50% | 48.50% | 48.92% | 41.26% | 34.06% | 53.92% | 18.90% | 27.12% |

| Operating Income | 14.21B | 17.21B | 27.69B | 16.72B | 13.51B | 11.96B | 10.93B | 7.05B | -6.13B | 7.18B | 15.06B | 9.33B | 30.11B | 21.70B | -7.56B | 14.75B | 13.19B | 7.64B | 6.23B | 3.12B | 1.64B | 1.43B | 929.00M | 926.00M |

| Operating Income Ratio | 34.00% | 39.25% | 50.81% | 41.78% | 35.95% | 32.69% | 32.18% | 25.65% | -23.94% | 18.77% | 32.21% | 19.55% | 51.05% | 47.90% | -27.18% | 39.41% | 40.92% | 38.86% | 42.82% | 38.72% | 30.73% | 34.66% | 23.28% | 23.53% |

| Total Other Income/Expenses | -1.99B | 2.57B | 1.85B | -4.37B | -13.66B | -5.14B | -3.10B | -398.56M | -11.59B | -5.58B | -7.82B | -9.94B | -2.20B | -1.38B | 1.64B | -1.53B | 2.04B | -1.08B | -303.00M | -41.54M | 10.00M | -828.00M | 191.00M | -195.00M |

| Income Before Tax | 12.21B | 19.78B | 29.54B | 4.97B | -2.78B | 6.82B | 7.83B | 7.98B | -17.72B | 1.55B | 7.24B | 3.92B | 26.80B | 20.31B | -8.79B | 13.22B | 15.23B | 7.83B | 5.93B | 3.00B | 1.65B | 601.00M | 1.12B | 731.00M |

| Income Before Tax Ratio | 29.22% | 45.12% | 54.20% | 12.42% | -7.39% | 18.64% | 23.05% | 29.05% | -69.19% | 4.06% | 15.48% | 8.22% | 45.43% | 44.85% | -31.64% | 35.32% | 47.25% | 39.84% | 40.74% | 37.23% | 30.92% | 14.58% | 28.07% | 18.58% |

| Income Tax Expense | 3.05B | 2.97B | 4.70B | 438.00M | -595.00M | -172.00M | 1.50B | 2.78B | -5.10B | 1.20B | 6.83B | -1.19B | 5.28B | 3.71B | 2.82B | 535.00M | 3.20B | 1.43B | 1.01B | 749.00M | 297.00M | -149.00M | -218.00M | -32.00M |

| Net Income | 7.98B | 18.79B | 22.45B | 4.88B | -2.18B | 6.86B | 5.51B | 3.98B | -12.13B | 657.00M | 584.00M | 5.37B | 22.89B | 17.26B | 5.88B | 13.22B | 11.83B | 6.53B | 4.47B | 2.57B | 1.55B | 680.00M | 1.29B | 1.09B |

| Net Income Ratio | 19.11% | 42.86% | 41.18% | 12.20% | -5.80% | 18.76% | 16.21% | 14.49% | -47.36% | 1.72% | 1.25% | 11.27% | 38.79% | 38.12% | 21.13% | 35.32% | 36.68% | 33.22% | 30.72% | 31.90% | 28.93% | 16.49% | 32.26% | 27.60% |

| EPS | 1.83 | 4.00 | 4.48 | 1.01 | -0.43 | 1.32 | 1.05 | 0.77 | -2.35 | 0.13 | 0.11 | 1.06 | 4.34 | 3.23 | 0.97 | 2.58 | 2.41 | 1.35 | 1.05 | 0.56 | 0.34 | 0.15 | 0.84 | 0.71 |

| EPS Diluted | 1.83 | 4.00 | 4.48 | 1.01 | -0.43 | 1.32 | 1.05 | 0.77 | -2.33 | 0.13 | 0.11 | 1.06 | 4.34 | 3.23 | 0.97 | 2.58 | 2.41 | 1.35 | 1.05 | 0.56 | 0.34 | 0.15 | 0.84 | 0.71 |

| Weighted Avg Shares Out | 4.37B | 4.64B | 5.01B | 5.13B | 5.13B | 5.18B | 5.20B | 5.20B | 5.15B | 5.15B | 5.15B | 5.11B | 5.25B | 5.25B | 5.36B | 5.06B | 4.89B | 4.85B | 4.61B | 4.61B | 4.61B | 4.62B | 4.62B | 4.62B |

| Weighted Avg Shares Out (Dil) | 4.37B | 4.64B | 5.01B | 5.13B | 5.13B | 5.20B | 5.20B | 5.20B | 5.20B | 5.15B | 5.15B | 5.11B | 5.25B | 5.25B | 5.36B | 5.06B | 4.89B | 4.85B | 4.61B | 4.61B | 4.61B | 4.62B | 4.62B | 4.62B |

Brazil government mulls 'tougher measures and sanctions' on Vale, minister says

3 Blue-Chip Stocks to Buy Under $20 With a Healthy Dividend Yield

Need $8,000 Passive Income? Invest $10,000 in These 9 Dividend Stocks

Ero Copper and Vale Base Metals Execute Definitive Earn-In Agreement on the Furnas Copper Project

Vale Production Report 2Q24: Positive Signs Despite Challenges

VALE S.A. (VALE) is Attracting Investor Attention: Here is What You Should Know

7 Undervalued Stocks to Buy With a Dividend Yield of Over 7%

If The Fed Slashes Rates Too Soon, Vale Could Spike Higher

Here's What You Should Know Ahead of VALE's Q2 Earnings

VALE's Q2 Iron Ore Output Up 2% Y/Y, Copper and Nickel Lags

Source: https://incomestatements.info

Category: Stock Reports