See more : Niagara Mohawk Power Corporation PFD 3.90% (NMK-PC) Income Statement Analysis – Financial Results

Complete financial analysis of Aurora Innovation, Inc. (AUR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Aurora Innovation, Inc., a leading company in the Information Technology Services industry within the Technology sector.

- New Wave Holdings Corp. (SPOR.CN) Income Statement Analysis – Financial Results

- EF Hutton Acquisition Corporation I Rights (EFHTR) Income Statement Analysis – Financial Results

- BeeX Inc. (4270.T) Income Statement Analysis – Financial Results

- Mianyang Fulin Precision Co.,Ltd. (300432.SZ) Income Statement Analysis – Financial Results

- Rekor Systems, Inc. (REKR) Income Statement Analysis – Financial Results

Aurora Innovation, Inc. (AUR)

About Aurora Innovation, Inc.

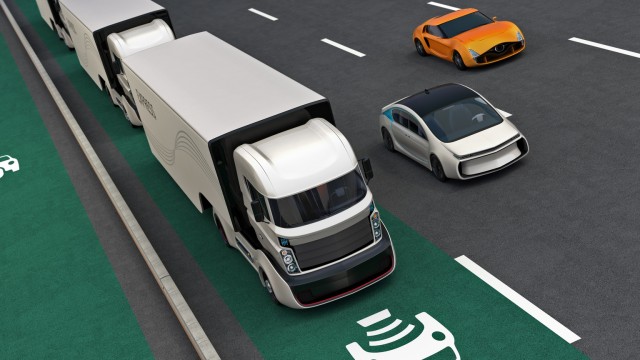

Aurora Innovation, Inc. operates as a self-driving technology company in the United States. It focuses on developing Aurora Driver, a platform that brings a suite of self-driving hardware, software, and data services together to adapt and interoperate passenger vehicles, light commercial vehicles, and trucks. The company was founded in 2017 and is headquartered in Pittsburgh, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 0.00 | 68.00M | 82.54M | 0.00 | 19.60M |

| Cost of Revenue | 716.00M | 50.00M | 697.00M | 17.23M | 160.00K |

| Gross Profit | -716.00M | 18.00M | -614.46M | -17.23M | 19.44M |

| Gross Profit Ratio | 0.00% | 26.47% | -744.46% | 0.00% | 99.18% |

| Research & Development | 716.00M | 677.00M | 697.28M | 179.43M | 107.37M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 119.00M | 129.00M | 115.93M | 38.69M | 25.59M |

| Other Expenses | 0.00 | 15.00M | -5.18M | -45.00K | -31.00K |

| Operating Expenses | 835.00M | 806.00M | 813.20M | 218.12M | 132.96M |

| Cost & Expenses | 835.00M | 806.00M | 813.20M | 218.12M | 133.12M |

| Interest Income | 59.00M | 15.00M | 525.00K | 3.72M | 11.70M |

| Interest Expense | 0.00 | 1.00B | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 48.00M | 50.00M | 41.01M | 17.23M | 1.84M |

| EBITDA | -748.00M | -716.00M | -718.95M | -197.22M | -111.68M |

| EBITDA Ratio | 0.00% | 417.65% | -836.52% | 0.00% | -569.77% |

| Operating Income | -835.00M | 262.00M | -730.66M | -218.12M | -113.52M |

| Operating Income Ratio | 0.00% | 385.29% | -885.24% | 0.00% | -579.14% |

| Total Other Income/Expenses | 39.00M | -985.00M | -28.95M | 3.67M | 11.67M |

| Income Before Tax | -796.00M | -1.72B | -759.95M | -214.45M | -101.85M |

| Income Before Tax Ratio | 0.00% | -2,533.82% | -920.73% | 0.00% | -519.61% |

| Income Tax Expense | 0.00 | 985.00M | -4.50M | 2.00K | -7.77M |

| Net Income | -796.00M | -2.71B | -755.45M | -214.45M | -94.08M |

| Net Income Ratio | 0.00% | -3,982.35% | -915.28% | 0.00% | -479.96% |

| EPS | -0.60 | -2.37 | -0.67 | -0.19 | -0.08 |

| EPS Diluted | -0.60 | -2.37 | -0.67 | -0.19 | -0.08 |

| Weighted Avg Shares Out | 1.33B | 1.14B | 1.12B | 1.12B | 1.12B |

| Weighted Avg Shares Out (Dil) | 1.33B | 1.14B | 1.12B | 1.12B | 1.12B |

Aurora to Host Second Quarter 2023 Business Review Conference Call on August 2, 2023

7 Tech Stocks That Could Form the Next ‘Magnificent Seven'

Aurora Innovation: Shocking Capital Raise

Aurora Announces Pricing of $220 Million Upsized Public Offering of Class A Common Stock

Aurora Innovation shares fall on public share offering

Aurora Innovation plans $600 mln private placement, shares fall

Aurora Announces Proposed Public Offering and $600 Million Concurrent Private Placement of Class A Common Stock

This Autonomous Vehicle Stock Doubled in June and May Do It Again

3 Next-Gen Tech Stocks to Buy With Explosive Upside Potential

3 Autonomous Driving Stocks to Buy With Explosive Upside Potential

Source: https://incomestatements.info

Category: Stock Reports