See more : Lexaria Bioscience Corp. (LEXXW) Income Statement Analysis – Financial Results

Complete financial analysis of Talon Metals Corp. (TLOFF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Talon Metals Corp., a leading company in the Industrial Materials industry within the Basic Materials sector.

- OncoZenge AB (publ) (ONCOZ.ST) Income Statement Analysis – Financial Results

- GYG plc (GYG.L) Income Statement Analysis – Financial Results

- HiTi Digital, Inc. (3494.TW) Income Statement Analysis – Financial Results

- Frasers Group plc (SDIPF) Income Statement Analysis – Financial Results

- Nippon Paper Industries Co., Ltd. (NIJPF) Income Statement Analysis – Financial Results

Talon Metals Corp. (TLOFF)

About Talon Metals Corp.

Talon Metals Corp., a mineral exploration company, explores for and develops mineral properties. The company owns a 17.56% interest is the Tamarack nickel-copper-cobalt project located in Minnesota, the United States. It has an option to acquire 80% interest in the mineral rights over a land package covering an area of approximately 4,00,000 acres located in the Upper Peninsula of the State of Michigan. The company is headquartered in Road Town, the British Virgin Islands.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.29M | 4.23M | 0.00 | 124.65K | 415.31K | 427.93K | 52.07K | 0.00 |

| Cost of Revenue | 50.52K | 36.11K | 13.90K | 8.96K | 10.30K | 5.97K | 9.90K | 20.35K | 57.42K | 39.38K | 21.99K | 35.55K | 34.87K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 392.52K | 223.83K |

| Gross Profit | -50.52K | -36.11K | -13.90K | -8.96K | -10.30K | -5.97K | -9.90K | -20.35K | -57.42K | -39.38K | -21.99K | -35.55K | 1.25M | 4.23M | 0.00 | 124.65K | 415.31K | 427.93K | -340.44K | -223.83K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 97.29% | 100.00% | 0.00% | 100.00% | 100.00% | 100.00% | -653.78% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 533.38K | 3.49M | 6.02M | 2.11M | 3.33M | 817.02K | 668.08K | 923.95K | 2.41M | 2.02M | 2.06M | 5.67M | 11.50M | 6.86M | 3.12M | 2.05M | 1.77M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 355.09K | 441.81K | 234.84K | 264.95K | 86.08K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 100.78K | 0.00 | 0.00 | 0.00 |

| SG&A | 2.41M | 3.94M | 6.25M | 2.38M | 3.42M | 817.02K | 668.08K | 923.95K | 2.41M | 2.02M | 2.06M | 5.67M | 11.50M | 6.86M | 3.12M | 2.05M | 1.87M | 2.21M | 2.43M | 70.78K |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 54.73K | -8.42M | 7.91K | 0.00 | 2.44M | -40.64K | 0.00 | 0.00 | 196.28K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 2.41M | 3.97M | 6.26M | 2.38M | 3.43M | 817.02K | 668.08K | 923.95K | 2.11M | 2.93M | 4.73M | 5.70M | 11.53M | 6.88M | 3.14M | 2.17M | 1.99M | 2.21M | 2.43M | 71.73K |

| Cost & Expenses | 2.41M | 3.97M | 6.26M | 2.38M | 3.44M | 822.99K | 677.98K | 944.30K | 2.17M | 2.97M | 4.75M | 5.73M | 11.53M | 6.88M | 3.14M | 2.17M | 1.99M | 2.21M | 2.83M | 295.56K |

| Interest Income | 968.52K | 266.28K | 15.34K | 14.59K | 17.98K | 3.00K | 4.24K | 3.16K | 6.31K | 46.96K | 75.54K | 200.34K | 810.40K | 73.51K | 12.66K | 270.64K | 415.31K | 427.93K | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 31.40K | 149.04K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 168.41K | 28.46K | 53.71K | 103.68K | 99.44K | 55.68K | 20.83K | 1.98K |

| Depreciation & Amortization | 50.52K | 36.11K | 13.90K | 8.96K | 22.63K | 5.97K | 9.90K | 20.35K | 57.42K | 39.38K | 21.99K | 35.55K | 34.87K | 23.12K | 20.00K | 20.00K | 17.94K | 6.00K | 3.28K | 948.00 |

| EBITDA | -2.36M | -3.51M | -6.04M | -2.37M | -3.33M | -761.55K | -655.94K | -862.22K | 3.86M | 11.36M | -4.77M | 5.07M | -6.92M | -2.55M | -3.11M | -6.71M | -1.56M | -1.78M | -2.77M | -294.61K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -538.49% | -62.75% | 0.00% | -1,404.18% | -374.66% | -415.37% | -5,321.01% | 0.00% |

| Operating Income | -2.41M | -6.18M | -6.97M | -2.37M | -3.50M | -820.00K | 1.81M | 941.15K | 2.46M | 3.02M | 2.01M | 5.58M | -6.96M | 2.57M | 3.21M | 1.77M | 1.57M | 1.78M | 2.77M | 295.56K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -541.21% | 60.79% | 0.00% | 1,420.22% | 378.98% | 416.77% | 5,327.30% | 0.00% |

| Total Other Income/Expenses | 65.15K | 2.04M | 504.01K | -448.73K | -647.69K | -8.68M | -2.51M | -503.25K | -4.00M | -14.34M | -1.14M | -23.98M | 34.87K | -6.92M | -5.05M | -8.60M | 8.32M | -1.78M | -2.77M | 0.00 |

| Income Before Tax | -2.35M | -1.50M | -5.55M | -2.73M | -3.98M | -9.44M | -3.15M | -1.37M | -6.30M | -17.25M | -7.17M | -18.40M | -10.25M | -4.35M | -1.84M | -6.83M | 9.90M | 1.65M | 2.76M | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -797.07% | -102.63% | 0.00% | -5,481.88% | 2,383.23% | 384.75% | 5,305.86% | 0.00% |

| Income Tax Expense | 0.00 | -2.51M | -732.29K | -8.96K | 86.13K | 149.04K | 2.48M | 421.18K | 6.57M | 14.24M | 2.20M | 10.56M | 2.84M | -100.49K | 53.71K | 103.68K | -3.66K | 55.68K | 72.90K | 1.98K |

| Net Income | -2.35M | -1.50M | -5.55M | -2.73M | -3.98M | -9.44M | -3.15M | -1.37M | -6.30M | -17.25M | -7.17M | -18.40M | -13.08M | -4.32M | -1.84M | -6.83M | 6.75M | -1.98M | -2.86M | -297.54K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -1,017.76% | -102.09% | 0.00% | -5,481.88% | 1,626.16% | -461.81% | -5,488.73% | 0.00% |

| EPS | 0.00 | 0.00 | -0.01 | -0.01 | -0.01 | -0.07 | -0.02 | -0.01 | -0.06 | -0.18 | -0.08 | -0.20 | -0.15 | -0.08 | -0.07 | -0.25 | 0.25 | -0.08 | -0.17 | -0.05 |

| EPS Diluted | 0.00 | 0.00 | -0.01 | -0.01 | -0.01 | -0.07 | -0.02 | -0.01 | -0.06 | -0.18 | -0.08 | -0.20 | -0.15 | -0.08 | -0.07 | -0.25 | 0.25 | -0.08 | -0.17 | -0.05 |

| Weighted Avg Shares Out | 867.89M | 768.10M | 674.21M | 531.45M | 393.29M | 129.65M | 129.65M | 129.43M | 106.95M | 94.30M | 92.08M | 92.03M | 87.06M | 57.65M | 27.05M | 27.05M | 27.05M | 24.70M | 16.81M | 5.95M |

| Weighted Avg Shares Out (Dil) | 867.89M | 768.10M | 674.21M | 531.45M | 393.29M | 129.65M | 129.65M | 129.43M | 106.95M | 94.30M | 92.08M | 92.03M | 87.06M | 57.65M | 27.05M | 27.05M | 27.05M | 25.73M | 16.81M | 5.95M |

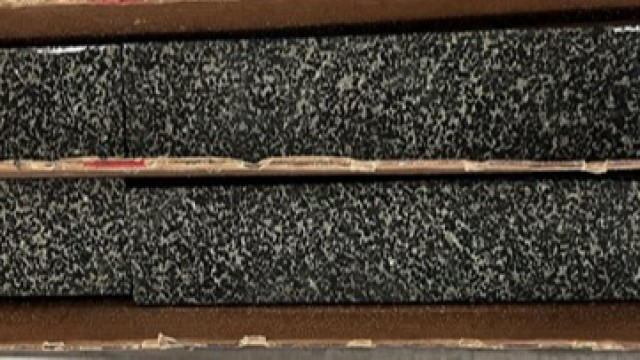

Talon Metals drills more high-grade nickel in Raptor Zone at Tamarack project in Minnesota

More High-Grade Nickel in the USA: Talon Metals Reports 139% Increase in Thickness of Nickel-Copper Mineralization in the Raptor Zone

Talon Metals CEO to speak at IEA conference in Paris

Talon Metals CEO to Participate in Inaugural IEA Summit on Critical Minerals and Clean Energy in Paris

Talon Metals signs agreement with US Department of Defense to support domestic nickel exploration

Talon Metals stock climbs on high-grade nickel equivalent results

Talon Metals drills long interval of high-grade nickel equivalent at Tamarack project in Minnesota

Talon Metals Drills 101.71 Meters (333 Feet) of 3.04% Nickel Equivalent at the Tamarack Nickel Project

Talon Metals Reports Results for the Quarter Ended June 30, 2023

Talon Metals drills new area of nickel mineralization at Tamarack project in Minnesota

Source: https://incomestatements.info

Category: Stock Reports