See more : Sourcenext Corporation (SRNXF) Income Statement Analysis – Financial Results

Complete financial analysis of The Gorman-Rupp Company (GRC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Gorman-Rupp Company, a leading company in the Industrial – Machinery industry within the Industrials sector.

- PT Wilmar Cahaya Indonesia Tbk. (CEKA.JK) Income Statement Analysis – Financial Results

- ERAMET S.A. (ERMAF) Income Statement Analysis – Financial Results

- Lionheart Acquisition Corporation II (LCAPU) Income Statement Analysis – Financial Results

- ECS Botanics Holdings Ltd (ECS.AX) Income Statement Analysis – Financial Results

- Stenhus Fastigheter i Norden AB (publ) (SFAST.ST) Income Statement Analysis – Financial Results

The Gorman-Rupp Company (GRC)

About The Gorman-Rupp Company

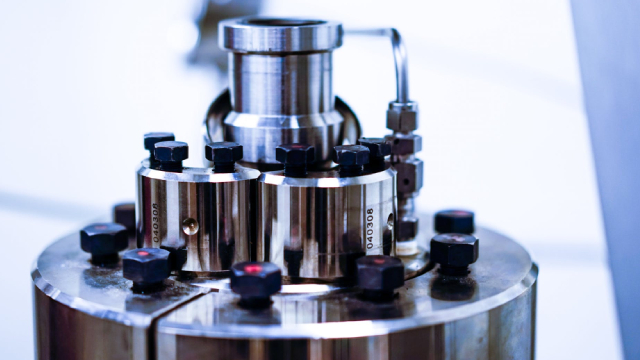

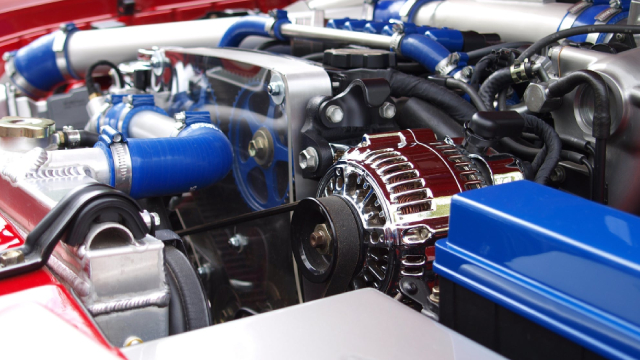

The Gorman-Rupp Company designs, manufactures, and sells pumps and pump systems in the United States and internationally. The company's products include self-priming centrifugal, standard centrifugal, magnetic drive centrifugal, axial and mixed flow, vertical turbine line shaft, submersible, high pressure booster, rotary gear, diaphragm, bellows, and oscillating pumps. Its products are used in water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire protection, military, and other liquid-handling applications, as well as in heating, ventilating, and air conditioning applications. The company markets its products through a network of distributors, manufacturers' representatives, third-party distributor catalogs, direct sales, and commerce. The Gorman-Rupp Company was founded in 1933 and is headquartered in Mansfield, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 659.51M | 521.03M | 378.32M | 348.97M | 398.18M | 414.33M | 379.39M | 382.07M | 406.15M | 434.93M | 391.67M | 375.69M | 359.49M | 296.81M | 266.24M | 330.65M | 305.56M | 270.91M | 231.25M | 203.55M | 195.83M | 194.08M | 202.93M | 190.14M | 179.30M | 171.20M | 164.90M | 155.20M | 149.50M | 137.50M | 131.50M | 126.00M | 123.40M | 119.70M | 114.30M | 82.80M | 74.40M | 65.30M | 67.30M |

| Cost of Revenue | 463.26M | 390.09M | 282.42M | 259.41M | 295.50M | 304.41M | 280.64M | 290.05M | 313.57M | 327.37M | 298.01M | 285.54M | 271.65M | 220.47M | 204.47M | 253.56M | 238.11M | 212.23M | 184.18M | 161.13M | 153.83M | 152.62M | 154.82M | 134.85M | 126.40M | 121.20M | 117.90M | 110.40M | 107.80M | 97.20M | 94.50M | 91.00M | 89.70M | 87.40M | 82.90M | 57.80M | 51.70M | 45.80M | 45.60M |

| Gross Profit | 196.25M | 130.94M | 95.90M | 89.56M | 102.68M | 109.92M | 98.75M | 92.03M | 92.58M | 107.56M | 93.66M | 90.15M | 87.84M | 76.34M | 61.77M | 77.09M | 67.45M | 58.68M | 47.07M | 42.43M | 41.99M | 41.45M | 48.11M | 55.29M | 52.90M | 50.00M | 47.00M | 44.80M | 41.70M | 40.30M | 37.00M | 35.00M | 33.70M | 32.30M | 31.40M | 25.00M | 22.70M | 19.50M | 21.70M |

| Gross Profit Ratio | 29.76% | 25.13% | 25.35% | 25.66% | 25.79% | 26.53% | 26.03% | 24.09% | 22.79% | 24.73% | 23.91% | 24.00% | 24.43% | 25.72% | 23.20% | 23.31% | 22.07% | 21.66% | 20.36% | 20.84% | 21.44% | 21.36% | 23.71% | 29.08% | 29.50% | 29.21% | 28.50% | 28.87% | 27.89% | 29.31% | 28.14% | 27.78% | 27.31% | 26.98% | 27.47% | 30.19% | 30.51% | 29.86% | 32.24% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 59.28M | 56.79M | 54.53M | 56.19M | 54.25M | 51.73M | 47.97M | 44.84M | 37.38M | 35.38M | 38.10M | 34.57M | 32.41M | 30.37M | 29.00M | 27.97M | 27.92M | 25.96M | 26.43M | 25.70M | 25.60M | 24.70M | 24.00M | 22.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 96.66M | 83.12M | 56.54M | 53.80M | 58.84M | 59.28M | 56.79M | 54.53M | 56.19M | 54.25M | 51.73M | 47.97M | 44.84M | 37.38M | 35.38M | 38.10M | 34.57M | 32.41M | 30.37M | 29.00M | 27.97M | 27.92M | 25.96M | 26.43M | 25.70M | 25.60M | 24.70M | 24.00M | 22.80M | 21.30M | 19.40M | 18.80M | 18.20M | 17.10M | 17.00M | 13.10M | 11.10M | 10.30M | 10.70M |

| Other Expenses | 0.00 | 7.64M | -2.11M | -4.51M | 1.33M | -323.00K | 1.52M | 785.00K | 875.00K | 429.00K | 2.36M | 264.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.86M | 6.50M | 6.30M | 6.00M | 5.70M | 5.20M | 4.50M | 4.30M | 4.00M | 3.90M | 3.70M | 3.70M | 2.60M | 2.30M | 2.10M | 1.90M |

| Operating Expenses | 96.66M | 90.75M | 56.54M | 53.80M | 58.84M | 59.28M | 56.79M | 54.53M | 56.19M | 54.25M | 51.73M | 47.97M | 44.84M | 37.38M | 35.38M | 38.10M | 34.57M | 32.41M | 30.37M | 29.00M | 27.97M | 27.92M | 25.96M | 33.29M | 32.20M | 31.90M | 30.70M | 29.70M | 28.00M | 25.80M | 23.70M | 22.80M | 22.10M | 20.80M | 20.70M | 15.70M | 13.40M | 12.40M | 12.60M |

| Cost & Expenses | 572.47M | 480.84M | 338.96M | 313.21M | 354.34M | 363.70M | 337.43M | 344.57M | 369.76M | 381.62M | 349.74M | 333.51M | 316.50M | 257.85M | 239.85M | 291.66M | 272.68M | 244.65M | 214.55M | 190.13M | 181.81M | 180.55M | 180.78M | 168.15M | 158.60M | 153.10M | 148.60M | 140.10M | 135.80M | 123.00M | 118.20M | 113.80M | 111.80M | 108.20M | 103.60M | 73.50M | 65.10M | 58.20M | 58.20M |

| Interest Income | 0.00 | 19.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 41.27M | 19.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 20.00K | 0.00 | 0.00 | 0.00 | 0.00 | 179.00K | 175.00K | 170.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 28.50M | 21.16M | 11.91M | 12.69M | 13.75M | 14.48M | 15.05M | 15.53M | 15.28M | 14.62M | 13.59M | 12.07M | 11.46M | 10.60M | 8.96M | 7.85M | 7.60M | 6.69M | 6.81M | 7.18M | 7.12M | 7.04M | 7.13M | 6.86M | 6.50M | 6.30M | 6.00M | 5.70M | 5.20M | 4.50M | 4.30M | 4.00M | 3.90M | 3.70M | 3.70M | 2.60M | 2.30M | 2.10M | 1.90M |

| EBITDA | 113.96M | 54.27M | 49.16M | 43.94M | 57.59M | 65.12M | 57.01M | 53.03M | 51.67M | 67.92M | 55.51M | 54.25M | 54.45M | 49.56M | 36.38M | 46.84M | 40.48M | 32.95M | 23.08M | 19.68M | 21.29M | 20.57M | 29.60M | 28.86M | 27.10M | 24.40M | 22.30M | 20.80M | 18.90M | 19.00M | 17.60M | 16.20M | 15.50M | 15.20M | 14.40M | 11.90M | 11.60M | 9.20M | 11.00M |

| EBITDA Ratio | 17.28% | 7.82% | 10.40% | 10.25% | 11.01% | 12.22% | 12.14% | 14.35% | 8.96% | 12.26% | 10.70% | 11.23% | 12.05% | 13.34% | 9.59% | 11.34% | 12.43% | 11.62% | 9.98% | 9.67% | 10.60% | 10.25% | 13.99% | 15.08% | 14.67% | 13.67% | 13.10% | 13.08% | 11.77% | 13.45% | 12.93% | 12.46% | 11.99% | 12.11% | 11.99% | 12.44% | 13.71% | 12.40% | 14.41% |

| Operating Income | 87.04M | 40.18M | 27.44M | 23.06M | 30.09M | 50.64M | 37.86M | 35.70M | 36.39M | 53.31M | 41.92M | 42.18M | 42.99M | 38.96M | 26.39M | 38.99M | 32.89M | 26.27M | 16.70M | 13.43M | 14.02M | 13.53M | 22.15M | 22.00M | 20.70M | 18.10M | 16.30M | 15.10M | 13.70M | 14.50M | 13.30M | 12.20M | 11.60M | 11.50M | 10.70M | 9.30M | 9.30M | 7.10M | 9.10M |

| Operating Income Ratio | 13.20% | 7.71% | 7.25% | 6.61% | 7.56% | 12.22% | 9.98% | 9.34% | 8.96% | 12.26% | 10.70% | 11.23% | 11.96% | 13.13% | 9.91% | 11.79% | 10.76% | 9.70% | 7.22% | 6.60% | 7.16% | 6.97% | 10.91% | 11.57% | 11.54% | 10.57% | 9.88% | 9.73% | 9.16% | 10.55% | 10.11% | 9.68% | 9.40% | 9.61% | 9.36% | 11.23% | 12.50% | 10.87% | 13.52% |

| Total Other Income/Expenses | -43.08M | -26.31M | -2.11M | -4.51M | 1.33M | -323.00K | -2.58M | -1.02M | 875.00K | 429.00K | 2.36M | 264.00K | -309.00K | -626.00K | 862.00K | 1.51M | 2.50M | 1.46M | 435.00K | 926.00K | 380.00K | 673.00K | 886.00K | 197.00K | 900.00K | 1.10M | 600.00K | 500.00K | 1.40M | 400.00K | 600.00K | 500.00K | 800.00K | 700.00K | 700.00K | 1.50M | 1.50M | 1.10M | 1.50M |

| Income Before Tax | 43.96M | 13.87M | 37.25M | 31.25M | 45.17M | 50.32M | 39.38M | 36.48M | 37.27M | 53.73M | 44.28M | 42.45M | 42.69M | 38.33M | 27.26M | 40.49M | 35.38M | 27.73M | 17.14M | 14.35M | 14.40M | 14.20M | 23.04M | 22.20M | 21.60M | 19.20M | 16.90M | 15.60M | 15.10M | 14.90M | 13.90M | 12.70M | 12.40M | 12.20M | 11.40M | 10.80M | 10.80M | 8.20M | 10.60M |

| Income Before Tax Ratio | 6.67% | 2.66% | 9.85% | 8.95% | 11.34% | 12.14% | 10.38% | 9.55% | 9.18% | 12.35% | 11.30% | 11.30% | 11.87% | 12.92% | 10.24% | 12.25% | 11.58% | 10.23% | 7.41% | 7.05% | 7.35% | 7.32% | 11.35% | 11.67% | 12.05% | 11.21% | 10.25% | 10.05% | 10.10% | 10.84% | 10.57% | 10.08% | 10.05% | 10.19% | 9.97% | 13.04% | 14.52% | 12.56% | 15.75% |

| Income Tax Expense | 9.01M | 2.68M | 7.40M | 6.06M | 9.35M | 10.34M | 12.82M | 11.60M | 12.16M | 17.59M | 14.17M | 14.24M | 13.88M | 12.37M | 8.99M | 13.30M | 12.52M | 8.65M | 6.24M | 5.08M | 4.61M | 5.27M | 8.45M | 8.40M | 8.50M | 7.40M | 6.30M | 5.70M | 5.60M | 5.60M | 5.10M | 4.70M | 4.70M | 4.90M | 4.60M | 4.20M | 4.90M | 3.80M | 4.80M |

| Net Income | 34.95M | 11.20M | 29.85M | 25.19M | 35.82M | 39.98M | 26.56M | 24.88M | 25.11M | 36.14M | 30.10M | 28.20M | 28.80M | 25.96M | 18.27M | 27.20M | 22.86M | 19.07M | 10.90M | 9.28M | 9.79M | 8.94M | 14.59M | 13.80M | 13.10M | 11.80M | 10.60M | 9.90M | 9.50M | 9.30M | 8.80M | -3.90M | 7.70M | 7.30M | 6.80M | 6.60M | 5.90M | 4.40M | 5.80M |

| Net Income Ratio | 5.30% | 2.15% | 7.89% | 7.22% | 8.99% | 9.65% | 7.00% | 6.51% | 6.18% | 8.31% | 7.69% | 7.51% | 8.01% | 8.75% | 6.86% | 8.23% | 7.48% | 7.04% | 4.71% | 4.56% | 5.00% | 4.60% | 7.19% | 7.26% | 7.31% | 6.89% | 6.43% | 6.38% | 6.35% | 6.76% | 6.69% | -3.10% | 6.24% | 6.10% | 5.95% | 7.97% | 7.93% | 6.74% | 8.62% |

| EPS | 1.34 | 0.43 | 1.14 | 0.97 | 1.37 | 1.53 | 1.02 | 0.95 | 0.96 | 1.38 | 1.15 | 1.07 | 1.10 | 0.99 | 0.70 | 1.04 | 0.88 | 0.58 | 0.34 | 0.36 | 0.30 | 0.28 | 0.56 | 0.53 | 0.50 | 0.45 | 0.21 | 0.19 | 0.36 | 0.36 | 0.12 | -0.15 | 0.07 | 0.06 | 0.06 | 0.06 | 0.05 | 0.04 | 0.05 |

| EPS Diluted | 1.34 | 0.43 | 1.14 | 0.97 | 1.37 | 1.53 | 1.02 | 0.95 | 0.96 | 1.38 | 1.15 | 1.07 | 1.10 | 0.99 | 0.70 | 1.04 | 0.88 | 0.58 | 0.34 | 0.36 | 0.30 | 0.28 | 0.56 | 0.53 | 0.50 | 0.45 | 0.21 | 0.19 | 0.36 | 0.36 | 0.12 | -0.15 | 0.07 | 0.06 | 0.06 | 0.06 | 0.05 | 0.04 | 0.05 |

| Weighted Avg Shares Out | 26.17M | 26.09M | 26.12M | 26.09M | 26.13M | 26.11M | 26.03M | 26.09M | 26.16M | 26.19M | 26.18M | 26.24M | 26.28M | 26.23M | 26.19M | 26.07M | 26.10M | 32.61M | 32.60M | 26.08M | 32.58M | 32.57M | 26.11M | 26.19M | 26.20M | 26.24M | 26.27M | 26.30M | 26.21M | 26.04M | 26.17M | 26.22M | 26.20M | 26.20M | 26.20M | 26.20M | 26.61M | 26.61M | 27.02M |

| Weighted Avg Shares Out (Dil) | 26.17M | 26.09M | 26.12M | 26.09M | 26.13M | 26.13M | 26.03M | 26.09M | 26.16M | 26.19M | 26.18M | 26.31M | 26.28M | 26.23M | 26.19M | 26.07M | 26.10M | 32.61M | 32.60M | 26.08M | 32.58M | 32.57M | 26.11M | 26.19M | 26.20M | 26.24M | 26.27M | 26.30M | 26.21M | 26.04M | 26.17M | 26.22M | 26.20M | 26.20M | 26.20M | 26.20M | 26.61M | 26.61M | 27.02M |

Is GormanRupp (GRC) Stock Outpacing Its Industrial Products Peers This Year?

Here's Why 'Trend' Investors Would Love Betting on Gorman-Rupp (GRC)

5 Small-Cap Stocks to Buy Despite Inflation Headwinds

Why Gorman-Rupp (GRC) is a Top Dividend Stock for Your Portfolio

GRC or IR: Which Is the Better Value Stock Right Now?

Best Momentum Stock to Buy for June 14th

New Strong Buy Stocks for June 14th

Gorman-Rupp (GRC) Upgraded to Buy: Here's What You Should Know

GRC vs. IR: Which Stock Is the Better Value Option?

Gorman-Rupp Completes Debt Refinancing

Source: https://incomestatements.info

Category: Stock Reports